As is by now widely reported, China stocks have been on something of a tear in the past few weeks, with the CSI300, for example, up by around 20% in that time. The usual suspects have been at work as the PBOC has encouraged a renewed money flood into being and those desperate for an income – and possibly with little else to do, at present – are enticed back into what is merely the latest in the nation’s rolling series of mania and speculative booms.

For example, the CSDC reports that 6.4 million new stock accounts were opened in the first five months of the year with the SCMP saying that the country’s two biggest brokerages, CITIC and Guotai Juhan, have recorded a further 30% addition to their roster of clients during June.

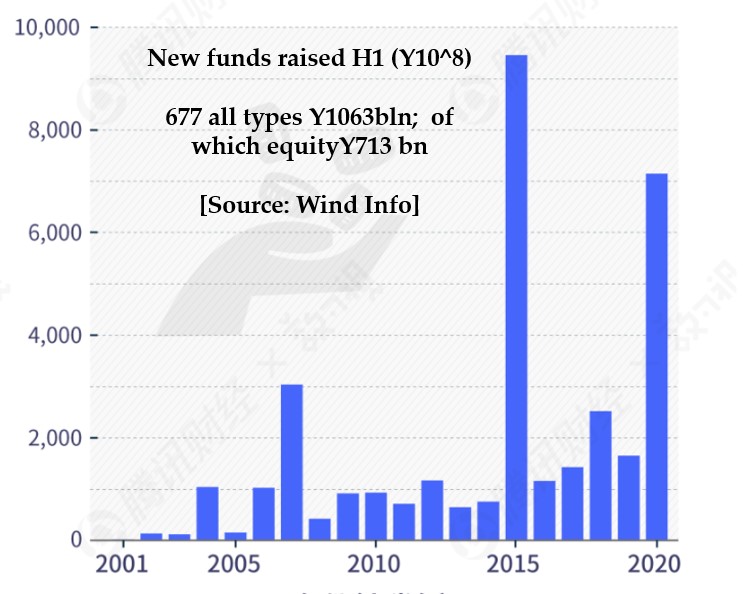

Moreover, 677 new investment finds accounting for CNY1.1 trillion in new assets were launched in the first half of the years, with Y713 billion of that impressive total being devoted to equity funds – an influx only beaten, according to Wind Info, during what we then called the ‘Mississippi Bubble 2.0’ of 2015 (memories are short in the Middle Kingdom, it seems).

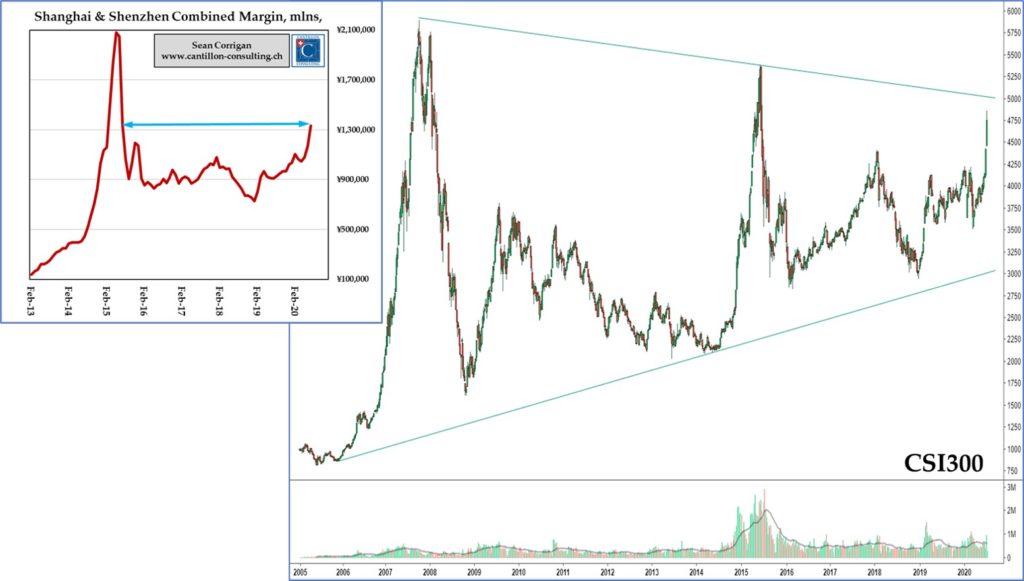

Official margin debt on the main two stock exchanges in Shanghai and Shenzhen has risen by almost a third since its cyclical low at the end of April, taking the tally through a Y1.3 trillion mark only previously exceeded during the peak months of madness, five years ago – with almost half of the extra leverage being added during last week’s all-time, like-perriod record addition. In another sign of the increasing frenzy, turnover has surpassed the Y1.5 trillion mark on each of its past six trading days, as stretch which includes a post-2015 highwater mark of Y1.73 trillion set on Thursday.

This being China, the official margin totals are only the tip of an exceedingly large iceberg of camouflaged borrowing, as evidence by the authorities’ announcement that same day that they had shut down no less than 258 illegal lenders – some said to be tempting punters with upwards of 10:1 leverage – and that they were insisting banks and insurers do not enable a resurgence of shadow lending aimed at fuelling speculation either in stocks or housing.

Even away from the less reputable fringes of the business, the many avid subscribers to the launch of so-called ‘explosive’ funds – those carrying the names of ‘star’ managers and so meeting mutli-billion AUM targets literally within hours of opening – are said to be able routinely to obtain 4:1 leverage as a means to maximise exposure. The same press articles have some of the firms involved also making allocations contingent upon willingness to invest in other company offerings, so further stoking the fever.

Obviously, the backstreet lenders, boiler rooms, and bucket-shops must occupy a lucrative niche when you reckon that almost the entirety of the nation’s 160 million trading accounts are held by retail ‘investors’; more than three quarters of whom are workers who earn less than Y5,000 yuan a month, according to a poll conducted last year by the Securities Times newspaper.

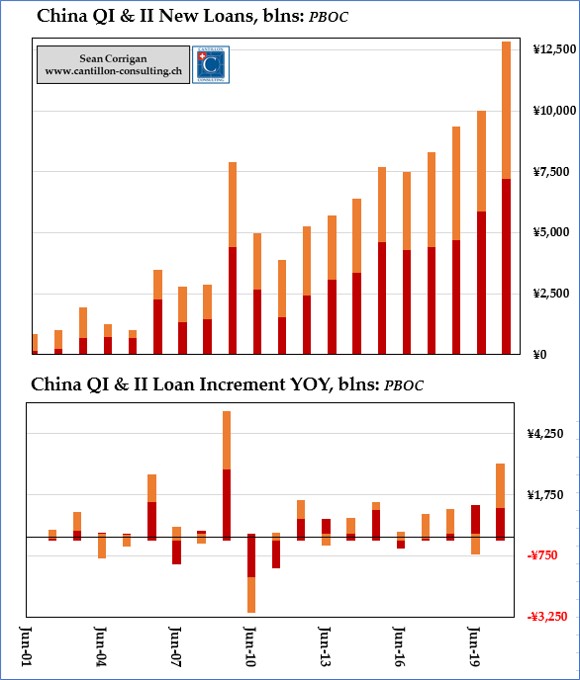

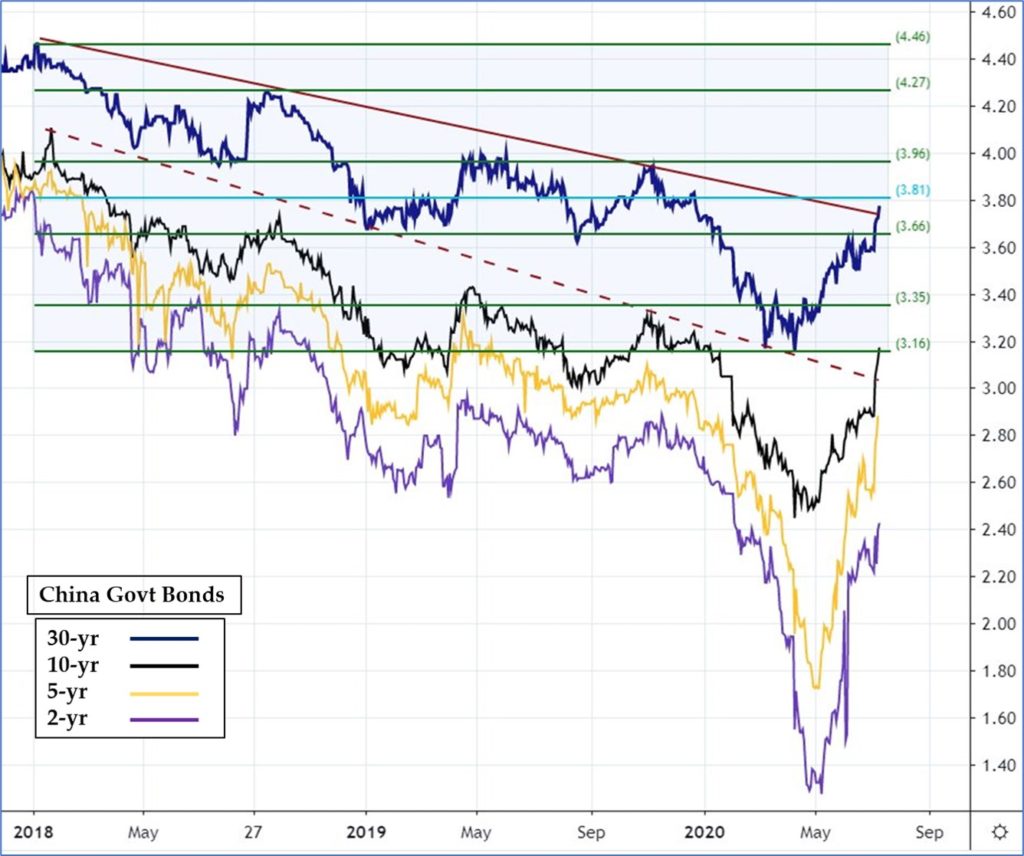

Even though there would seem to be more than enough money to go around, given that the latest central bank figures show a ~40% gain in the past quarter’s increment of new bank loans (taking the first half total to a second-ever high of Y12.1 trillion (a run-rate which only just falls short of $10 billion a day), as the money has flooded into equities, previously sought-after bonds have fallen heavily into disfavour, with government bond yields backing up anything between 60-115bps at the long and short ends of the curve, respectively. SHIBOR, too, has recently been showing signs of strain.

As that switch implies, Wealth Managers have themselves become the MOMO traders du jour: “Our company’s mixed products can have 60% allocations to stock, but now we’re at 70-80%. This is a normal phenomenon [sic],” one was quoted as saying.

This latest burst has also spared CNY the ignominy of setting a once-threatened, new 12-year high above 7.18, instead pushing it briefly back through the talismanic 7.00 parity. As a side-effect, the HKMA – lately the target of short-sellers sniffing gains amid the recent political upheavals in the SAR – has had to intervene to stop the local dollar strengthening too much. While some of this move could be attributed to locals repatriating funds. the better to get in on the action – or, alternatively, to escape imminent US financial sanctions – Johnny Foreigner has also undeniablybeen sucked into the move.

Specifically, overseas buyers have ploughed a cool Y1.2 trillion into the Mainland via HKEX’s Stock Connect programmes so far in 2020, their enthusiasm in some cases being enough hit foreign ownership caps among the mainly consumer, biopharmaceutical, and home appliance stocks most keenly exciting their appetite. Despite a rare net outflow to close last week, July’s total is already up by more than Y70 billion – putting it into third place on the all-time list, with two-thirds of the month still to come.

As has been the case in past manias, the brokerage stocks themselves have been well to the forefront, with the larger bookies attracting some of the biggest margin flows in what can only be described as an act of meta-speculation; a game of helping the people enabling the market rise to get even richer by borrowing money from them (for a fee) and paying them commission to boost their own share prices – a kind of buy-shares-in-those-selling-shovels-in-the-Klondike strategy on acid.

No boom would ever be complete without an IPO frenzy. Despite a heavy calendar – the new GEM Third Board has no less than 249 companies currently straining at the leash for the off – an outfit called National Quantum rocketed briefly to a 10-fold gain on its first day of listing, beating the previous week’s then-top performer, Tinavi Med-Tech – a poor relation on Tuesday with a gain of just 614% – and leaving Geovis Technology Co’s 438% Wednesday debut eating dust. One has to go back to 2002 to find a larger opening-day gain – and to 2001 for the only other such instance in the annals. Even convertible bonds have caught the party spirit, with gains of 20-70% (sic) seen in a number of issues on Monday!

Kanghau Biotech, meanwhile – a maker of rabies and meningitis vaccines – has gone limit-up for 18 days in succession since the stock’s June 16th opening, with Monday’s jump breaking all previous single-day increases in market cap for a new listing.

‘Leaving money on the table’, anyone?

Granted, the week just ended did close with a shadow the size of a man’s hand, in the form of the prominence given to declarations by two of the ‘National Team’ – the Chinese People’s Insurance (social security fund) and the rather clumsily named National Integrated Circuit Industry investment Fund – that they would be divesting a modest percentage of their holdings. Despite protestations that these were ‘standard asset allocation decisions’ concerning only a select handful of major firms – some of which had made outsized gains of late – many commentators read this a ‘signal’ that the authorities – only last week accused of deliberately fostering mass involvement in the rise – now wanted to brake the ascent.

Well, maybe. Though we can see that, with the SSE50 having come within a whisker of its 2015 mania highs, a little judicious re-positioning would hardly seem to be unwarranted.

Similar forces are at work elsewhere. For example, though commercial real estate is understandably in the doldrums, with vacancy rates climbing smartly and rents correspondingly trending lower, residential real estate is again being characterized by the emergence of hotspots, most notably in Shenzhen where the 10,000 existing homes sold in June to the YTD total to 44,000 close to the last peak, another which was registered at the climax of 2015’s bubble. Nor is such enthusiasm entirely localised: in general, the China Index Institute reveals, average land prices have risen an impressive 16.5% yoy.

Meanwhile, it’s not just gold and silver which are trading strongly among the other tangibles: industrial commodities are also garnering their share of China’s hot money. Copper is trading at 19-month highs; coke is at its best in fourteen months, iron ore in eleven. Glass and aluminium are as expensive as they have been for over ten months, lead for six, and zinc for five. Pig prices have risen by a fifth inside of a month (and are up over 80% in the past twelve). Rapeseed and other vegetable oils are stirring and, in the tradition of recent years’ excitement in outwardly mundane comestibles such as garlic and apples, the press is now marvelling at the new -er– scramble developing in egg futures, of all things.

I seem to remember there is a word for a phenomenon such as this, don’t you?

Sentimentals v Fundamentals

Meanwhile, Premier Li Keqiang wants to allow people to set up old-style market stalls in the gleaming streets of the metropolis as a way to make a living, while simultaneously pleading on a recent morale-boosting tour of the hinterland for new rural factories to be set up to help the 70-odd million ex-migrant workers some – albeit controversially – estimate to be left without work there. When he asked the crowd, assembled to provide him with a suitable backdrop for his photo-op, what still remained ‘difficult’ in a situation he described rather hopefully as having improved, he must have been just a little taken aback to hear bold cries of, “employment!”, reverberating back at him.

With ominous echoes of Mao’s ’60s, the CCP is now telling graduates to ‘go back to the country’ to begin their careers since prospects in town are so unpropitious. Much mirth is also being had at the new ‘job’ categories being listed by colleges as part of their required catalogue of success at preparing the vanguards of Tomorrow for recruitment. Among others, e-commerce ‘influencers’ and semi-pro ‘gamers’, as well as dedicated day-traders, were found to be included among the novel outlets for the energies of the fresh-faced and expensively educated cadres of prospective future wealth-creators.

Then there’s banking. Paradoxically, while the favoured few Big Fish among the breed have been told to surrender up to Y1.5 trillion of their preferentially-earned gains, principally by subsidising their loans to SMEs, ‘evergreening’ their debts, and cutting their fees (a sum reckoned by GS and others to equate to around 75% of total financial sector profit and to 25% of combined revenues), the smaller fry, regional banks are in such parlous condition that they are having to rely on chronically overindebted local governments – inveterate scroungers who have themselves been allowed to issue 23% more bonds this year – earmarking Y380 billion in ‘capital’ injections out of the Y3.5 trillion total these profligates have so far raised.

This infusion, it is hoped, will help local banks avoid further, confidence-sapping depositor runs and thus enable them to continue to prop up those same SME minnows who are the cause for such widespread concern – a concern hardly overstated since as many as a third of them were lately categorised in yet another industry survey as already being ‘in distress’.

Elsewhere, the business of external trade is in such dire straits that it prompted Zhang Kuo, GM of Alibaba International (who might just be talking his book, of course), to warn that 90% of traditional export companies could fold in the coming months.

All this has prompted Beijing to urge the sector’s constituent firms to concentrate on making a shift to domestic markets. A daunting prospect, given that local cynics say that much of the nation’s all-important foreign trade industry is largely viable only because foreigners tend to pay up front and – even more importantly – because of the sizeable, associated tax rebates (often heavily gamed, of course) involved in shipping goods abroad.

Needless to say, no such scope for regulatory arbitrage or quick settlement of outstanding bills exists in the home market.

Furthermore, while we’d be among the first to agree that supply does create its own demand, more often than not, one must pause here to wonder how likely to succeed this will prove given that the ripples have still not subsided from Li’s recent disclosure that 600 million of his fellow citizens live on less than Y1,000 pcm – even when they DO still have jobs to go to.

As for domestic sales, try this rather gloomy survey of consumer intentions, conducted among 5,000 random households by Southwestern University of Finance and Economics. This poll found – not entirely surprisingly – that well over half the respondents were planning to reduce their regular outlays, not least because one-fifth fewer of them were in employment in rural areas and one-tenth fewer in the urban ones.

Even this litany of tribulation does not take into account the tangible effects of aggravated relations with the US; the loss of HK’s ‘special status’ (presumably crucial for much of the SAR’s vast re-exports); or the armed imbroglio with India. Then there’s the flooding, the pests and diseases already pushing up food prices and hence weighing on disposable incomes.

None of these are conditions exactly conducive to the development of a genuine bull market, one might feel.

But, hey! If money is easy: if Zhongnanhai yet again wants to launch a bubble to distract attention from its woes and so give its favoured clients a bit of breathing space at the expense of Auntie’s retirement fund; if dumb gweilos will be benchmarked in, willy-nilly, because their self-imposed rules tell them they must be – who’s to say it won’t run and run?

We shall see. There will be those who are more conscious of the evident vulnerabilities listed here – both in terms of arguably over-wrought market conditions and of the sorry macroeconomic backdrop. Such sceptics did have a small, week-ending reversal against which to sell and position their stops. But, except if they sold only the largest stocks (e.g., those in the laggard SSE50), Monday would have brought them a first dose of disappointment.

Volumes then were again heavy (over 1.6 trillion shares traded), foreigners/repatriators were active (almost CNY7 billion came ‘northward’ from HK), 239 stocks hit record highs, while the Nasdaq-equivalent GEM/ChiNext index jumped 4% to reach an altitude not attained since January 2016.

Over the next few sessions, the bears’ success or otherwise in any attempt they make to dampen the euphoria will surely tell us whether gravity is about to exert its awful influence or whether there’s yet some fuel left in the rocket burners.

The science of ballistics – as well as the history of Chinese asset manias – should always keep us mindful of the fact that what goes up does eventually come down but, as ever in trading, the key question is: exactly when and from where – and only a close observation of the market action itself can hope to tell us that…

[stock charts courtesy of investing.com & tradingviews.com]