The Beggar’s Opera

First published 2nd February 2009

“Today, with the exception of a dozen or two reasonable individuals, the whole world is in complete agreement on two points: debts should remain unpaid, and the economy should be stimulated through strong inflation.”

Mises to Fritz Georg Steiner, letter dated January 29, 1932, Mises Archive 71: 11.

A good deal of our writing over the past year and a half has concentrated on analysing the course the downturn would take, once it emerged; how deep it might become; and how widespread would be the pain felt as the latest of all too many New Era runaway trains crashed headlong into the unchanging economic realities it had long sought to deny.

Naturally, our attempts at prognostication were necessarily less than perfect. The emerging market currency crisis of the latter months of 2008 escaped us, to name one big miss, as we committed the cardinal sin of failing to disaggregate the data pertaining to dollar-based assets and liabilities in Asia, Russia, and Brazil and so spoiled the fact that we had come early to the conclusion that the ‘decoupling’ thesis was sheer economic charlatanry by failing to consider how an external liquidity crunch would exacerbate the collapse of exports in a whole slew of foreign exchange-rich – and, hence, theoretically not funding-constrained – countries.

Nor, of course, were we able to directly specify the timing, nor the exact sequence of events as the calamity unfolded. While being among the most committed and consistent sceptics of the merits of government activism, even we could not have suspected that Hank’n’Ben, surely the greatest paired buffoons since Abbot and Costello, would – through sheer, vacillatory incompetence – contrive to undo the supposedly salutary effect of all the hundreds of billions of dollars they obtained under false pretences – or which they simply printed up – in order to shower them without overmuch in the way of either solid legal sanction or well-tested precedent on their best Wall St. buddies.

Neither could we have imagined that, within the space of a few short months, these two clowns would eradicate all grounds for rational calculation by counterparties, claimants, and would-be purchasers by:-

- first shoehorning Bear Stearns and WaMu into JPM and Merrill into BoA (bemoaning all the while that institutions grown even more gargantuan as a result were already ‘too big to fail’);

- then violently switching tack to proffer establishment poster-boys such as GS and Morgan Stanley the shelter of the Fed’s ever-spreading comfort blanket of liquidity;

- next brutally throwing fellow investment bank Lehman to the wolves – pour encourager les autres;

- even as they near-simultaneously issued a blank cheque of unprecedented scale to that mission creep-blighted un-insurer, AIG?

Apart from greatly increasing counterparty risk, this also threatened to trigger CDS-related cash-payouts on an incalculable scale. In turn, this forced the Big 3 central banks not only to slash rates and to monetize all sorts of highly unsuitable assets, but to offer foreign currency swaps to the tune of $650 billion and, further, to allow banks to build up a veritable mountain of superfluous re-deposits with them of no less than $1.3 trillion – undermining what was left of the interbank lending market as they did.

Hence, we have moved swiftly from a problem of localized stress in the automotive and residential real estate markets to a general constriction of even the most basic of trade flows as working capital has evaporated, leading to a classic ‘struggle for liquidity’ (albeit one partly masked in terms of its effect on, say, the yield curve, by the extraordinary actions being undertaken by the central banks in their role as cartel welfarists).

Toccata and Fugue

Though much of our approach has involved a direct application of our teachers’ traditional precepts, any extra skill we may have displayed in relation to the unthinking Herd, has also arisen from today’s adapting the analysis to take account of the peculiar political, institutional, and social framework in which unchanging economic laws may express themselves in greatly varying specific outcomes.

To take an example of the general case, Mises wrote perhaps THE classic exposition of what has broadly befallen us in his Meisterwerk, Human Action, Chapter XX – a piece of writing so percipient that it merits an extended quotation:-

‘Deflation and credit restriction never played a noticeable role in economic history. The outstanding examples were provided by Great Britain’s return, both after the wartime inflation of the Napoleonic wars and after that of the first World War, to the prewar gold parity of the sterling. In each case Parliament and Cabinet adopted the deflationist policy without having weighed the pros and cons of the two methods open for a return to the gold standard. In the second decade of the nineteenth century they could be exonerated, as at that time monetary theory had not yet clarified the problems involved. More than a hundred years later it was simply a display of inexcusable ignorance of economics as well as of monetary history.

‘Ignorance manifests itself also in the confusion of deflation and contraction and of the process of readjustment into which every expansionist boom must lead. It depends on the institutional structure of the credit system which created the boom whether or not the crisis brings about a restriction in the amount of fiduciary media. Such a restriction may occur when the crisis results in the bankruptcy of banks granting circulation credit and the falling off is not counterpoised by a corresponding expansion on the part of the remaining banks. But it is not necessarily an attendant phenomenon of the depression; it is beyond doubt that it has not appeared in the last eighty years in Europe and that the extent to which it occurred in the United States under the Federal Reserve Act of 1913 has been grossly exaggerated.

‘The dearth of credit which marks the crisis is caused not by contraction, but by the abstention from further credit expansion. It hurts all enterprises–not only those which are doomed at any rate, but no less those whose business is sound and could flourish if appropriate credit were available. As the outstanding debts are not paid back, the banks lack the means to grant credits even to the most solid firms. The crisis becomes general and forces all branches of business and all firms to restrict the scope of their activities. But there is no means of avoiding these secondary consequences of the preceding boom.

‘As soon as the depression appears, there is a general lament over deflation and people clamour for a continuation of the expansionist policy. Now, it is true that even with no restrictions in the supply of money proper and fiduciary media available, the depression brings about a cash-induced tendency toward an increase in the purchasing power of the monetary unit. Every firm is intent upon increasing its cash holdings, and these endeavours affect the ratio between the supply of money (in the broader sense) and the demand for money (in the broader sense) for cash holding. This may be properly called deflation.’

As he went on to explain:-

‘But it is a serious blunder to believe that the fall in commodity prices is caused by this striving after greater cash holding. The causation is the other way around. Prices of the factors of production–both material and human–have reached an excessive height in the boom period. They must come down before business can become profitable again. The entrepreneurs enlarge their cash holding because they abstain from buying goods and hiring workers as long as the structure of prices and wages is not adjusted to the real state of the market data. Thus any attempt of the government or the labour unions to prevent or to delay this adjustment merely prolongs the stagnation.

‘…Under a credit expansion which first affects the loan market… the inflationary effects are multiplied by the consequences of capital malinvestment and overconsumption. Overbidding one another in the struggle for a greater share in the limited supply of capital goods and labour, the entrepreneurs push prices to a height at which they can remain only as long as the credit expansion goes on at an accelerated pace. A sharp drop in the prices of all commodities and services is unavoidable as soon as the further inflow of additional fiduciary media stops.

‘While the boom is in progress, there prevails a general tendency to buy as much as one can buy because a further rise in prices is anticipated. In the depression, on the other hand, people abstain from buying because they expect that prices will continue to drop. The recovery and the return to “normalcy” can only begin when prices and wage rates are so low that a sufficient number of people assume that they will not drop still more. Therefore the only means to shorten the period of bad business is to avoid any attempts to delay or to check the fall in prices and wage rates.

‘Only when the recovery begins to take shape does the change in the money relation, as effected by the increase in the quantity of fiduciary media, begin to manifest itself in the structure of prices.’

Variations on a Theme

But the time for unalloyed diagnosis is past: what we must now attempt is the much trickier task of prognosis. In attempting this, the questions we, as commodity investors, must try to face up to are threefold; just when the recovery will ‘begin to take shape’, what sort of ‘shape’ that might be, and broadly how will the ‘structure of prices’ be ‘manifest’ when it does.

Here, having cited Mises as an authority on how the archetypal business cycle breakdown comes about we must briefly digress to consider a number of key differences between today’s economy and the one he was analysing in the first half of last century.

The first of these lies in the fact that the malign effects of credit expansion used to be largely the result of giving exclusively producers greater means with which to purchase inputs (whether relatively long-lived machinery, stocks of semi-processed goods, or labour itself) beyond the levels which could be funded out of their own profits and at interest rates below those at which they could attract into their schemes other sources of genuine savings.

By definition, we take these latter to mean those money sums which represent a voluntary abstinence from exhaustive consumption. The twin significance of this is that not only do these savings’ very genesis demonstrate that a limited satiety has arisen with respect to current output (and hence that something new on the menu might be welcomed from entrepreneurs in future), but also that a tangible pool of unutilized goods must now exist; goods which can therefore be reallocated from a marginally over-supplied end-consumption to serve as inputs (direct or otherwise) in the newly re-organized or expanded productive processes for which the businessman is seeking the funds in the first place.

The principal virtue of insisting upon such a correspondence is that it greatly limits the scope for the development of the sort of systemic entrepreneurial error which so plagues us today, a phenomenon which can only arise under conditions of unbacked credit expansion (so-called ‘forced saving’), and the frustration of true market mechanisms (which categorically do NOT include state-sponsored fractional-reserve banking or the maintenance of ‘managed’ currencies either within, or across, borders).

That such a blight pertains today, should by now be undeniable, but, overlaid upon this, trillions of dollars of additional credit has also been made available to serve no obvious productive end, but merely as a means of providing instant gratification on dangerously stretched and under-discounted payment terms to end-consumers (private or public) who were either unable to afford it out of current income, or by issuing claims against the earning assets already in their possession.

For far too long, the games has been to push all reckoning off up an ever-mounting hill of sand, all the time trying to pretend the present value of each grain of obligation is a reasonable one. Alas! Once the force of economic gravity at last won out over the illusions of investment bank ingenuity, it triggered a power-law avalanche, burying one of the millions of easy-terms Sisyphuses under the weight of a burden each thought he should never again have to shoulder.

It is true that some of this credit had a counterpart in a real desire to save, but such a transfer of resources to exhaustive- (rather than to constructive-) users has largely vitiated the savers’ benign impulse to make provision for their future. Moreover, two contemporary elements have served further to reinforce this baneful financing of unproductive (and hence, in essence, destructive) consumption – the two phenomena tritely labelled ‘globalisation’ and ‘securitization’, respectively.

By the former we mean the fact of separating the functions of an increasingly feckless, home-bred cadre of the takers of instant material pleasures from those of a well-motivated (if often only semi-skilled) overseas workforce of the makers such delights – an unfortunate apartheid often reinforced by a one-sided policy of currency (mis)management on the part of the latter’s government and by abject irresponsibility on the part of the formers’ overlords (herein lies another difference with the classical tale of the business cycle, though not necessarily with the experience of the intra-war years themselves)

Like much in economics, we must be careful not to drown the individual in the anonymous swamp of the mass, for we may all – at one time or another – find ourselves on either side of the divides which fall between borrower and lender, producer and consumer (a split which we must therefore be careful not to moralize about too monotonously).

However, as individuals, there are certain obvious boundaries over which we would not overstep unless these were hidden from us by means of either financial manipulation or political intervention. Sadly, few such limits have been in evidence in a world in which rampant inflationism has been encouraged, in great measure, by central banks desperate to forestall the consequences of a series of preceding busts and oblivious to the fact that a modest rise in their favoured index of consumer goods prices is far from being the sole litmus test of economic well-being.

Compounding this, those charged with directing the emergent nations have been all too happy to build the Potemkin village of pseudo-prosperity out of the straw of unrealizable promises to pay being liberally issued by richer foreigners with far too few material goods, but only a plethora of suspect IOUs, to offer in exchange for the poorer citizens’ sweat. The foreigners’ suzerains, for their part, were even more willing to close their eyes as thrift disappeared and investment withered under the twin pestilences of chronic credit expansion and a creeping government encroachment on free association. Instead, they were content to fool themselves that a Never-Never land profusion of flat-screen TVs and dockside dining establishments – largely charged to plastic or parlayed out of an ephemeral gain in home values – had somehow offset the latent impoverishment and progressive demoralisation which was insidiously eroding their societies’ long-held competitive advantage.

This is not to suggest – as both the right-wing autarkists and the left-green Savonarolas are equally wont to do – that a greater international division of labour is bad, per se. Far from it: the whole history of human civilisation is one of a greater specialization of function and of the evolution of higher levels of mutual co-operation which it instils. Not only are these the conditions for more rapid material progress, but they also tend to be conducive to the maintenance of peaceful relations, too, given that such fruitful interdependence means the dubious benefits of war become more and more paltry in prospect when compared to the ongoing bounties of commercial interaction which must perforce be sacrificed upon the bloody altar of Mars.

What IS needed, however, is to adhere faithfully to a monetary-financial system which promotes such an impetus, rather than prostitutes it. To abandon the semi-automatic regulation of a proper gold standard and the self-correcting tendencies of the price-specie mechanism it transmits for a world of chicanery in which central banks routinely aim to force interest rates to artificially low levels and finance ministries seek to defend unrealistic currency parities vis-à-vis their trading partners is no less heinous a method of false accounting than is the sophisticated sham of the bankers’ ‘Level 3’ assets or the crude deceit of a Madoff.

The crux of the second named influence is that not only does securitization break down the bounds of mutual responsibility and prudence between counterparties; not only does it encourage the sorcerer’s apprentices to introduce a dangerous degree of over-ingenuity into the associated repackaging, but that it inherently mirrors the psychology of the indulgent borrower by providing the lender with his own form of après moi le déluge instant gratification. This is realised when the originator books – and promptly re-leverages – a notional profit long years ahead of the receipt of what he has, in fact, ensured is an ever more protracted stream of smaller and smaller quanta of payments, each predicated upon an ever more dubious ability to generate the necessary cash when it falls due.

Moreover, when our securitizer then lends the purchase price to those to whom he sells the resulting security (and sometimes even capitalizes the fees due from this as part of another securitization), we can see that a great deal of undesirable leverage can become obfuscated by the layers of seductively lucrative pyramiding being piled on top of what is, at root, a very basic – if often a highly suspect – transaction.

Institutionally, this has been made worse by the fact that finance has become the master, not the servant of the economy, a reversal which has seen star-struck politicians compete away their powers of oversight in this explicitly non-market area, in order to have the greatest number of free-spending financiers come settle in their own particular fiefdom.

The result has been that of allowing the bankers to determine their own risk limits with the same disastrously predictable consequences of enjoining teenage hot-rodders only to ease off the gas pedal once they, themselves, felt they were driving a little too fast for comfort.

Battle Hymn of the Republic

To return to our larger theme, the second major disparity between conditions today and those which obtained when the traditional business cycle theory was being teased out is that, in the interim, even the peace-time state has gone from inflicting the incidental annoyances of a worthy, but over-officious nightwatchman to marshalling a swelling roster of Gauleiter and commissars, each charged with implementing a Petri-dish profusion of bureaucratic and penal Do’s and Don’t’s in every nook and cranny of the citizen’s life. It is therefore able to commandeer scarce resources to a degree unheard in more self-reliant times.

To take but one measure of this, in the America of 1929, private sector income – wages, proprietors’ earnings, dividends and interest – was reckoned at more than twelve times the size of the public sector wages and welfare payments being doled out. Even at the height of the New Deal (and hence at the depths of the Depression) this ratio stood at five to one. In stark contrast, in today’s much-touted ‘free market’, the proportion has lately languished – even amid 2006’s boom-time conditions – at around 3:1, below that recorded even in the final years of WWII.

If we stop for a moment to make an additional adjustment for all those ostensibly ‘private’ businesses whose sole or major client is the state (and whose totals should therefore be transferred from numerator to denominator), we can see that what has lately fallen apart is anything but Darwinian ‘capitalism’ and that it is not so much the red staining the tooth and claw of the marketeer about which we should be concerned, but rather the one staining the banner of the International which flutters above us all.

The point here is that if government is a dead weight in good times – especially with regard to the enormous costs incurred as its legions of pen-pushers, inspectors, and collectors earn a nice living, thank you, making up arbitrary rules and shuffling resources from Peter (who is not THAT electorally important to their masters) to Paul (who currently happens to be) – it can be equally a decelerant in the bad ones. Even here, though, we should harbour no illusions about whether this attribute simply prolongs the patient’ s agony, rather than being of any identifiable therapeutic value to him.

There is no magic at work here, only a suspension of accounting conventions. Any sprawling organisation able to siphon off the wealth of others by diktat can endure even the most sizable mismatches between income and outgo for a considerable time, especially when the Maynard-in-Wonderland orthodoxy positively encourages it to abandon any pretence of living within its means (effectively, within those of the subjects from whom it levies them) whenever storm clouds gather in the vicinity.

With the cargo-cult of Keynesian ‘spending’ dominating the collective consciousness, Depression may be the sickness of the citizen, but it is assuredly the health of the State no less than is War (to recall Randolph Bourne’s trenchant phrase). Thus, the enormous, bloated girth of Leviathan is bound to expand relatively – and probably in an outright fashion, as well. As it does, GDP – which is biased to the sort of end-expenditure at which government excels and which largely ignores questions of the sustainability of such flows – can be temporarily boosted and payrolls kept artificially inflated, even if the ongoing loss of wealth is increasing.

Given the socio-political tenor of our times it is pointless to pretend that one can make many converts to the viewpoint that what the economy needs now is not more meddling, but instead the greatest entrepreneurial flexibility in adapting to drastically altered conditions; the maximum facility in matching costs to falling revenues; and the utmost capacity in altering the composition of its capital base.

Conversely, in the purely dispassionate attempt to formulate an investment strategy it would be equally naïve not to allow for the fact that, well-intentioned or not, the perverse incentives attaching to interventionism (which, sui generis, must involve a policy of not allowing many of the necessary adjustments to proceed) and to the general substitution of narrow political preference for the market-based expression of individual will may well cushion some of the most violent effects of the down wave, but only at the cost of seriously impairing both the speed and quality of the subsequent recovery.

Remember that, for all the unheard-of billions thrown at the problem, for all the monetary debasement so cynically practiced, even Roosevelt’s most ardent apologists will tend to subscribe to the misconception that it took the forcible enslavement of six million young men in the armed forces and the institution of a rigid command economy to ‘put and end to’ the downturn.

Effectively, this is to admit that only by a tyrannical diversion of the labour of a significant portion of the workforce to the least constructive ends imaginable could a Keynesian programme keep everybody occupied – albeit for the scantest of material rewards to those so made to toil! No surprise then, that many of FDR’s Brain Trust openly admired Mussolini, or that JMK himself notoriously prefaced the German edition of his General Theory with a wistful encomium to the totalitarian system under which he imagined the machinations laid out therein best working.

Be that as it may, it is clear we must resign ourselves to a repeat of the experiment, for each passing day brings us yet more activism – much of it sweatily reactive; little of it showing signs of reflection or the pursuit of a considered strategy; most of it adding to uncertainty and thus spreading paralysis rather than acting as a palliative.

But if it is a military maxim never to reinforce failure, it is equal a principle of politics that if one billion fails, then two billions must be required, or, indeed tow hundred billions. Switching metaphors, the quacks into whose tender mercies we have been committed consider that, if the patient has become anaemic and run-down as a result of long years of dissipation, he must be bled and, should he not recover from his swoon, he must be purged and bled some more.

Pomp & Circumstance

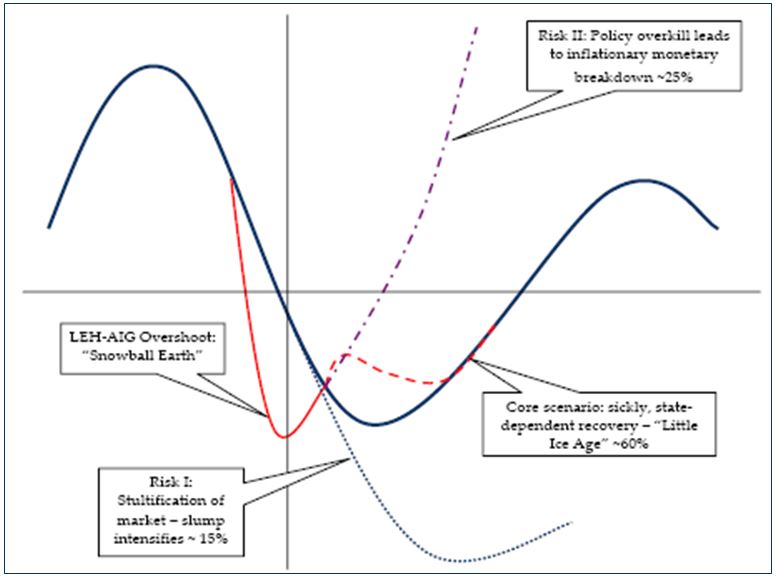

Of course, it just m-i-g-h-t be that something in the seemingly endless barrage of new measures accidentally delivers one of those ‘Yes, we can’ moments for which all President Obama’s many worshippers are so fervently praying, but there are also three far less benign outcomes which we would argue lie much higher up the list of likelihoods, namely:-

- that what remains of the market mechanism will wither and die as the incalculability of the regime changes saps its last vestige of vitality and so allows the slump to intensify disastrously;

- that the advance of government, far from being an auxiliary source of strength, simply provides a cover for the private sector to withdraw from the fray, clamping down on its own expenditures and snuffing out the embers of investment as its members retreat from a world in which they can foresee no realistic chance of turning a profit – something Mises himself was already talking about as early as 1931;

- that the crazed moves to slash interest rates, to monetize an increasingly unlikely basket of shaky claims, and to balloon public deficits might yet trigger a series of currency collapses or unleash a wild Weimar, wheelbarrow ride to the poor house.

The first of these scenarios needs only a little exposition. Perhaps the most pressing danger in this regard is that an unstoppable death spiral emerges from the current fiasco over the banking bail-out, especially in countries where the relevant scale of contingent fiscal support is clearly beyond the bounds of possible delivery.

Promptly liquidating bad banks, like liquidating any other failed enterprise, would have served to reduce the horrendous degree of over-capacity all too apparent in an business where ever more insane levels of risk and leverage – as well as ever more sly regulatory prevarication – have had to be accepted in order to make the expected return on capital.

But rather than encouraging full and early disclosure of each entity’s true status and then applying a rigorous practice of triage – thereby making room for the remaining healthy banks to continue to serve sound borrowers at an economic rate of interest – the authorities have so contrived it that almost the entire industry has now come to be dependent upon the public purse and/or the central bank printing press, with regulators also conniving in a relaxation of reporting standards and capital adequacy testing at precisely the moment when the cancer of distrust – of discredit, if you will – is poisoning the system, to the detriment of all. The only purpose this seems to be serving is that of keeping the plague victims alive for just long enough to pass the infection on to the healthy.

Be that as it may, we are now almost irreparably committed to the very opposite course – thanks to the incomprehension of some leaders and to the vainglory of others. In this context, we had previously argued that in major countries with relatively little foreign currency debt, the constraints on the monetization of assets, on central-commercial bank support for even long- term government debt, and therefore on unbalancing the budget were perhaps further away than was generally imagined. However, on reflection, that might have been a little too glib and it occurs to us that there are two main caveats to be borne in mind – one general and one more specific.

In the round, the mistake we made regarding EMs last quarter tells us to be wary of over-aggregation here, too. One could well expect that the sharp drop in a given currency which such extreme measures tend to provoke (viz., the UK) might initially be welcomed as an aid in ‘rebalancing’ activity away from the external sector, but, even where overall foreign currency debt levels suggest the side effects should be muted, we must always be wary that certain sectors – or even individual bellwether companies – might, nonetheless, find themselves driven onto the rocks, dragging down their counterparties with them as they founder (Russia is a case in point here).

Even were this not to occur, one cannot entirely allay the nagging suspicion that a sharp fall in the reserve currency, for one, might actually be broadly deflationary, as was sterling’s abandonment of gold in 1931. Though this might seem a perverse judgement to those conditioned to see a sickly greenback as the world’s main inflationary driver, just imagine what would happen to world trade flows, to real income, and to foreign balance sheets – packed as they are with paper denominated in it – if the dollar were suddenly devalued 50% overnight and so prompted widespread write-downs and bought fewer imports (and also, in such credit-straitened times, gave others the means to buy fewer US exports, too).

Turning to the more specific problem we can envisage, the rub is that for such extraordinary steps to be taken, the central bank must be a full and active participant in them – in the jargon, the demarcation between fiscal and monetary policy must be removed. This, however, may be easier to achieve in, say, Japan, the US, or China than it is ever likely to be the case in the Eurozone.

If even Germany has struggled to get its paper away in recent auctions, what price a Greece or a Portugal if bond spreads widen and CDS quotations climb further? To deal with the inevitable fiscal strain of a deep recession is one thing, but to have to resuscitate the entire financial circulatory system at the same time is a prospect which is already beginning to spook the horses.

It is true that the same government bonds with which a polity may intend to support an ailing bank – or use to extend finance directly to a cash-strapped local business – are the ideal balance sheet fodder for that same bank (being zero risk-weighted, earning assets), a fact which sets up the possibility of pulling off a neat little round-robin of accounting trickery.

As we have long said, in extremis, the state could become the lender and spender of first resort, with credit institutions relegated to becoming rump depositories of the proceeds of what would effectively be ‘war-bonds’. Moreover, since these bonds would also be eligible collateral for the ECB, even in the Zone, the central bank could be inveigled into playing a supporting role without formally having to announce its willingness to do so.

Nonetheless, there is clearly much more scope inside the fractious EU for political schism – especially across the historic divider of the Rhine – than exists within, other more homogeneous sovereignties and those who argue that the case of a Spain is no different to that of a California clearly forget that the last time American states signalled their wish to exercise their constitutional right to secede in the face of unsupportable economic policies, a certain high-tariff, corporate-welfarist from Illinois ‘unleashed the fateful lightning of His terrible swift sword’, leaving a million of his compatriots to share his own, premature obsequies.

Beyond the purely financial angle, a further possible route to the abyss which might lead from the adoption of unlimited fiscal support for too many zombies would be constructed amid a resurgence of antagonistic protectionism. The worry here is that as each state acts to prop up more and more of its ailing domestic industries, it will be tempted to try to secure them a market share of which their own efforts have been all too undeserving. Furthermore, State A is likely to become even more bellicose about its new ward’s foreign (non-voting) competitors if it can persuade itself that they are only able to pose a threat to its protégé because their home State B is supporting them in their turn.

An outright repeat of the Smoot-Hawley debacle is probably not to be looked for, but a creeping erection of barriers to trade (whether or not dressed up in the cant of ‘ethical’ or ‘ecological’ rhetoric) – and hence a curtailment of the means by which the indebted can pay down their obligations – is not to be lightly dismissed. Worryingly, both the backlash against immigrant workers seen in Europe, the ‘national champion’ policy emanating from the Elysée and the insidious moves by the US steel lobby to tie Washington hand-outs to preferential use of its products show how rapidly things could degenerate as stresses mount.

The Farewell Symphony

Assuming we do avoid such pitfalls, we must next consider whether government can actually stimulate business or merely substitute for it and the lesson of 1930s America is salutary in this regard.

For example, real, private net domestic investment was negative throughout all of the six years from 1930 to 1935, inclusive, strongly suggestive of the inference that the very business-to-business component of spending which is largely cancelled out in the GDP methodology, but which is crucial to the maintenance – much less the elevation of – material prosperity, was withering on the vine.

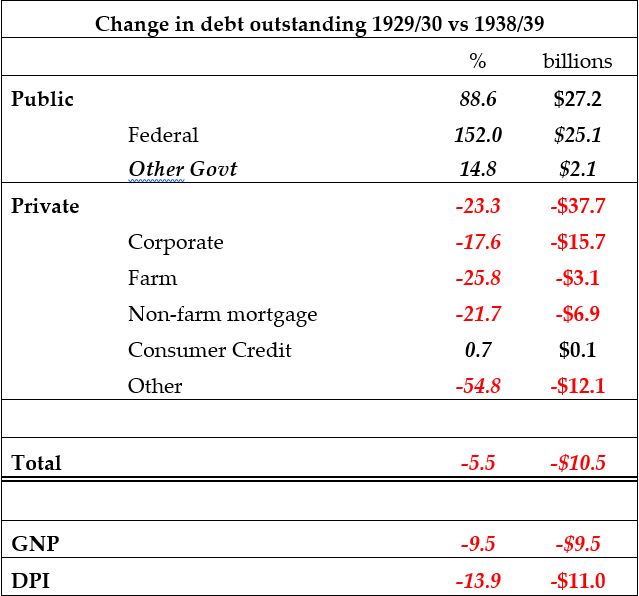

With overall retained earnings negative for these same six years – as even non-financial companies sought to maintain some level of dividend payment in the face of a plunge into negative aggregate profitability unique in the statistical record, renewed investment – and hence a re-employment of displaced workers – was all the more reliant on access to funding (and, conversely, to the willingness to take the accompanying risk). A look at the trajectory of aggregate debt levels is therefore instructive here, as the following table highlights.

TABLE 1: ‘Crowding out’ 1930s-style

From this, it is evident that, by 1938/9, though FDR’s regime had increased its indebtedness to no less than 2 ½ times the levels which had prevailed on the eve of the slump in 1929/30, the private sector total provided more than an offset, by contracting 23% from a much larger starting base.

Thus, while government debt outstanding rose some $27 billion (equivalent to a third of average nominal GNP over the period), private balance sheets shed nearly $38 billion, led by a $16 billion drop in corporate liabilities, a $12 billion decline in commercial & financial loans (only partly a result of the $2.3 billion fall in brokers’ loans), and a $7 billion fall in non-farm mortgages. Not shown here, net new issuance of corporate securities declined more than 90% from a 1928-9 combined peak of $13.3 billion to a 1939/40 nadir of only $1.2 billion.

That the net shrinkage in the combined debt stock of $10.5 billion almost exactly matched the $9.5 billion decline in GNP, or the $11 billion drop in disposable personal income is almost too perfect a coincidence, but nevertheless shows up a very real causative chain.

This ‘passing of the baton’ was a major reason why, despite the appearance – after years of Coolidge frugality – budget deficits of exceeding a then-shocking 5% of GDP, a 40% devaluation of the currency, and a tangled lunacy of producer subsidy and supply destruction, ‘only’ took the average change in CPI to the abnormally high peace-time level of 3.4% between 1933 and 1937, but did not entirely realise the contemporary fears of those who fretted over the ramifications of this concerted display of voodoo economics.

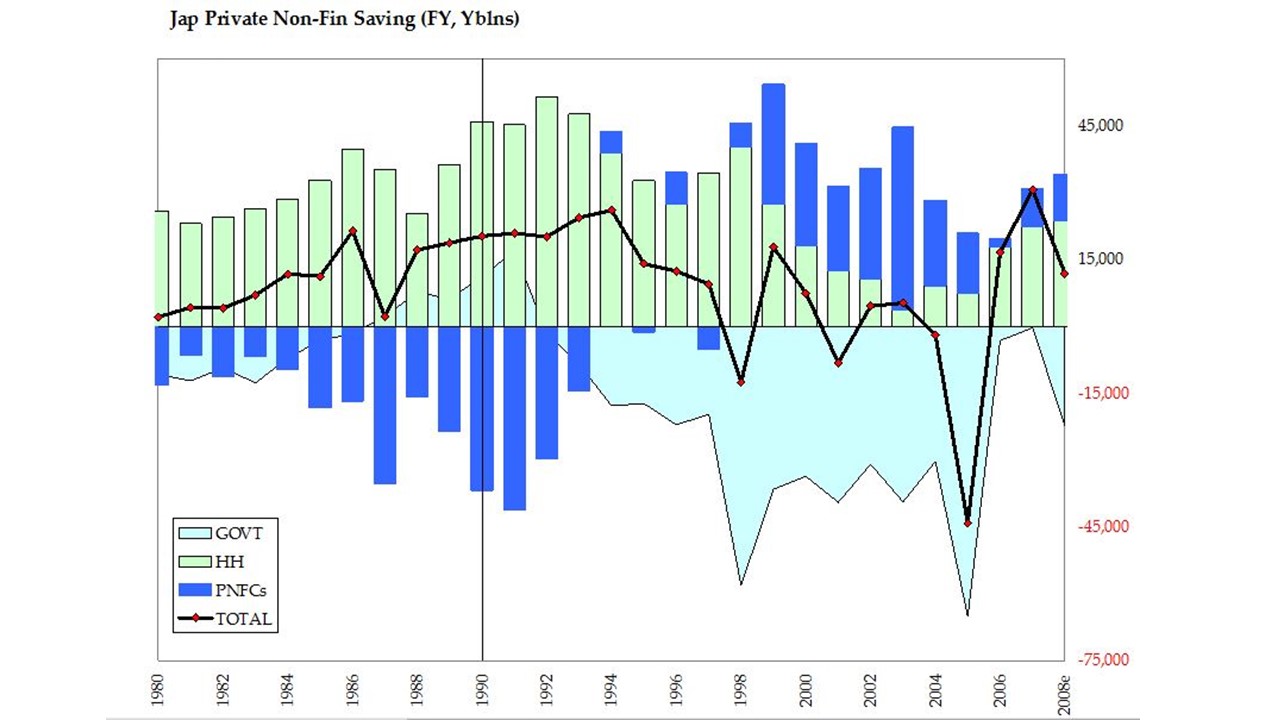

Japan of the 1990s offered a repeat version of the trend. From taking up 80% of household savings around the bubble peak (i.e., in the five years 1987-91), private, non-financial corporations switched dramatically to being net lenders of funds, adding to the pool a sum almost three times that set aside by householders. Put another way, from borrowing 9.2% of total private domestic demand, they ended up saving 7.2%, thereby largely offsetting the vast expansion of the government’s contribution.

Figure 1: Leaving the field of play

Indeed, so counter-productive was this latter, that it was only after the Koizumi reforms started to reduce its footprint – from around 2002 – that private sector demand showed any signs of revival. Shortly, thereafter, in 2003, gross corporate expenditures finally pulled out of a six-year, 14% nominal-yen slump (where they had hit a level first seen way back in 1990) and embarked upon their most rapid and sustained advance since the bubble itself burst, more than a decade before.

So, today – where left to themselves – many businesses have already begun to taking tough, but rational, steps aimed at coping with a radically changed environment. Such an adaptation is, after all, what constitutes the recession itself and this, it should never be forgotten, is a healing process.

Certainly, for some while, fewer capital goods will be needed (or, at least, fewer of last year’s hot-ticket items), fewer workers will be hired, and fewer productive inputs – such as fuel and other raw materials – will find a use. Though one can have a sincere degree of compassion for those individuals blamelessly caught up in the dislocation which must ensue, the shortest route back to gainful employment for them all is for entrepreneurs to be given every encouragement to do what they do best and to be provided with all possible means to identify new opportunities and to suffer no let or hindrance in taking advantage of the temporary slack in resources as they move to exploit them and so act to restore a more durable form of prosperity.

If governments r-e-a-l-l-y wanted to do some good, therefore, they would desist from monetary quackery and strictly limit assistance to that which temporarily alleviates genuine hardship. They would drastically reduce business taxes – as well as those levied on all forms of private savings. They would simplify planning protocols and cut loose the onerous burden of largely pointless regulations being mindful of the fact that building a better framework within which the state-dependent legal nonsense of fractional reserve banking is one thing, but telling entrepreneurs how many threads per inch must be on each screw they use or insisting upon written confirmation of the maximum capacity of each fire bucket is quite another.

Above all, governments should desist from spending much beyond their now-reduced incomes. Though anathema to the tenets of modern macroeconomics (the same ones, you will recall, which were of such help in both predicting and, hence, avoiding our present woes, much less in helping rectify them), this would both reduce business costs directly – hence helping restore profitability – and make the least charge on the sorely-depleted pool of useful existing resources. Such minimalism would therefore greatly facilitate the entrepreneurial shift we so urgently need to take place.

Capriccio Espagnol

But, to re-iterate, it is a forlorn hope to look for an outbreak of collective sanity to occur, so we have to assume that frictions will be increased, not alleviated and that recovery – in the main scenario, at least – will be shallower and more enfeebled than it need be.

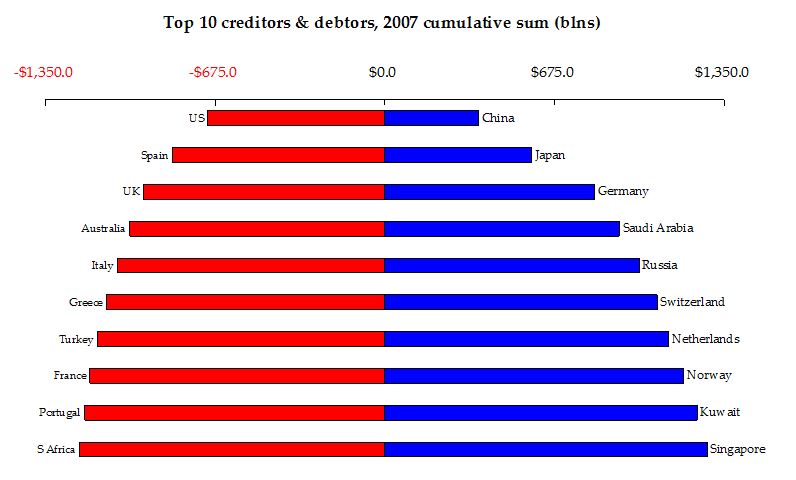

In essence, those residing in the inveterate deficit nations (see the accompanying graphic) need to borrow and spend less and save and produce more of almost everything but domestic real estate! If necessary, some reflection of this could be seen in altered foreign exchange rates – ideally as a one-off movement recognising the falsity of the existing parity and its distortive effects on economic calculation – but only where this is not frittered away by renewed credit expansion and the sort of self-defeating short-termism reported by the Bank of England agents last month when they revealed that UK exporters had tried to use the fall in sterling to try to increase prices, only to wonder why orders were not then sufficiently forthcoming in a world already cutting back on outlays of all kinds.

Figure 2: Neither a borrower, nor a lender be

In the language of Boehm-Bawerk, such nations need to lengthen their structure of production – something not best achieved by mindlessly promoting end-consumption, whatever the Krugmans and Kaletskys of this world may think. As Hayek replied to R. F. Kahn’s disbelieving question on the occasion of delivering his seminal ‘Prices and Production’’ lectures at the LSE, in 1931, if everyone went out and bought a new overcoat (i.e., if excessive end-consumer demand were stimulated), it would make the problems worse, not better for enfeebled higher-order businesses by bidding inputs away from them.

As far back as John Stuart Mill, it was recognised that the demand for end-consumer goods does not constitute a demand for labour, per se – only a vote as to how labour should be employed. It is the pairing of the saver and the productive redeployer of the saved resources which puts others to work, not the hedonistic depleter of the existing stock of goods. But even such a simple, two-step analysis eluded the mathematical meddler who was Keynes, however, leading him down some ludicrous blind alleys, indeed.

As Mises recalled (quoted in Marxism Unmasked, San Francisco, 1952)

“An American friend published an article dealing with his personal friendship with Lord Keynes. He tells a story about visiting Keynes in a Washington hotel. In washing his hands, the friend was very careful not to soil more than a single towel. Keynes then crumpled all of the towels and said in that way he was making more jobs for American chambermaids. From this point of view, the best way to increase employment would be to destroy as much as possible. I would have thought that idea had been demolished once and for all by Frédéric Bastiat in his broken window story. But evidently Keynes didn’t understand this tale of Bastiat’s.”

Nor do all too many commentators today, one would add.

Conversely, the chronic surplus nations have to ward off the curse of what has seemed like their own success. They need to curtail investment in more export capacity and, in future, those that have resisted it should allow their currencies to appreciate gradually, limiting the possibilities for a future over-reliance to emerge. Rather than acquiring ever more claims against those abroad who are unlikely ever to repay them in full, they would be well advised to eat a little more of their own cooking than has lately been their practice.

In some cases – loosely, that of Allemanic Europe – the expansion has been much more horizontal (an extra car assembly line, an extra shift at the turbine casting works), rather than longitudinal (whole new layers of long-duration, deferred-amortization, interlinked productive stages) and the response should therefore simply be to reduce that capacity which has only served to deliver goods to those inveterate over-borrowers no longer in a position to take them up.

As many commentators have noted, one inevitable and rather unpalatable consequence of the present mess is the striking disparity between the situation in the Teutonic core of Europe and that found in the Latino-Celtic fringe – one which must be faced – assuming the European project itself is not jeopardised without the panacea of a currency adjustment to help bridge the gap in productivity and the cost base.

Self- evidently, Spain, Greece, and their peers need to hunker down and live far more within their means, while Germany and the Netherlands must, in turn, generate far more of their wealth internally than has been their practice, or else they must seek out counterparts able to pay for their shipments machine tools and mining equipment with useful merchandise of their own, not kited cheques.

Patently, the days are long past when it might have seemed sensible to squander such a high proportion of savings in offering ‘vendor finance’ to foreign customers – for that has only been to swap hard-won real resources and human toil for the pixilated promises of a prodigal. Note that this is not to endorse the standard ‘rebalancing’ argument that the surplus nations should simply resolve to spend more, willy-nilly, as an offset for the deficit nations’ retrenchment, for the former, too, have significant losses to make good while the partial re-orientation of their mighty engine of exports will take a great deal of savings-backed capital to accomplish.

In some of the surplus nation a further difficulty arises since here the mountain of export receipts has been used to further swell the domestic monetary base, enabling the ensuing credit influx to foster a true, producer-style boom – China, India, Russia, the Gulf nations, spring to mind. These countries need to shorten their productive structures as well. The irony here is that though individually laudable for their industry and thrift, people in the surplus nations face the much more difficult task in coming to terms with the new order (especially where they were foolish enough to borrow short in foreign currency in order to finance long-term schemes at home). This is something perhaps not still entirely understood by the mainstream

It may be unpleasant to forego the luxuries to which one has become accustomed until one has worked to earn the means to afford them – as the debtors may now have to do – but is usually a great deal harder to accept that the towering superstructure of machinery and plant one has built with the sweat of one’s brow to provide them now needs to be idled, retooled, or scrapped completely. The temptation must surely be to muddle along, high grading mines, skipping maintenance and deferring replacement schedules in factories, seeking for funding (where accessible) to tide oneself over, all in the hope that conditions may one day improve as mysteriously as they seem (to the average business executive) to have deteriorated.

Unfortunately, that is only a choice which serves to increase the consumption of capital and which will thereby add to the impoverishment one is currently seeking to avoid. There is no denying the harsh truth that the overcapacity which has been so painfully revealed these past few quarters is nothing less than a colossal physical reflection of the wastefulness engendered by the worldwide credit expansion. Whether or not those who commissioned the building of the excess were any more than passive participants in a monetary laxity often generated elsewhere and insidiously transmitted to their shores is utterly beside the point: capital has been misguidedly lavished upon it and workers hired to man it. Sadly, the implosion of the boom has left both unable to generate sufficient revenues to justify their continued engagement on anything like the scale envisaged when illusion still reigned supreme.

In the Hall of the Mountain King

We have often remarked that much of what has passed for the exceptional levels of profitability enjoyed by many companies in the upswing was as much as facet of financial engineering (again, much of it associated with securitizing customer receivables, lease payments, etc.) as it was anything to do with improved technique. (It is also salutary to note that, according to the US FoF data, no less than three-fifths of the whole $6.3 trillion, 63% rise in non-financial corporate net worth recorded during the five year upswing, 2003-08, can be attributed to notional gains in the value of real estate holdings, while the remainder can be ascribed to an increase in the balance sheet total of ‘miscellaneous’ financial assets).

Ultimately, aggregate nominal profits in a given country can only improve if a greater proportion or revenues do not have a corresponding cost item immediately to offset them and this can come about only because there has been: (a) more saving-based investment (thoroughly commendable); (b) higher overseas demand (fine, subject to all the qualifications voiced above); (c) or through credit expansion – this latter, of course, the root of all evil.

If any confirmation were needed that this indeed played a very large role in the last cycle, consider what Richard Dobbs, et al, of McKinsey wrote in March 2008:-

‘Gauged either by earnings as a share of GDP or by returns on equity, US companies apparently fared better than they ever had, at least during the 45 years of our data. Between 2004 and 2007, the earnings of S&P 500 companies as a proportion of GDP expanded to around 6 percent, compared with a long-run average of around 3 percent, with the increase most acute in the financial and energy sectors. At the heart of this widely enjoyed earnings growth was a sales-driven expansion of net income rather than improved overall operating margins, growth in investments, or invested capital, each of which grew only slightly. In effect, companies increased their capital efficiency by selling more without making proportionate investments. In the nonfinancial sector, this meant squeezing greater capital efficiency from plants and working capital, so that returns on capital employed rose some 40 percent above the long-run US trend. Credit-driven consumer expenditures provided much of this revenue boost.’ [Our emphasis]

If we accept that, here among the rubble of the Western banking model, those days are long gone, this has significant consequences for both the top line and the bottom line (not to mention for the balance sheet) as many those same consumers fail to meet their past obligations, much less opt to expand them so incautiously in future.

It adds weight to our view that the last business cycle was one supercharged by easy credit – arguably on a scale never seen before. The inescapable inference is that the Bubble was not so much in real estate, or emerging market stocks, or modern art daubings, or vintage Bordeaux, or hedge funds, or crude oil – or whatever you care to name – these were all symptoms, not causes. No, the Bubble was the whole warped continuum of a monetary-financial system primed for disaster and propelled there by the utter incomprehension of what they had wrought which was so evident among its principal architects and overseers (the men, you will note, who are now charged with the task of ‘mopping up’ in its calamitous aftermath).

Absent such a bubble, even once the long, weary work of recovery is underway, we should set aside all thoughts of seeing such growth rates again for a very long while to come. That is, unless the third and final scenario comes to pass.

This, of course, is the one in which the opening of the Pandora’s Box of fiscal radicalism and monetary overkill lets fly the demons of currency debasement and floods the world – as is the central bankers’ unconcealed desire – with so much cash that people’s main concern becomes no longer how they can get hold of it, but how they can disembarrass themselves of the stuff.

Given that the finances of the populist Provider State are to be tested to levels not seen in peacetime, and given that the explosion in central bank balance sheets are likewise extra-ordinary – not least for the amount of sheer junk contained therein – the world has definitely taken the Tiger by the Tail. Absent the necessary degree of retrenchment and redeployment of resources, it seems the economy will become progressively more sickly and ever more politicised and will be prone to swoon every time the fiscal or monetary valves are opened less than fully, or every time a neighbour devalues his currency faster than one does one’s own.

Already, there are rumblings in Europe about the effects of sterling’s plunge, while the Swiss National Bank, no less, has brazenly warned that, if it deems the circumstances require, it could ‘sell an unlimited amount of Swiss francs…in order to prevent an appreciation…or even to bring about a substantial devaluation of the national currency.’ While the Singaporeans are trying, for the moment, to slow the rate of decline of their currency, the Russians are happy to oversee a rapid one of theirs. For their part, the Japanese are said to be concerned about he appreciation of the Yen, while the nominee for the position of US Treasury Secretary has been telling Congress that it is ‘important’ that America’s trading partners have ‘flexible currencies’ – transparent code for ‘we want a lower dollar’.

In such a world, it will be hard to imagine that the same central bankers who could not normalize interest rates in Japan for thirteen long years after pushing them below 1%, and who took far too long to restore a modicum of sanity in the aftermath of the Tech bust (itself a legacy of the Asian Contagion, which stemmed from efforts to mitigate the Tequila Crisis, which had its roots in the Japanese Bubble, which came about because of the S&L crisis, and the Occidental property bust which arose from the ’87 Crash, which came about thanks to the LDC debt crisis, which could trace its lineage back to the oil shock and hence to the break up of Bretton Woods…) will act pre-emptively and aggressively to withdraw the stimulus once the worst is past.

If that great student of the Depression, Chairman Bernanke has already apologized publicly on behalf of the 1929 Fed for easing too late, do we really think he will risk repeating the mistake they are deemed to have made when they tightened prematurely in 1937? Does it not disconcert you, just a little, to hear Secretary Timothy Geithner telling the WSJ that: “…There (will be) a huge temptation to see the light at the end of the tunnel before it’s really there and therefore to kind of shift back to restraint before you have recovery fully established…”?

Nor can we really envisage the politicians willingly surrendering a degree of influence, vote-grubbing, and patronage which had successively eluded close to three decades’ worth of their predecessors in office. A speedy return to small(er) government and budgetary continence once the worst is past? Forget it!

So, one cannot fail to reckon without a third scenario – the one we have long espoused (though not without a few doubts in recent months as the bungling has continued). This is that – as Charles Goodhart notoriously put it in 2005 – ‘Deflation in a fiat money system is a self-imposed injury’. The only point is that, at some point, the people who use the money have also to come to believe it is the case and to switch to fearing that the cure may soon become worse than the disease.

Nor should we worry about there being enough ‘willing borrowers’ to effect the necessary bursting of the levees. If, for example, the government cut taxes to zero, while maintaining or even increasing its disbursements and simply issued T-bills to the central bank to make up the difference, a spendable, lendable surfeit of money would quickly find its way into people’s pockets, even absent a functioning private credit system. Likewise, if the central bank offered to swap unlimited quantities of bank notes or reserve balances for any identifiable claim to property, or against any verifiable promise of deferred payment presented to it, a shortage of currency would not long be felt to be a constraint.

Long-term private investment might well find little comfort under such conditions, so wealth creation might be moot, but a feverish struggle to exchange money for such goods as are available might mislead the monetary cranks into thinking they have succeeded in restoring some vitality to the system.

Given the intemperance with which those in power are acting, given the pride which they – closet Jacobins, to a man – take in being wildly ‘unconventional’ in all things, a rebound from falling to sharply rising prices is eminently possible. The larger the government deficits incurred along the way, the more engrained the habits of economic dictatorship, and the more entrenched the fiefdoms so created, the greater the overhang of outstanding debt which will result and hence the more intense the incentives to monetize it away in real terms.

Bamboozled by our Bloomberg screens and quickened in our impatience in a world of iPhones and Instant Messaging, we should not lose sight of the fact that we are still at a relatively early stage in the game – it is only eight short months, after all, since the ECB was last raising rates, while even the BoE only started cutting aggressively in September. Do not rule out the possibility that we are already putting in place the means for a destruction of wealth and values in a wholly opposite manner to the one everyone presently fears.

Figure 4: Heat Death, Snowball Earth & the Little Ice Age