Here we present one of a series of brief runs-though of the salient events of the past week or so. A more detailed treatment of these and other issues is intended to be released on a monthly schedule, starting in early May. Today, the focus is on the US.

The new quarter was ushered in with the signs that the long, cold winter of economic ‘surprises’ had finally reached a culmination in the soft ISM survey responses and the mildly disappointing jobs numbers. As it did so, the market’s intellectual promiscuity was clearly displayed in the fact that, if anything, more importance was attached to the latter – a supposedly ‘lagging’ indicator’ – than the former – by contrast, a ‘leading’ one.

The reason is not hard to find, of course, namely that it is the Herd’s not wholly unjustified prejudice that Madame Yellen will not dare to inch the Funds rate back up unless would-be employers, having exhausted all conventional means of filling their work rosters, are having to resort to either press-gangs or sizeable golden hellos in their desperation to secure the services of anyone with a room temperature IQ and the shallowest of pulses.

Truth to tell, the ISM did offer a little comfort to those who had been suffering through the Long Bond’s worst, 2.6 sigma, 65bps, five week sell-off in 3 1/2 years (in fact, its equal worst since the bounce out of the Pit of the GFC). Crucially, the purchasing managers’ gloom on new orders meant that this key sub-index has endured a four-month slide equal to the worst of anything seen since Lehman closed its doors, deep enough to reach a (crisis-excised) 1.5 sigmas deviation from the norms of the past three decades.

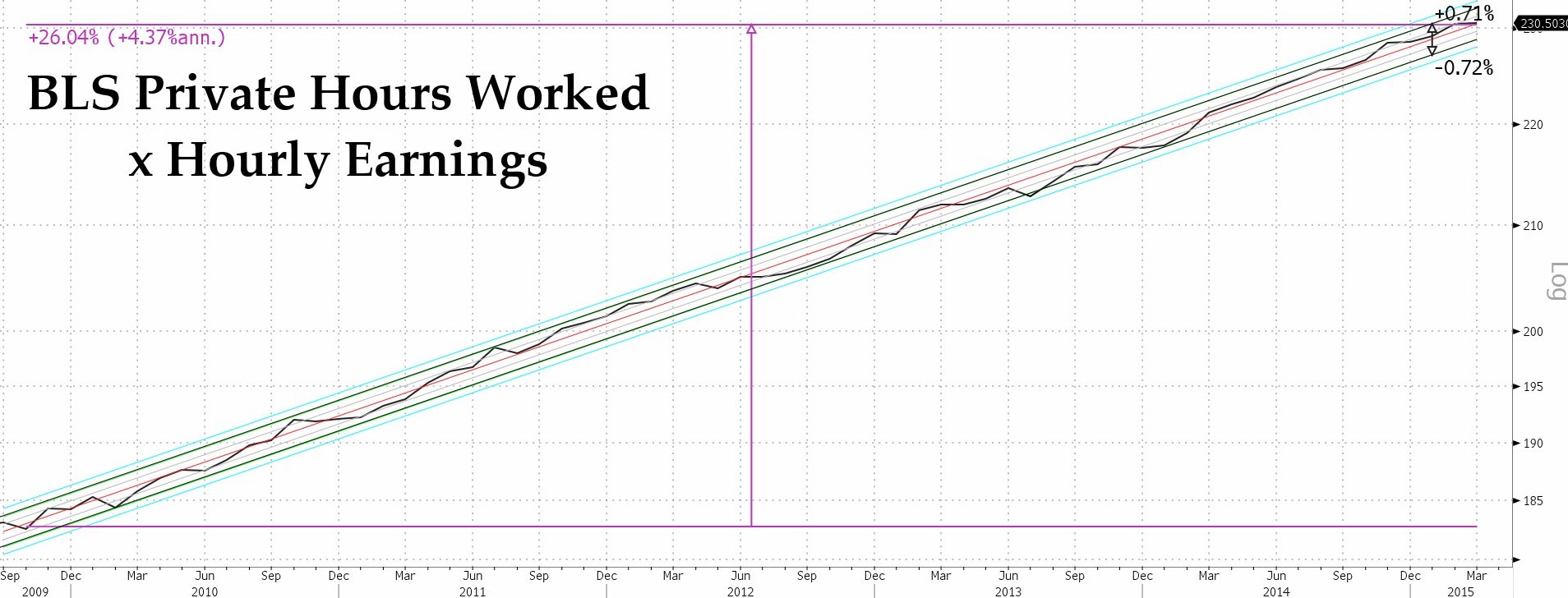

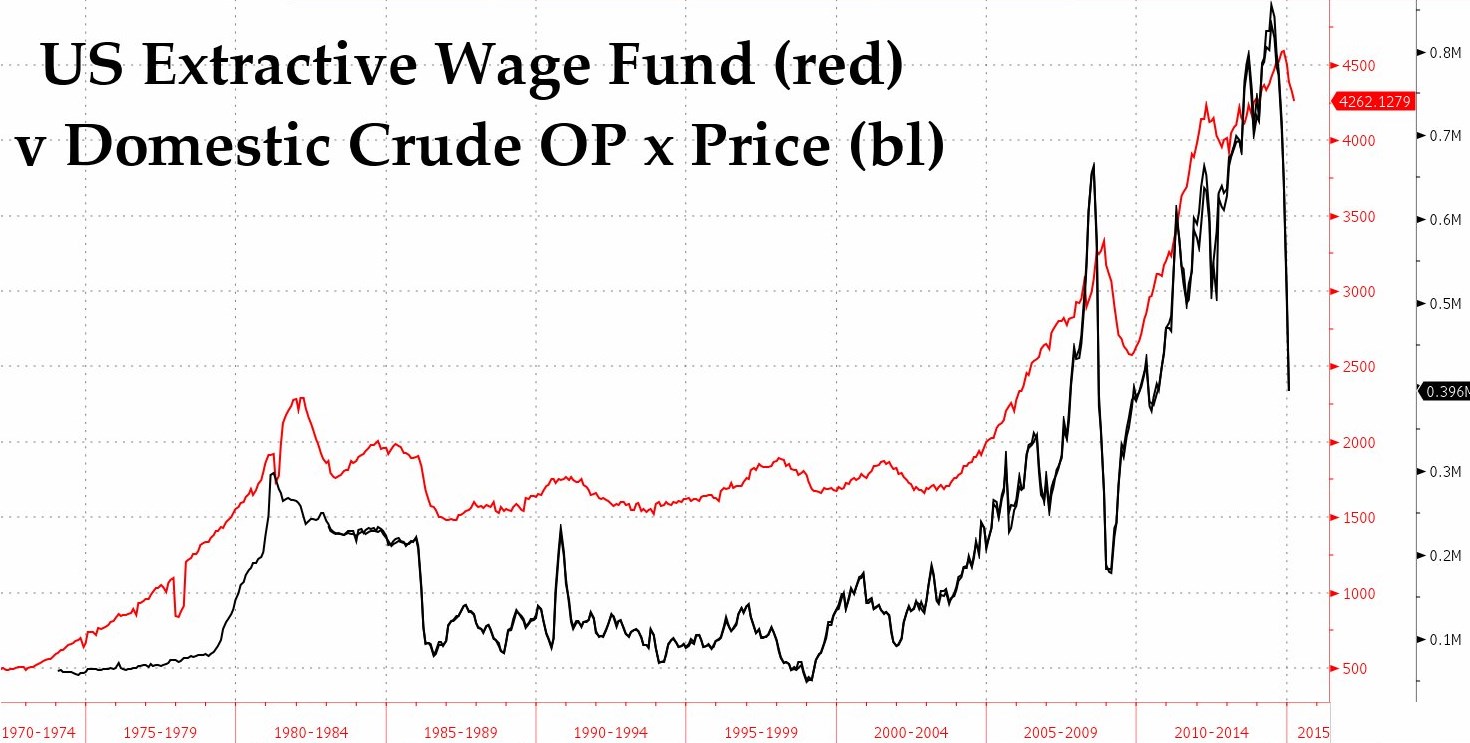

Yes, too, the private NF payroll gain of 129k was the least in 15 months, the second lowest in 33, but the increment of full-time workers was about par for the past 5 1/2 year stretch nor did the overall wage fund (hours worked x pay rates) deviate much from its tight 0.35% sigma, 4.4% CAR trend, so even the bad news from this horribly volatile and substantially revisable series was distinctly second order, with such weakness as there was most evident in a stagnation of manufacturing pay and employment and in a highly understandable, oil-led plunge in the extractive industry sector. Such symptoms of a slackening of pace also played out in the track of revenues and of sales:inventory ratios in across the various sectors. Given that this constellation might just signal and Austrian-style, top-down recessionary development, this clearly bears watching but lights should only be flashing yellow until further confirmation is received.

Bear in mind here, however, that in recent times the country has suffered not just the reverse energy shock (what we like to say is a nine-month transition from Peak Oil to Oil Pique), but several nasty labour disputes (most notably at the West Coast ports), and an abnormally disruptive and prolonged cold snap in the main North-eastern population centres. While the impact of the first may yet take a while to run its course, the latter two factors can no longer offer any excuse. The Fed, however, is all too likely to fall back on the perceived need to verify the disappearance of such one-offs in order to postpone – yet again – the day of reckoning.

To that degree, then, the market is perhaps right to relax a little but, with both initial and continuing jobless claims at their lowest outright levels since the peak of the Tech Bubble – and at their lowest as a proportion of the population since Neil Armstrong was shaking moondust off his boots – it might be wise not to extrapolate the drop in yields too far or to bet too heavily on a meaningful weakening of the USD just yet.

As for the dollar – the arbiter of all, it seems at present – though the mental rescheduling of Fed action did cause it to bleed some airspeed (as well as to give a fillip to gold and oil prices, among others), so far the damage has not been enough to trigger any major liquidation, inordinate numbers of longs notwithstanding.

Although the current pace of inventory additions Stateside is testimony to the continued oversupply of oil, sentiment appears to have taken a change for the better. Even the somewhat hazy prospect of increased Iranian exports and news that Saudi is pumping at a record rate has not been enough to blight the spring shoots of optimism which pushed through the soil when the EIA started hinting recently that the long-awaited US production declines might at last be upon us.

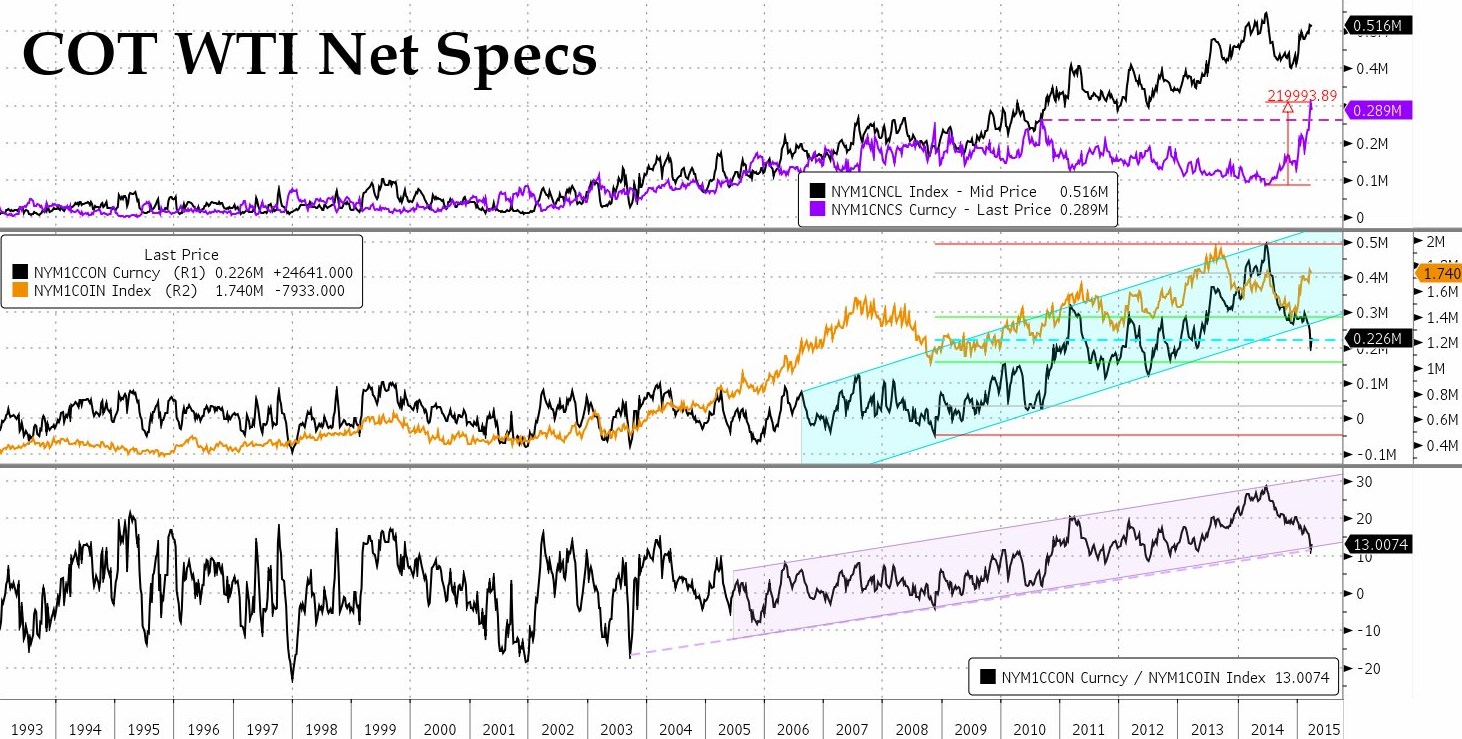

With spec shorts on Nymex having risen 2 1/2-fold from 10-year lows to record highs during crude’s plunge, this has been enough to make the market vulnerable on the upside. Even though spec longs have been accumulating to a point just 16k contracts and 6% shy of their own June record and even though the bulls still outnumber their bear counterparts by 80%, this has been enough to make rotations higher more violent than counter-rotations lower.

That said, both front and back ends of the curve remain range-bound, meaning that a slightly more medium term perspective should temper both euphoria and despair for now.

More widely, there is a two-way dynamic at work here: a stronger dollar makes US assets look better than their ROW counterparts while capital inflows to the US to chase the prospect of such superior returns also boost the USD. Thus, while we watch to see whether the Greenback can regain its élan and resume its upward march, it is also worth noting that, both domestically and internally, several key sectors of the US market are becoming historically rich.

That does not mean to say, of course, that they cannot become richer still, only that tolerance for disappointment at such lofty heights could well be limited and thus trading should be more conservative, or insurance should be purchased, or both.

NB The foregoing is for educative and entertainment purposes only. Nothing herein should be construed as constituting investment advice. All rights reserved. ©True Sinews