In our previous ‘Money, Markets & Macro’ monthly publication, we devoted some time to a consideration of the fact that the growth in US payroll costs was beginning to outstrip that of business revenues, a state of affairs which we suggested could not long be endured.

Either businesses had to increase sales volumes and/or hike prices or, assuming this to be difficult in today’s selectively oversupplied world, wage growth must be retarded or headcount reduced. Three out of those four possibilities would, needless to say, represent an undeniable deterioration of conditions, casting doubt on the continuation of the economy’s heretofore steady, if unspectacular, climb away from 2009’s slough of despond.

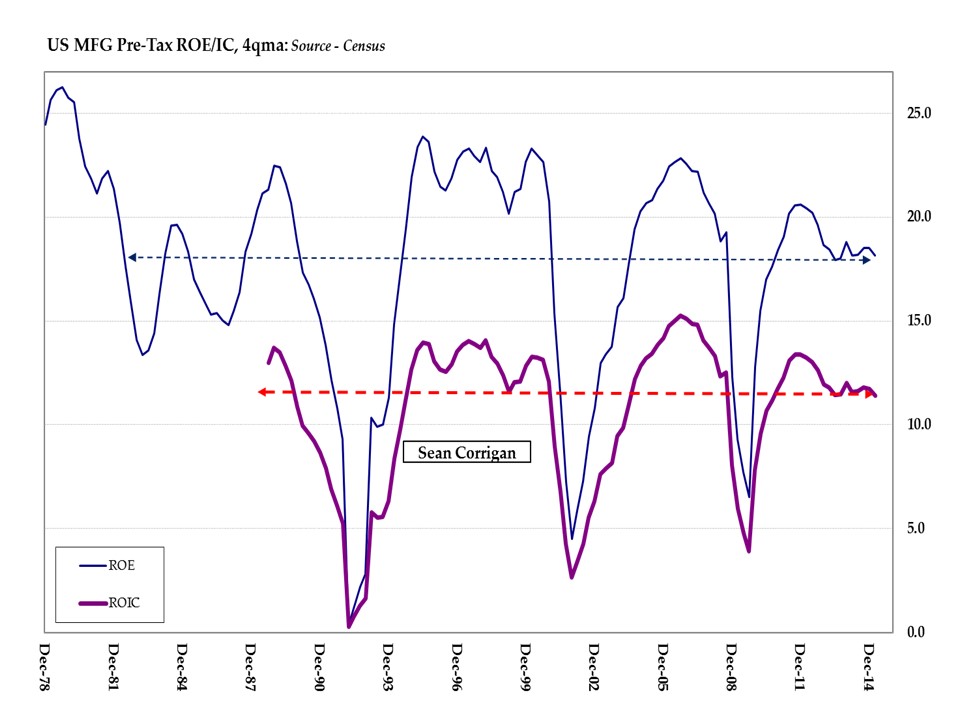

The fact is that, last quarter, the effects of this squeeze showed up in strong relief in the bottom line of the nation’s manufacturers. Profits fell to the lowest in over two years, touching a level first reached (in nominal dollars, to boot) all the way back in 2006 when the S&P500 was some 40% lower at 1250. ROE and ROIC both plumbed their lowest levels since the GFC as a result leaving these measures, indeed, just on the cusp of the levels from which we have spiraled down sharply into four out of the last five recessions.

Sales had better pick up soon, or else!

FOR MUCH MORE PLEASE VISIT ‘MIDWEEK MACRO MUSINGS’ AT HINDESIGHT LETTERS

NB The foregoing is for educative and entertainment purposes only. Nothing herein should be construed as constituting investment advice. All rights reserved. ©True Sinews