Thanks very much to my old friend, Steve Sedgwick at Squawk Box Europe for the chat this morning. We looked at Growth v Value, the US v ROW, we touched on bonds and borrowing, money supply, inflation, lockdown, commodities & gold – all in under 10 minutes!

To fill out what all might seem a bit rushed on the soundfile, here are the notes I sent to accompany our chat, complete with a little extra gloss for you to read at your leisure:-

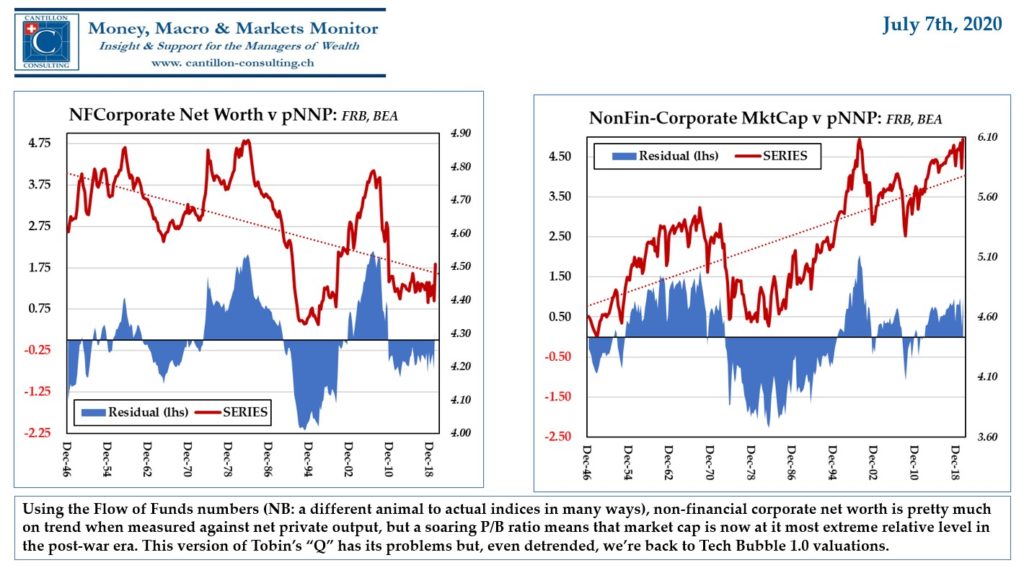

First up, while the aggregate net worth of both corporate and non-corporate, non-financial businesses continued their modest trend decline as a proportion of net national output (perhaps because firms are growing more efficient, but more likely because they are simply employing greater leverage), the soaring price/book ratio is pushing market cap to a new, post-War, relative extreme.

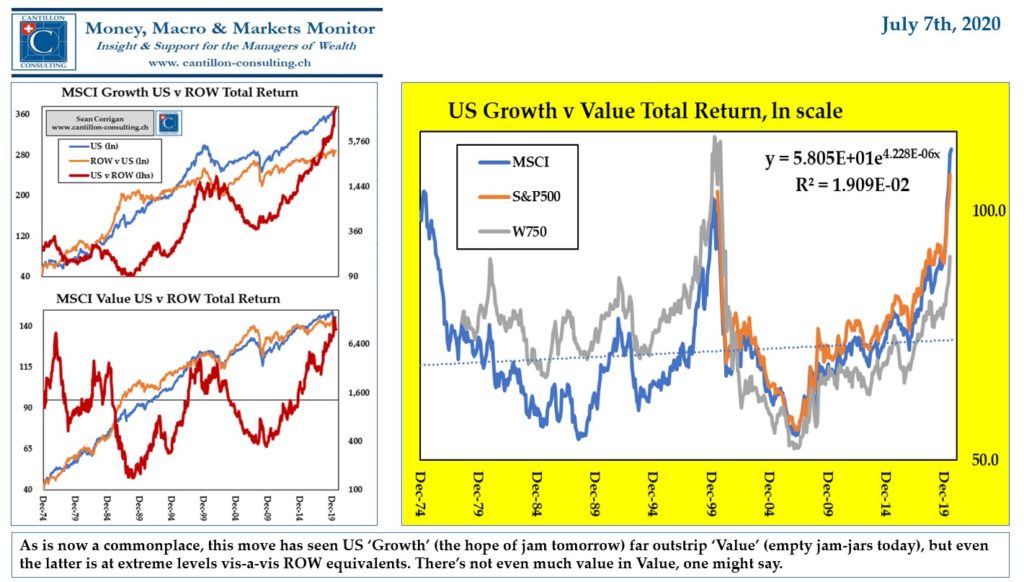

Next, Growth – as the ‘promise of jam tomorrow’ – is now as overpriced vis-à-vis Value – as ‘the empty jam-jars of today’ – as at any time since WWII while the US flavours of both ‘styles’ are rich to their ROW counterparts.

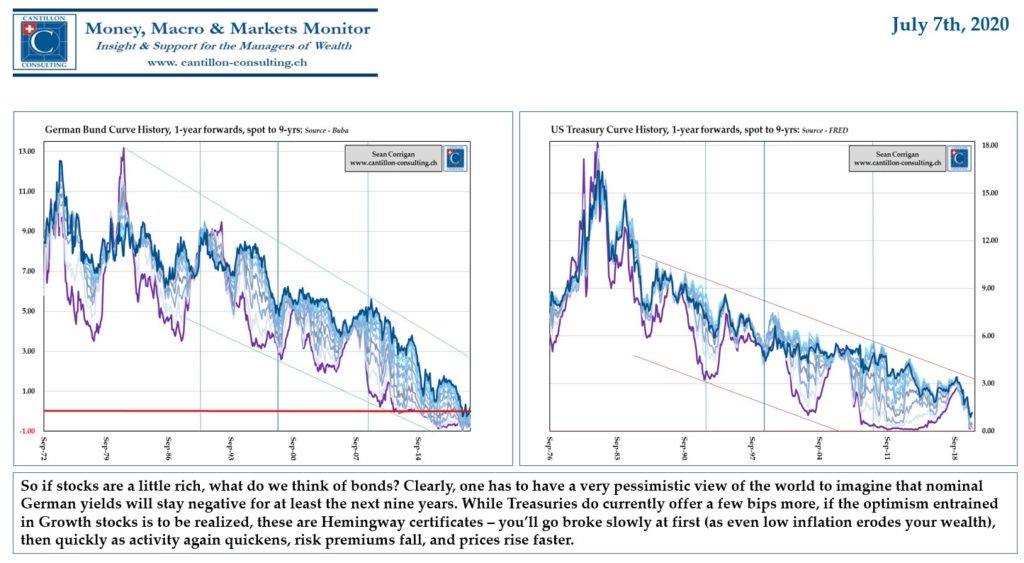

Bonds, of course, have their own issues. Central banks have made them into Hemingway Certificates: at first, you’ll go broke slowly by holding them: then, all at once.

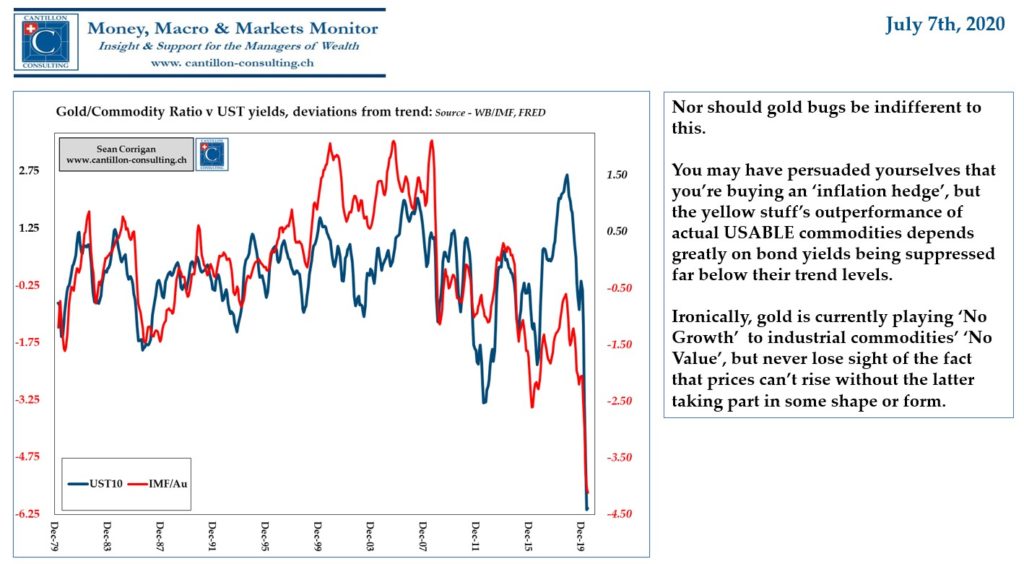

And you may think that gold is a place to hide from all this but it, too, is partly an opportunity cost story (with a dash of safe haven thrown in) and partly a bet on prices rising more rapidly again in future. Bullish charts mean it’s still dangerous to sell it, but don’t forget ‘prices rising’ means OTHER commodities must rise, too. [Please see here for Squawk Box video clip]

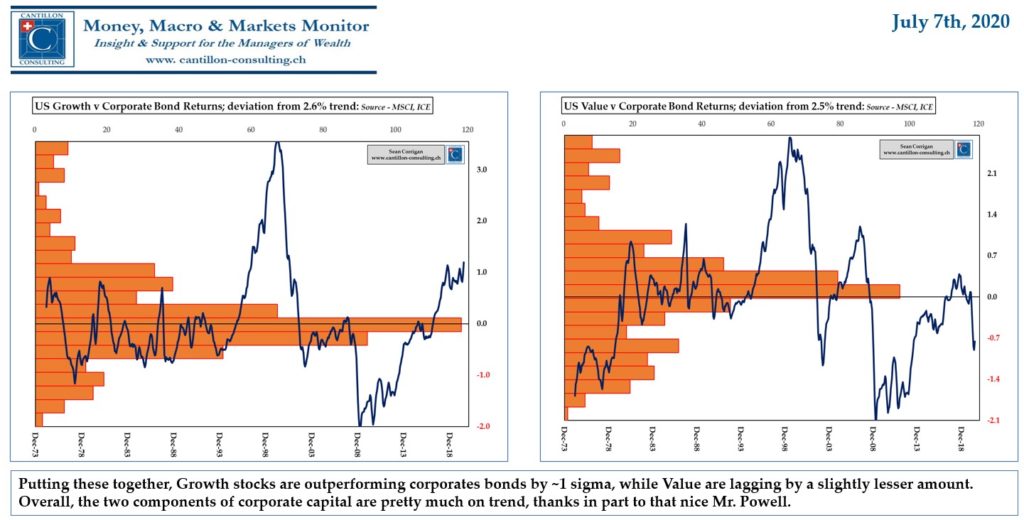

Overall, relative to the long-term trend (if you like, either side of a typical ERP of around 2 1/2%), stocks and bonds are in line with one another: Growth is obviously a tad rich: Value a touch cheap. If that means there’s not much there to get your teeth into, let’s cast the net a little wider.

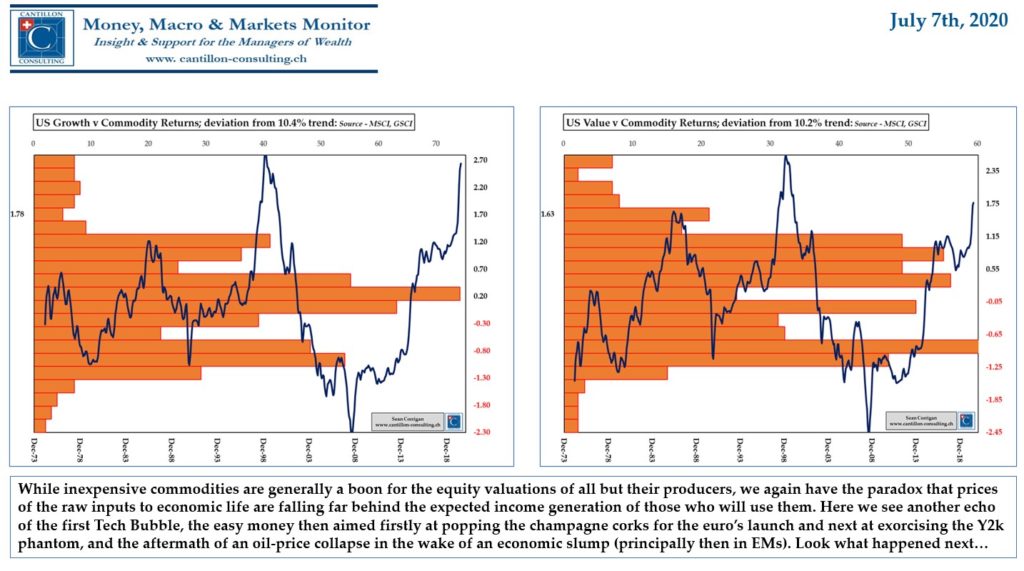

Equities are obviously w-a-y ahead of commodities with which, in the modern age, they tend to dance a Risk On tango, but, remember, even Facebook and Google need revenues from businesses toiling down in the engine room of the economy: even Amazon needs other buyers & sellers to be willing and able to transact. Tech may seem bullet-proof, but it cannot live forever by stealing everyone the shrinking contents of everyone else’s lunch-box.

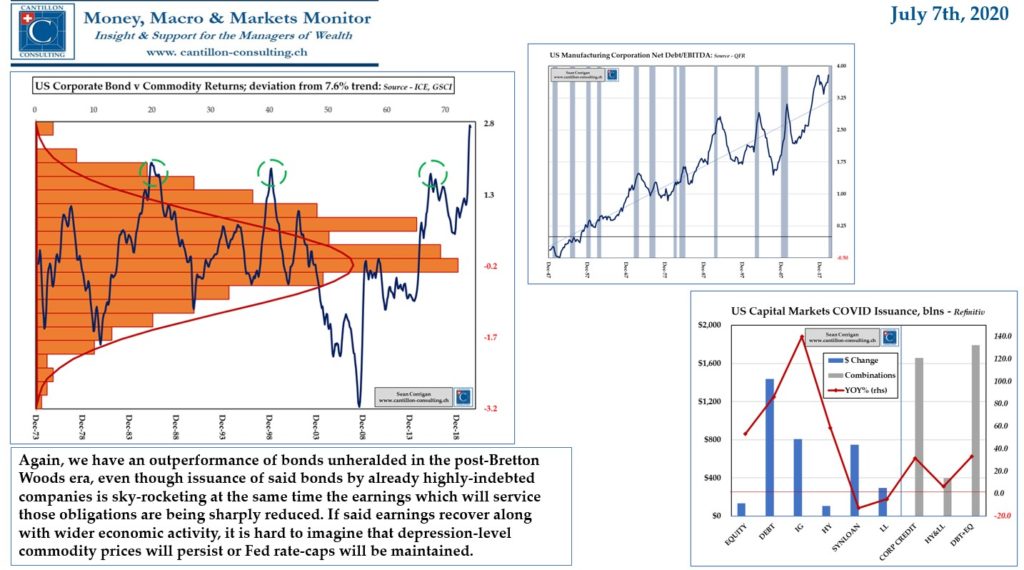

Bonds, too, are off the chart v their traditional Nemesis, commodities, but -support from the Fed , the ECB, et al, aside- they’re being carried on increasingly stretched balance sheets and so storing up risks for the future. The one saving grace here is to be found in the size of the deposit war-chest being stockpiled on the other side of the T-account.

To sum up, if the Growth chasers are correct, Value cannot but regain some ground, in due course. Such a scenario puts a floor under commodities; takes some wind out of gold’s billowing sails; obviates extreme CB measures & so leaves bonds, in turn, exposed.

Robinhood can’t KEEP taking from the poor & giving to the rich indefinitely.

On the other hand, if the Growth mania IS just another speculative bubble ( ‘You might very well think that but I couldn’t possibly comment, ‘ to channel the inimitable Francis Urquhart), once it exhausts, it should lead the subsequent – possibly violent – downdraft and so still leave the alternatives looking to be the better bet.

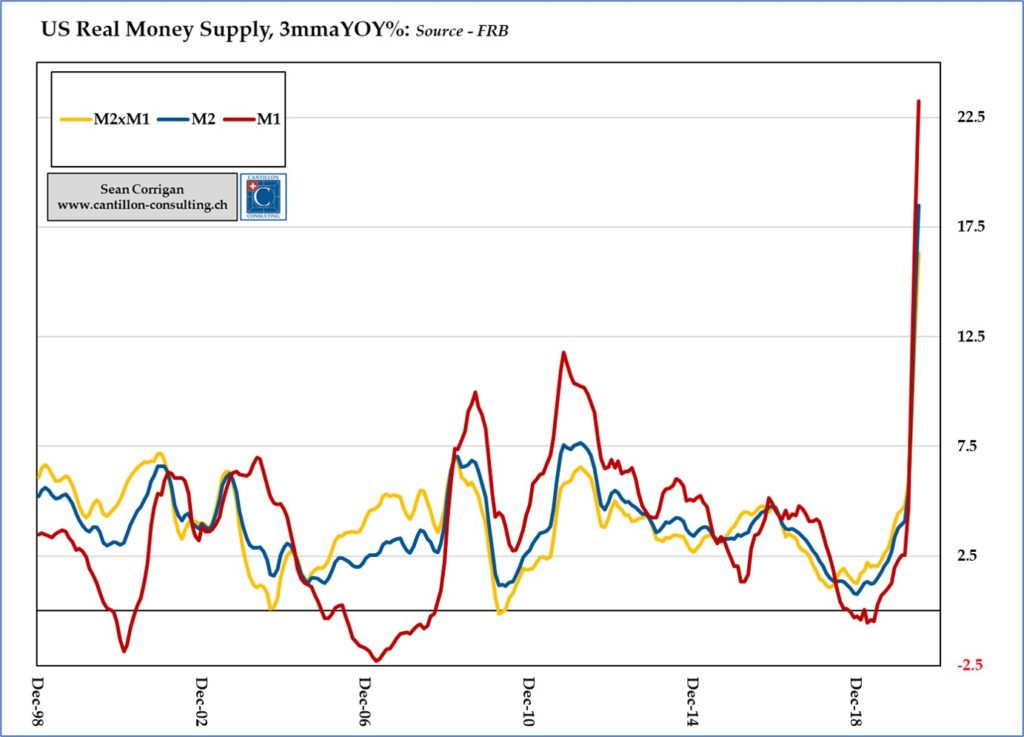

As for the hoary subject of inflation? Here the key is how much failure, disruption, lack of investment, outages and COVID restrictions will impede a ready restoration of supply and how much the losses endured, the caution engendered, and the forcibly shrunken horizons inhibit demand. The alarming increase in money supply could be quickly reabsorbed if the similarly unprecedented levels of debt being contracted as part of its creation turn out to be partly precautionary in nature and hence are quickly paid down, the moment it is deemed safe to do so.

Finally, one has to bear in mind the role of governments and politicians, all eager to borrow and spend their way to glory, Greenery, or both. Public prodigals versus the private prudent might be a contest on which the bookmaker will give very short odds indeed.