With the Fed supposedly steeling itself at last to remove a little of its emergency ‘accommodation’, it has suddenly become fashionable to warn of the awful parallels with 1937, as the highly-respected Ray Dalio of Bridgewater has notably done.

That year, the story goes, the nation’s ascent from the depths of the Great Depression was aborted because the Fed ‘tightened’ and the government ‘cut spending’: a sharp recession was the immediate and highly avoidable result. Therefore, we are told, we must not act today.

We strongly refute the analogy: Fed actions were marginal and largely technical in nature while the real fiscal story was the rise in taxes, not any slashing of regular outlays

Far more instrumental in the slump was the nature of those taxes – being steep, ideologically motivated increases in levies on wealth, profits, and capital.

Also to blame were the government’s tolerance of labour militancy and its concerted campaign against ‘tax avoiders’, ‘economic royalists’ and the ‘top sixty families’ – all of which frightened and discouraged the entrepreneurial classes. This fear intensified greatly when the Supreme Court was neutered as means of seeking relief from the state’s attacks.

It is in such displays of pitchfork populism by financially and intellectually bankrupt governments that we – in the age of Piketty, of the organized deprecation of the ‘1%’ and of the abuse of the ‘Fair Share of Tax’ slogan – need to draw the most pertinent comparisons

The real Ghost of ’37 takes the form of such mean-spirited and, counter-productive politics: the spectre should not be conjured up to excuse the central bank from further delaying its overdue embarkation on the long road back to normality and policy minimalism.

With his recent, detailed foray into the world of historical comparisons, the renowned fund manager, Ray Dalio has given rise to something of a journalistic cottage industry in which every journeyman scribbler tries to ensure that references to 1937 feature as prominently in their submissions as can be, all the better to frighten the horses with the catastrophe that they insist must inevitably befall us should the Fed ever take that first, tentative step away from extreme over-accommodation.

In some ways this is gratifying, if woefully belated, for this is a theme that your author has been propounding all through our seven long years of financial famine – though for almost exactly the opposite use than that to which the analogy is being put today.

For instance, a bare couple of months after the demise of Lehman triggered the great convulsion, we wrote:-

‘…the sorry track record of both post-Bubble Japan and the post-Tech Boom West amply demonstrates – the central banks will be far too reluctant to remove their unparalleled degree of accommodation for fear of provoking a new crisis, as fears of 1931-3 are essential replaced by those of 1937-8 – supposing, that is, that with balance sheets now so horrendously compromised, they would feel able even to make the attempt.’

‘Official rates probably have further to fall and will be maintained at low nominal (and increasingly low real) yields for a good while thereafter. If Bernanke thinks he understands 1931-33, he surely has also drawn (the equally wrong?) lessons from 1937-8, in addition.’

Again in spring 2011, readers were reminded of the dangers we foresaw:

‘As we never cease to underline… we lose our money and squander our wealth, by making mistakes here, during the Boom: we merely recognise these errors—and, ideally, realise them and rectify them – during the travails of the Bust. The attempt to subvert this cleansing process through the inflation of a new bubble of false asset pricing on the ruins of the old—a development the Fed has explicitly been trying to engineer—is not to break the cycle, but to intensify it, as each intervention becomes more radical, less well thought-out, more plagued with unwanted side-effects, and more rapidly self-defeating than the last, the whole bringing about an increasingly costly and accelerating hysteresis of ‘Stop-Go’ capital destruction.’

‘Thus, if the Ghost of 1933 got us into this mess—i.e., the mainstream’s fervent adherence to a largely mythical narrative of the Great Depression, centred on Roosevelt as Messiah—the Spectre of 1937—an alarmist rendering of the dire consequences of a ’premature’ interruption of gross market interference—has guaranteed that the Fed will only make matters worse’

The following spring, the attack was renewed:-

‘…[policy makers] will again be tempted to re-open the Keynesian spigots, issuing yet more billions of their doubtful pledges with the implicit backing of their pliant central banks, so as to take advantage of interest rates which have suppressed to perilously low levels and which will continue to be capped for as long as is humanly possible. That this is no fanciful prognosis can be seen in the fact that, even within the very throne-room of the kingdom of the blind, the partially sighted Richard Fisher at the Dallas Fed has forthrightly accused his own institution of seeing “every problem as a nail: its only tool a hammer.”’

‘If this is continued beyond the point where the current, highly unusual willingness to hold on to a large fraction of the superabundance of newly-created money – and thus dampen its worst disruptions – begins to evaporate, what we have called the Spectre of 1937 – that fear of tightening too early which will almost guarantee the tightening comes too late – could well turn this into… a flight to real values.’

Similarly, that autumn, we wrote:-

‘The State – helped by its willing patsies at the Central Bank – all too frequently overplays its hand, not least because its interference prevents the economy from properly ‘resetting’ itself and so renders too much of what subsequently passes for growth both weak and overly stimulus-dependent. In turn, this almost guarantees that the timely adoption of an ‘exit strategy’ is not to be expected: the Ghost of 1937 features no less large in the folklore of Depression than does the Spectre of 1931.’

Then, from May 2013:-

‘What is moot in all this is whether this activity is well-founded or whether too much of it has been built on the shaky sands of an impossibly loose monetary and far too undisciplined fiscal mix… If only the Fed and the Administration could summon up the courage to trust in American technical know-how, entrepreneurial spirit, legal advantage, and natural endowment to drive the recuperation, all might be well, but what we must fret upon instead is that – as we wrote almost five years ago – the Ghost of 1933 would impel policy settings into a blind alley an exit from which the Spectre of 1937 would do its best to deter those in charge from attempting.’

Once again, from this time last year:-

‘As we wrote way back, while the padlocks were still swinging on their newly-imposed chains on the doors of the Lehman building, it was one thing to accept that the Phantom of 1933 would lead the central banks to react in fear to a crisis largely of their own making – and so to prolong it unnecessarily – but it was quite another to sit idly by while they used the Spectre of 1937 to postpone any subsequent attempt to correct their errors. Hopefully, the Chinese have finally screwed up the courage to lay their version of this particular ghost.’

And finally from the True Sinews piece, ‘Money, Money, Money‘, posted a week before Mr. Dalio’s contribution to the debate appeared, we said that:-

‘…on our twitter account – where the compressed nature of the communications means that a certain sloganeering is not only permissible but almost de rigeur –we have adopted one or two mottoes in the attempt to try to bind our monetary text-bites into a more coherent narrative. One is simply,”Abenomics fail”– shorthand for our disdain for a programme of pretending that an ageing nation of import-reliant savers can get rich by devaluing their currency and by promoting a speculative hunger for equities. Another leitmotif is the “Ghost of ’37”– a reference to the widely shared folk mythology that a combination of monetary and fiscal tightening in 1937 prematurely put paid to America’s burgeoning recovery from the earlier slump when in fact the proximate cause was that a new front was opened that year in the New Deal’s regulatory and ideological war on ‘Capital’ – i.e., on entrepreneurship itself.’

It should by now be clear that when we raised this parallel it was with a weary foreknowledge that the terror of being held responsible for a cessation of the lunatic rise of asset pieces, much less for a slackening of the pace of real economic activity, is something that holds in its thrall a present crop of policy-makers who utterly lack the fortitude of predecessors such as Paul Volcker or Hans Tietmeyer.

Sure enough, now that the pundits and the promoters are all worried about the imminence of a move from the Fed, the idea that we are about to repeat some crushing mistake of history has gone viral. The fact that it has done so highlights the callowness of the mass of commentators who still think that it is central bankers who create wealth and finance ministers who ‘manage’ the economy. It also reflects rather poorly on their faith in the justification for the remarkable ascent of the stock prices of those great corporations whose praises they otherwise fill their days in singing.

What they should come to realize is that if the inflation of equity values is just that – a monetary distortion which is largely divorced from the underlying merits of business practice and entrepreneurial genius – the sooner we are made to look at things with a more dispassionate gaze, the better for our long term well-being. If, on the other hand, prices really do deserve to be daily setting new highs, they should ask themselves why they are being so lily-livered at the prospect for a whole 25 basis points hike in interest rates.

But what is it about 1937 that so compels its use as a lesson for today? The answer, as Ray Dalio laid it out, is that there are indeed sufficient similarities in the observable time series to confirm in their prejudices anyone prone to the belief that all economic events can be traced back to an identifiable change in the trajectory of a small number of macro-variables and, by extension, to the actions of those who may have set these in motion.

If you believe that recovery from a slump can only be brought about by the determined application of Keynesian profligacy and monetary crankdom – by some combination of fiscal and monetary ‘pump-priming’ – then , of course, it is all too easy to persuade yourself that a callous government led astray by the hidebound pursuit of ‘austerity’ and a central bank peopled with paranoid inflation hawks could be foolish enough to nip a long-awaited industrial and commercial renaissance prematurely in the bud – even if it is truly hilarious that we could ever tar an administration led by Roosevelt or a Fed chaired by Eccles with THAT particular brush!

This interpretation even seems to bear up to a superficial consideration of the facts – or at least of those ‘facts’ which best lend themselves to quantification and to manipulation in a spread sheet. For was it not indeed the case that, in little under a year, the Fed doubled reserve requirements? That federal government outlays in the period to the May ’37 peak of industrial production were much diminished once the boost occasioned by the hefty, pre-election sop of the Veteran’s Bonus bond, granted the previous June, had dropped out of the accounts? Or that tax receipts were substantially boosted by the draconian Revenue Act of 1926, so reducing the oxygen of deficit finance to an asphyxiating low?

Moreover, was it also not true that the Fed and the US treasury were both fixated on sterilizing gold inflows – and so were somehow both slavishly addicted to and simultaneously ‘cheating’ on a gold standard mechanism which they had shamelessly abandoned just four years previously – and this to a degree which impaired their ‘management’ of the domestic economy?

All of these charges do, indeed, contain a kernel of the truth, but to stop there is to try to judge the book, not so much from its cover as from a glance at the tables laid out in the appendix in the back. This very point was in fact raised by a director of the NBER, Albert Hettinger, in his closing commentary in Friedman & Schwartz’s seminal ‘Monetary History of the United States’ – a work in which they memorably sought to apportion all the blame for the ills of the 1930s to the Fed’s stubborn refusal to inflate early enough, energetically enough, or enduringly enough to a certain Mr. Ben Bernanke’s enthusiastic agreement.

Gently questioning the authors’ almost exclusive reliance on the effects of arithmetical changes in ‘high-powered’ money, Mr. Hettinger – who had been active in business and finance throughout that vexed decade – wisely noted that:-

‘To me, businesses imply decision making and calculated risk taking… It has been burned upon me that monetary policy, in the final analysis, acts on men whose conduct is not predictable; it neither operates in a vacuum nor in a world in which all other factors can be taken as constant.’

With that insight kept firmly in mind and since it is the facet of the problem to which appeal is being explicitly made today, let us try to deal with this monetary issue first. Afterwards, we shall move on to a consideration of the fiscal angle, a study which, we will argue, will allow us to tease out the true explanation of what went wrong and so allow us to derive the real lesson for the circumstances of today.

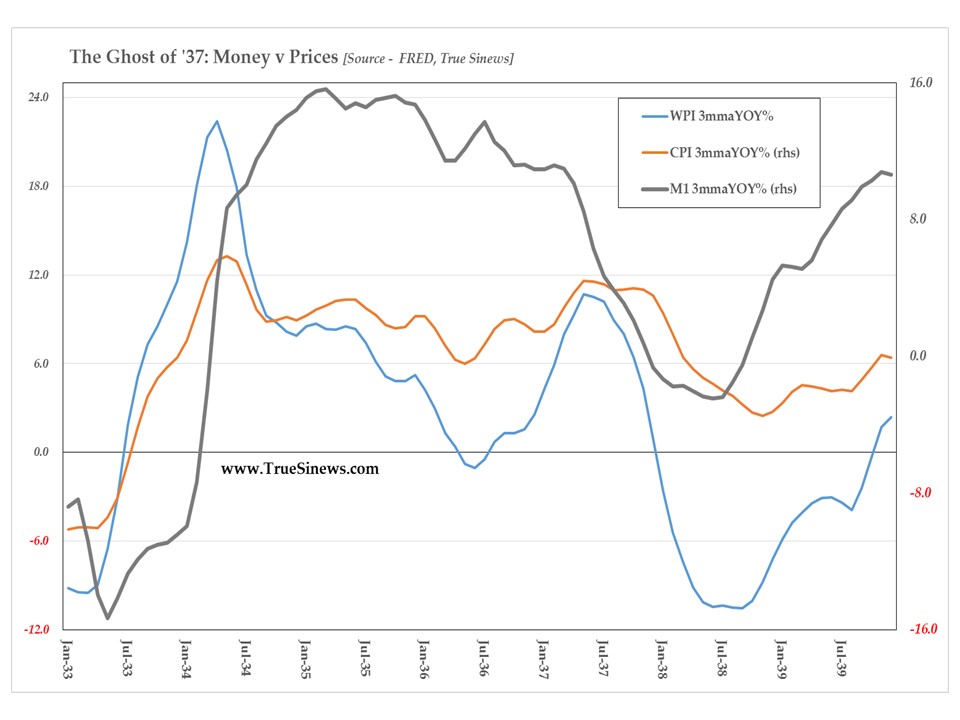

Fig 1: Money supply & Price indices

From the depths of the initial collapse, early in 1933, money supply – depending somewhat on which set of the available data one uses – had expanded somewhere between 55-65% in the four years to the cyclical highs of late spring 1937, or by an impressive 12-13% a year compounded. Reserve growth followed an even steeper path by, tripling over the period in question. This was an increment of such magnitude that the count of excess reserves contained within it swelled by a factor of 5.7 and so came to account for no less than half the total by mid-1936. Gold holdings grew likewise, up 150% in the four years since the devaluation at a 27% compound annual rate.

As the upswing approached its climax, domestic appetite was even strong enough for imports to outpace exports, with both growing at over 40% a year. That was enough to produce the largest trade gap in a decade typically marked by the generation of surpluses, so one might forgive the Fed for thinking that much of the recent inflow of gold represented a form of hot money of which there was already too much to hand. One could also imagine them to believe those suspicions confirmed when they noted the then fashionable Fairchild’s index of retail prices rising 9.2% in the space of a twelvemonth, alongside wholesale prices which were up 10.1%, or when they saw copper soaring 48%, rubber 35%, cotton goods 23% and tin 20%. The fact that the stock market was up 20% in twelve months and had doubled in twenty-four – over which latter horizon pre-tax earnings had only managed a 40% gain – would also have given pause for thought. Finally, as we shall see below, wages were also charging ahead while the roll of the jobless had shrunk by almost 60%.

What was the Fed to do, we might ask today’s perfect hindsight critics? Underwrite this burgeoning inflation by further monetizing it? That, too, would have been a course fraught with peril.

Part of the gold ‘avalanche’- as it was then described – was due to a surge in production to which the metal’s raised price and the miners’ lower costs had so greatly contributed that global output in 1937 was a full 75% greater than that of 1930, the last year before the metallic exchange standard collapsed. Opportunistic dishoarding at the new elevated parity in India added more to the pot while the ongoing economic and political turmoil in Europe provided one final source of bullion.

Rendered uncompetitive by Perfidious Albion’s defection from the gold standard in 1931, then dealt a double blow by Roosevelt’s 1933 repudiation of it, the remaining members of the Continental gold bloc had been jolted from one crisis to the next, each of which gave rise to an increase of flight capital. Successive defections by the Czechs in 1934 and the Belgians a year later only served to increase the pressure on the Netherlands. For its part, Switzerland had to suffer through the politicking associated with an ultimately unsuccessful popular referendum which called for the Confederation to adopt a package of American-style measures. Just as today, however, the real problem lay with France.

Here successive, short-lived administrations had alternated wildly between attempts to balance the books by cutting costs and partial emulations of New Deal reflationism. The one constant was that, whether spending was going up under one faction or revenues were coming down under the other, the finances could not be adequately controlled. Alas, the only means of bridging the crippling gap between income and outgo was to have recourse to the Banque de France – a policy guaranteed to see further gold losses and so to frighten off whatever smattering of investment remained.

Finally, in early 1936, the spin of the political wheel brought to power Leon Blum at the head of a Popular Front coalition of Socialists and Communists. Taking office, the incoming regime opted to try to suspend the laws of economics and thus achieve the Workers’ Paradise by decree. The results of such fatuous Utopianism were entirely predictable. The programme, in whose failure lies the first of the salutary lessons we might genuinely hope to draw from our grandfathers’ tribulations, included such evergreen Jacobin themes as a crack down on fraud, speculation, and tax evasion, combined with state support for agriculture and an extension of benefits to young and old alike. But the real killer was the move to cut the working week from 48 hours to 40, while adding 2-3 weeks of paid leave and simultaneously hiking wages by up to 15%.

Today’s cart-before-the-horse apostles of a higher minimum wage as a means to increase ‘purchasing power’, please take note: a 30% effective jump in labour costs meant that joblessness was soon mounting while the anxious attempt to pass on the rise in wage and other input costs set off successive waves of distress for businesses and consumers alike. Bowing to the inevitable, Blum reneged on his election pledge to maintain the franc and undertook a 25% devaluation of the currency. The Swiss, Dutch, and Italians quickly followed, the Czechs took a second bite at the cherry, while Greece, Turkey, and Latvia forsook their attachment to the franc and joined the sterling bloc instead.

Sparing the world another cascade of disruption on the foreign exchange market, this volte face was in fact conducted under the auspices of a fuzzy concord between Britain, the US, and France which was grandiloquently called the Tripartite Agreement. Though far from binding, this did offer some vague assurance that now that each of the signatories had in turn drunk deep from the poisoned well of competitive devaluation, there would be no more deliberate recourse to this hoary old tool of mutual beggary. Markets breathed a sigh of collective relief and if some of France’s foreign holdings headed temporarily for home, the promise of stability led many private individuals in the other former adherents to the bloc to cash in their windfall profits by adding to the monies chasing Wall St.’s eye-catching rise.

Ironically, the abatement of distrust of their home currencies – by revealing just what an embarrassment of gold there was in the world – eventually led to a desire to be rid of the stuff and to swap it for holdings of dollars above all else. Fearing yet another revaluation loss on their reserves were the British and American stabilization accounts to be swamped and the gold price reduced – as was actively discussed at the Empire Conference of May 1937 – many smaller central banks began to unload their remaining stocks of metal and so came near to rendering the prophecy a self-fulfilling one. It would take the gathering of the clouds of total war and the fears of its effect on paper currencies during the course of 1938 to finally arrest this impulse.

It is in this context of the rapid reversals in speculative flows unleashed by the unanchoring of the system – a turbulence further strengthened by the succession of policy shifts and broken promises from on high – that the US Treasury undertook to dampen the effect of an influx which, as 1936 turned to 1937, was beginning to alarm both it and its counterparts at the central bank. To the extent that such swings were not being driven in the main by underlying conditions of trade, it hardly seems fair to accuse the authorities of trying to subvert the working of the classic specie-flow mechanism and so of failing to allow a domestic inflation to ‘compensate’ for a deflation abroad. Given, too, that the stabilization account worked so as to increase bank ‘inside’ moneys – i.e., the gold-sellers’ deposits – not ‘outside’ ones – i.e., reserve balances at the Fed – and that there was an excess of the latter to set against the former, any monetary tightening occasioned can only have been of secondary importance.

Here we should pause to make one further thing clear: although the Fed’s three stage doubling of reserve requirements (effective August 1st 1936, March 1st and May 1st 1937) seemed to coincide with the peak in monetary growth, it is to be borne in mind that it was the excess, not the total of reserves which was drastically scaled back, the rationale being that these were so disproportionate that they not only constituted a threat to future stability but that they made the Fed’s ability to influence current events quite nugatory. Notwithstanding the moves, overall reserve growth was still an impressive 23% yoy in the interval to mid-37 and if the quota of required reserves was double that of the previous summer, so too was their provision.

The effect of all this on bond and money markets was, in any case, moot. Yes, from the rates which prevailed before the first increase, there was a reaction, but we must also bear in mind these were rates so low and so beyond anyone’s experience that Benjamin Anderson, Chase Manhattan’s eminent chief economist, was moved to describe them as ‘fantastic’. From their 10-12bps starting point, T-bill and BA yields rose almost 50bps to their peak (though a peak actually attained before the last reserve hike when the Fed started buying modest amounts of paper), as banks made adjustments to their balance sheets (and perhaps as working capital demands increased for reasons we shall discuss below), but Treasury and investment-grade corporate bonds only saw a modest 15-20bps increase and high-yield actually slipped a few bps until the recession hit home and subsequently pushed yields and spreads in that sector up by 150bps or so in time-honoured fashion.

What we have to ask then, was whether the subsequent, 14-month long, dip in the nominal money supply (which we can variously estimate at somewhere between 3.5 to 5.0% and of something like 1.5% of GDP) was enough to crush the real side of the economy, driving domestic production down by a third and imports by a half, slicing 40% or more of the value of stocks, and throwing seven million people out or work, especially when some part of that ostensibly critical reduction would have been related to a regulatory-arbitrage between higher reserve requirement demand deposits and lower-requirement time and saving alternatives (these latter rose 1.5% in the interval); and also when a further undefined, but more typically more volatile fraction (of at least 10% by analogy with other, known figures) was interbank in nature and so strictly not determinate.

We might also note that the Fed was swift to react once it became aware of the change in the situation (in fact it had already partly mitigated the reserve tightening even before the last raise had become effective). In August 1937, it cut the discount rate by 50bps to 1% (though this still represented something of a penalty rate in comparison with those prevalent in the market) and it encouraged bankers to avail themselves of the Window in case of need. It then invited the Treasury to ‘desterilize’ a sizeable $300 million in gold and authorized the Desk to buy securities when necessary despite an earlier expressed reluctance to accumulate further government paper. All this was to no avail – or at least it was without any effect of that same suspicious immediacy with which its tightening moves were to be much later credited. The following spring, the final reserve hike was rescinded, but by then, the bottom of the cycle had already been reached.

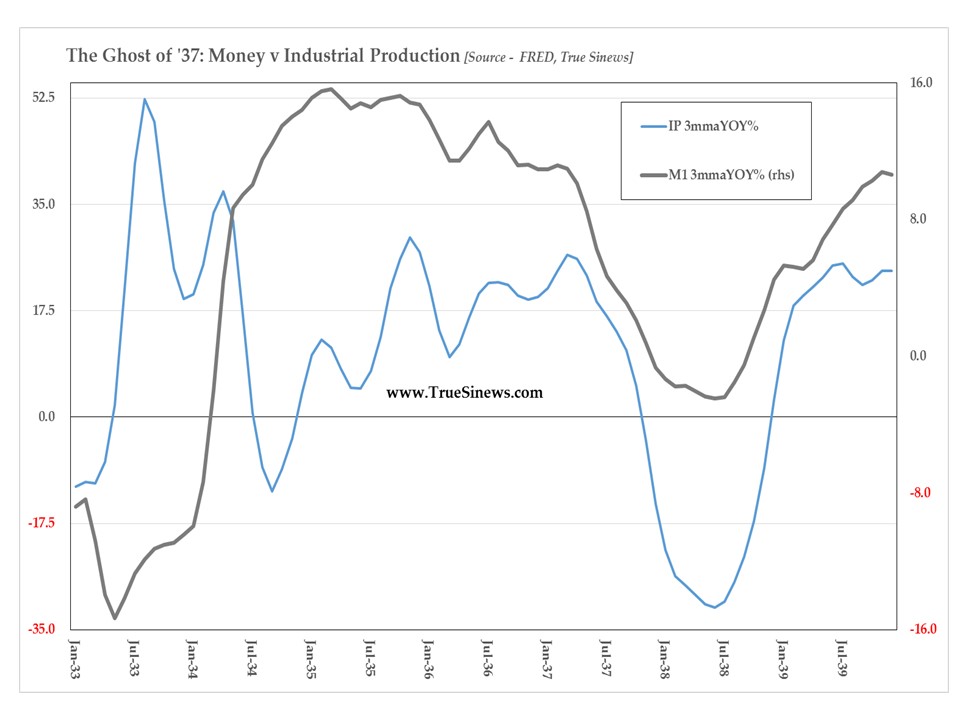

Fig 2: Money supply v Industrial production

Given all this, it is well worth asking whether we might in fact have the causality back to front; that rather than postulating that a change in money retarded production, considering that a fall in prices and output might have occasioned a minor, but noticeable contraction of a few percentage points in money and loan balances. Remember the sagacity of Mr. Hettinger: we are dealing here with the hearts and minds of men, not with some tightly-jointed mechanical linkage.

If we can bring ourselves to entertain this possibility for just a moment, we must then to try to imagine what could have caused such a sudden, violent departure from the preceding, upward path. Firstly, let us recall that in order to have the means to buy the product of others, people must first turn out their own. Furthermore, those whose great societal talent lies in that they can organize such production must themselves feel they have a fighting chance of doing it sufficiently well that there will be something left over not only to reward them and their backers and to pay their dues to their creditors, but also to have something left over to spend in the quest for a way of doing it better the next time around. In other words, they must believe they have a reasonable chance of making – and keeping at their disposal – a profit.

Once we come to that realization, we might just begin to see that some of the factors we have already discussed might have been instrumental in triggering the recession: input prices were rising and government receipts were greatly elevated. If we add the fact that the price of a far less amenable labour force was also shooting higher – average weekly wages in the six months to June ’37 were 16% above those of the previous year and a third higher than in the year before that – an extra piece of the puzzle might seem to have been slotted into place.

Even then, the sterile time series alone can barely afford us a glimpse of what was in truth a seething hotbed of class warfare, of cynical and often casually destructive political manoeuvring, of legal and regulatory uncertainty and of the swingeing, almost vindictive taxation of gain. In short, we need to take a quick tour of Roosevelt’s disastrous second term to put some flesh on the dry, numerical bones of the data.

Two years earlier, in May of 1935, all had not been well in the New Dealers’ City on the Hill. Industrial production had still not moved beyond the peak set in mid-1933 in the first flush of enthusiastic rebound. Unemployment rates were still in excess of 22%, representing a miserable total of 11 million souls without work. The stock market, at the wrong end of a year-long, 20% slide, was back to the levels of early 1933 – and before that to those of late 1931 and even of spring 1922.

Then came the moment when the logjam was broken and the upward momentum was regained, once more. The roll of the jobless would then fall for two years to a seven-year low of 4 ½ million; industrial production would rise by almost a half; the stock market would double. And what wonder would achieve this miraculous transformation? Some bold new stroke by the Federal Reserve? Some vast new proto-Keynesian push to spend money borrowed into existence by the state? Neither of these.

Instead we can attribute much of the turnaround to the landmark judgement of that last bastion of constitutionalism, the Supreme Court and its ‘Four Horsemen’, in which their Justices used the opportunity provided by the appeal of a pair of kosher poultry butchers, the Schechter brothers, to throw out Roosevelt’s Byzantine centrepiece of legalized cartelization and bureaucratic meddling, the National Industrial Recovery Act.

The NRA agency, with its infamous Blue Eagle emblem, represented Roosevelt at his Corporatist worst, being a misguided attempt to control all aspects of business; prices, wages, hours, and even – as the Schechter case showed to the hilarity of the courtroom – the customer’s ability to choose one particular chicken over another. Not for nothing did an eminent counsel to the brothers highlight the dreadful similarity with practices in Mussolini’s Italy. Not for nothing did men and women everywhere relish the thought that the verdict of the Court might allow them once more to go about their business in a manner which they clearly knew far better than did some busybody with a clipboard, newly descended upon them from Washington.

Nor did the Court stop there. Several other key agencies and programmatic innovations of the New Deal were deemed unlawful – among them the pig-slaughtering, crop-ploughing under abomination of the Agricultural Adjustment Act. Some measure of commercial and industrial freedom, it seemed, was to be restored to the initiative of the people and the long period of legal inconstancy they had suffered might be thought to be drawing to its end.

Being both ignorant of economics and acutely sensitive to any personal setback, Roosevelt failed to draw the obvious conclusions from this reinvigoration of enterprise. The rosy dawn of the revival which was launched by this liberation was sadly obscured by the glowering thunder of his pique. Instead, he turned to the task of securing his re-election by means of an appeal to the worst instincts of his fellow citizens, one he framed in a divisive populist invective about ‘economic royalists’ and later, about the ‘sixty families’ who were sabotaging the move to the Promised Land. Thomas Piketty and today’s disparagers of the ‘1%’ would have been in raptures.

The labyrinthine jockeying for position of the influence-peddlers around the Great Man and his own vacillation between one proposal and another out of those they set before him– indeed, his frequent willingness to sanction two seemingly contradictory approaches at once – need not detain us too long here except to identify two main strands to his actions which, taken together with his ill-advised thirst for vengeance upon those members of the Supreme Court who had opposed him, would rapidly undermine the nation’s burst of growth in a far more comprehensive manner than did any tinkering with reserve ratios on the part of the Fed.

The first was his tolerance for – indeed, his government’s promotion of – that particularly belligerent strain of union activism which came to be conducted under the accommodating aegis of the Wagner Act’s National Labour Relations Board and which was championed by the pugilistic and intensely ambitious John L. Lewis.

The second took shape in a damaging assault on the wealthy and the powerful – conducted not just with stage-managed vituperation and the whipped-up ‘name-and shame’ witch-finding of the kind with which today’s headlines resound, but with a barrage of punitive tax laws which were aimed not just at exacting a few extra quarts from the milk-cow, but at imposing a toll on her byre, as well as at claiming a large share of her hide when she died. Worse, the regime was not content to restrict its redistributionism to the personal sphere, but was determined to do the same for corporates, too, lest those afflicted by the former onslaught sought a ready refuge in the latter.

Together, these were to act to raise the costs of doing business as well as to reduce drastically the rewards for doing it.

Emerging from the relative backwater of the Union of Mineworkers to direct the mighty river of the CIO for which he himself largely dug the channel, Lewis was, by his own lights, one of the most successful labour organizers of the era, if we can judge success by the scale of disruption and intimidation – both of bosses and workers – which he effected, or by the deep pot of captive political funds he was soon able to deploy in order to buy both legislative and executive support for his doings. Sheltered by the Wagner Act and far more militant than any of the old guard of labour leaders, Lewis was to sow dissent and ill-feeling all along the commanding heights of the industrial economy – principally in steel, coal, and autos. As he led a push which saw the unionized proportion of the workforce double to 25% in four, short years, the tide of strikes, stoppages, and sit-ins mounted and mounted until the toll of workdays lost in June 1937 – just as recovery rolled over into relapse, you will note – was an all-time record of 5 million.

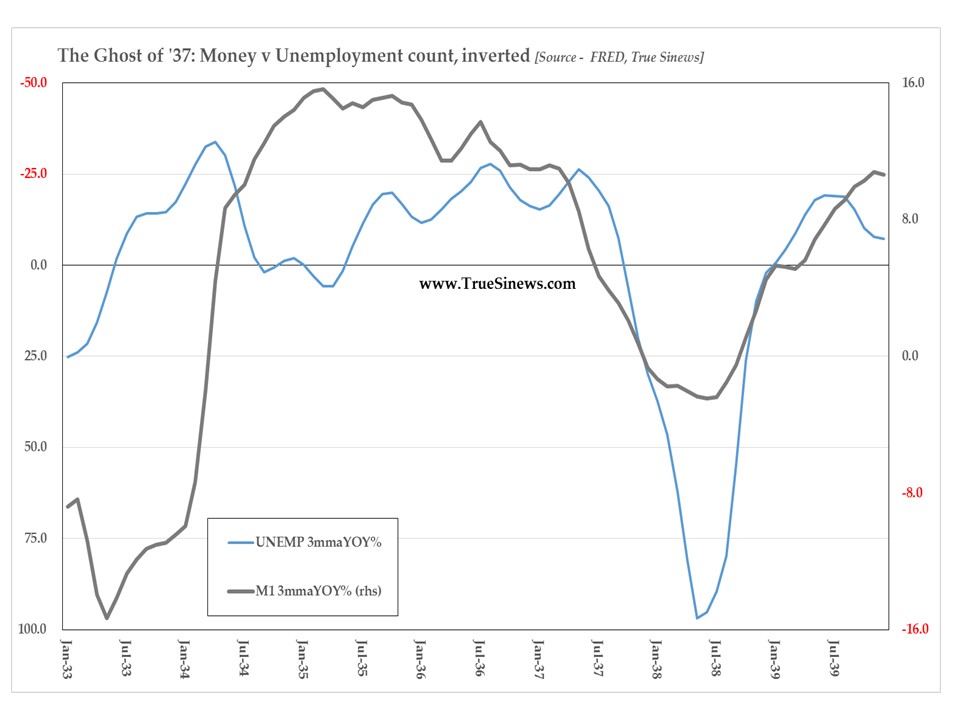

Fig 3: Money supply v Unemployment

Once you recognise the scale of the unrest thus created, might it lead you to suppose that it was not entirely the Fed’s fault that the economy stalled so suddenly and so disastrously?

With the law coming down largely on the side of the strikers, management everywhere had little choice but to succumb to their blackmailers after whatever period of costly resistance it was it chose to put up. Pay rates rose rapidly as a result to the point that one unnamed but ‘high-up’ government official impressed Chase Manhattan’s Anderson with a chart showing that the trend of real wages in the US was only being exceeded by those in Blum’s basket-case France. It would not be very long before our man’s diagnosis would prove all too painfully accurate. GM – less than a year after being forced to bow the knee to Lewis’s generals – would sack 30,000 of its conquerors’ foot-soldiers and put the rest on a three-day week. Lewis himself would be forced to play the supplicant at the court of King Franklin in a vain attempt to secure some extra relief for his now redundant vassals.

A particularly disheartening moment came in April of that blighted year when the Supreme Court, that last great beacon of hope, flickered and faltered badly. Patently acting with an eye at defusing Roosevelt’s ultimately fruitless but, to contemporaries even of his own party, blatantly dictatorial attempt at arrogating to himself the powers needed both to purge that august body of its recalcitrant old Solons and to pack it instead with his hand-picked Yes-men, Their Justices shocked every businessman who had come to rely upon the Court’s routine rejection of whole swathes of New Deal interventionism by upholding the validity of that same eristic Wagner Act, by allowing a new version of the Farm Mortgage Act to pass along with the then-contentious Social Security Ac (deliciously characterised by Garet Garret as a ‘fraud’ in which people could only receive ‘their own money back less the cost of government’), and by completing the somersault when they reversed their previous disapprobation of several other of the Brain Trust’s wheezes including a far-reaching one regarding the setting of minimum wage rates.

With one dissenter. Judge Roberts, turning apostate and another, Judge Van Devanter, about to take advantage of a knowingly crafted rule allowing those over 75 years of age to retire on full pay, the President may well have had to swallow the bitter ignominy of a rare defeat in the Senate that July on the issue of the Court’s composition, but it was clear that the final victory was soon to be his. There was to be no further relief for the business community, it seemed.

While all this had been going on, Roosevelt’s team had been eroding the nation’s foundation of prosperity in other ways as it set about attacking those best placed to contribute to a general recovery for little better reason than the New Dealers’ ideology of envy –a poisonous broth which was spiced up with more than a dash of their boss’s characteristic malice and spleen.

Early in the slump, Hoover had enacted one of the largest tax rises on record – a misstep for which he has rightly since been excoriated. But Hoover – the Great Engineer of Things – was a tyro by comparison with Roosevelt, the Great Manipulator of Men. While Keynes (whose Shade we can surely picture chuckling from the Stygian gloom at the doings of today’s hapless central bankers), was fantasizing about what his artificially low interest rates would do to the poor saver – or the ‘rentier‘ to use his own sneering pejorative – the New Dealers were actually enacting a similar pursuit of the ‘euthanasia’ of the entrepreneur and of the capitalist who financed him.

The first blows fell in the shape of the one-two struck by Treasury Directive 4222 and the Revenue Act of 1934. Here, the government drastically curtailed the ability of individuals to offset losses against gains in the calculation of capital charges and, more importantly, it launched a crackdown – and an often retrospective one at that – on firms’ use of depreciation allowances. Not only did this latter greatly limit the scope of upfront deductions, it sought to recover past allowances now deemed to have been ‘excessive’. Furthermore, in direct contradiction of the normal standards of jurisprudence, the Directive aimed at shifting the burden of proof onto the claimant, making him prove he was innocent of any infraction, rather than having the Revenue agent demonstrate he was guilty of any abuse of what was to become a particularly tortuous body of regulation.

As explained at the time by Dana Latham (founder of what would grow to become one of today’s largest law firms and a future Commissioner of the IRS itself under Eisenhower), the measure’s proponents had explicitly argued that it was ‘necessary to prevent in the future the great accumulation of corporate saving which was one of the contributing factors to the present depression [sic]. Corporations, by continually plowing [sic] profits back into the business and declaring tax exempt stock dividends, enable their stockholders to escape all income taxation.’

Perish the thought that a businessman might have motives other than tax avoidance when he ‘plows’ the fruits of his success back into his endeavours! Heaven forfend that he does not instead have to strive to raise the means to further advancement in a moribund securities market or by begging a few pennies from the unwilling grip of a recently-chastened banker!

Given that the NIRA itself had tried to limit by license all equipment purchases and that there were still calls being made in Congress for a tax on patents and for a levy on the use of machinery in order to prevent the introduction of any new labour-saving (a decidedly loaded description of what are, of course, labour-enhancing) devices, is it any wonder that this twin-pronged attack on both the means and the motives for capital improvement had a severe impact? It is all very well bemoaning a lack of ‘animal spirits’ as a root cause of both the severity and the duration of the slump: it is equally fine to issue issuing lofty appeals for the ‘socialization of investment’ as a palliative for the malaise. But it is correspondingly hard not to become exasperated at the display of ignorance – both economic and political – before one when the unresponsive ‘animals’ in question are being simultaneously starved and beaten by the lackeys of the state!

The next year, worried at being outflanked to his left by the rabble-rousing Senator Huey Long of Louisiana, Roosevelt had had his team cook up what they called the ‘soak the rich’ Revenue Act of 1935. Though somewhat watered down during its passage through Congress – a sharply ‘progressive’ (i.e. progressively rapacious) tax was imposed on incomes and inheritances, taking top rates up 14 points to 83% on income in a single bound and levying a world-beating 72% top rate on the man’s estate. Bad enough for its demoralization – not to mention its despoliation – of those whose money might well have been made in (and was frequently re-utilised for) the provision of jobs for some and of valued goods and services for the many, worse was yet to follow.

As if this was not enough, in the Revenue Act of 1936, the pernicious device of the undistributed profits tax was conceived. Worried that the potential victims of the previous year’s legal larceny were avoiding the worst of its depredations by shielding their gains within a corporate structure, Morgenthau and the New Dealers decided that all a company’s retained earnings were henceforth to be taxed. In fact, at the scale of the original proposals, any company with a pay-out ratio of less than 50% would have faced a tax on the original income of up to 42.5% and thus would have seen nearly three-quarters of the balance it wished to hold back confiscated by the state!

It is hard to imagine anything more counterproductive than a tax on self-generated capital, whether in respect of the soundness of the firm’s finances; of its ability to adapt to a changing environment; or of its capacity to invest in its own advancement and thus in the greater satisfaction of its customers. If material progress – as well as the spiritual and cultural edification to which the more easily assured satisfaction of our bodily needs is so evidently conducive – is not based on channelling the necessary capital means to those who have proven they know how best to use it; if the generation of a surplus in one’s own line of business is not the best proof of such an ability; and if its retention at its place of its origin is not the simplest way of assuring its delivery to the right place, then we are at a loss to suggest alternatives.

But, in their zeal to root out tax avoiders and also in their susceptibility to the false if ineradicable superstition that if we are to avoid depression then money earned must be money spent exhaustively (i.e., on end-consumption), whether by its direct recipients or by the beneficiaries of the government’s faux largesse, Roosevelt’s team were utterly blind to its malign consequences.

As Ogden Mills, sometime Secretary to the Treasury, pointedly asked: did anyone suppose that Ford Motor Co. would have gone beyond its humble, back street garage stage if Henry had sat down at the end of every month and shared out all his proceeds among himself and his workers? Answer came there none.

Again, even though Congress managed to take some of the sting out of the tax by reducing the top rate to just over one quarter rather than nearly three-quarters of the retention, the immediate results of sowing this wind were entirely foreseeable: dividend payments jumped in each of the next two years, weakening balance sheets and threatening banking covenants in a manner which would reap the whirlwind in the coming recession. In order to make up the shortfall, security issuance also shook off some of its long maintained lethargy though this should hardly be taken as a sign of renewed capital appetite, merely of an expensive, if necessary, regulatory arbitrage.

Not content with this triumph, the New Dealers came back to take another swing at the Golden Goose in 1937. This time, the bill was all about closing ‘loopholes’; at eliminating certain forms of incorporation; at hindering or banning the use of trusts or foreign holding companies, while also setting up a fiscal Inquisition in the form of the Joint Committee on Tax Evasion & Avoidance. Warming to the task, Roosevelt bade Treasury Secretary Morgenthau set his operatives to sift through the tax audits of wealthy individuals, looking for those who had minimized their liabilities.

Then, as today, the essential distinction between legal avoidance and illicit evasion was conveniently blurred so as to round up more victims for the fiscal auto-da-fé. With even less propriety, the Chief told his tax commissioner to publicise the names of 67 such ‘offenders’, men whose only crime was to take shrewd advantage of the existing law but whose fate was to be held before the Mob as examples of people whose actions were frankly acknowledged to be legal but nonetheless subject to condemnation for not being ‘conscientious’. On the back of the ensuing ballyhoo, a compliant Congress meekly passed the tax bill in its entirety.

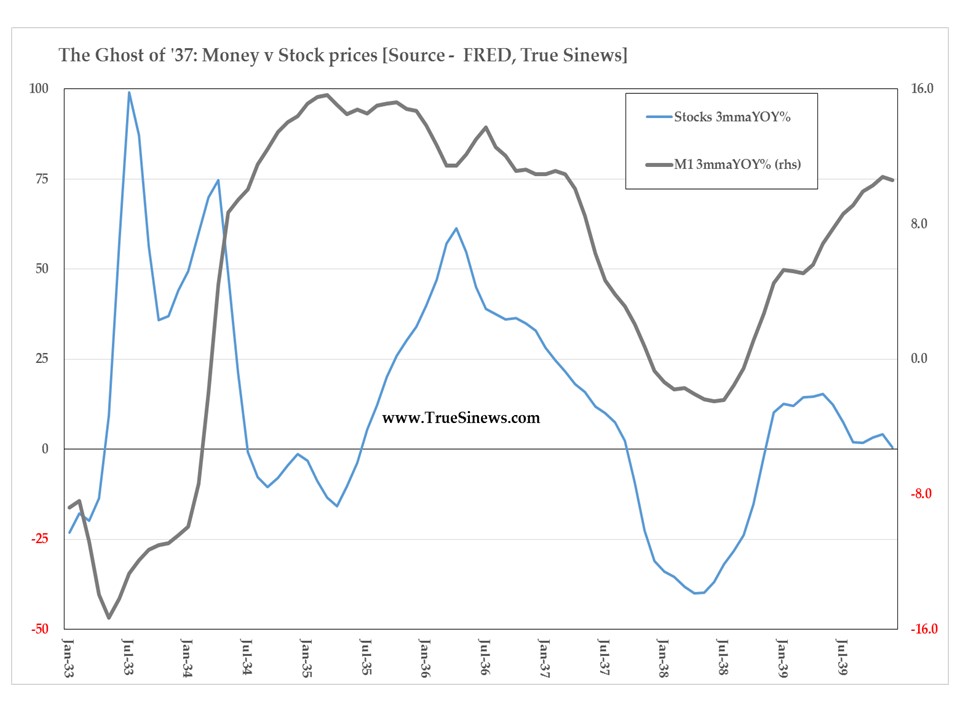

Fig 4: Money supply v Stock prices

It must now be apparent that, by the summer of 1937, businessmen small and large must have been feeling the squeeze. On one side of the vice was the rise in costs – especially, but not exclusively, that associated with the payroll – and on the other was the knowledge that even if their efforts were rewarded with a gain, a good part of that would be wrested from them and that, were they to have the temerity to protest, they would be hounded and harassed in the press as well as the courts. Is it any wonder that many of them came to feel they would not or could not go on as before?

Lost amid the silent aggregates with which the macroeconomist likes to work is also the critical fact that such profits as were being earned were highly concentrated – as in truth they still are today when 40+% of corporates, representing 25-30% of all sales make no money from their activities, even in a good year.

Of the 2 million or so registered business in 1937, around half a million took corporate form. Of these, those who actually managed to generate a positive net income were members of a highly-skewed distribution in which the largest 5% of companies were responsible for 85% of all profits; where the next 20% accounted for another 12% of the gains; and where the long trail of the laggardly residuum of 75% were left to scrabble over crumbs which represented no more than 3% of the cake as a whole.

Even this bleak vision does not convey the true nature of the challenge facing the small entrepreneur in trying to keep his head above the lapping waters of viability for it ignores the many who are already submerged in loss. Leonard Ayres of the Cleveland Trust estimated that, in the prosperous year of 1936, as many as two-thirds of all firms were beneath the waves. Performing a separate calculation, E. D. Kennedy noted that once you removed the 960 companies quoted on the New York Stock Exchange from the total, you had already accounted for the entirety of 1935’s profits. Just 42 of those listed corporations alone took three-fifths of the entire pot and, of them, the biggest 6 swallowed up almost a quarter.

So now try to imagine how those companies were faring in 1937, mired in a newly-tangled web of rules and regulations (to help keep up with the breaking tsunami of these, the government helpfully published the first Federal Register, a catalogue of impediments whose inaugural edition stretched to 2,620 pages before leaping by a third to 3,450 in 1937 itself), painfully aware of the authorities’ antipathy to their leaders and owners as a class, confronted by the aggression of professional union provocateurs, having to pay a higher price for their inputs, and now unable to plough as much of anything they did manage to make back into the business without rendering a portion of their precious capital unto Caesar.

Do you not suppose that an extra 10, 20 – even 100 – basis points on interest rates would have been among the least of their worries in the circumstances?

Certainly there was little evidence that anyone at the time thought so.

No less a worthy than Joseph Schumpeter remarked of the business community’s plight that its members ‘…realize they are on trial before judges who have the verdict in their pocket beforehand.’

Another contemporary observer, David Lawrence, wrote in 1938 that the President ‘… has aroused in the financial and business communities a fear almost amounting to terror and a distrust which has broken down the morale of the whole economic machinery …[and] the spirit and faith…in the actual safety of a citizen’s property and his savings.’

The ever perspicacious Garet Garrett declared in the March 5 edition of the Saturday Evening Post, in an article entitled ‘The Fifth Anniversary’ whose diagnosis of the ills besetting his country should be compulsory reading for all concerned with framing or executing policy today: ‘…the New Deal has crippled the free competitive system that was working I this country…with all its faults better than any other system that was ever known. In these ways it has been destroying what was unique in the American system…What we have been watching is the experiment of trying to make captive capitalism work, conducted by a government that only half believes in it and yet has not the daring to destroy it.’

In 1936, Howard E. Kershner came closer to the truth when he wrote that: ‘Roosevelt took charge of our government when it was comparatively simple, and for the most part confined to the essential functions of government, and transformed it into a highly complex, bungling agency for throttling business and bedevilling the private lives of free people. It is no exaggeration to say that he took the government when it was a small racket and made a large racket out of it.’

Even Lammot du Pont, the eponymous head of that mighty industrial concern – one of the six that earned a quarter of the nation’s profits – expressed his bewilderment in the same year, when he said:

‘Uncertainty rules the tax situation, the labour situation, the monetary situation, and practically every legal condition under which industry must operate. Are taxes to go higher, lower or stay where they are? We don’t know. Is labour to be union or non-union? . . . Are we to have inflation or deflation, more government spending or less? . . . Are new restrictions to be placed on capital, new limits on profits? . . . It is impossible to even guess at the answers.’

If a powerful man such as he – privy to the information which flowed through two of the world’s mightiest business concerns, Du Pont itself and GM in which the family was a major stakeholder – was at a loss as to how to proceed, can you imagine the state of mind of the owner of the local machine shop or the manager of an upstate paper mill?

Even from within the sanctum of the temple doubts were being expressed. Brain Trust founder Raymond Moley wrote in his private diary in May 1936 after a frustrating meeting with the President. ‘I was impressed as never before by the utter lack of logic of the man, the scantiness of his precise knowledge of things that he was talking about, by the gross inaccuracies in his statements, by the almost pathological lack of sequence in his discussion. . . . In other words, the political habits of his mind were working full steam with the added influence of a swollen ego.’

Perhaps most damningly for the many worshippers of their joint cult, even Keynes was perplexed by his twin deity’s approach. In his open letter to the President of 1938, the Bloomsbury sage told him:

‘There seems to be a deadlock. Neither your policy nor anybody else’s is able to take effect…. Personally I think there is a great deal to be said for the ownership of all the utilities by publicly owned boards. But if public opinion is not yet ripe for this, what is the object of chasing the utilities around the lot every other week? …It is a mistake to think that they [businessmen] are more immoral than politicians. If you work them into the surly, obstinate, terrified mood, of which domestic animals, wrongly handled, are so capable, the nation’s burdens will not get carried to market; and in the end public opinion will veer their way.’

Given all of this, can we say have any truck with the simplistic narrative which insists that it was the fact that ‘FDR cut spending’ that contributed to the collapse and that, ergo, no government today should ever dare to rein in on its deluge of doles and entitlements? Not when it was not spending that was cut in 1937 (not once we abstract the Veteran’s bonus effect, at least) but that taxes were raised, raised hard, and moreover that they were taxes of the most harmful kind, imposed in the most hateful of manners?

Given all of this, can we really be so superficial as to say it was all the fault of the Federal Reserve and that, by extension, today’s Fed must never ever take the risk of starting out on a slow re-normalization of policy?

For that, let us leave the last word with Benjamin Anderson, a man we have already cited above. Dismissing the charge monetary factors were responsible for the setback, he insisted that:-

‘It is very important that we clear up misunderstandings regarding these points lest excessive timidity regarding future money market control be generated by them’

Quite. I hope we have persuaded you, Mr. Dalio, of the merits of Anderson’s prescription and that we should not on any account seek to dissuade the central banks from trying to paint their way back out of the corner into which they have forced themselves, lest their lack of moral courage occasions us a far greater harm in the future.

Let us lay the Ghost of ’37 once and for all, by better understanding the true nature of this grisly apparition, and not allow the spectre to imperil us all over again while we cower in terror before an entirely phantom danger.

All rights reserved. ©True Sinews