In trying to describe the mania which is sweeping China, the mere use of superlatives falls far short of conveying a true picture of what is afoot, meaning we have to just let the numbers speak for themselves.

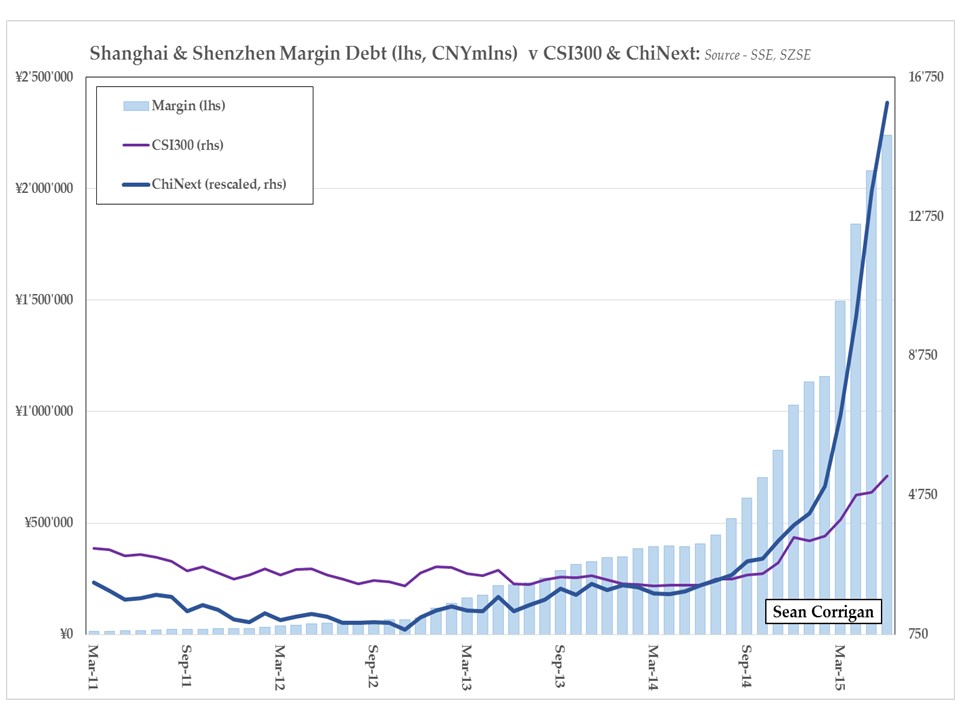

Firstly, leverage. Margin debt has doubled since February and quadrupled since last August, adding CNY1,082 billion in that time, equivalent to $175bln or around $50bln a month. The latest total is CNY2,240bln or $360bln (=3.5% of Market Cap). For comparison, margin debt on the NYSE took 3 1/2 years of bull market to double to today’s $507bln (only 1.9% Market Cap).

This means that in the three months to end-May, Chinese margin debt accounted for 35% of all new loans, and equated to 35% of all RE investment undertaken and to 13% of nationwide retail sales. Since last August, the increase has exceed the total addition to the stock of M21 money and these numbers—impressive as they are—take no account of fund leverage or off-exchange transactions, remember.

In terms of turnover, things are just as extraordinary. April and May combined saw $10 trillion’s worth of shares traded (versus $4.5tln in New York), meaning that for every $7 which changed hands in the rest of the world combined, $8 were bought and sold in China. Over the past two months, China’s turnover has been a whopping 5.5x GDP; compare that to America’s lowly 1.5x.

Madness

FOR MUCH MORE PLEASE VISIT ‘MIDWEEK MACRO MUSINGS’ AT HINDESIGHT LETTERS

NB The foregoing is for educative and entertainment purposes only. Nothing herein should be construed as constituting investment advice. All rights reserved. ©True Sinews