Ahead of my remote appearance on CNBC @SquawkBoxEurope on April 3rd, I prepared a few notes for the guys which I am happy to share here with you. The main topic, ahead of the emergency OPEC meeting which briefly bolstered crude prices that week was, unsurprisingly, oil but we did also discuss the outlook for the wider economy.[An audio version of our conversation can be had here: CNBC Podcast ]

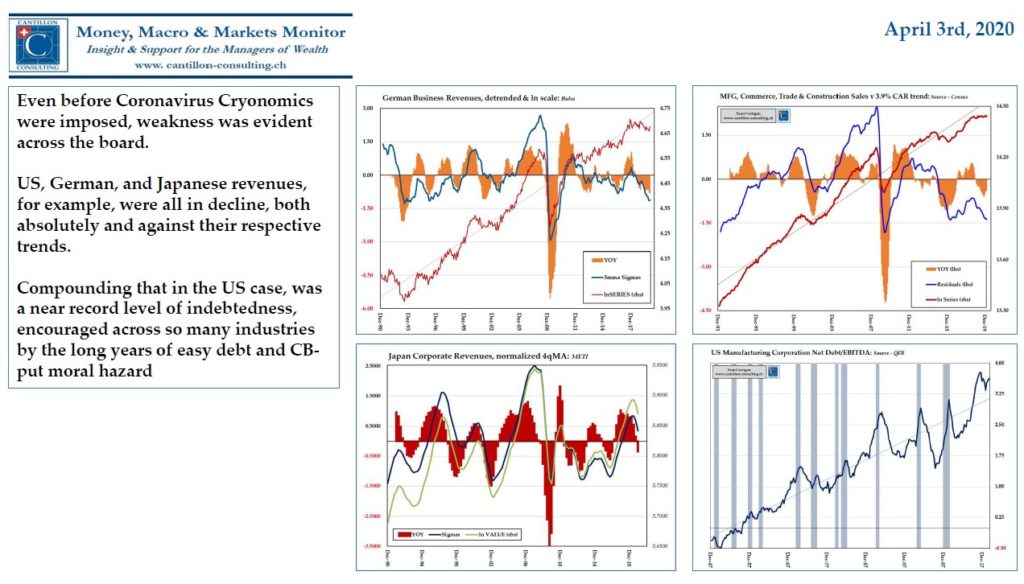

Even before coronavirus struck, there were signs that the bloom was off the rose:-

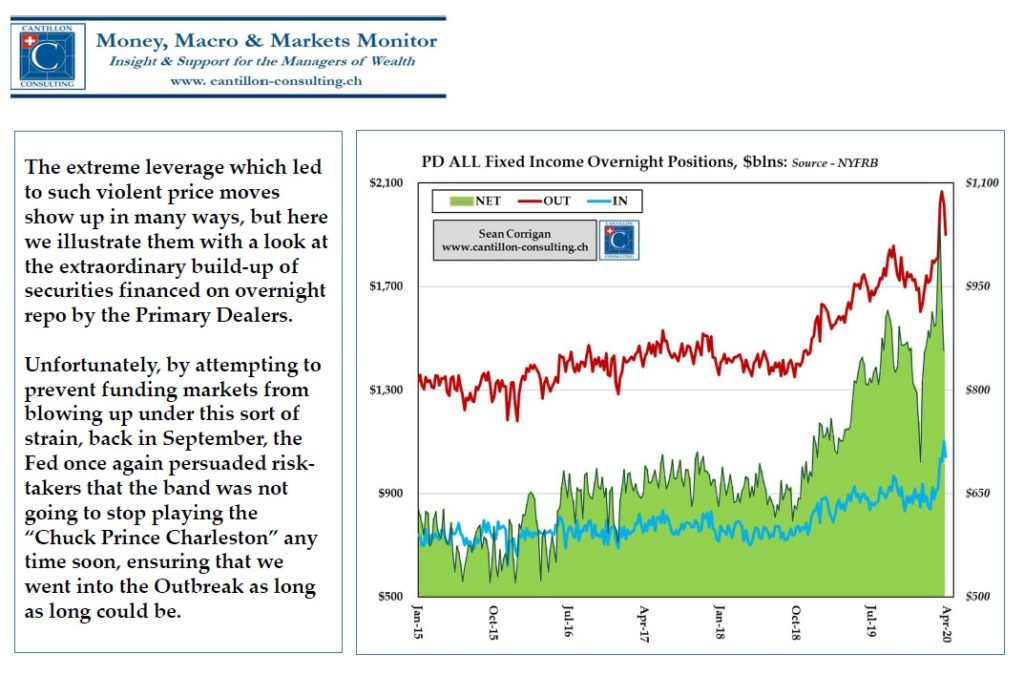

Exposures were high going in and – in some cases – have only gone up amid the turmoil:-

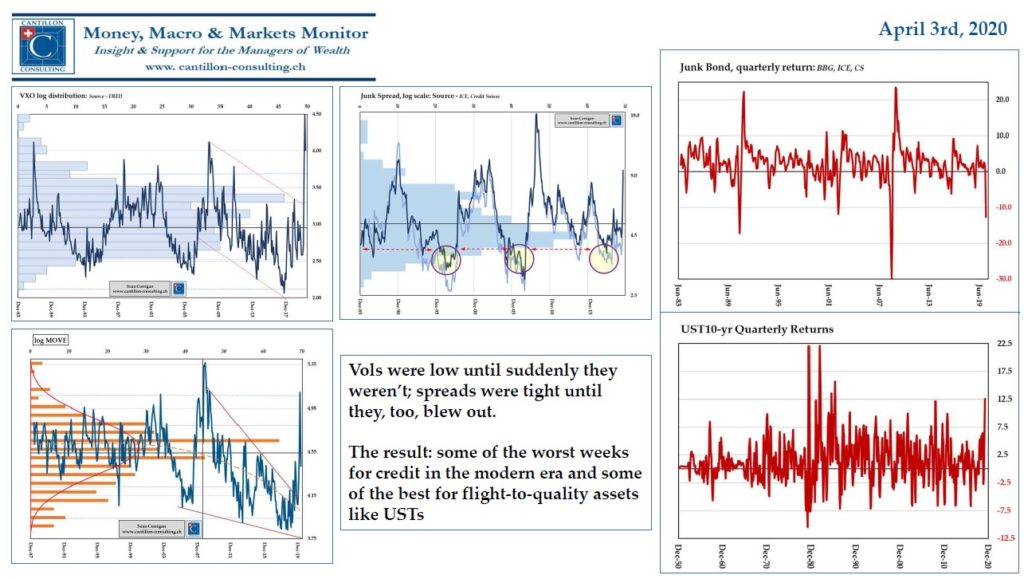

Central banks have encouraged us to dance, in hobnailed boots, carrying a knapsack full of rocks through an ever denser and more extensive minefield. Last month our luck ran out:-

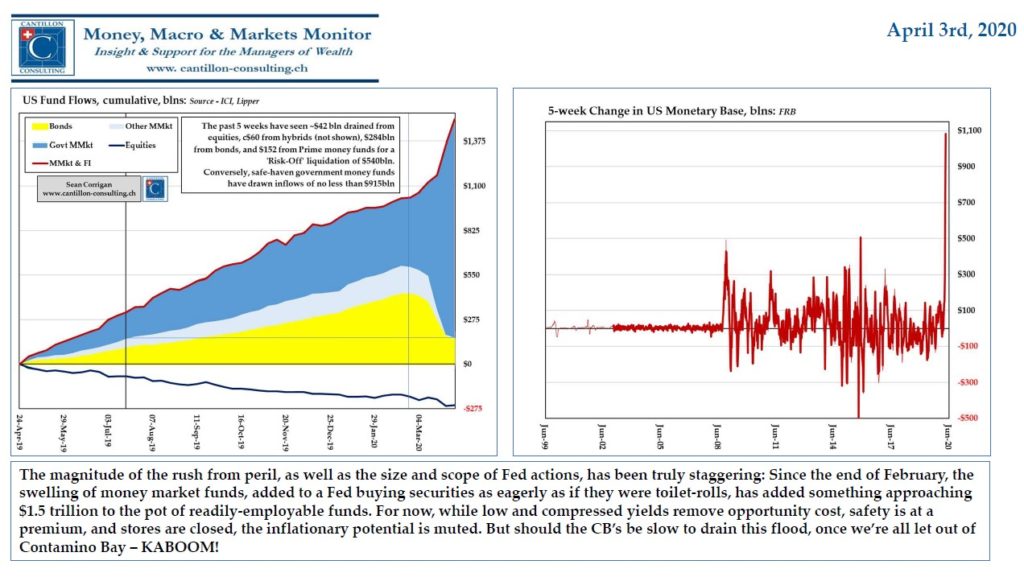

So, the guys who mugged us around the last street corner are now offering to help us find our stolen wallets. As ever, the answer to every problem nail is a bigger monetary hammer:-

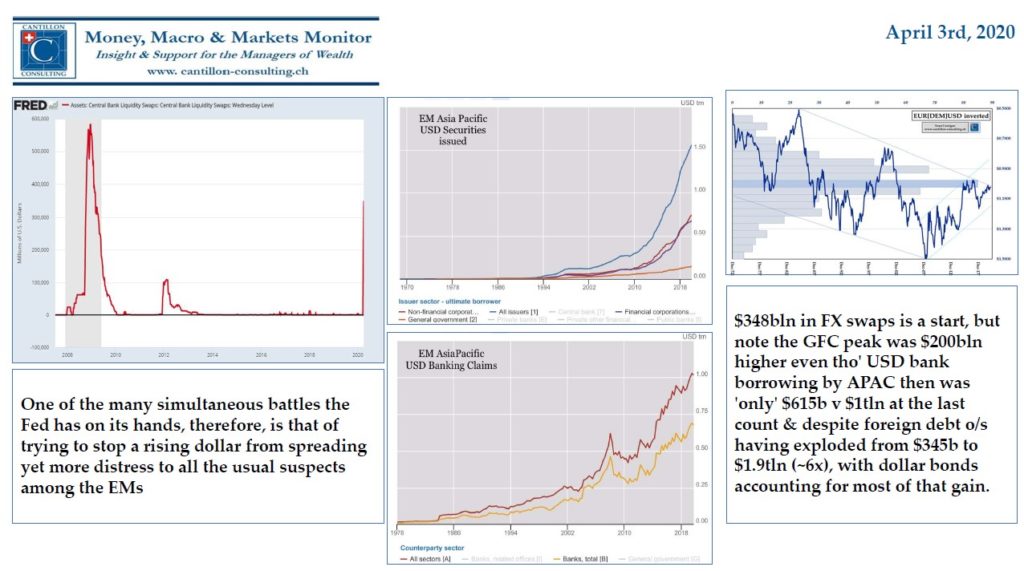

“The dollar is our currency, but it’s your problem”

The Fed may have a good deal more printing to do on that account:-

So, is the equity bottom in? Perhaps. Since the panic liquidation ended at a near perfect chart-point – the 2016 lows, start of the Trump Reflation Rally.

But a lot of bad news will have to be digested: enough, maybe to have rallies sold, not BTFD.

Similarly, as discussed with @steve_sedgwick, those shorting crude oil down here have just had a little wake-up call, but fundamentals ARE bad and bankruptcy IS coming.

Could #WTI repeat the scale of the last two dumps?

[Spoiler: Yes, it did!]