Just when you thought the British ruling classes could not stoop any lower or more avidly play Limelight Leapfrog to the detriment of their electors’ well-being, we lately witnessed a deluge of fawning, flash-lit, choreographed adulation over the petty, proxy-war despot masquerading as a paladin of liberty – the fearless defender of ‘our values’ – who was not seen as the importunate beggar he is, but as some holy guru, come to grace them with his sainted presence. Continue reading

Category Archives: Uncategorized

We Must Rise

Though a long standing critic of the EU and a vocal supporter of Brexit, I never harboured any illusions that it was going to be a panacea for the UK’s more deep-seated ills. Rather, the practical element of my advocacy was that it ought to have meant that neither the mistakes nor the malice of the domestic government could continue to be conveniently blamed on others. That way, it was to be hoped that the escape from the Brussels Bonapartes might afford the electorate a heightened means of demanding accountability from their so-called ‘representatives’.

Alas, our homegrown politicians – whether bullied, bribed, blackmailed, brainwashed, or simply backroom Berias – have since shown the utter depth of my folly on that score.

In essence, ‘We took back control’ from Brussels only to hand ourselves- bound hand, foot, and facemask- to a far more sinister – if not an actively satanic- clique.

And now we are truly lost.

The chains with which to bind us, our children – and indeed all of future Mankind – are being forged, link by link, hour by hour. They are being woven into an inescapable mesh of unblinking surveillance, pervasive control, human livestock-farming, bodily violation, spiritual subjugation, social deracination, immiseration, and chafing constraint.

And yet, we mostly stand by and do nothing to resist our coming enslavement. After all, Malaga beckons, now that we’ve meekly enlisted in the genetech experiment. United are at home this weekend. And that woman did s-o-o well on ‘Strictly’ last night, didn’t she?

Pan(ic)em et Circenses prevails while the plutocrats and praetorians openly parade their power and mock our feeble struggles, interrupting their scornful displays of unmasked mirth only to extinguish our voices permanently and to mark us down for a subsistence-level Social Credit score in the Digital Gulag now being erected around us.

Parliament is defunct. The judiciary sleeps. The media has been suborned. The churches preach the Gospel of Lucifer. “ScienceTM” is become our graven idol and “The Planet”, the stepped pyramid on whose blood-stained summit we must sacrifice our offspring in expiation for the sin of once being free, prosperous, and largely self-reliant.

Where is the end? What chance have we to escape this Hell?

The one, faint hope, is that the sneering hubris of the Davocracy and the utter, weaselly mendacity of their Pawns-in-Office (Yes, that means YOU, Prime Minister!) finally stirs enough outrage in us, the supine masses, that we look up from our smartphones, switch off Netflix, take out our earbuds, and awaken to our peril.

But what then? What are we to do, if we are to clamber back out of the abyss before its walls reach insurmountably far above the depths to which we have already fallen?

I suggest that the answer lies before us in the antics of those twin street-theatre troupes of state-endorsed energy poverty – Extinction Rebellion and Insulate Britain. We should learn from their irritating example and ask ourselves this question: if a clutch of raggedy vicars and a gaggle of metromarxist matrons can bring those lawfully travelling the nation’s highways shuddering to a frustrated halt, what could hundreds – thousands – TENS of thousands – of peaceful protesters not achieve, in their place?

If we are to ward off the impending evil, we need a liberation movement akin to that which toppled and humiliated the awful despotism of Red Communism. We, too, must act en masse if we are to avoid being enveloped in the enduring misery promised by that former tyranny’s new, Green instar. We must quickly rein in the Medico-Media Industrial Complex which otherwise threatens to crush us into expropriated atoms.

We therefore need to take inspiration from Solidarnosc and mimic its resolute stand of four decades ago against the awful and then seemingly insuperable might of the Soviets.

Solidarity, the movement, we clearly need. But it would also greatly help our cause if we had a figurehead, a leader, a spokesperson, a personification of the struggle, a voice of the people – our very own Lech Walesa.

Where can we find such a one? Among the few honest MPs who have vainly striven to hold back this Juggernaut and hold the Junta to account? Among the courageous handful in the media who have refused to parrot the narrative of fear or to intone top-of-the-hour demands for further craven servitude? Or is there someone as yet unknown to the public stage – a conscientious doctor, an outraged mother, a working man of keen intellect and cast-iron scruples? Does anyone know?

Surely someone among us must possess the requisite character, the moral backbone, the ability to articulate the aspirations of the Silent – or rather, the Silenced – Majority: someone willing to grasp the flag of freedom and lead us over the barricades to win back our God-given liberties?

We must earnestly hope they do exist and, existing, that they can be persuaded to stand up bravely before the basilisk glare of the Deep State and the venomous breath of its ravening corporate cronies. For without our enlistment in this Army of Passive Resistance and without him or her to help mobilise and guide our struggle, the corrupt institutions under which we suffer will continue relentlessly about their wicked schemes until they reduce us all to digitised, sanitised, lobotomised serfs, each anxiously flashing our short-expiry Health Passports; hoping the value of our newly-programmable digital currency will not dwindle too quickly in our hands; and ever fearful that our personalized, good-behaviour carbon-rations will not be enough to fill our bellies or to allow us to warm our homes.

Be under no illusion, that last, bleak vision of a technocratic Dystopia is no longer a matter of science-fiction. It has long since moved from ‘conspiracy theory’ to avowed intent. If this is not the legacy we wish to bequeath to our children, we must rise – and rise soon before the prison walls about us become impregnable.

Hoping for Growth. Searching for Value.

Thanks very much to my old friend, Steve Sedgwick at Squawk Box Europe for the chat this morning. We looked at Growth v Value, the US v ROW, we touched on bonds and borrowing, money supply, inflation, lockdown, commodities & gold – all in under 10 minutes!

To fill out what all might seem a bit rushed on the soundfile, here are the notes I sent to accompany our chat, complete with a little extra gloss for you to read at your leisure:-

Beguiled by their Own Augury

When Fed Chairman Jay Powell cleared his throat to speak at the Council for Foreign Relations this week, the air was one of rapt attention. [To listen instead to my podcast on this, please go to CantillonCH at SoundCloud, or search Apple Podcasts and Spotify for ‘Cantillon Effects’] Continue reading

Midweek Macro Musings: Complimentary edition

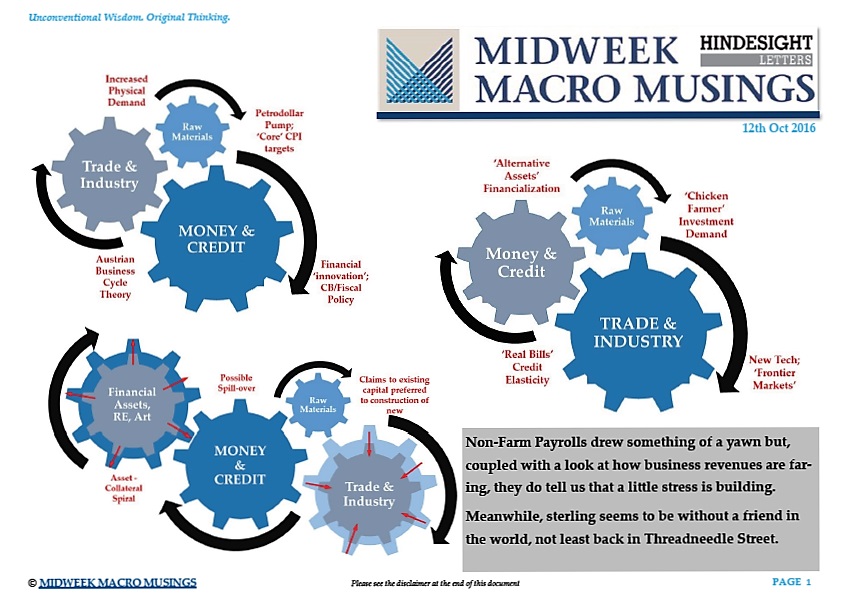

Non-Farm Payrolls drew something of a yawn but, coupled with a look at how business revenues are faring, they do tell us that a little stress is building.

Meanwhile, sterling seems to be without a friend in the world, not least back in Threadneedle Street.

Please click the link for a special, complimentary edition of my bi-monthly market update.

Two-minute Markets

Please see the page heading above which bears this title for a daily 2 1/2 minutes’ worth of reportage, commentary – and comedy – on the financial events of the day, as broadcast on World Radio Switzerland during its evening ‘Drive Time’ programme.

Hamilton’s Curse (reprised)

The following article is (after very light editing) something your author wrote early in October of 2008, when the padlocks on the Lehman office building doors were still swinging. The reader will, he hopes, find that most of the presentiments expressed and the analysis submitted sadly turned out to be more accurate than otherwise.

It is to our collective detriment that, eight long, painful, underemployed, increasingly indebted, more societally divisive years on, few if any of these lessons seem to have been drawn by the Powers-that-Be.

Mehr Europa? Wir sagen, Nein!

Riddle me this, if you will. ‘Europe’ as a concept has perhaps never stood in lower regard, whether in the eyes of its own citizens or of those of us thankfully still beyond its reach. Yet the euro is strengthening – with options showing levels of bullishness not seen since the 2008/9 Crisis – and the likes of Italy and Spain can both borrow for 30 years at much the same rate as can the USA. Ye Gods! It truly must be the Promised Land.

But, forget the fantasy world of central bank-distorted financial markets for a moment and look around at the world beyond the Bloomberg screens.

The Ballad of Alpha, the Bull’s Bull, All Geared

With all due credit to the great Irish songwriter Percy French for his comic ditty (tune here) which originally concerned the (once more horribly pertinent!) conflict between the Tsar and the Ottomans – one familiar to all true rugby fans in a decidedly more ribald version. When this was first published in the last days of 2007, it was offered as piece of seasonal levity regarding the dire state of financial markets which were already giving undeniable indications that the drama through which we were all living was headed to a very operatic denouement indeed.

ECB Excesses

With last week’s report of monetary developments in the Eurozone, we again have evidence both of Draghi’s monetary monomania and of the sheer futility of his constant refrain that the ECB is just buying time until member states undertake the ever-promised, but never-delivered ‘structural reforms’ which they all so patently require.