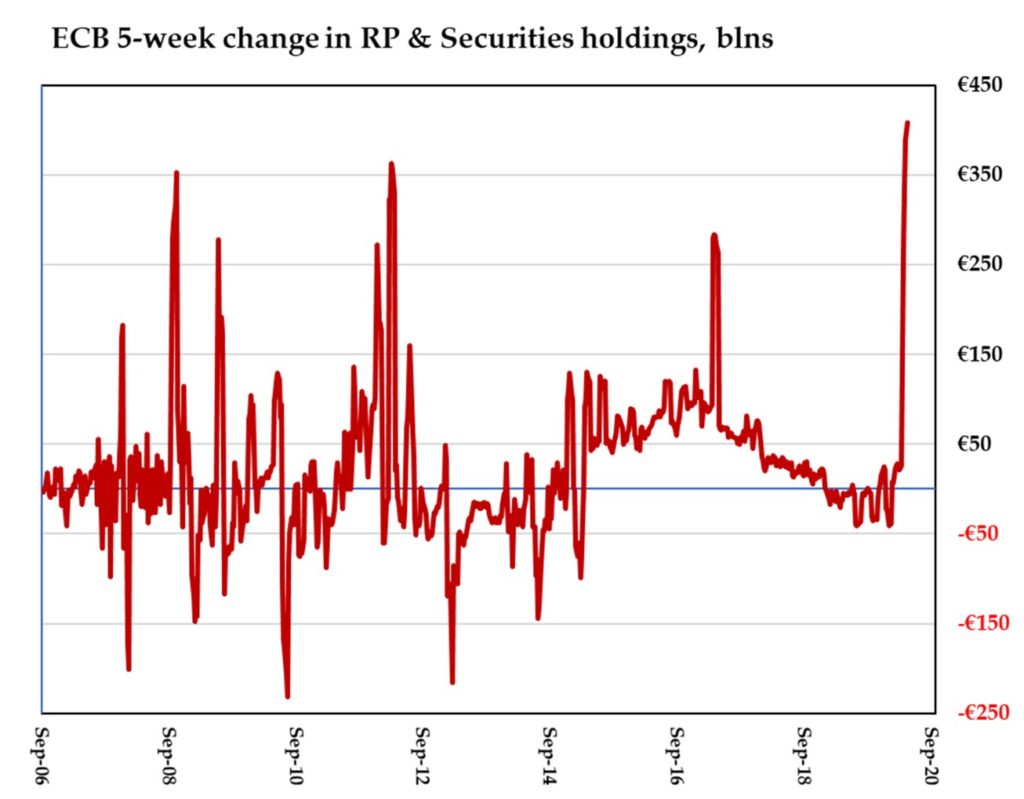

On March 15th, the Eurozone branch of the Throw-more-money-at-it lobby were making themselves heard, calling for the ECB to run the printing presses for a limited (author pulls down lower eyelid with index finger) period as a supplement to the to the €120 billion in extra security purchases already made to that point. [NB total ‘assistance’ to April 17th had reached to €275bln in RP, €148bln in securities, and €126bln in FX swaps for a total of €550bln in five short weeks].We responded:-

Calls for ever more money to be injected into asset markets surely miss the point. Yes, some (mostly speculative) credit has been extinguished – *POOF* – and hence security prices have reverted to a level closer to what would be paid by those investing actual saved funds – i.e., capital. Is that a BAD thing so long as we avoid it degenerating into too much of a fear-driven overshoot?

Despite those losses, however, most of that underlying financial capital still exists (albeit with the notional gains of the past several months -arguably a largely ‘fictional’ overlay- extinguished).

What is understandably lacking is the will, the confidence, to employ it. Hence the rush to buy ‘safe’ government securities as a default option; a scramble which has led to further distortions in pricing and has encouraged a further, damaging quasi-nationalisation of capital.

So, if there is a case for government intervention here, it should be to act as a bridge between that vast pool of capital and the otherwise sound businesses put in jeopardy by the coronavirus counter-measures.

Ergo, the state should either offer a ‘credit-wrapper’ -a partial guarantee- for private sector ‘survival’ loans or -perhaps more practicable, if clearly more open to abuse and misplaced effort- to issue hypothecated, time-limited (sinking fund?) bonds to wary savers with which to perform that ‘bridging’ function. This would obviate much or all of the need for open-ended deficit spending, make further corrosive central bank expansion largely redundant and so lessen the burden of all its attendant evils and perverse incentives.

The aim should be to keep Ray’s Drywall Service from bankruptcy, not to make up for Ray Dalio’s losses. It should be to mobilise existing capital, not further dilute it. For the state to provide nightwatchman support, not opportunistically launch a billion barrels of pork. 7

As for lowering interest rates per se, a key point which few seem to appreciate is that when a good becomes more scarce (due to either or both of a rise in demand and a fall in supply) it is not only natural but positively beneficial that its price rises, to signal to others that they should economise, try to create more, seek to use it only for the most urgent purposes.

NOT ONLY DOES THIS BASIC AXIOM APPLY ALSO TO CAPITAL, BUT IT COULD BE SAID TO APPLY A FORTIORI!

So, keep monetary channels unclogged? Fine! But do NOT force rates lower or encourage exhaustive spending. Do NOT add to the confusion by pumping unbacked credit into the mix.