The sharpening of the conflict between China and the US became all too apparent last week when Beijing released an official white paper in which it seemingly abandoned all hint of conciliation with a burst of accusations, exculpations, and a good deal of bluster. [First Published June 3rd]

Reinforcing this more hard-line stance at a major regional security conference, Defence Minister Wei Fenghe roundly condemned US interference in China’s internal affairs while issuing barely veiled threats of military action should America do anything to support or encourage Taiwanese separatism.

Simultaneously, stories spread of a possible extension to members of the CCP of the previously anti-Russian Magnitsky Act – under the terms of which the US arrogated to itself the right to freeze the assets of alleged human rights violators, as well as to ban their entry to the States. China responded by ‘warning’ its students of the difficulties they might face were they henceforth to try to pursue their studies in America.

Seemingly not satisfied with this mutual display of Transpacific bellicosity, the Trump administration simultaneously revoked India’s trading privileges under a program of loose developmental aid called the ‘General System of Preferences’ (thus clearing the way for – you guessed it – the imposition of higher tariffs) and also threatened Mexico that it, too, could be a target if it did not do more to stem the politically contentious tide of illegal immigrants in transit through its territory.

At this point, with the prospect of yet more damage being wrought both upon global supply chains and the financial links which secure them, it seemed that the liquidation which has been underway since the latter part of April might be about to swell into a tidal wave of selling.

Compounding the difficulties, the Tech sector which has led the charge higher through much of the last decade is now not only perceived to be at risk because of Huawei-led disruption and the threat of Chinese reprisals but also due to a growing sense that FAANG companies are the Robber Barons of our present Gilded Age and are therefore vulnerable to the sort of anti-trust backlash which broke up Old Man Rockefeller’s mighty empire a century ago.

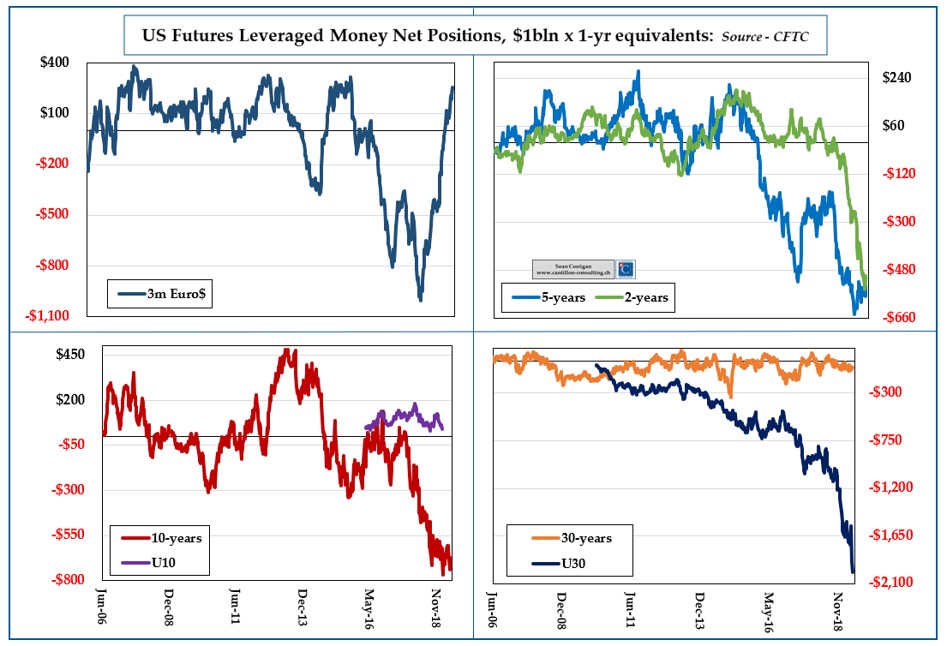

Gold – the traditional safe haven in a crisis – started Thursday at around the $1275 an ounce mark, essentially where it started the year. As the mood suddenly darkened, however, a one-way surge of buying took the metal on an almost uninterrupted, $50 ascent to its best levels for 10 weeks. With ‘managed money’ (CTAs and hedge funds) only modestly long of around 27,000 net contacts before the move started and producers not having made any significant additions to their not overly large hedges for the better part of six months, this does have the potential to ignite another one of those tantalising attempts to surmount the barrier in the $1360/70s upon which goldbug hopes have been dashed so many times in the past three, frustrating years.

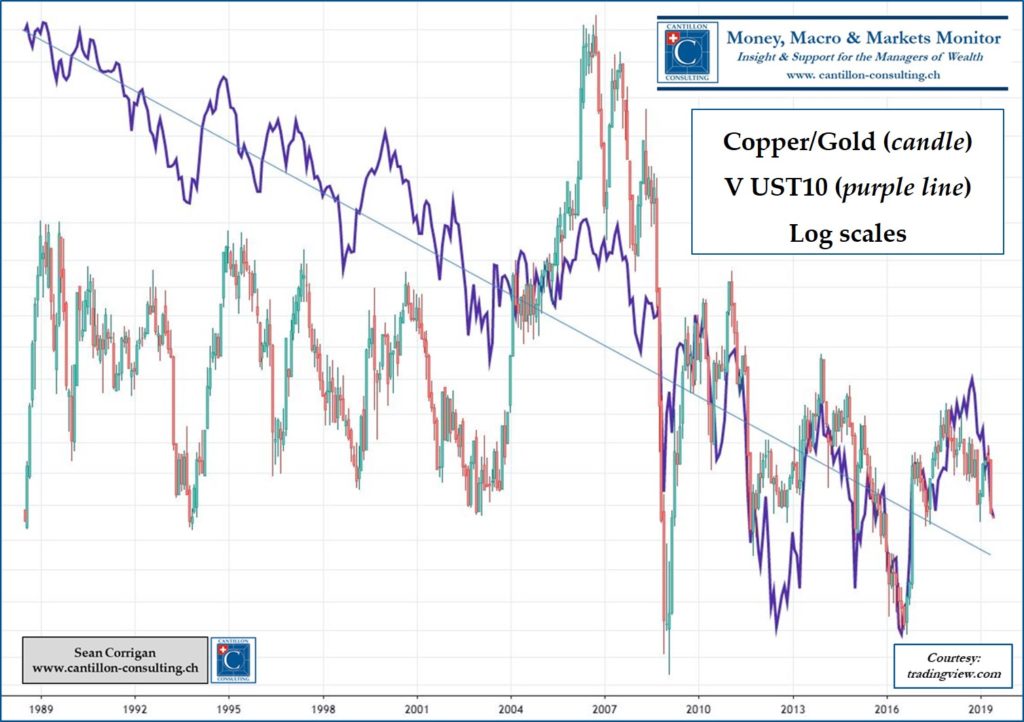

But, far more important than the behaviour of gold – as well as arguably one of the primary influences in its outperformance of workadya commodities – has been the dramatic behaviour of interest rates.

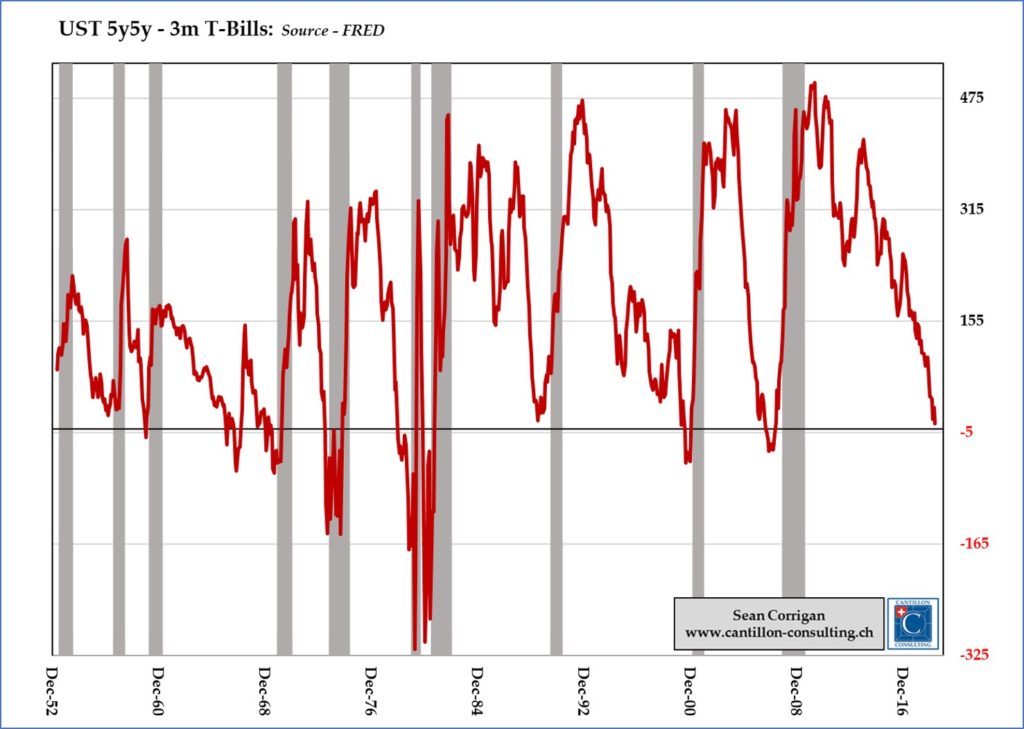

Not only have longer-dated bonds traded down below the yields to be had on their shorter equivalents but, for the first time in this cycle, they have also moved below that most fundamental anchor of the whole term structure, the overnight Federal Funds rate.

Given the unbearable weight of past precedent and current superstition which applies in such a situation, this has set alarm bells ringing everywhere.

And it’s not just the long end. The collapse in yields of shorter maturity bonds, too, has been highly impressive. The US 2-year Treasury note has also shed almost 30 basis points in less than three trading sessions – something not seen since Lehman Brothers collapsed – to take it to a full half-point below the effective Fed funds rate – a level of implied rate-cut expectation also not seen since the run-up to the Great Financial Crisis itself.

If one looks instead at the various short-date futures contracts for clues, they deliver a stark message: the Fed, so the Herd now believes, will deliver its inaugural cut before the end of the summer and will continue in that vein at roughly three-monthly intervals until the middle of next year, knocking a full 1% off rates as it does.

Is the economy really in such a parlous condition as to warrant this, especially when real interest rates (that is, those which are left after deducting an allowance for inflation) are already shrinkingly small, if not actually negative for some maturities?

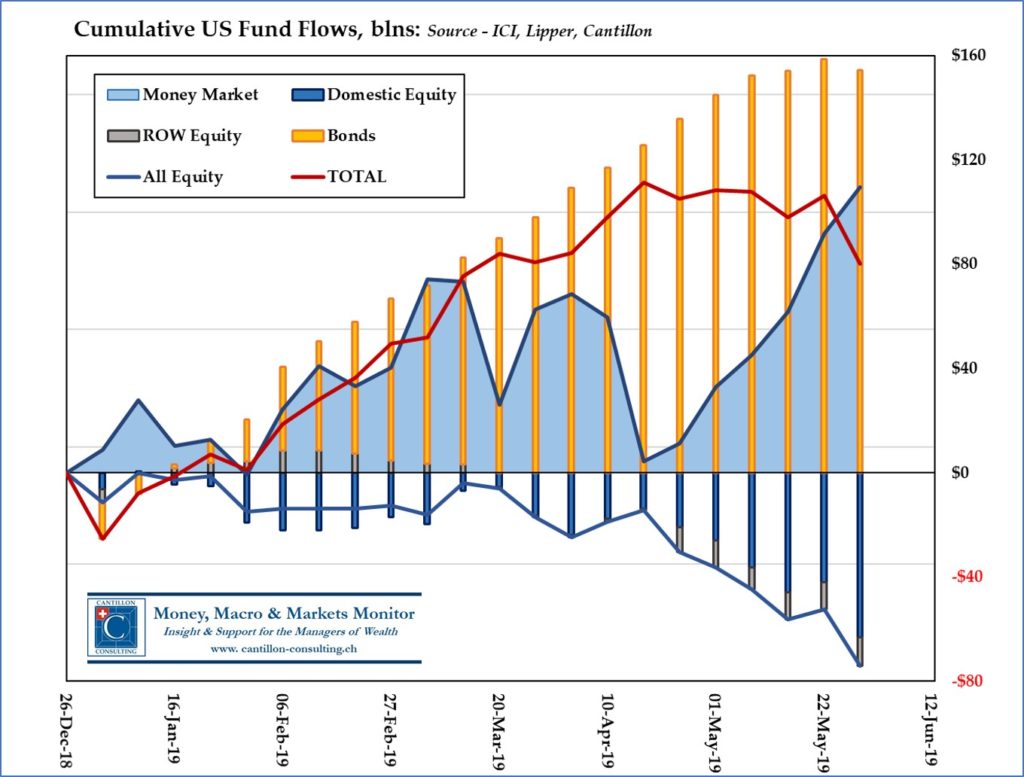

Well, it is not to be denied that the past six months have seen a marked deceleration in the pace of activity, not just in the States, but elsewhere around the globe. It is often difficult to determine which end of the real economy-financial economy Push-Me-Pull-You is acting as cause and which as effect at any given moment, but whichever is leading the dance at present, money supply growth is patently slowing in any number of jurisdictions and all manner of real activity along with it.

It can be argued that some part of this ostensible slowdown has simply been due to the mobilisation, as interest rates have at last moved higher, into other savings media of funds previously – and uncharacteristically – parked statically in demand accounts in an opportunity cost-free world of QE, NIRP, and private sector credit retrenchment.

Be that as it may, revenue growth in the US (and elsewhere) has braked hard since the autumn, as evidenced by corporate reporting, the ISM survey results, the data for trade, trucking, manufacturing shipments, private construction spending, and more besides.

In such an environment, it would be foolish to rely upon the Fed being deaf to the mounting chorus of accusations that its tightening has (again) gone one step too far regardless of the fact that much the same howling mob of critics were lambasting Chairman Powell for the opposite sin when he supposedly knuckled under to Presidential pressure by suspending those same, allegedly superfluous rises at the end of last year!

In sum, one is acutely aware that what the present price action additionally comprises is one of those classic Dog Chasing Tail moments when the Market thinks it is front-running an imminent Fed response at the same time that the Fed is persuading itself that the Market knows something it doesn’t and so does prepare to move, thus providing ex post validation for a pricing shift otherwise lacking any real degree of substance.

Unless we receive a rapid burst of stronger-than-expected data – and fast! – or unless Mr. Powell proves himself to be far more steely a character than he is suspected of being, the geniuses driving bond yields lower – many among them caught leaning over the wrong side of the boat as the move began – are all too likely to appear far more prescient than is really the case.

The big questions then will be, whither the dollar and will stocks see that as a helpful shot of laxity or as confirmation that things really are as bad as their owners are beginning to fear.

Woof! Woof!