Between Li Keqiang, Mario Draghi, and the BLS, markets everywhere had a wild ride into the weekend.

Starting east and working west, the upshot of the Chinese ‘Twin Sessions’ was a perseverance with the so-called ‘New Normal’ theme – namely, with the idea that headline, GDP-style growth should be lower in future with the emphasis shifting from brute volume to the encouragement of a shift in the productive structure towards the provision of higher-value added, more technology-rich goods, towards service in place of smokestacks, aall the better to spread the benefits of industrialization to the domestic populace.

Formally, this saw Li declare that GDP this year should be ‘around 7%’ – a clear signal, after last year’s disappointments, that ambitions were being reined in yet tighter or, more precisely, that no-one should look for the panic button to be hit if a further deceleration from last year’s 20-year low in this measure were to eventuate in the months ahead.

In fact, the 21st Century Business Herald laid out several reasons why 7% might actually be an upper, not a lower bound. One of them, that the economy need average no more than around 6.6% if the avowed intent to double GDP over the course of the decade is to be realised, we might dismiss as mere Five Year Plan numerology. More importantly, the much more tangible aspiration to create a minimum of 10 million new urban jobs this year has actually allowed for the calculation that, since 2014’s 7.4% average gave rise to a record 13.2 million such openings, 2015 could in fact come in only a little over 6% dead and still do the trick.

Services, you see, are the magic ingredient. Each new hairdresser and commis chef can be squeezed into a lower increment of GDP than can a labourer on a building site, wielding his pick in the construction of one of the country’s many echoing ghost towns. Leeway – Li-way? – might therefore be said to exist.

What all this does not do much for, however, is China’s appetite for quite as many dirty great lumps of metal or slabs of coal during its attempt at mass reorientation. Add to this the fact that, despite the recent official rate ‘cut’, actual market rates have risen at the long end and stayed unchanged at seasonally elevated levels at the short end and you have a recipe for further weakness in resource prices.

It is also of note that the Securities Journal had Zhou Xiaochuan deliberately downgrading the PBoC’s traditional M2 target also in light of the manifold changes taking place both at the institutional and at the macro-economic level. ‘No other central bank targets it,’ he said. ‘ So we have to be flexible.’

All the old certainties are crumbling as we write, it seems.

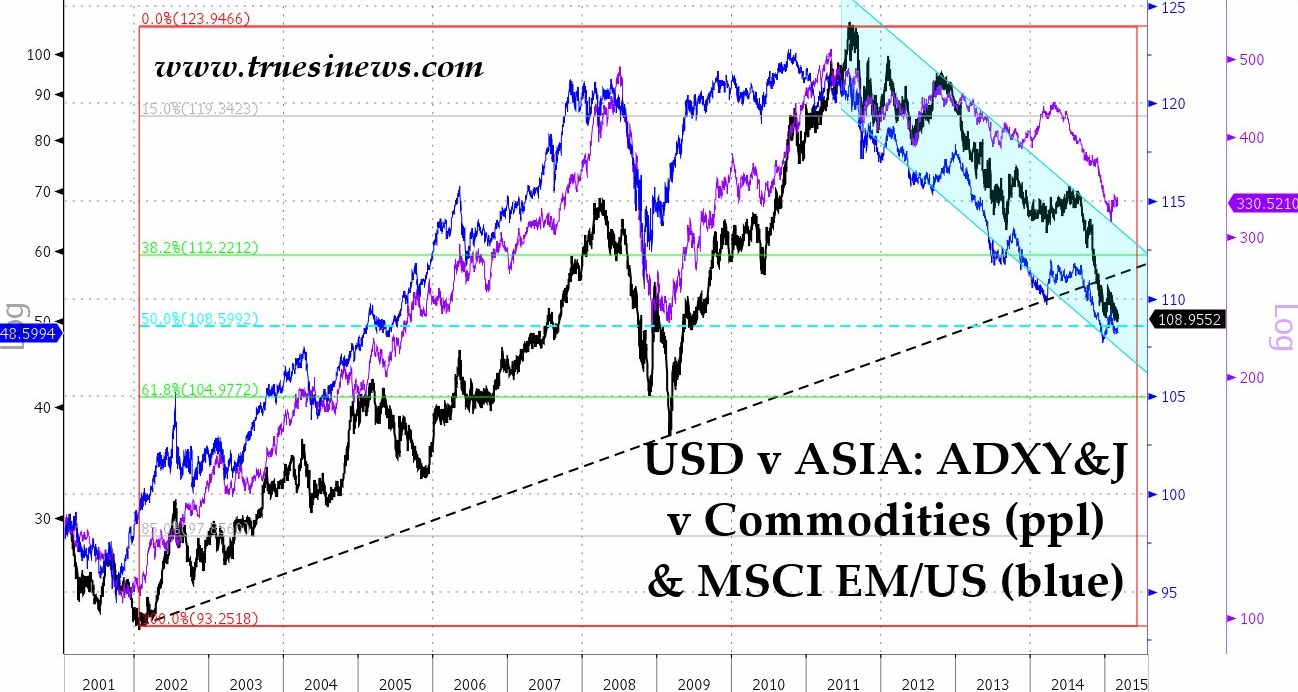

One certainty that remains, however, is the strong co-movement of the value of the dollar – particularly in terms of Asian currencies – with both commodities and the relative pricing of EM equities versus their US benchmarks. A glance at the plot of these latter with an inverted trace of our ADXY+J index (which comprises an adjustment to JPM’s widely-watched ADXY index so as to include an additional trade-weighted component for the yen) will show you what we mean.

All in all, this combination has meant that any sign of renewed heavy industrial vitality, now that the New Year celebrations are behind us, are proving somewhat elusive to come by. Take the case of steel and iron ore prices, for example.

This, however, being a world in which no-one really cares whether a given business is doing well, so long as they can borrow the funds with which to buy its counters on the stock market, you will not be surprised to learn that neither the Party hierarchy’s attempts at expectations management, nor the dire state of commodity markets has yet put a dampener on the kind of speculative fever which has propelled the ChiNext into the stratosphere in true NeuMarkt, Nasdaq-2000 style.

Moving around the globe to Europe, what can we say about the latest ECB-inspired ructions? We have already dealt at length with the fact that we strongly contend that ‘QEuro = 2 much, 2 late’ not to have to go into it at length again here.

Suffice to say that Mario finally got to pull the trigger – though not with out giving rise to a good deal of perplexed commentary about what exactly he would buy and when. But what was clear was that the Dr. Faustus of Frankfurt has not lost any of his magical touch. Even before he wrote a cheque – and despite the fact that we professionals are supposed to be masters at discounting such events well in advance (especially when they are as well-signalled as this one was) – the bond market put in a whole series of joyous backflips. Buy the rumour and then buy the fact all over again, is the new traders’ watchword, it seems.

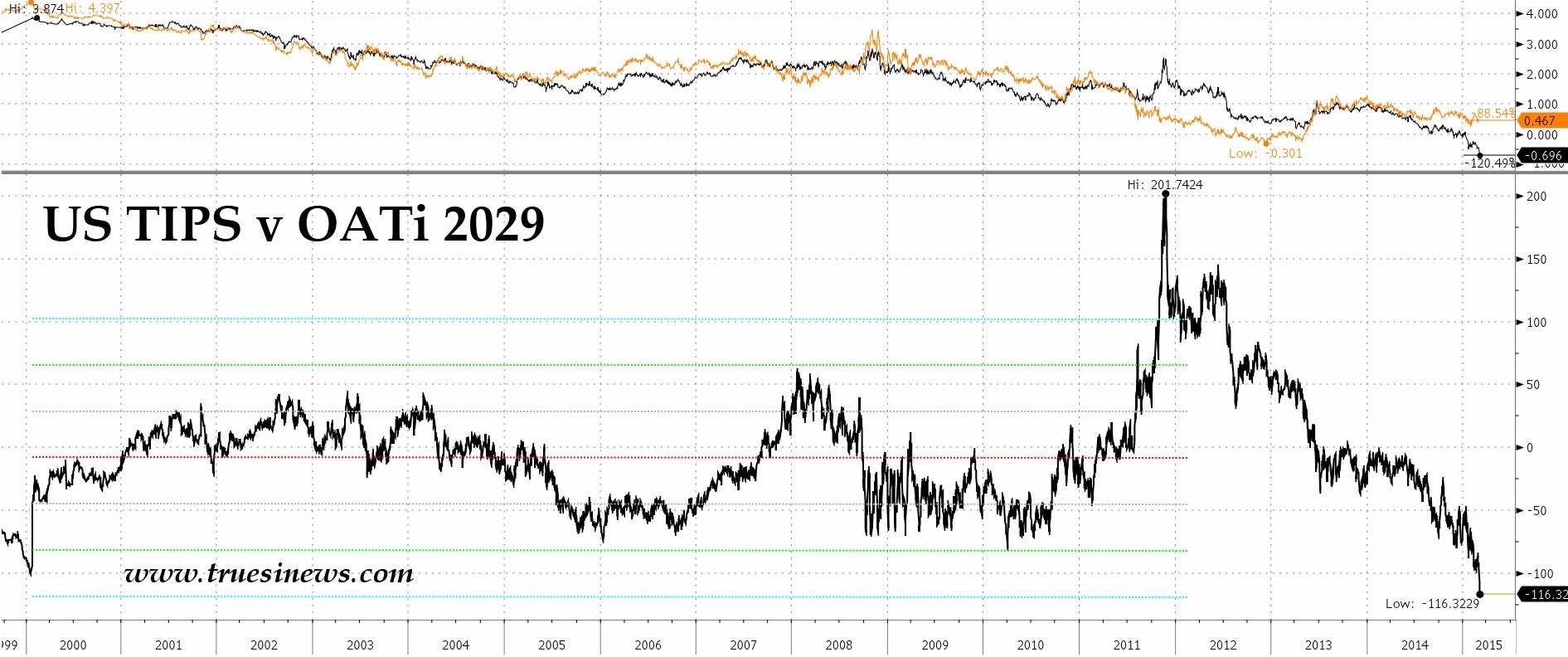

Yields on the Euro periphery converged further onto those for Germany, pushing them to record nominal lows along the way. More remarkable still, it seems a number of participants took Mario at his word in the matter of inflation targeting (I bet Haruhiko Kuroda is absolutely spitting blood at how easy it was for him) and so, in the attempt to price a break-even rate closer to his 2% desideratum than today’s near zero, they had to drive index-linked bonds even further up in price than the straights with which they were already filling their boots.

When you note that the Italian linkers maturing in 2026 climbed more than 6 big figures in the past week, on top of the 7 1/2 they have managed since the start of the year, for an overall capital gain of 11.5% (which works out to 535% annualized!), you can be forgiven for suffering an attack of the vapours. A YTD slump of 110bps to near zero outright – and to 30bps through Treasuries has been the upshot. Spain’s equivalent 1.8s of 2024 actually hit negative 18bps (UST-65bps) before events the other side of the Atlantic took a little shine off the rally into the close. Among less troubled credits, French real yields now lie 115bps below their US peers – just the 3+ sigmas below the norm whcih prevailed during the first decade of the millennium.

It would be hard to find anything which better shows how truly screwed up capital pricing has become.

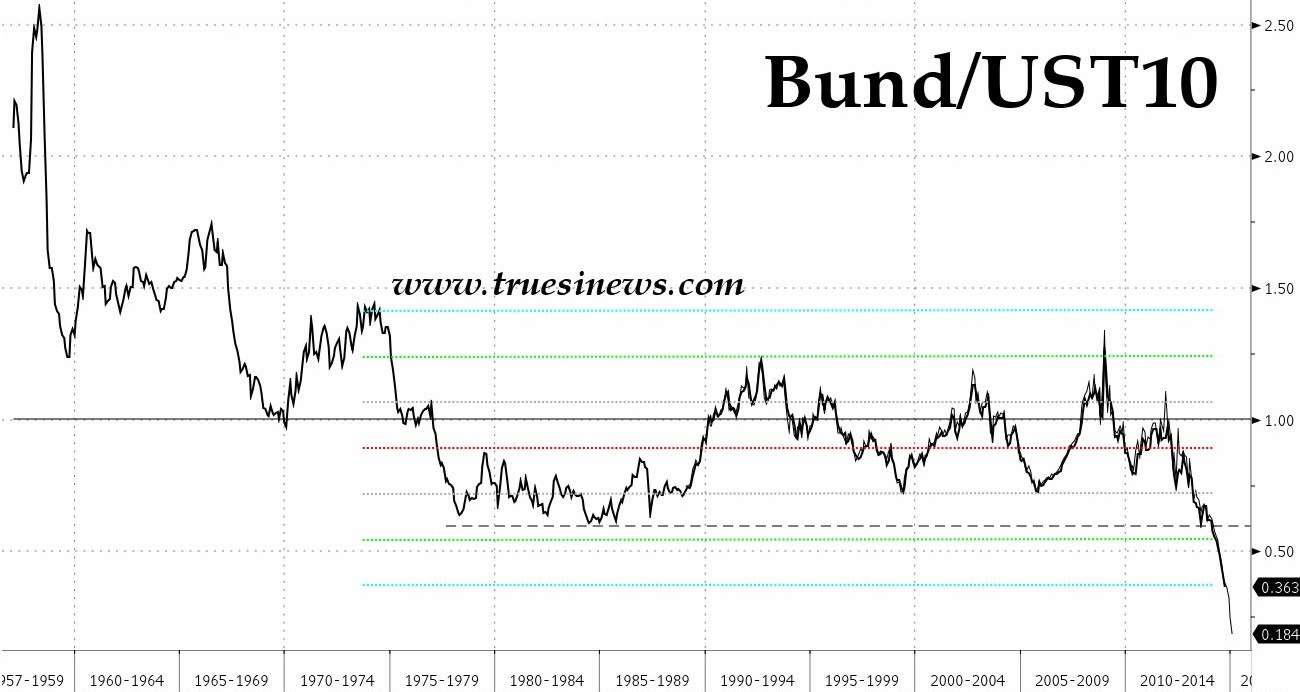

Taking straight yields alone, Bunds have sunk to their deepest yield discount to the US in arithmetical terms since the Berlin Wall came down but if you truly want to be amazed, take a glance at the following grraph which shows Bund yields as a fraction of the corresponding Treasuries [and, yes, the true picture is a touch more extreme than the one shown here since we have been indolent enough not to adjust UST upwards on account of their semi-annual basis].

Major new lows, as you can see, and all of 4.2 sigmas below the mean of the past four decades!

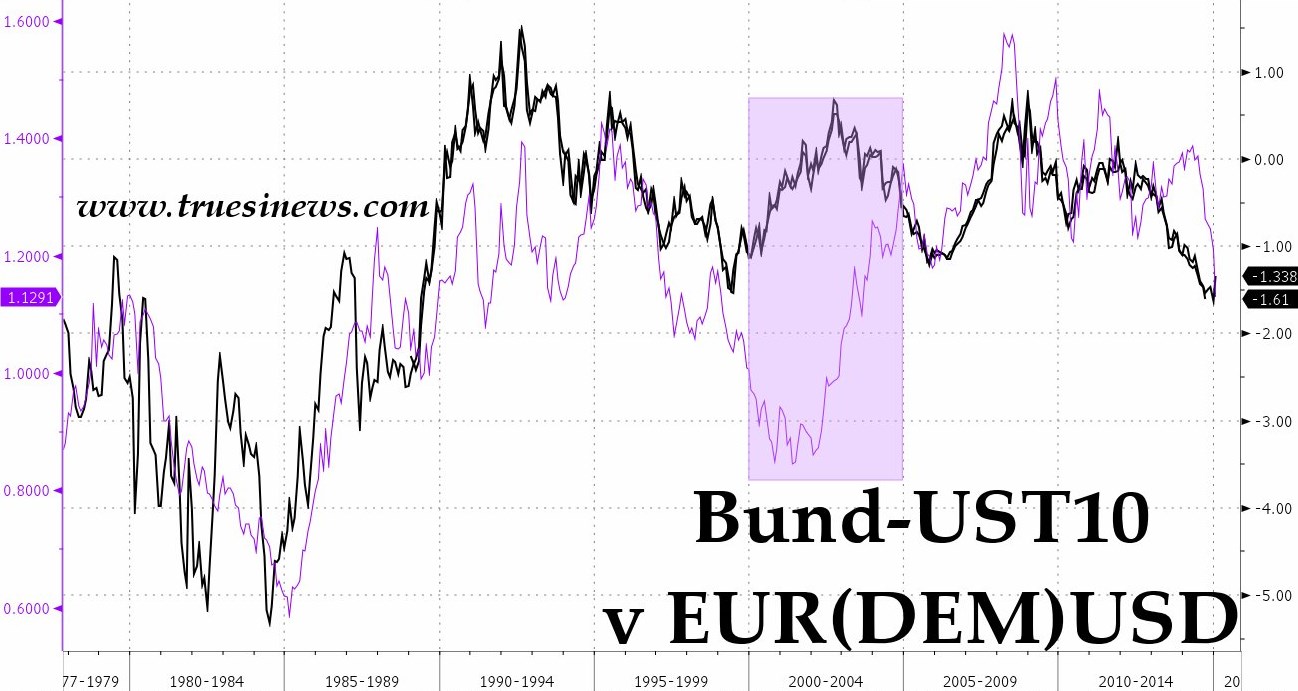

Where this becomes significant is when we look at the fairly robust correlation between US-German bond differentials and the relevant currency parities. Generally speaking, the more yield pick-up you get, the stronger the one currency becomes in terms of the other. The only major exception to this occurred in the immediate aftermath of monetary union when it took a few years for people to trust the infant single currency as much as they had the good, old Deutschemark.

No wonder then, that the euro nosedived, hitting an 11 1/2 year low against the greenback itself, as well as reaching a 12-year low on the BOE’s measure of its trade-weighted value.

Recall here that Ludwig Erhard – the author of Germany’s post-war Wirtschaftwunder – used to say (paraphrasing loosely) that the best thing a resource-poor nation like his could experience was a currency that appreciated by around 2% a year. The rationale was that this reduced input prices but also forced domestic entrepreneurs to look to cost-saving innovation and capital deepening. His country today, doing well enough to send some of the more flighty members of the Kommentariat into raptures, is certainly enjoying a cheaper supply of raw materials but as for the healthy discipline to be imposed on producers, or the imperative to invest in order to raise the average capital endowment and hence both the productivity and the sustainable real wage of the workers – forget it! A devaluing currency trumps all eventualities!

As we have noted, there are many reasons why the euro should weaken and enough tacit official delight that it is doing so not to fear any active resitance to its ongoing decline. The question, then, is of how far its fall will extend from here.

A look at the chart suggests that one credible candidate for a halt does not lie that far beneath present values – at $1.0700, the long-term DEM-EUR mid, to be precise, a juncture which also coincides with the trend drawn off the Superdollar lows of 1985 and the ensuing Tech bubble/euro launch bottom of late 2000. Cyclically, too, this would mark a certain symmetry in time though a delay to autumn 2016 would be needed to render this exact.

We are becoming sufficiently oversold to argue that we should soon pause for breath, if nothing more, at these levels – a possibility enhanced by the fact that the dollar itself has now managed a 50% retracement of its post-Y2k decline to bump up against the log-trend drawn from its own previous peaks and all to the accompaniment of a new RSI high.

Once we have worked off that condition, if there were to be any further decline – and bear in mind that the previous two major reversals saw respectively 42% and 50% of the peak surrendered rather than the 32% lost to date – we could look for the linear scale fib at $0.9450 then to the log midpoint at $0.9275.

In the US meanwhile, the somewhat stronger than forecast employment numbers served to get everyone wondering just when Madame Yellen’s ‘patience’ might run out. That was enough to wipe 15 tics off green and blue euro$ and, indeed, to inflict similar damage on a long bond which has now endured a principal loss of 12% in five short weeks.

Having been lucky enough to have picked the lows at that time and having recommended adding to the position when it traded through 2012’s previous extreme, we must now look at where to take at least partial profits. 3.10% – the Operation Twist midpoint – is one suggestion, with the 3.22% swing target and the 3.35% fib level the next two candidates beyond that.

Rising rates, a stronger dollar, and Chinese weakness is hardly a combination guaranteed to boost commodity prices and so it transpires that we end the week on a decidedly soft note across the complex.

The gold price has broken the shallow uptrend of the past four months even though net spec longs still account for 30% of total open interest. Look out below with a loss of anything up to $150/oz a very real possibility if the vultures start to circle the corpse. Silver was not much better while platinum printed it lowest close – if only just – since mid-2009.

Copper inventories on the LME and Shanghai combined have more than doubled since Christmas to stand at 15-month highs, even as a hefty $85/tonne spot premium has ebbed away to $20 and 40% of January’s record shorts have covered. Momentum has waned as a result. Physician, heal thyself!

Lumber – not a material we normally accord much interest, but sometimes illustrative of wider developments – has also lost its mojo and in mean reverting in classic style it has also broken the last few years’ reflationary uptrend. Whether this is more indicative of weakness in the US or the Chinese housing market is difficult to say, but one or both of them must lie at the root (sorry!) of such weakness.

Finally, it has been another tough weak for US crude. A new high for output, a monster leap in inventories and these coming despite the loss of another 32 rigs in Texas, 64 across the US. As a result, that latter is an ostensibly supportive statistic in which the market appears to be rapidly losing faith. Currently, Cushing hold 49 million barrels of oil and so is two-thirds full. A repeat of the stock build seen so far this year would see that spare capacity exhausted by late spring with unimaginable consequences for the front end of the curve.

The contract had a close shave in the Friday session, managing to find buyers right on the trend of the past seven weeks’ improvement. Much through $48/bbl, however, in the days ahead and a whole new downside could potentially open up.

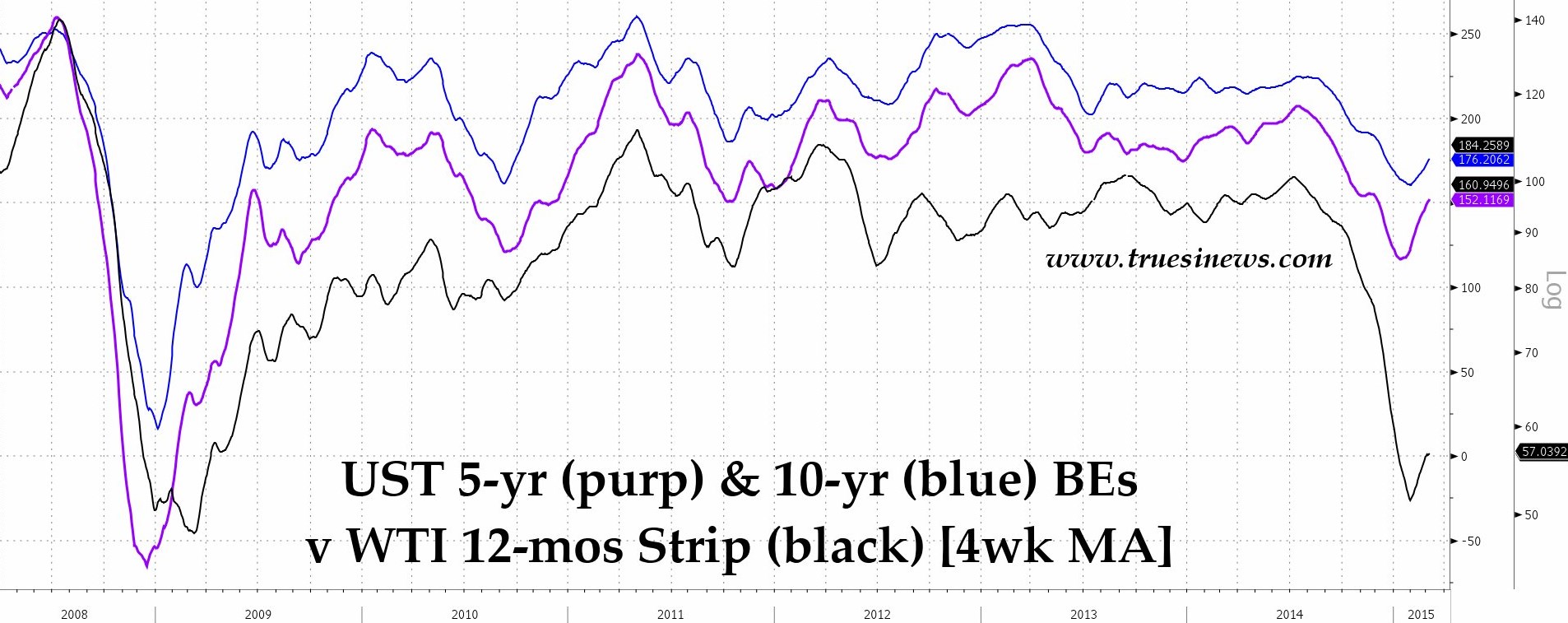

If that were to happen, the one consolation might be that the drop would be bound to drag US break-evens lower once more since these have spent the bulk of the past six years trading with an r-squared of 71% to the crude strip. It may be one of our least favourite indicators, but we are not the ones setting interest rates and, for reasons best known to themselves, it cannot be denied that some members of the FOMC do pay undue attention to the gauge.

Though they are not supposed to be reacting to the supply side benefits of cheaper energy, therefore, a further reduction in such costs could well serve to exert an indirect influence on the timing of a rate hike which has otherwise seemed a much more imminent prospect this past week or two.

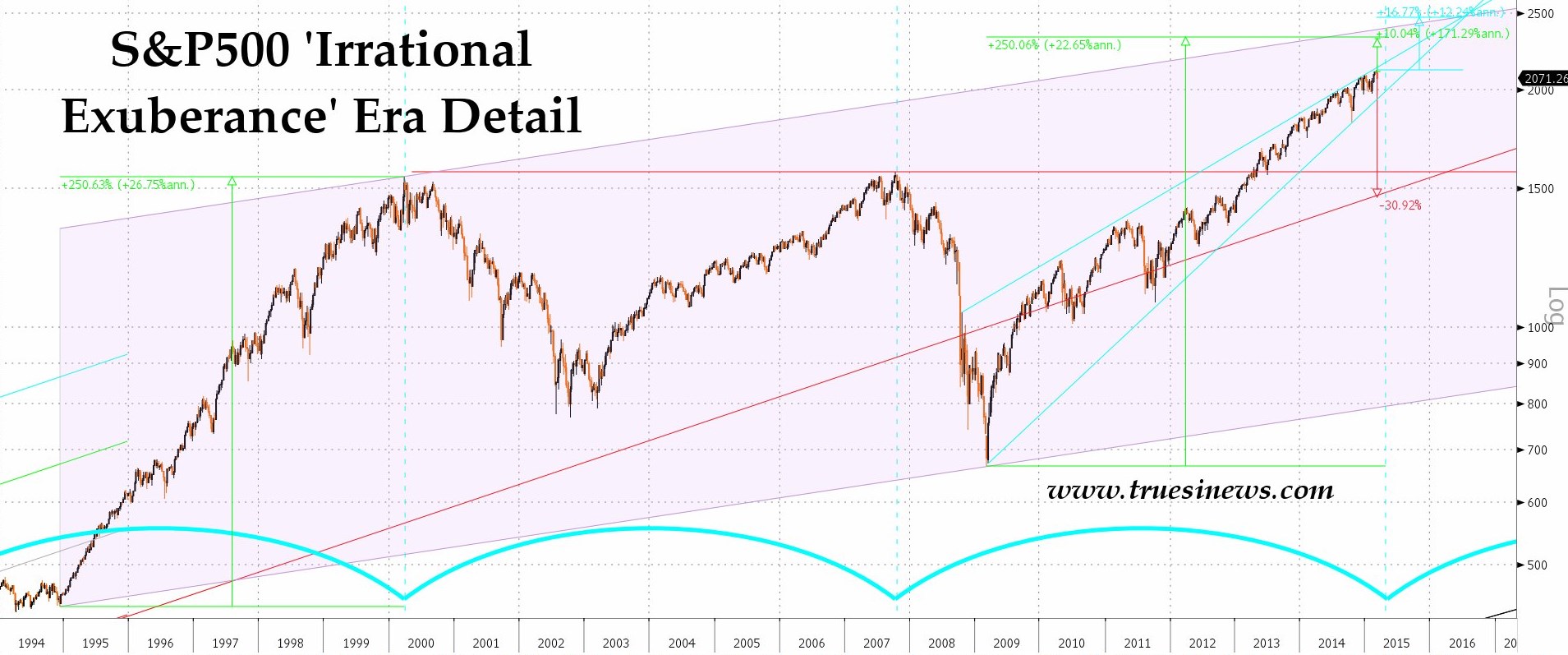

Finally, with both large and small caps closing beneath their December high and with the first, faint signs of stirring in the VIX and the put:call ratio, we offer – more by way of gentle amusement than with any firm degree of advocacy – the notion that, somewhere around here, both in terms of price and of time, a perfect spot is to be found at which to call the top of the 80-year bull market in stocks or else, if not quite so Wagnerian, at which to instigate a return to the 6.7% a year nominal trendline which now lies some 30% below.

Either way, it pays us to watch out for signs of exhaustion. Negative rates and muti-billion central bank bids for bonds notwithstanding, there are hints that the market is becoming weary of the endless procession of new highs and it does so while grossly overlong of all forms of risk. If that feeling of satiety truly takes hold, the few basis points in warehousing fees being charged by the central banks for holding cash balances in their vaults might quickly come to seem like a real bargain.

NB The foregoing is for educative and entertainment purposes only. Nothing herein should be construed as constituting investment advice. All rights reserved. ©True Sinews