In ‘Risk and Failure in English Business’, his study of the development of eighteenth century Britain, UCL professor Julian Hoppit identifies no less than ten financial and commercial crises to have occurred during its first eight decades, to which a quick glance at the annals allows us to add at least three more over the next two. In the nineteenth century, we can enumerate roughly one such outbreak a decade in Britain alone, with a higher count if we include episodes from the Continent or the fledgling US of A.

To gain a feel for the shockingly contemporary nature of much of this litany of default and defalcation, consider what David Morier Evans had to say about his American contemporaries’ behaviour as far back as 1837:-

“The banks, instead of controlling and giving right direction to adventurous enterprise, identified themselves with speculation; descended from their high station as conservators of capital and, while they enriched a few corrupt associations, ruined the community and entailed permanent dishonour on the nation.”

We moderns, however, are in no position to mock the gullibility or primitivism of our forebears since, in the last 35 years alone, we have reeled from side to side of our own Ship of Fools – through the Bretton Woods break up; the oil shocks and secondary banking crisis; the LDC debt disaster; the Plaza-Louvre accords rollercoaster; the Crash of ’87; the S&L tsunami; the implosion of the Japanese ‘Miracle’; the early 90’s property bust; the Tequila Crisis; the Asian Contagion; the Russian bankruptcy and LTCM fiasco; the Tech-Telecom bubble; defaults and devaluations in Latin America, Turkey and Eastern Europe; Enron, WorldCom and the corporate bankruptcy spike; the CDO/sub-prime catastrophe; and, now, yet another period of simmering sovereign debt distress.

Though circumstances differ greatly, it is not hard to find the common denominators in all of this. Principally, we cite the particular legalized violence which is governmental abuse of credit, especially where this either involves, promotes, or relies upon that frightful chimera of corporatism which is fractional deposit banking.

The astute and highly-explanatory observation made by the political philosopher Franz Oppenheimer was that there are two essential ways by which men seek to make a living. The first of these means is the economic one, involving private production and free exchange based upon voluntary association on an unhampered market. The second is the use of political means which is, at root, nothing more than a protection racket, an extortion of property with menaces, whether the shakedown is undertaken by the leader of some local banditti (‘We don’t need no stinkin’ badges!’) or by the Right Honourable Members of that Neo-Gothic fantasyland upon the Thames.

To this we could perhaps add a third means, one which straddles the two, for, as the Medici long ago recognised, banking entails a system whereby ‘the money gets the power and the power protects the money.’ Or, as the Swiss constitution puts it: ‘the law of private property does not apply to the Swiss National Bank’ – an unusually explicit recognition of the privilege extended by grant of a positivist state to its favoured institutions in infringement of natural law.

What shall it profit a Man?

Foremost among these are the sanction of fractional reserve banking (about which much more below); the introduction of and compulsion to accept fiat money; and, undergirding the whole by binding the monied interest to the state – as the founders of the Bank of England were proud to affirm – the incorporation of that engine of inflation and that paymaster of executive absolutism, the central bank.

This form of banking is very effective at fostering, fortifying, and fossilizing a self-perpetuating plutocracy whose venality is thereby left unchecked and whose vested interest comes to dominate policy making. It is, moreover, a marvellous way of inducing elected politicians – who, as a class, are not usually well-versed in such matters and who are, in any case, incentivized to suppress any misgivings they may feel – to believe they are able to ignore the hard constraints of economic inevitability. This highly dubious presumption is one for which they generally seek to enlist electoral support by trumping Marie Antoinette in declaring: “Let them eat cake and have it, too!” All that such men aim at is that the bill does not finally fall due until they personally relinquish the reins of power to their successors. Thus is both their cynicism and their Saint-Simonism bankrolled, to the detriment of all.

The bankers, too, are apt to delude themselves that mere economics can be circumvented if sufficient twisted ingenuity can be applied by their batteries of idiot-savants in cooking up a new batch of so-called ‘innovations’. These are usually dressed up in complex sounding names or clouded in a daunting alphabet soup of obscure acronyms, but represent little more than accounting tricks wrapped up with inappropriate gambling strategies. These consist of the hoary old devices of anticipating and then capitalizing future revenues; palming off the devalued coin; cheque-kiting; playing fast-and-loose with both capital requirements and capital structure; hiding exposures off balance sheet through wholly legal chicanery; and otherwise obfuscating the risks being run through the employment of, e.g., securitisation, ‘special-purpose’ vehicles, and derivatives.

Innovations, when undertaken by a real business are aimed at improving the range of realisable material possibilities by discovering how to do more, or better, with less. In finance, however, the usual game is to try to extend the range of claims upon such possibilities by finagling a way to buy more, or better, with less money down and extended payment terms thereafter.

As that giant of Victorian High Finance, Samuel Loyd, Lord Overstone, put it:

“The ordinary advantages to the community arising from competition are that it tends to excite the ingenuity and exertion of the producers, and thus to secure to the public the best supply, due regard being had to the quality and quantity of the commodity, at the lowest price, while all the evils arising from errors or miscalculations on the part of the producers will fall on themselves and not on the public. With respect to a paper currency, however, the interest of the public is of a very different kind; a steady and equable regulation of its amount by fixed law is the end to be sought and the evil consequence of any error or miscalculation upon this point falls in a much greater proportion upon the public than upon the issuers.”

The consequences of ignoring this injunction should be all too apparent. Indeed, this is a methodology which the Bank of England’s own Director of Financial Stability (titter ye not at the ‘Io, Saturnalia!’ implications of his title) pithily dubbed ‘Risk Illusion’ in a recent speech.

- Firstly, it generates the immense waste of the business cycle itself.

- Secondly, it imposes a chronic inflationism upon society – an insidious pestilence which intersperses treacherously quiet periods of relative dormancy (viz., the risibly-named ‘Great Moderation’) with feverish eruptions of mass self-aggravation. This corrodes morality, self-reliance, and the viability of voluntarism as much as it renders all economic calculation suspect.

- Thirdly, it dragoons us all into the role of speculator – regardless of aptitude or circumstance – as we try to preserve our spared value across time in order to provide for our dotage, or to bequeath a little seed capital to our children.

- Fourthly, the insidious Cantillon effect of favouring those who get the new money first sucks far, far too many resources into finance itself, turning it from a conduit of savings and a facilitator of investment into a canker of self-engorgement and a furtherer of intemperance.

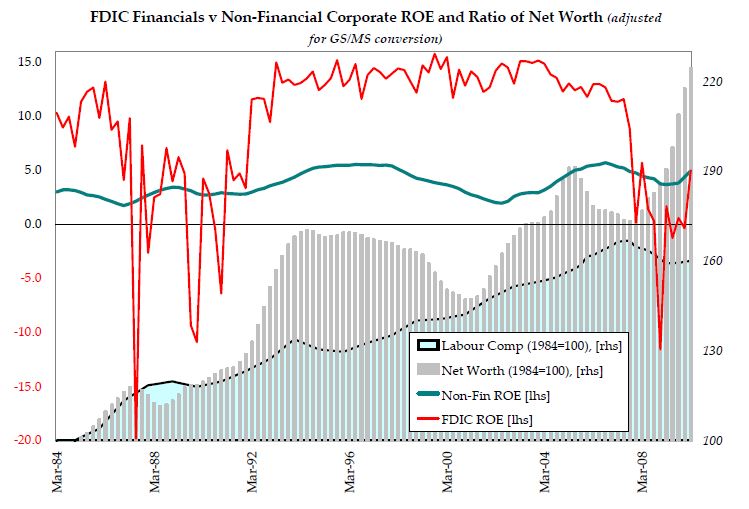

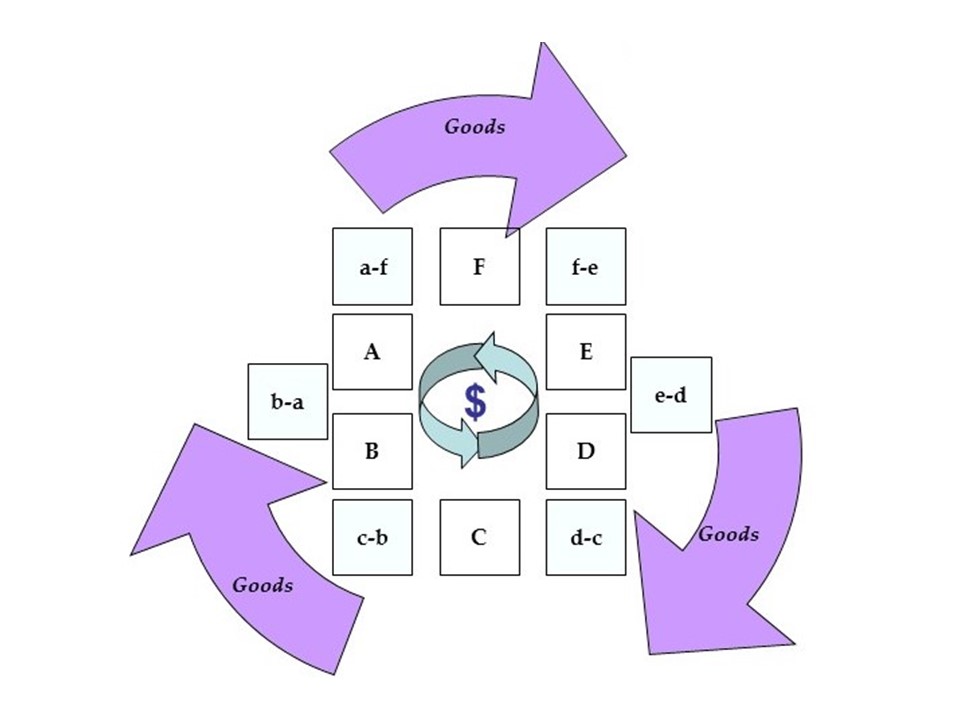

Figure 1: Banking v Business – Undue Enrichment

Finally, since few can protect themselves adequately from its ravages, such a system immeasurably increases the value of state patronage and so expands the reach of collective politics and shrinks the realm of private, economic action to a mere vestige of what it should be in a flourishing republic of law.

In sum, our dire financial-political symbiosis – what John Brewer memorably rendered as the ‘fiscal-military state’ – leads to the apotheosis of the Financier Class, the Expropriation of the Middle Class and the demoralization of the Working Class, a sorry pass we might justifiably term, Soft Fascism.

The Midgard Serpent

Once in the coils of this world-girdling Jörmungandr, we swiftly find that they form a vicious circle which slowly constricts our liberties and occasionally chokes out our very lives.

Banks emerge from the last crisis temporarily chastened and perhaps even subject to a tighter regulatory leash. But, before long, they have forgotten their former humble state and are embarking upon another wave of ‘innovation’ as their in-house sorcerer’s apprentices learn to game the new regime and once more prise open the Pandora’s Box of bad money and easy credit.

These are, after all, in their current manifestation, institutions riven with agency problems. They lack a due proportionality of aims between insiders and outsiders, or between short-term and long. They are unrestrained by the availability of that virtual ‘capital’ which only an institution with largely immaterial values on both sides of its balance sheet can deploy. They are ever-prone to a total abnegation of fiduciary duty – and yet they are the favoured children of a state which loves nothing better than the meretricious euphoria of the Boom, a period when politicians, too, can persuade themselves they have become true, bull market geniuses.

Come the inevitable dispelling of this illusion and the Bust is soon torn by the mutual recriminations, now that the thieves have fallen out. Boasts of ‘market fundamentalism’ give way to sneers of ‘market failure’– though the role of anything genuinely purporting to be a ‘market’ in all this remains elusive.

Those who would debauch us from the Right now cede place to those who would despoil us from the Left in a vicious circle which causes what we might call a dialectical dematerialisation of wealth and freedom, two precious pearls which are ground to dull, grey powder between the millstones of their antagonistic, but equally determined enemies.

Making the cycle worse is the fact that it has its own epicycle of Fatal Conceit intermeshed with it, for the modern central bank is not just there ‘for the continuation of the war’ – i.e. to obviate the need for the executive to persuade those who would otherwise furnish it with its ‘sinews’ to comply with its demands – nor is it merely the ultimate back-stop for the bankers’ cabal – ‘the lender of last resort’ – it is nowadays its own little Gosplan, charged with steering that grand, aggregate, quasi-hydraulic, abstract problem of engineering we are wrongly indoctrinated to think of as the duly-capitalized ‘Economy’.

Pushing and pulling on the levers of liquidity; arbitrarily moving interest rates up and down rather than letting capital-in-being and expressions of composite time preference lead them to their own level; tinkering with foreign exchange rates and even asset prices at large, the central bank aspires to a monopoly of knowledge it cannot, in fact, possess and, in serving too many masters at once, it compounds its errors of economic ignorance by dropping all other objectives in order to become a fire-fighter whenever the contradictions between them break out into open unrest.

Figure 2: ‘Tying the People faster to the Government’

Hence, moral hazard is entrenched and extended, crisis by crisis, as our earlier authority, Lord Overstone, was well aware it would when he railed, over 150 years ago, that:

“The vicious system of Credit and Banking which is the source of the evil will derive additional strength from the assurance that, in all future emergencies, the Law will be relaxed for their assistance and protection… this leads me to anticipate future convulsions, increasing in magnitude, and more formidable in their consequences…”

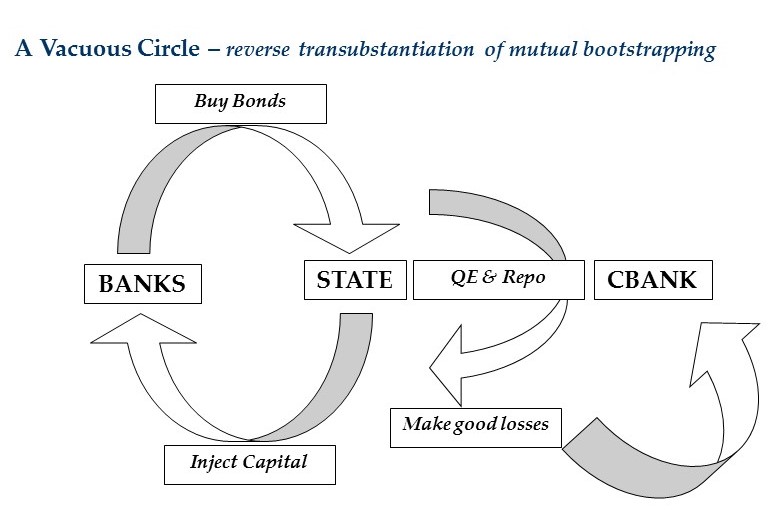

Where all this ends up is perhaps best characterised as a Vacuous Circle – one built on nothing more tangible than the Cheshire Cat’s smile: a reverse transubstantiation where the more you look, the less you see.

In this, the state realizes it cannot do without its stricken banks (no matter what temptations accrue in the meanwhile to succumb to a populist condemnation of their undoubted enormities). Thus, it injects what it calls ‘capital’ into them and begins a ‘counter-cyclical’ expansion along the lines of that advocated by Bloomsbury’s most hallowed underconsumptionist crank in order to maintain ‘aggregate demand’ – whatever that might be.

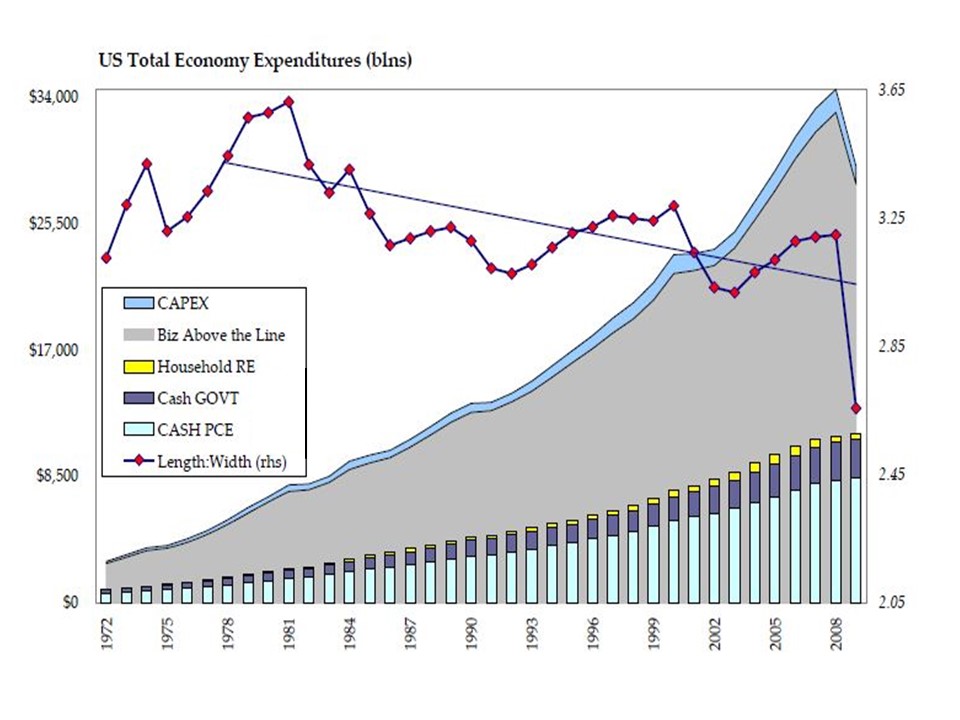

Figure 3: Who’s saving whom?

Since this means it is soon spending even more above its income than is its norm, it also provides our central bank commissars – through their direct or indirect purchases of the resulting security issuance – with a way to inject more money into a system to make up for the quasi-nationalized banking sector’s temporarily inability to do so. As it expands its balance sheet – and takes on a riskier range of assets so as to accomplish this – the CB seeks an explicit guarantee from the Treasury that any losses which thereby accrue will be made good and so ensures that its own, vanishingly thin layer of ‘equity’ will not be compromised.

However, the longer the malaise persists – and an Austrian would have to insist that the reinflationary shock treatment and associated meddling is more likely to hinder, rather than to help, the self-healing process of entrepreneurial adjustment and individual self-repair – more and more will the awareness spread of the unsustainability of the government’s own finances, shifting the locus of the crisis to the sovereign fisc. Faced with a strike on the part of many of the former buyers of its paper, the state will insist that the banks mutate from the saved to the saviours by taking up that paper of their masters which its former buyers will not now accept – before refinancing it on highly favourable terms with the increasingly overstretched central bank.

So each drowning man avows that he will hold up all the others, though, the truth is that not only do all risk foundering, but that this noyade will drag under many whose only sin is to be unfortunate enough to live within the main actors’ jurisdiction.

Glasshouse or Glass-Steagall?

So, what is the solution? So far the suggestions – where actually made in some approximation of good faith – have focused on what we might call a narrowly institutional approach. This has certain merits – if only because nothing could be worse than leaving things as they are – but it will probably only provide an arena for future exercises of ‘innovation’. Like the hydra, we can expect two heads to grow for everyone that is severed unless we cauterize each wound as we go and for this we require the flaming brand of monetary reform, not the flickering taper of financial regulation.

One suggestion is that the banks undergo a rigorous separation of function, reversing a trend towards ‘universal’ banking which, far from adducing to stability, has patently encouraged even the most sleepy and conservative of financial firms to ‘tunnel’ profits from one department to another and to treat customer funds merely as the table stakes which senior employees and executives hope to parlay into the huge bonuses they intend to carve out of their winnings in the Global Casino.

Among their diverse roles, bankers (let us not here say, ‘banks’) may act as brokers of loans, foreign exchange or securities, earning a fee for bringing the two sides of a transaction together; they may lend their own capital to underpin the extension and acceptance of trade or other commercial finance; they may underwrite and even participate in the raising of capital for other firms; they may offer financial and investment counselling; and they may even take up the honourable enough role of speculators – provided this is not undertaken in connexion with a limitless ability to create credit from nothing and hence they should not be afforded the power to ignite a destabilizing, leveraged firestorm of conjoint asset-collateral appreciation.

Individually, all of these fields offer the scope for genuine entrepreneurialism: mixed together they are a bordello of the temptation to peculation and a cesspool filled with conflict of interest. Singly or separately, they should take place without either explicit or implicit government support or subsidy and should be subject to no less rigorous an application of the law than is any other business. It may even be asked whether the positivist legal privilege of limited liability should be withheld from those charged with managing other people’s wealth. Though it seems anachronistic to say so, even this was once seen as a dangerous ‘innovation’ which bought increased activity at the cost of a drastic reduction in personal responsibility, no where moreso than in finance.

If men wish to become bankers for the rewards they foresee, surely they can not object to being obliged to form a partnership to that end – a constraint which would bring the added benefit of preventing that overconcentration of risks which results in the deplorable spectacle of the worst malefactors being deemed ‘too big to fail’ and propped up at their victims’ expense.

For all the merits of such ideas, the issue of paramount importance is that bankers should be proscribed from undertaking any of the above activities in a manner which can itself give rise to the creation of money, per se. Once that particular genie is out of the bottle, all other hopes of a purer, safer finance are a phantasm or will-o-the-wisp: corked firmly inside it, however, and we may finally lay the ghosts of Chang Yung, Law, Thornton, and Keynes.

Physician, Heal thyself!

Now we come to the vexed issue of whether or not a Libertarian can consistently demand that the State whose interference he so abhors should be enjoined to enact the reforms he feels are necessary in this – or, indeed, in any other sphere. In this particular context, the question often finds expression in the rather querulous enquiry: “Why do you Austrians suddenly become so étatiste when it comes to banking?”

Firstly, we must insist upon our earlier proposition that banking – as presently constituted – is an insidious practice which straddles Franz Oppenheimer’s great divide between those who make their living through economic means (i.e., through private production and free exchange) and those who extort one, stealing others’ bread through political means.

Thus to enlist the machinery of the state to deny banking its access to political enrichment – leaving only its genuine market functions unfettered – is no more an act of tyranny than it would be to order the secret policemen to perform one last duty of throwing open the prison cells before handing in their uniforms and relinquishing their offices, once and for all.

Beyond even this objection, however, there comes the claim that, so long as a reformed banking takes place upon a ‘free’ basis – i.e., absent any government support, whether explicit or implicit – then it is nobody’s concern whether or not the individual bank decides to operate upon a fractional reserve (or ‘fiduciary media’) basis.

To our counter that there can be no justification for allowing an organisation to exist which is grounded in the non-Aristotelian nonsense that both A and not-A can simultaneously lay claim to the same property title, our free-fractional antagonists respond, in turn, that no voluntary arrangement – however delusional its basis – should ever be explicitly banned.

That may be all well and good for so long as the madmen confine themselves to their private, mutually-chosen bedlam. But, if one of them insists that when I buy from him – or, indeed, from one with whom he has previously dealt – a mutton, he is at liberty to deliver me something with two legs and feathers that clucks and lays eggs, the insanity he perpetrates can now have no place in any valid form of contract.

And – no! – for all the many attempts at establishing the analogy, fractional reserve banking (FRB) is NOT akin either to owning a stake in a time-share apartment or to paying for membership of a gym where the number of subscribers is demonstrably greater than the count of the machines.

Notice that the very description of the first clearly delineates a shared (i.e. partial) – and hence non-overlapping – claim to ownership, while the latter represents what is not even a call option upon fitness equipment services, but rather the purchase of a repeated entry to a lottery (albeit one in which the chances of winning are unusually elevated as these things go!) whose prize is their momentary usufruct.

Moreover, this misses the point that FRB precisely does allow multiple owners to exchange their sham claims for real property in the wider world, so a better parallel would be the improbable case where you can persuade your grocer to let you pay at the checkout by offering him to give him your gym membership card in settlement.

Once the gym owner realises that this is happening, he will abandon his former estimate of how many such memberships he can sell – a calculation once based upon the size of his establishment and the likely avidity for physical exertion he gauged his clientele would display – and instead he will start issuing more and more of the cards, secure in the knowledge that their owners now consider most of these not as use goods – against which he will routinely have to deliver – but as exchange goods whose hidden toll the wider community will be duped into bearing as he progressively expands their number and hence dilutes their content.

At its most basic, FRB pretends to offer a plurality of persons simultaneously exercisable rights to demand delivery of a present economic good, a veritable delusion; a rub-a-dub-dub, three-men-in-a-tub proposition with which only a quantum physicist could possibly be comfortable.

The Spark in the Powder-room

But let us move beyond what some may see as mere casuistry and consider a more fundamental objection, namely that for the true libertarian, liberty is a negative construct: that one can give rein to any form of behaviour one chooses – no matter how reprehensible some third-party moralist, or how manifestly self-damaging some frustrated paternalist may deem it – as long as the enjoyment of that liberty occasions no infringement upon the freedoms, or harm to the property rights, of others

Here, is where we would make our case against FRB most strongly, for it is not merely a question of the issuers of fractional monies stamping clear health warnings about their irredeemability-in-extremis upon the bank-notes, cheque-books, and cash cards which they give out and leaving the rest to an appeal to the spirit of caveat emptor – FRB is much more pernicious than that and much more harmful to the commonwealth at large.

After all, a man may well walk a highwire strung between two skyscrapers to which he has legal access – and he may even step out into the void, trusting to the imaginary support of a fractional reserve tightrope, if he so wishes – but what he may not do is jeopardise the lives of the innocents going about their lawful business hundreds of feet below him, wholly oblivious to the human sword of Damocles which teeters precariously above them.

Wherein, then, does this harm lie? Well, in the very consequences of all inflationism, of course – in the engendering of cycles of mass entrepreneurial error; in the inequitable enjoyment of a seigniorage rent by the issuers of money claims, destined to become overmighty in the economy as a result of this sweat-free exaction; in the promotion of disruptive fluctuations in the prices of goods and titles thereto by making them subject to a destabilizing speculation on the part of a hypertrophic financial sector which acts on the principle that where credit begets price rises, price rises beget collateral value, and collateral value again begets credit.

A bank may, of course, freely engage in credit broking and negotiation – bringing together borrowers and lenders (who enjoy no subsequent recourse to the bank itself) together for a fee; or earning a ‘net interest margin’ by interposing its own, saved capital between the two parties as additional security for the creditor.

What it must NOT, however, be allowed to do is to grant a credit ab ovo from nothing more than an entry on its books, trusting that an offsetting liability will later reappear as its loan customer’s payee seeks a home – however temporarily – for the proceeds, whether these are directly placed over the originating bank’s own counter or whether it borrows the relevant deposit from some other bank where the receipt has been parked, at least not where any liability in this chain takes the form of an unbacked demand – or fiduciary money – deposit.

We say this because such a mechanism, once permitted to operate, can and will be repeated many times over, distorting monetary valuations and eroding the whole superstructure of sequential exchange – and hence inflicting harm upon non-participating individuals. As Chuck Prince, the disgraced ex-CEO of Citibank famously and hubristically put it, in the summer of 2007, just before the iceberg tore open the bows of the entire ill-fated White Star fleet: ““When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.”

Or, as the ever-sage Overstone argued in 1837:-

“A Banker cannot contract his accommodation at a period when the whole trading and mercantile world are acting under one common impetus of expansion. If, under these circumstances, the Banker, in addition to what may properly be called his ordinary and legitimate resources, is also entrusted with the power of issuing paper-money ad libitum, is it not inevitable that he should abuse that power? Can we expect that… while all his other resources are strained to the utmost… he will keep a firm and unyielding restraint over the amount of his issues? Will he, under such temptations, in no respect compromise his…duties…?”

The harm comes about because each practicing FRB bank becomes instantly and irrevocably illiquid – a parlous status no other businessmen may wilfully entertain while in operation – while it also aggravates the hazard of becoming insolvent since any consequent monetary tremor will be multiplied throughout the shaky pyramid of a credit become too far extended; too far removed from the possibility of service – much less redemption – by its intemperate distribution; and too blithely treated as a viable money substitute by a majority dulled into incaution by the easy prosperity of the resulting inflationary Boom, yet disastrously prone to spurn it in favour of real money once the spectre of the Bust intrudes.

This Little Piggy went to Market

There are those who see this as ‘only’ a question of narrow financial prudence, going on to argue (in a rather credulous fashion, in the eyes of this particular, jaundiced, financial market veteran), that the removal of state support for the banks will be sufficient to bring behaviour back within acceptable bounds of risk, logical impossibilities and endemic insolvency, notwithstanding.

What this approach still neglects, however, is the pernicious effect of even the most actuarially-conservative generation of money de novo by banks on the very basis for entrepreneurial calculation and business planning.

Whether you see money as merely representational – as a warehouse receipt for some more material consignment of value – or as a good providing services in its own right, either it (or that which underlies it) must be, like all other economic goods, subject to scarcity and hence subject to hard choices about which other subjectively valued good will and will not be foregone in order to acquire or to hold on to it.

Once this qualification is removed – a deletion which FRB fatally achieves – we not only compromise money’s role as a medium of exchange in the here and now, but we scramble its ability to help distinguish between present and prospective outcomes, i.e., we disrupt intertemporal signalling, too.

In a distributed, divided-labour, delocalized, highly discretionary economic network such as ours, money must act as a reliable transmitter of information, not just as a porter of goods: it is not just a bloodstream, but also a neurotransmitter and while any disturbance to the former is cause enough for concern, any degradation of the latter function is likely to prove critical for the whole body politic.

No matter how restricted the practice might become once the state does not actively endorse or underwrite it, it is hard to acquiesce in a process which effectively counterfeits not just currency, but economic data – falsifying cargo manifests and forging bills of lading; faking stock taking and fiddling work rosters; miring the whole Spontaneous Order of the free market in a Great Salad Oil Swindle of fictitious accounting.

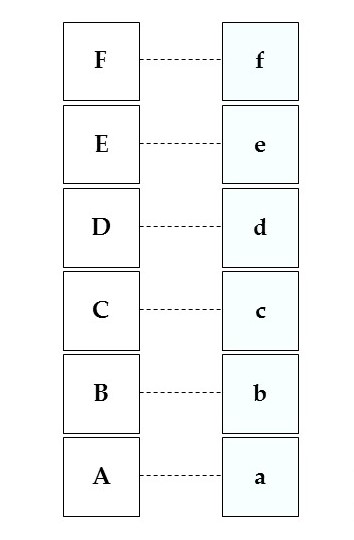

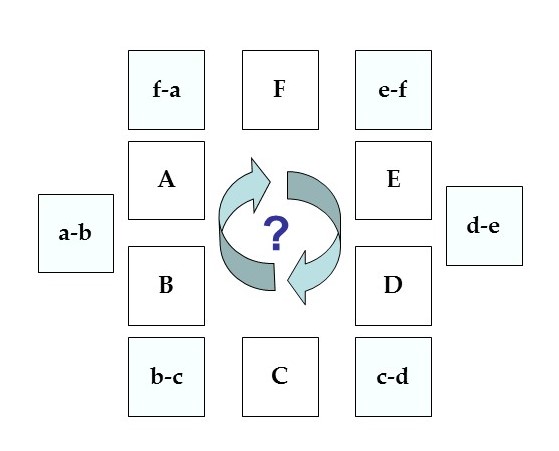

Figure 4: Six Crusoe Island – every man for himself

We can start to visualize this by considering what happens when we move from subsistence agriculture to a specialized system of production for exchange, as shown here. Once a number of merchants meet at a fair or country market, the hoary old ‘coincidence of wants’ argument leads us to suspect the rapid selection of a money will quickly follow, the better to circulate goods between them all.

Figure 5: The first market

Now C finds B has already sold to borrower E, leaving him chasing an alternative outlet of a lower, less satisfying ordinal ranking for his money, and so he ends by driving up the price of, say, corn. This accrues to B’s immediate disadvantage since his real return on the labour which he devoted to producing and marketing his eggs cannot but decline.

Figure 6: Money makes the World go round

Were bank money only hard – i.e., 100% backed by money proper, F could only have borrowed to buy B’s eggs if some other member of the group could have been persuaded to forego his own purchase in favour of saving that money, placing it in the bank, and seeing it lent on to F. No-one could have been cheated of his due, or seen his standard of living forcibly lessened in order to promote another’s higher, FR bank-enabled gratification.

Had that saver been C himself, little noticeable change would have occurred at all. But even the unquestioned and possibly discomfiting adjustments to be undertaken if anyone else had suddenly deferred his wonted consumption would at least have had the merit of being the result of a genuine change in consumer preferences. These would have been flagged through their effect on relative prices. C would soon have become aware that he had henceforth to consider either producing less of what he did before or else finding a remunerative way to lower his selling prices. The change in ‘data’ would also have sent out a message that surplus goods in some form now existed and that these could be used as capital, were anyone to be struck with a bright enough idea as to how to put them to a different — and hopefully more productive – use in the future.

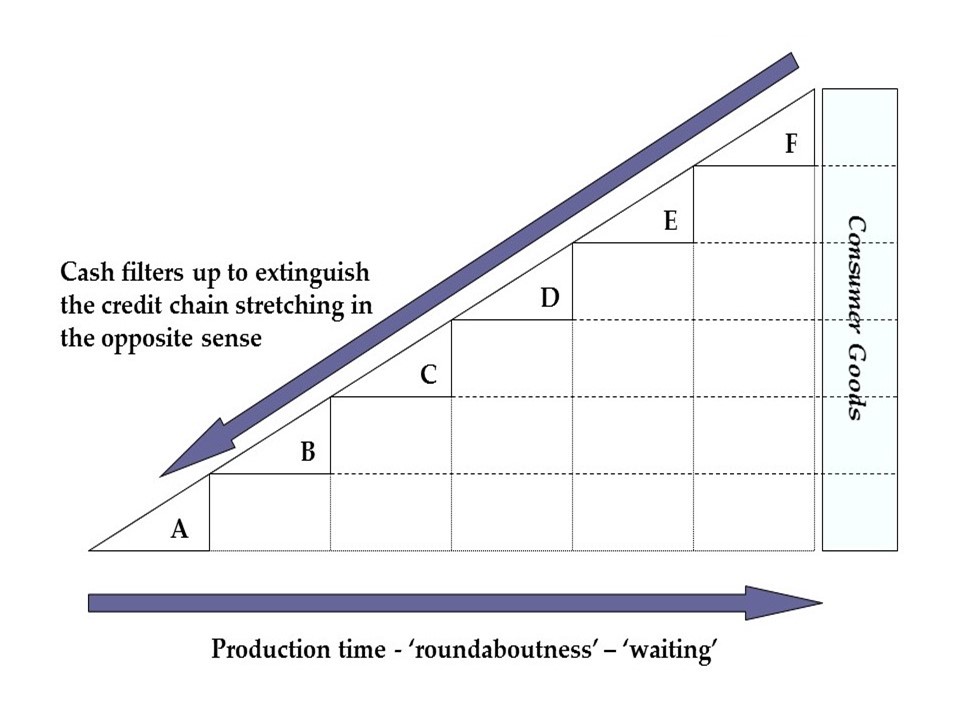

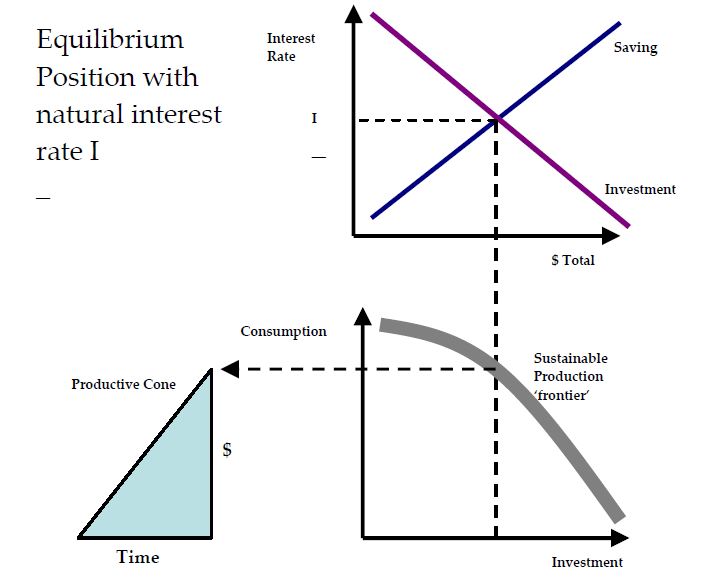

Saving – the Source of All Spending

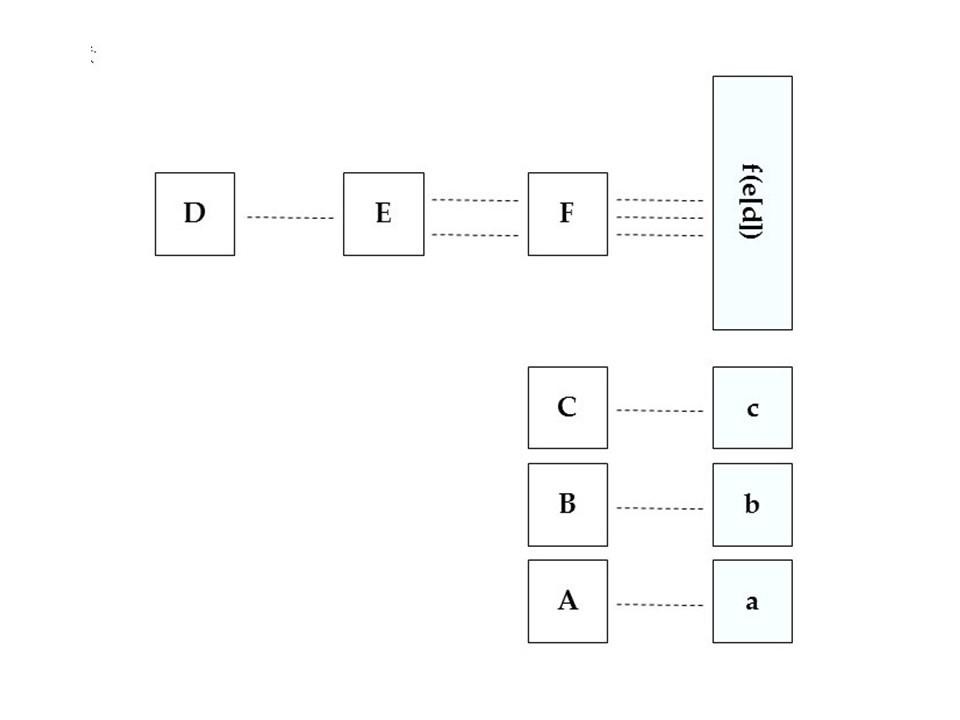

Patently, we do not live in such a simple E-Bay world of selling and buying horizontally, across the same (lower) order of end-consumer goods. Rather, the majority of us earn a living – and contribute to a vastly more productive array as we do – by helping give rise to higher-order goods – parts, precursors, tools, tramways, machines, machine-makers, forges, fireclays, smelters, semi-submersible drill rigs, and so forth.

In order to get to this particular state, goods spared immediate, exhaustive, end-consumption were once required, both to be redeployed as specific constituents of the new businesses’ equipage and in order to feed and clothe the personnel involved in their construction while they waited for the saleable goods to which they will give inception to be completed and stacked on the supermarket shelves in their turn.

The powerful consonance here, as we shall see, is that it takes net new saving to build the chain, ab initio, but then gross saving of the same magnitude in order to maintain it. Therein lies the danger of FRB and a prime reason why it should never be countenanced, as we shall further try to explain.

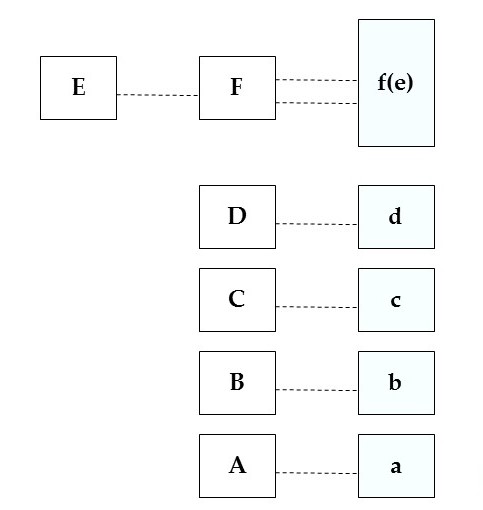

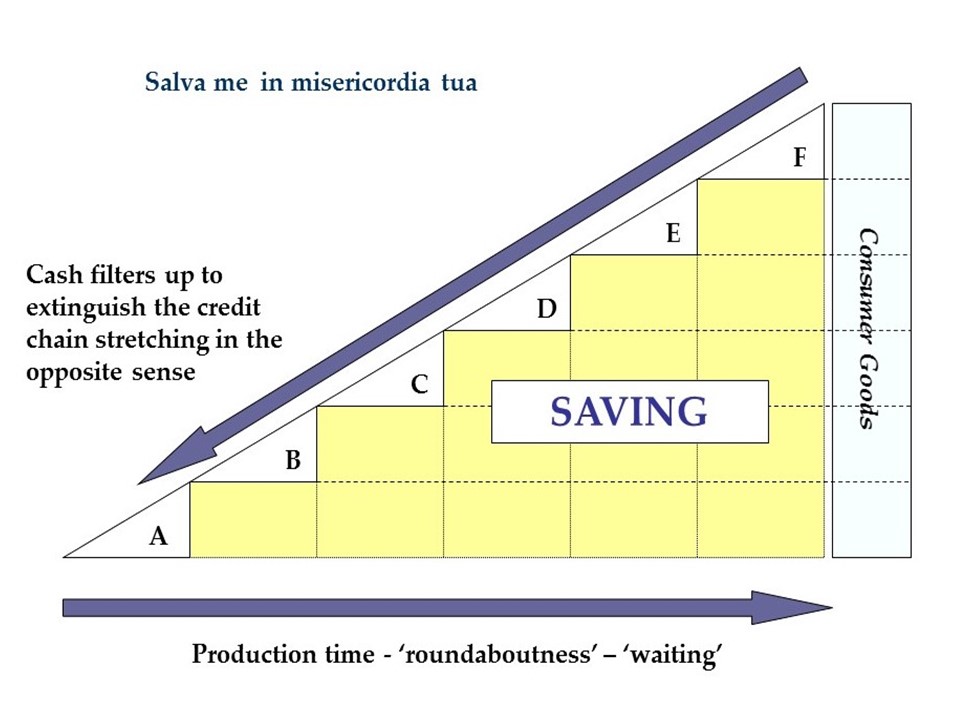

Figure 7: The structure lengthens – divida imperaque

As a first step, imagine that, instead of each making end goods directly, E and F come to realise that if they specialize, the products of their labours will be fructified – that they will either make more with less, or take less time doing the same, or both. What they discover next is that while E is rearranging his affairs, he will not be contributing to the end product for the one ‘cycle’ for which this retooling lasts. Thus he and F must already have saved one unit of end product before they can begin.

Once set up, this vertically integrated arrangement, this proto-productive structure, sees F have receipts of 2 units, one of which he extracts for his own income and spends (essentially on his own output), the other of which he remits to E in settlement of the intermediate goods he earlier delivered. E, in turn, spends that 1 unit on the remainder of F’s output of consumer goods.

Since the act of foregoing consumption today in the hope of enjoying a like or greater sum of consumption later is how we define SAVING in the first place, it is not too far a semantic stretch to insist that the ends to which F has committed half of his revenues have taken the form of saving even if to engage in such a productive outlay (an investment) seems very different to Grandma putting her widow’s mite into her post office account, for a rainy day. If you doubt this, just picture the distinction between the case when the CEO buys a new machine and hires ten new workers to service it – in the hope of boosting profitable output in the not-too-distant future – and that when our Boardroom Bravo simply votes himself a bigger pay rise and lays in a few crates of Chateau Margaux and a Picasso cartoon with the proceeds.

That granted, let us now suppose D is persuaded to join the chain, making an even higher-order good for E to transform, now into two, not one, unit of input to F’s factory, enabling him to churn out three, rather than two, units of final consumer goods. Now, F’s revenues expand to 3 units, but his cost of sales (all labour being supposed to be his own, and hence all net income, his profit) reach 2 (his gross saving), while E now spends 1 unit on end goods (to keep body and soul together) and devotes one unit of further saving to paying D his dues, so that D too may eat of F’s harvest.

Figure 8: Repeat as necessary

Already the economy has been transformed into one wherein the 3 original units of final output – of GDP, if you must – have been replicated, but now to the accompaniment of three additional units of gross saving where at first there were none. If we further trace back the process by which D moved from subsistence to his role high up in the structure, we can see that this involved him in waiting for two cycles to pass until his output found its final embodiment on the shop floor. Thus it takes two net units of saving (in addition to the one already laid out on E) and that this formative net saving henceforth becomes entrained as part of the expanded total of three units of gross saving continually involved in each repetition of the process. Again, we have three units of GDP-type end spending, but also three units of saving which go wholly unrecorded by the mainstream macromancers.

It should be obvious that each further lengthening (each ‘vertical’ increase) in the structure requires proportionately more saving and hence we are led to assume an ever increasing fraction of overall economic activity which will be completely neglected by a Keynesian-Kuznetzian mainstream which will thereby be left tangled in its non existent paradoxes and self-contradictions. Indeed, by the time all our six original actors have rearranged themselves into a chain of sequential buying and selling, we will have six GDP units but no less than 15 units of gross saving at issue.

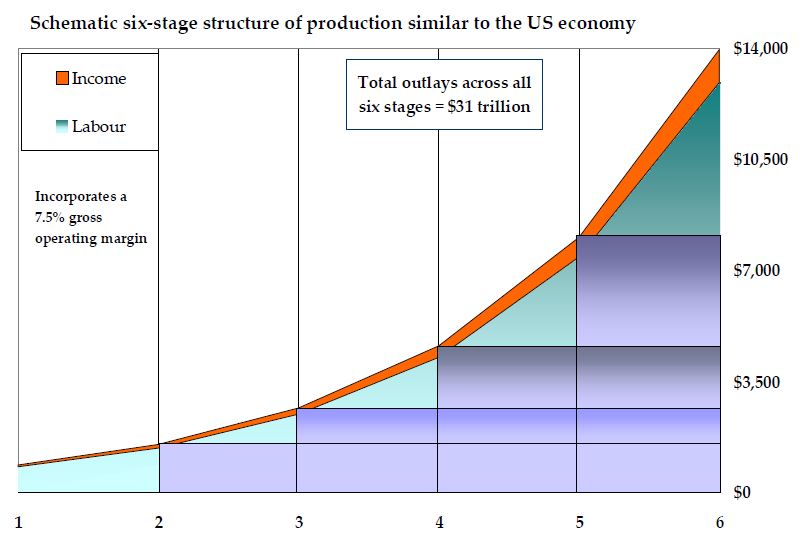

Figure 9: Hayek meets Henry Ford

This may seem odd to those brainwashed to believe the mantra that ‘consumption is 70% of GDP’ but only because GDP is largely defined to capture end consumption in the first place! Hence the truism is a little like that saying that since 50% of the clothing I put on my feet are socks, the state of rest of my attire has no bearing on how warmly I need to dress when I go for a stroll! In fact, a careful reckoning of the US economy shows that there is a ratio between exhaustive, end expenditures and all business outlays of around 1 to 3.2, whereas our toy economy here gives a ratio of 6 to 21 or ~1 to 3.5

Figure 10: The Saving Grace of Specialization

Indeed, by plugging in the actual official statistics from the US which pertain to wages (including the forced levy on all – the tax – which employs the legions of the State), entrepreneurial income, sales margins, the proportion of revenues spent on buying-in goods and services (what we tend to call ‘Chain’ outlays), and that paid to one’s own workers – and after adding a few simplifying assumptions – we can pretty much mimic the broad structure of that entire economy with just such a simple, six-stage model as has already been outlined.

Figure 11: A Toy version of the US Economy

[As an aside, even the sums laid out by the last, lowest order entrepreneur on his own workforce is money he could have spent on end-consumption not, as here, for a productive purpose. Strictly speaking, it, too, can therefore be considered an act of ‘saving’, driving this proportion even higher in the overall mix and further giving the lie to the Keynesian bedazzlement with end-spending and its abhorrence of thrift.]

Figure 12: The Actual US Economy

Though we have not shown it here, the inference must be that we undertake all the toil and self-denial needed to institute this capital-intensive procedure, this savings-fertilized method of cultivation because we are aware that it leads to both a greater fecundity and a greater rapidity in the productive process.

What may be less evident from this schematic view is that, in order to provide higher order producers with the necessary capital means – without introducing dangerous disharmonies to the entire ensemble by simply creating a fictive version of them in the banking hall – we must trust in the emergence of a positive feedback between a greater division of labour, higher technological efficiency, greater material plenty, more readily available savings, lower yields on a more abundant capital provision and – yes! – gently falling prices.

Every Man for Himself

If you have borne with us so far in this somewhat protracted preamble, we may finally return to our theme in hand: viz., why FRB is so harmful and hence why there can be no place for it in the Free Society of our dreams.

Let us suppose that when we tried to introduce D to our nascent productive chain above, there were actually no real savings to hand. No-one had sufficiently foregone consumption: no-one had built up a large enough sum of loanable funds as their counterpart. As a result of this dearth, D’s attempt to utilize those funds would have immediately and correctly pushed up the yield payable on them, to the point where his undertaking would have been entirely discouraged.

Reinforcing this, relative prices – here the ones between those of the present goods which D needs as inputs (but which no-one else has relinquished) and the break-even prices of the future goods into which he hopes to turn them (and which must incorporate the higher interest his lender will charge) – will closely reflect the balance of consumer time preferences and the availability of the scarce, physical entities to be apportioned between them.

But, suppose a fractional reserve bank (state-fostered or free) had stepped into the breach, offering a simulacrum of those funds to D who – as a would-be entrepreneur, not an expert on Austrian monetary economics – could hardly be expected to appreciate the degree of extra risk this entailed, both to his own project and to the well-being of others, when he took this bogus ‘money’ and sought to wrest goods away from those not otherwise willing to surrender them from the purposes to which they had habitually been put.

Arriving early with his unbacked deposit claim in hand, D might initially inveigle their vendor to sell to him, but only by forcing others to go short of what they were accustomed to acquiring with their own, real money. D’s increased command over the available pool of resources could only come, therefore, at the expense of someone else’s real income, thanks to the fraud of FRB.

Without looking any more deeply into the likely consequences of this depredation, the very fact that we have here entered into a zero-sum game of pre-emption and deception, even as we are supposedly seeking to extend the scope of a harmonious, coherent, interaction of mutual betterment, should lead us to doubt whether such underhand means can ever be truly compatible with their avowedly benign ends.

What will happen, in essence, is that – this first time, at least – the late arrivals to the shopping centre will find that the shelves are less well stacked than before and that they must perforce make do with less, even if they offer the same sum of money as would previously have filled their baskets.

What Mises termed ‘forced saving’ has made its malign appearance. This is a phenomenon which, left to run without further injections of bogus money (and absent a near-miraculous, post hoc acceptance of the changed structure which D and his FR Bankers are trying to dictate to their fellows), will soon give rise to reversionary shifts (Hayek’s ‘Ricardo effect’) and a negative yield-curve struggle for liquidity (his ‘Investment that raises the Demand for Capital’) as producers and consumers come, not to co-operate, but to strive among one another like the warriors sprung from the dragon’s teeth in King Aeetes’ field.

But, as we have seen, whatever capital – whatever net new saving – it has taken to build a given productive structure, it takes an equal amount of ongoing gross saving to maintain it.

Thus, while many will acknowledge the Misesian futility of starting from scratch projects for which the necessary physical means are lacking, few recognise the corollary that FRB also perverts the process of ensuring the ongoing gross saving flow matches the resources needed to maintain an existing array, characterised by an extended capital structure, Herein lies another means for FRB to attack and undermine what we already have, much less foredoom a good deal of what we are starting anew.

Moreover, in today’s world the avidity with which banks seek to extend credit to consumers, not just to producers, only serves to sharpen these wholly avoidable conflicts by instigating an arms race of FR spending, one portion of which is trying to lengthen the productive structure beyond its sustainable extent and the other which strives to pull everything from the future into the present, conversely lowering capital intensity – and hence real wages – and simultaneously eradicating much of the ability to support the debts incurred as a result of this struggle.

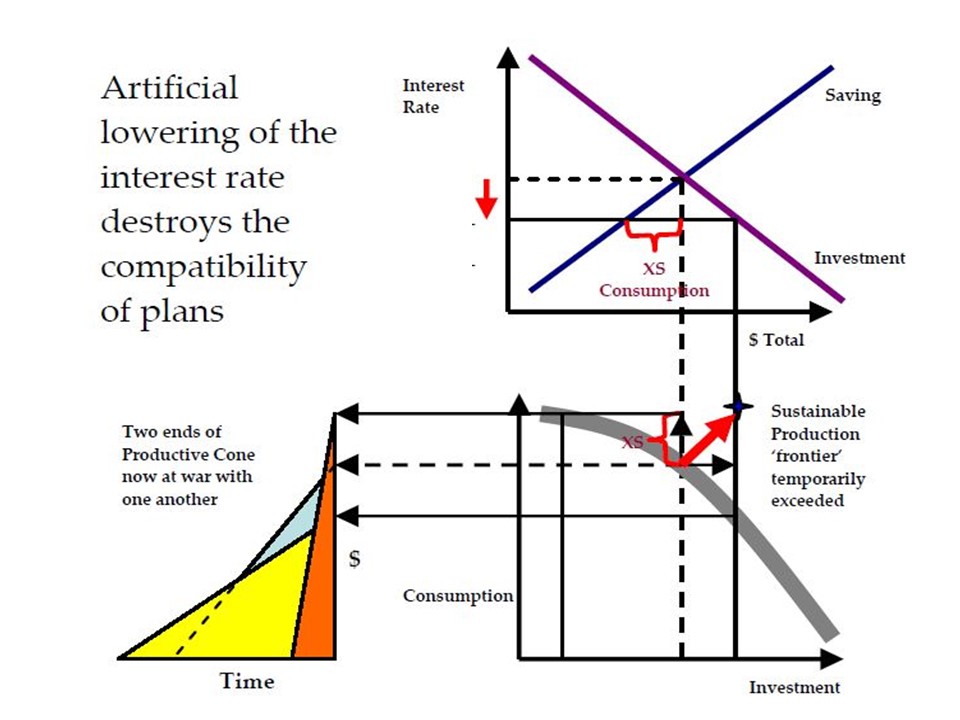

Figure 13: Garrison’s ‘Austrian Macro’ before…

Here, too, we cross paths with the hoary old fallacy of the ‘real bills’ hypothesis. This untenable dogma was held by the so-called Banking School during the great monetary controversies of the early nineteenth century – and, in truth, is adhered to, in a broader interpretation, by central bankers today.

Figure 14: …and after intervention

At its simplest, what this says is that there can be no bad outcomes if banks restrict themselves to extending credit only on the security of documentary evidence of actual, short-dated commercial transactions, not least because these are said to be ‘self-liquidating’ and the loans are held only to ‘serve the needs of trade’.

But this only holds good if the banks are 100% reserve banks, since they otherwise entertain the power to monetize their loans – i.e., to turn into the most widely acceptable present good – evidence of the production and onward sale of a future good, i.e., of a present good yet-to-be.

Let us be clear here: we are not decrying the very necessary practice of a seller giving his customer time to pay for the wares. Business-to-business credit comprises no evil if left to itself. But, to transform this act of ‘waiting’ into a freshly-minted tranche of instant purchasing power, through the necromancy of A-and-Not-A FRB, is to turn a consensual line-up for orderly, sequential gratification into a disorderly mob of queue-jumpers and to make of every shopper a common looter.

In our well-ordered, toy economy, there is no cause for alarm if A sells to B on deferred payment terms and B to C, etc., all the way down to F who sells the resulting batch of consumer goods to his end customer base and remits the necessary monies back up the chain. In practice this theoretical self-liquidation is a trifle hard to unravel since a renewed credit chain will already be forming as the assembly lines roll on.

[To digress a moment, this reformation cannot simply be assumed away as mainstream economics tends to do as part of its crude, toilet-flush concept of end demand automatically calling forth a refilled cistern. If we can only break away from this Keynesian Cargo Cult, we should be able to see that each renewal constitutes a discrete, purposeful, entrepreneurial decision. It is here that we find the mechanism of ongoing adaptation and evolution that we call ‘growth’; here, too that the breakdown which goes by the name of ‘recession’ arises as the chains stretch and snap under credit-induced tensile loads too great for them to bear; and, finally, here where ham-fisted and ill-advised ‘stimulus’ packages become self-defeating by preventing the repair and re-routing of the connections necessary to put men and machines back to work and bring about ‘recovery’.]

To return to a theme, there is no difficulty to be endured if our man, A, decides he cannot wait to be paid and so persuades some third party (yes, perhaps through the intermediation of a bank) to buy B’s endorsed IOU for cash (with the inclusion of a little discount, by way of an incentive, naturally). Here, one man with a justifiable claim upon present goods (genuine money) voluntarily decides to save and so temporarily transfers his lien over them to A in exchange for B’s freely-given promise to pay.

Where this does fall apart, however, is when the FR Bank buys B’s note and credits A with an unbacked, fiduciary deposit balance. Now there has sprung into existence a claim on present goods which has not been renounced by a former holder – the bank has simply forged it – and, once again, this misdeed will provoke an undeclared struggle for resources which will disrupt relative pricing and arbitrarily re-direct spending. It will incite unforeseen migrations among the more mobile factors of production – each seeking their most remunerative new employment – and hence deprive the less mobile ones of the complementary goods necessary for the realization of their full, projected value. All of this tends to frustrate entrepreneurial calculation – most likely to A’s own ruination, since his position at the topmost, most specialized end of the chain makes him uniquely vulnerable to shifts taking place all along its lower reaches.

Thus, the application of unreal money to real bills banking theory delivers us unto the woes of the business cycle once again.

Gentlemen of the Jury

And if we were to accede to the demands of the advocates of Free Fractionalism, what compensation could we expect for allowing the serpent back into our little corner of paradise once he has dissociated himself from the support of the state? Why, we could congratulate ourselves at being beyond all aspersions of hypocrisy in our protestations of libertarianism. Less facetiously, we are told we could breathe more easily knowing that free FR banks could routinely expand and contract the money supply as demand for it waxed and waned (if you believe in the second possibility ever becoming arising, that is), thus maintaining the volume of the money flow through the economy in a fashion of which any Chicagoan or central banker would be proud.

To the contrary, we hope to have demonstrated by now that sufficient harm accrues from even a limited exercise of FRB that it constitutes a social evil to be tolerated neither by the enlightened despot nor under even the most minarchist of governing regimes, thus rebutting the first charge.

As for the second, this, too, is something of a macro-economic canard since such instabilities as this purports to minimise would in any case be unlikely to arise among a population habituated to the discipline of sound money and therefore with much less exposure to the double-edged sword of debt leverage and the insubstantial money which fosters them.

In navigating the far more robust, equity-girded productive channels which they will frequent in their dealings in a hard money world, it will be sufficient for the people to work under the instruction of committed entrepreneurs who are each intent on maximising their local success. Thus, the perceived need for macro-manipulation can safely be consigned to the dustbin of history along with theories of dephlogisticated air and tales of the bodily humours.

The entrepreneur will also become a man who runs a proper factory in a proper manner, rather than the shifty overseer of a tool-shop set up to disguise the atrium of a replica banking hall (as too many of his peers are today).

There will be less systemic frailty; fewer so-called ‘shocks’ as the lesser occurrence of incompatible plans will more rarely lead to a general grinding of the economic gears. There will be slow, productivity-induced price decay – a feature which, of itself, will tend to reinforce an anti-inflation mentality once people become attuned to it and recast their contractual arrangements in line with it. There will therefore be much less scope for inducing mass entrepreneurial error – perhaps none at all.

Thankfully, there will be no risk at all of that damaging monetary explosion known as a Boom: nor, conversely, of the general ruin which ensues amid the shattering collapse of a prior FRB inflation in what we know of as the Bust

In short, by extirpating this poisonous weed wherever it seeks to take root, we can ensure that we shall have no need to call upon the power of fractional reserve banking to protect us from the ill-consequences of fractional reserve banking itself!

The basic creed of liberty can be expressed in two Latin phrases – one other adopted by the London Stock Exchange as its motto in 1923, the other derived from Hippocrates. The former, “dictum meum pactum” – ‘My word is my bond’ – is both a declaration of personal honour and an affirmation of the sanctity of contract so essential to a largely impersonal, exchange-based economy. The latter, “primum non nocere” is Galen’s rendition of Hippocrates’ injunction, ‘First, do no harm’ and a useful rehearsal of the doctrine of negative liberty to which we adhere.

FRB intrinsically makes promises it cannot keep, so violating the first tenet, and routinely renders harm though garbling the signals generated by the actions, not just of those who indulge in it, but all of their fellows as well, thus transgressing repeatedly against the second. In short, FRB lies, cheats, and steals, and should be proscribed forthwith.

Thus, free bankers can only become useful, respectable, entrepreneurial members of society once the deadly opium of the fractional reserve is put irrevocably beyond their use. Denying them the capacity to wreak general havoc – however unwittingly they and their customers may do so – is, we contend, both a sine qua non of effective reform and a defence of, not an abrogation of natural rights at large.

Re-Peeling the Act

Back in 1788, the Blackburn textile manufacturing giant of Livesey, Hargreaves, Astie, Smith & Hall spectacularly failed – triggering, as it did, yet another commercial panic.

In many ways the Enron of Enlightenment England, the firm had come to neglect its former practice of seeking out and employing the most technically advanced production methods in its real business in favour of a fatal fascination with the fruits of financial engineering – ultimately in a wholly fraudulent fashion.

That same year, just down the road in Bury, a rival clan of calico printers briefly set aside all consideration of the tumult caused by the bust to celebrate the birth of a son to the head of the family. Half a century later, that same child may well have reflected upon the stories told him of the troubled time he came into the world when, as the capstone of a long and noteworthy political career, the by-then Sir Robert Peel passed a famous piece of legislation – the Bank Charter Act of 1844 – aimed at heading off the possibility of any such event ever recurring again.

Sadly, the rudimentary understanding of what constituted ‘money’ in a period of changing commercial and financial arrangements – a lack hardly less prevalent today, if truth be told – thoroughly vitiated a brave attempt to limit that unbridled bank expansion which had correctly been identified as the root cause of all the woes.

Ironically, the error lay in refusing to accept that the unbacked deposits which we have here argued are an avoidable evil could not be money, precisely because not all the claimants thereto could possibly be satisfied at once. Thus did the sheer illogical nature of fractional reserve banking defeat the keen, logical minds trying to limit the excesses spawned by it!

Now this is all very well and good, you say, but how are we actually to effect such a radical change in a modern economy? Surely, we are beyond the point of no return and it would prove far too complex to reconstruct three centuries of building work, in situ, however jerry-built and ramshackle the existing edifice may be?

Well, perhaps. But there are ways to turn the arguments of the Jacobins who rule over us back to bite them, in their turn. We, too, might resolve ‘not to waste a good crisis’, but to turn the unpopularity of bankers and the growing distaste with politics-as-usual to a solid, liberating effect.

To show how this could be done – at least in principal – let us set aside our doubts about whether such a thing could be put into practice and instead concentrate on how it might be done by means of a Gedanken experiment of monetary reform that owes much to Professor George Riesman of Pepperdine University, coupled with a neat fiscal manoeuvre based on the ideas of that somewhat contested eminence, Irving Fisher*, and adds a few castles-in-the-air from your author which outline a series of political changes to accompany them.

After all, as Sir Charles Wood, later Viscount Halifax, the then-Chairman of the Parliamentary Committee of Inquiry into Banking, put it, in 1840:

“I anticipate from the adoption of this measure a less fluctuation in the amount of circulation – a less fluctuation in the range of price; but I am not so unreasonably sanguine as to suppose that it will put an end to all speculation and to all miscalculation in commercial matters. Prices will necessarily vary according to relative supply and demand for commodities at different times. Speculators will make mistakes in the calculations… prices may be unnaturally forced up and individuals may be ruined in the collapse.”

“All this cannot be put an end to, so long as competition exists in trade and hope of gain influences the human mind; but it is no reason why we should not remedy what is in our power because we cannot attain everything. We can prevent an additional stimulus being given to a rise of prices and undue speculations by the influence of an ill-regulated currency; and this it is the duty of the legislature to attempt.”

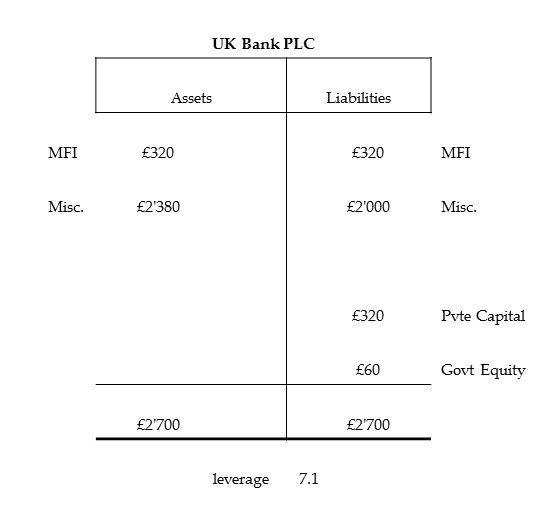

So, to start, firstly let us imagine that the aggregate figures which the Bank of England provides for the sterling assets and liabilities of UK banks (MFI’s or ‘Monetary Financial Institutions’ in the jargon) actually refer to a homogenous collection of banks similar in all their essential details.

Figure 15: All for One & One for All

We find that (in round figures) these banks have around £2.7 trillion in assets, of which £320 billion represent claims on each other and, hence, a similar £320 billion of liabilities due to their peers. As well as some £2.0 trillion in other liabilities, they dispose of around £380 billion in equity capital, $60 billion of which represents the emergency infusion undertaken by the government at the height of the recent Panic.

More specifically, around £800 billion of those liabilities consist of demand deposits held by entities other than banks, while £100 billion of the assets are deposits and reserves held at the Bank of England and £70 billion represents loans to, or purchases of securities from, some level of government.

[* Since writing this piece, Professor Jesus Huerta de Soto of the Rey Juan Carlos University of Madrid has pointed out to the author that a broadly similar scheme of monetary reform was set out in his 1998 book Dinero, Crédito Bancario y Ciclos Económicos]

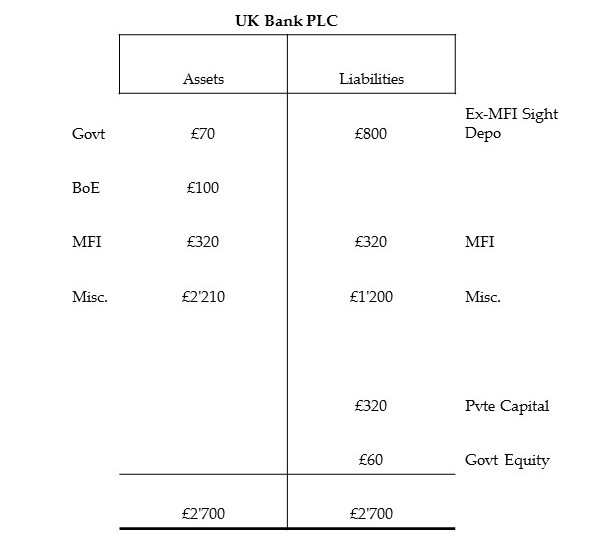

Figure 16: A Closer Look

To undertake a bit of necessary housekeeping first, let us arrange for a ‘tear up’ of that whole £320 billion of ‘pig on pork’, interbank entries, much in the manner that we do with credit derivative positions, through netting and novating via a clearing house. Perhaps, as its one last act of public service (!), this can take place under the auspices of the Bank of England which will also assume direct liability for the £100 billion in demand claims which the banks have already redeposited with it as part of the extraordinary precautions they have engaged in over the past two years as they have sought to shelter from each other’s poorly-concealed frailties.

Figure 17: The Bare Essentials

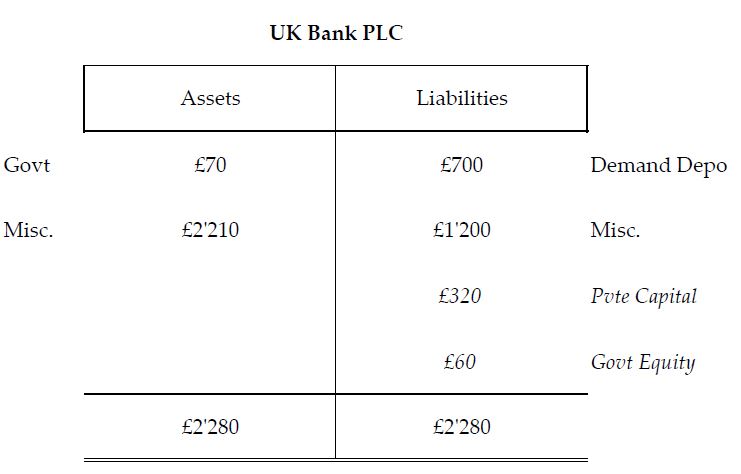

Next, we come to what we have argued is the crucial point – viz., the removal of all the unbacked, unpayable, fiduciary media, demand deposits from the banks’ books, thereby relieving them of the greatest single threat to their continued existence and cutting them off from the money creation business, once and for all.

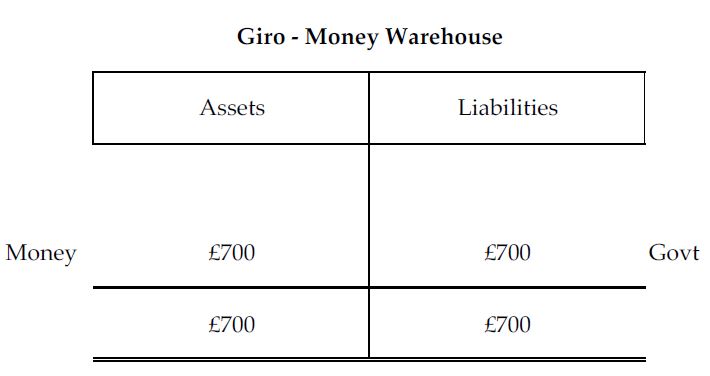

Figure 18: The Communal Strongbox

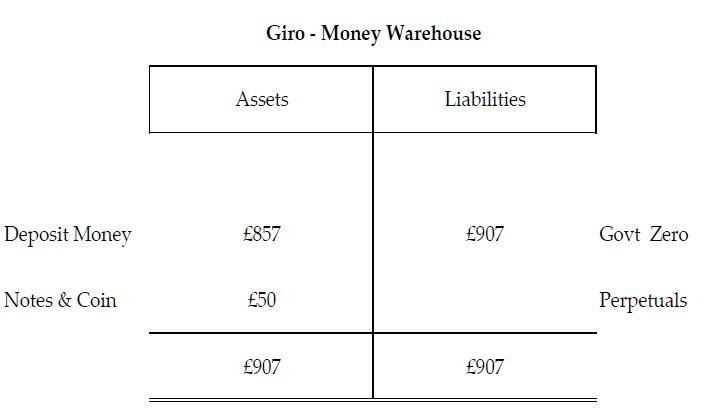

In an ideal world, we would argue that this should best be done using precious metal, but even government certificates would provide an acceptable interim solution as long as we insist no more than the amount we will finish with at the end of this transformation is ever to be printed again or accepted in settlement of any account. In practice, we will probably not need to realize much of this sum in paper form at once, since we can register the balance in a centralized, digital money warehouse, or giro office, to which anyone in the country can have a convenient electronic or smart card access simply by applying with the relevant personal details and demonstrating initial proof of a claim to some (low) minimum sum.

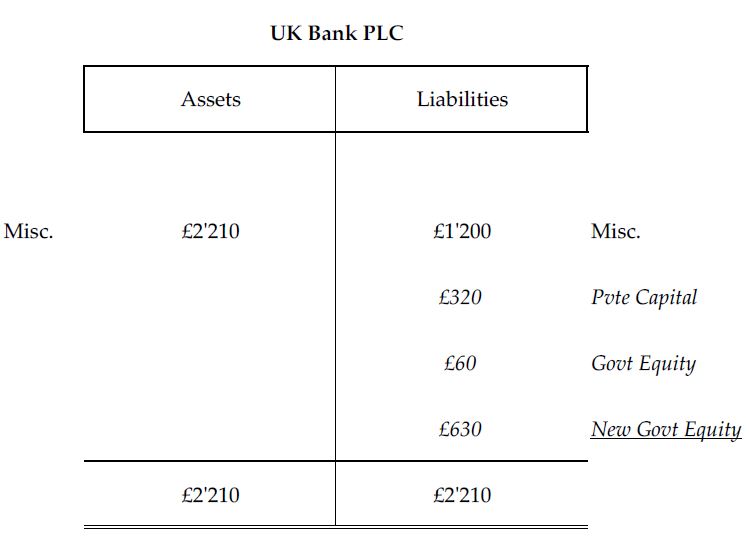

But if the banks now have £800 billion fewer demand liabilities, but only £100 billion fewer assets (thanks to the transfer involving the BOE), we must do something to prevent the residual £700 billion becoming a windfall addition to their net worth. We achieve this by insisting they compensate for the deposits’ redemption by issuing shares of equal value to the government (in fact, they can pay for £70 billion of that by relinquishing the claims they already hold on the state, meaning they only need issue £630 bln in new equity).

Figure 19: Taking the ‘M’ out of MFI

This obviously represents a massive – though, as we shall see, a temporary – dilution of the existing shareholders, but they are hardly in a position to complain given that they only retain a holding at all, thanks to the concerted government/central bank intervention in their favour these past two years.

Moreover, we could simply tell them that the alternative is to keep their demand depos – absent any form of government guarantee and shorn of any possibility of accessing funds from the central bank – and that they will naturally be subject, under ordinary company law, to a rigorous marking-to-market of all their existing assets. Once suspects that very few would have the temerity to run the existential risk such an option would entail, but those that do would presumably be the fitter specimens and therefore fully justified in their non-compliance – so long that is, as they swap the necessary quantity of other assets for money proper and so acquire full, 100% backing for their retained demand deposits, without delay.

At this point, the asset side of the aggregate balance sheet has lost £70bln in claims on government, £320bln in interbank lending, and £100 vis-à-vis the BoE, leaving it with a notional £2,210bln in miscellaneous claims. Against this latter total it has £1,200bln in non-demand liabilities, £320bln in private equity capital and £690bln in government equity.

Suitably reinforced, we can now apply that rigorous cleaning of the Augean stables about which the banks and their masters have been prevaricating for far too long. Assets must be marked sternly and unsentimentally to market so as to restore trust in their valuations and hence to make possible a full resumption of business on the free market, in due course.

Assuming this to take the form of a haircut of some 15% across the board from QI 2010 book levels simply by way of example and not to imply any special authorial insight into the matter), we can apportion the resultant loss of £331bln equitably among all the stock holders, leaving a privately-owned net worth of £215bln and a public stake of £464bln (a loss of around a third each).

Figure 20: The Leviathan Trust

Now comes the next clever bit: the state re-privatises its portion (taking a pro rata lien over the total portfolio) in the form of either a cash payment with which it will redeem its outstanding debt or by way of a debt-for-equity swap. The private shareholders of the bank itself are, of course, at perfect liberty to try to buy out their ‘partners’ if they can raise the necessary funds on a market where these cannot, however, now be conjured out of thin air by the witchcraft of fractional reserve banking. Failing this, the separated entity can convert itself into a closed-end fund or be subsumed into the assets of, say, an acquisitive insurance company or pension fund.

Figure 21: The Fifth Labour of Heracles

The sound, sanitised, non-fractional, private, free banking company rump left behind in this second case will thus end up with £1,415bln in solidly-valued assets funded by £1,200bln in miscellaneous, non-demand (and, hence, non-monetary) liabilities and £215bln in equity capital. More to the point, the integrity of its accounts should now be beyond all reasonable dispute.

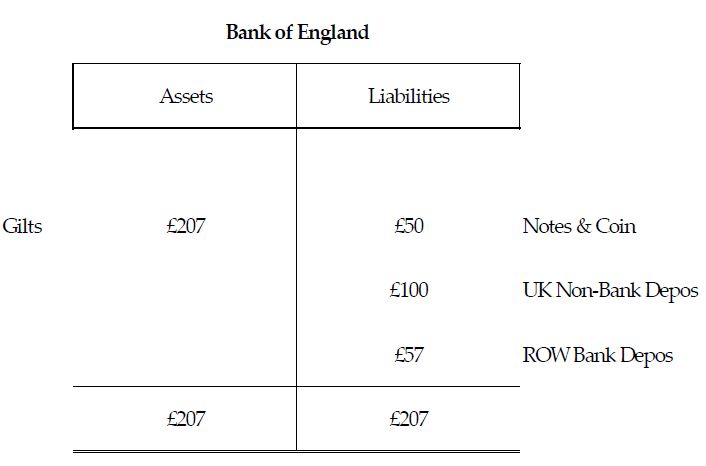

Given that we will have no further place for fractional reserve banking; given, too, that we are going to pass a binding, balanced budget resolution through parliament; and given that we are going to convert a considerable slice of government debt to non-interest bearing, perpetual certificates (bank notes and giro entries), we shall henceforth have no need of the Bank of England and can move straightaways to abolish the problem brainchild of that old seventeenth century buccaneer, William Patterson, putting an end to its three centuries history of mischief and malfeasance.

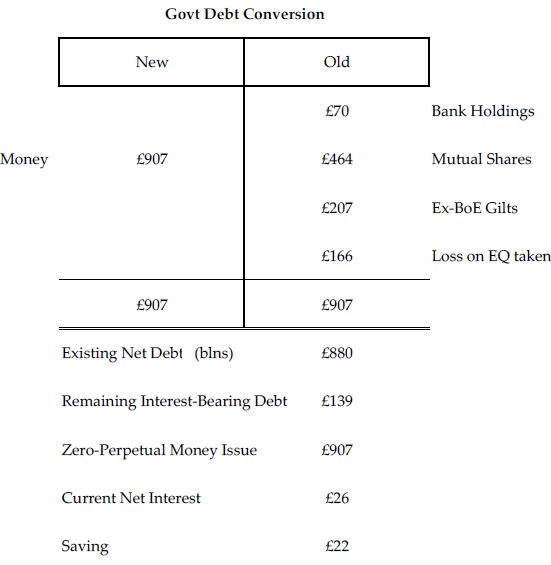

The Old Lady herself holds £207bln in government paper against £50bln in physical notes and coins, £57bln in deposits from foreign banks, that £100bln of the public demand deposits we earlier transferred off bank balance sheets. Once again, we will redeem these latter two against a credit in our giro office and we will simply let the state assume direct responsibility for the note and coin issue, thus allowing it to cancel another £207bln in outstanding, interest-bearing debt obligations.

Figure 22: The Discontinuation of the War

Overall, the government has been able to redeem £741bln of its current £880bln of net gilt and Treasury Bill issuance in this fashion, giving it a seigniorage gain of around £22bln a year in interest savings – equivalent to a rise in VAT of over 4%. Of course, that will still leave the Chancellor with an annual hole of around £110bln to fill before he can balance the budget, as we shall insist he must.

Figure 23: The Rewards of Virtue

Happily, this will leave him no choice but to take an axe – perhaps even a flamethrower – to the strangling underbrush of the Welfare-Warfare State and so allow space for the green shoots of peaceful private enterprise to spring up.

Here at the conclusion of our programme, the public has just as much money as it had before, except it holds this now in a non-fractional form. This is neither inflationary nor deflationary (for so long as we can adhere to our bargain to allow no more money ever to be created) and so the transition should inflict the least pain on the economy, though this is not to say that there may not follow some kind of stabilization crisis as those who have come to rely too heavily on a continued flow of unsaved credit begin to make some painful, but unavoidable readjustments to their affairs.

Figure 24: Safety Deposits

Though not strictly necessary, as a next stage, we might encourage the public to buy gold and silver with their holdings, against which money certificates could be issued and hence a genuine ‘coverage’ gradually increased which would provide a better guarantee against future political backsliding. Perhaps we could even impose a small transaction levy on financial dealings, partly hypothecated for the purpose of paying the running costs of the money giro, and partly for buying metal, with this latter allotment strictly scheduled to expire the minute that all monetary liabilities have been matched with a due weight of bullion and full-blooded specie.

Were we to give full rein to our irony, we might instead raise this sum as a ‘Tonnage of all Vessels… and certain additional duties of excise upon Beer, Ale and other liquors…’!

With a safe and stable money supply equivalent to more than 25% of total gross spending, there should be no foreseeable shortage of the means to effect final payment. Banks have been restored to health and have been given incentives to develop a truly entrepreneurial business model. The central bank has had the last rites read over it, bringing an end to Whig Corruption and War Socialism, both. The government has rid itself of five-sixths of its interest-bearing debt obligations, immediately helping stabilize its finances and ‘crowding’ private investment back in to the capital markets which are themselves now made properly functioning distributors of savings.

Secure in the knowledge that we have an unshrinkable core of money to which activity can readily adjust; comforted by the recognition that we have done our best to pop bubbles while they are still the merest flecks of foam; cognisant that we have greatly limited the pyramiding of one financial risk upon another; we can now embrace falling prices as the mark of our productive expertise, the sign of our material improvement and the reward of our self-discipline and providence.

Why should the Commonwealth not now flourish and the Republic of Law not stand firm?

Custodiemus ipsos Custodes

Back in 1856 – in the wake of yet another crisis – the report of the Select Committee on the Bank Acts contained the following, trenchant phrase:-

“No system of currency can secure a commercial country against the consequences of its own imprudence.”

With that in mind, let us conclude this exercise by deviating from economics a little, for what these reforms need – variously, to fix them in place, to re-orient men’s thinking, and to remodel their institutions so that they can wrest the best advantage from the new landscape of sound money – are changes of a political dimension. In that light, we offer the following broad platform of proposals.

For starters, the paring back of that overgrown rent-extraction industry which is finance should not be viewed with remorse, but with relish at the prospect that all those hard-working, sharp-witted individuals who can no longer find a niche there might turn their hand to creating wealth rather than siphoning it off from others. In order to nurture such a shift, the state must not succumb to a dirigisme it, in any case, can probably no longer afford, but it must exercise foresight in removing all identifiable barriers to productive enterprise.

We want no Colberts, only Cobdens: no Five-Year Plans only freedom of association and contract.

In our newly non-inflationary world, this will thrive best within an equity culture, not a debt addiction, something which will necessitate a deep-seated alteration in the tax treatment of dividends and interest payments. Furthermore, this wholesome trend towards owning a business rather than leasing it from one’s banker should be encouraged by assisting the firm’s capacity for self-finance through a radical overhaul of the concept of depreciation allowances.

Additionally, all possible steps should be taken to assist new, competitive upstarts to challenge entrenched business dinosaurs. We want no artificial impediments to the selective pressures which will drive a constant process of improvement under a profit-seeking framework – nor do we want those profits to result from cosy deals between established corporate giants and the collusive state: we are pro-market, NOT pro-business, much less pro-Corporativismo.

A beginning might be made by enacting a drastic reduction in paperwork and regulation, together with a widespread disavowal of state interference in both labour and customer relations. All of these are burdens which tend to penalise those starting out in business, by dint of the disproportionate fraction of their meagre resources which they have to devote to satisfying their bureaucratic tormentors. A further advance would be the facilitation, not the frustration of, effective succession planning, so that we harness a man’s entrepreneurial drive to his laudable desire to provide for his family with the aim of rewarding longer-term thinking and sound business management.

Having thereby empowered the entrepreneurs who will drive this new economic wonder, we now need to ensure they have sufficient fuel in their engines. Since this capital means will henceforth take the form of genuine savings, not the pretence thereto issued by a fractional bank, such taxation as is necessary should be minimised in its impact on thrift and investment and shifted instead to weigh more on items of end consumption.

As we have mentioned above, the sundering of the unholy alliance between the Executive and the Banks will discourage too much government borrowing, but it would not hurt to underpin such parsimony by insisting upon a binding balanced-budget mandate. Restoring the power over the purse to elected representatives would be a first step on the road to devolving it all the way back to those whose money is actually being disposed of.

Stripped of its ability to offer benefits to those who will vote for it beyond anyone’s willingness to foot the bill directly, the sliding scale eradication of the vast, divisive and despotical Provider State should not just become an ideological ideal, but a financial imperative.

This would be further hastened if we were to recall both de Tocqueville’s perspicacious observation that a democracy can only last until the government realises it can bribe people with their own money and the less steadily-attributed inversion of Tytler’s that it will also fail when the people discover they can vote themselves money out of the public treasury. Here, we would propose that each person is given a fractional franchise, suffering a reduction in the weight of their vote which is graduated according to how much income they derive from the state.

Naturally, full time public employees (and employees of ostensibly private firms whose business is the fulfilment of government contracts) would be denuded of the camouflage that they, too, pay tax out of a notional gross wage, when all they really receive is the net that has been confiscated from the earnings of some put-upon private sector worker and, as a result, they would immediately be disenfranchised. Thus the taxpayer’s oft-truculent ‘servants’ would no longer be able to outweigh their currently hapless employer’s valuation of their services, or override his decision as to the strength of their overall establishment, just as those he hires privately are unable to do, either.

A surer link between value received and value given we cannot conceive of and if this means that public sector work seems less rewarding in future – or, as we suspect is much more likely, if demand for public ‘services’ is revealed as a great deal more limited once the illusion that it is ‘free at the point of delivery’ is replaced with an identifiable and personal price tag – so be it.

Beyond this, we would do all we can to rid us of the curse of the lifelong professional politician. We wish to slam the door shut in the face of the sort of fledgling Gauleiter who studies politics at university, then attaches himself to some previous generation, hack incumbent of his exact same ilk, perhaps as a researcher or – worse – a lobbyist, and then begins to wheedle his or her way up the greasy pole.

His/her apprenticeship of amoral expediency fully served, our worm next passes through that latter-day Rotten Borough, the ‘safe’ seat – to preclude which chicanery we would also insist upon full local command of the candidacy for all constituencies, backed up with a meaningful residency qualification to avoid cherry-picking by those political parachutists who drop in from Central Committee to garner the votes of those they are supposed to represent, but in whom and for whom they display neither interest nor affinity. Beyond that, and there beckons that table-scrap of patronage – the junior ministry.

Successful in attaching him/herself to the entourage of the most successful and ruthless of his party’s many venal jockeyers-for-power, our specimen ends by bagging one of the great offices of state – and then looks forward to a life of red-carpet book signings, soft sofa TV appearances, fat chequebook think-tank lectureships, lucrative company directorships, and the odd, deep slurp from the UN or EU gravy-train as a reward for what he/she claims, in his/her cant, to have been his/her long, austere years of pious self-sacrifice and disinterested public service.

Since we do not ever want decisions being made about our lives and livelihoods by men and women like this, with no experience of what it is to make an honest living in competition for a customer’s hard-earned sovereign, we would deny eligibility to Parliament to people who have not worked for at least ten years in the private sector (the authenticity of this to be judged by their average rating in our proposed fractional franchise over the period).

Since we also do not want people spending every minute of every day thinking up new rules and regulations and passing reams of intrusive new commands and prohibitions – whether to satisfy their own intellectual vanity or to promote their career prospects by seeming to be ‘effective’ – MPs should be paid no more than the most exiguous stipend by way of defraying a minimal level of expenses and they should be actively encouraged – not debarred from – simultaneously engaging in productive employment in order, severally, to make a living; to keep them well-grounded in the cares of the real world; and as a deterrent to ensure that no-one wants to loll around Westminster for too long, cooking up mischief .

That done, it would hardly be unpopular to drastically reduce the time the House sits. To convene infrequently to discuss the co-ordination of a necessary fix for something that has obviously become broken is one thing, but to be plotting and scheming, day and night, to remould Mortal Man in the planner’s image is quite another.

In fine, Parliament should only meet with the words of Cromwell pre-emptively ringing in its members’ ears: ‘You have sat too long for any good you have been doing lately – Depart, I say; and let us have done with you. In the name of God, go!’

This article grew out of a short presentation given to the Institute of Economic Affairs in London, 9th July 2010, at the kind invitation of those stalwarts of liberty who run the Cobden Centre.

Sean Corrigan