As the Yellen Fed inches painfully towards taking its first ‘data-dependent’ steps to raise rates (albeit with the promise that such a process will follow the disastrous, well signposted creep upward which enabled so much damage to be wrought after the Tech Bust), the evidence mounts as to just how belated any such action will be. Take housing, for instance.

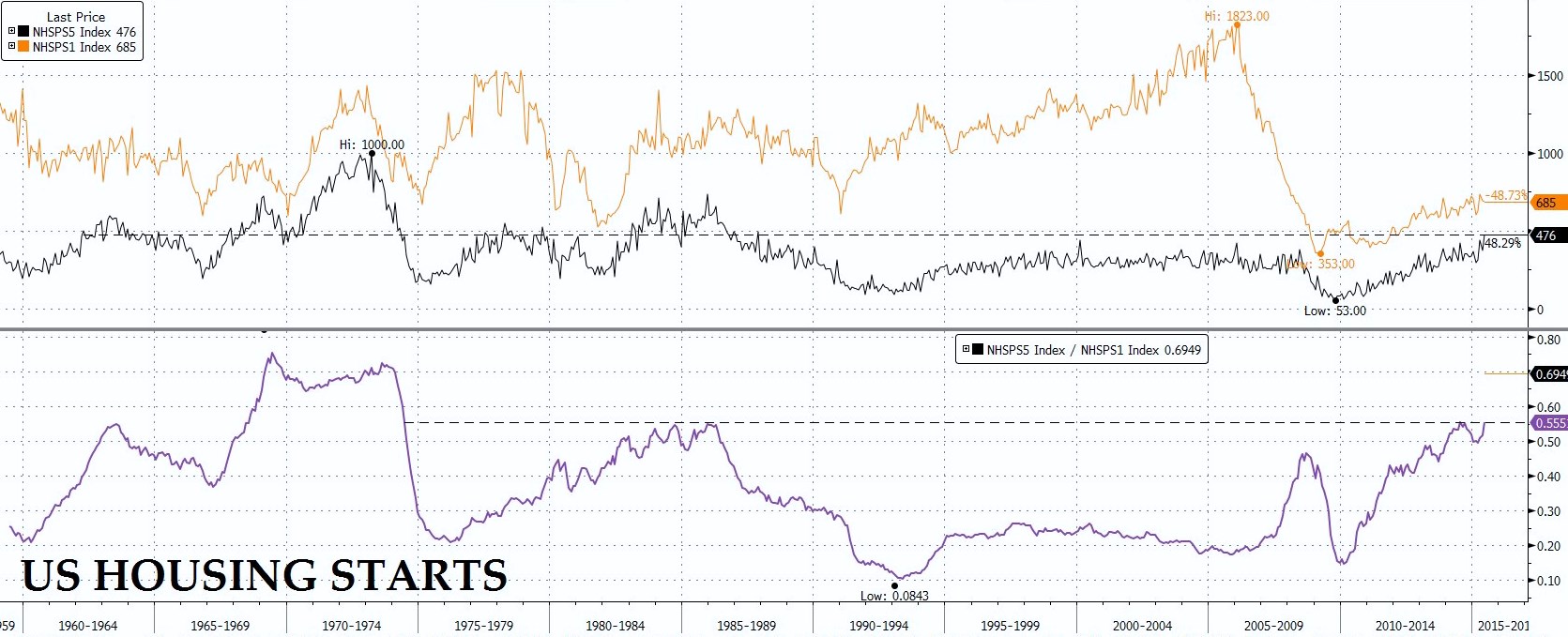

Here, the latest release shows that multi-unit starts were the best since 1985 after rising 13.5%YOY to stand 275% off their lows. Adding to the sense of building excess, the ratio of starts for 5+ to single-unit buildings has not been topped since the inflationary peak of 1973. Permits are also robust, rising 30%YOY to hit an 8-year high with the multi-unit variety up +70% to a 25-year high. The ratio to singles was the best since 1986 and thus lay close to a 40-year peak.

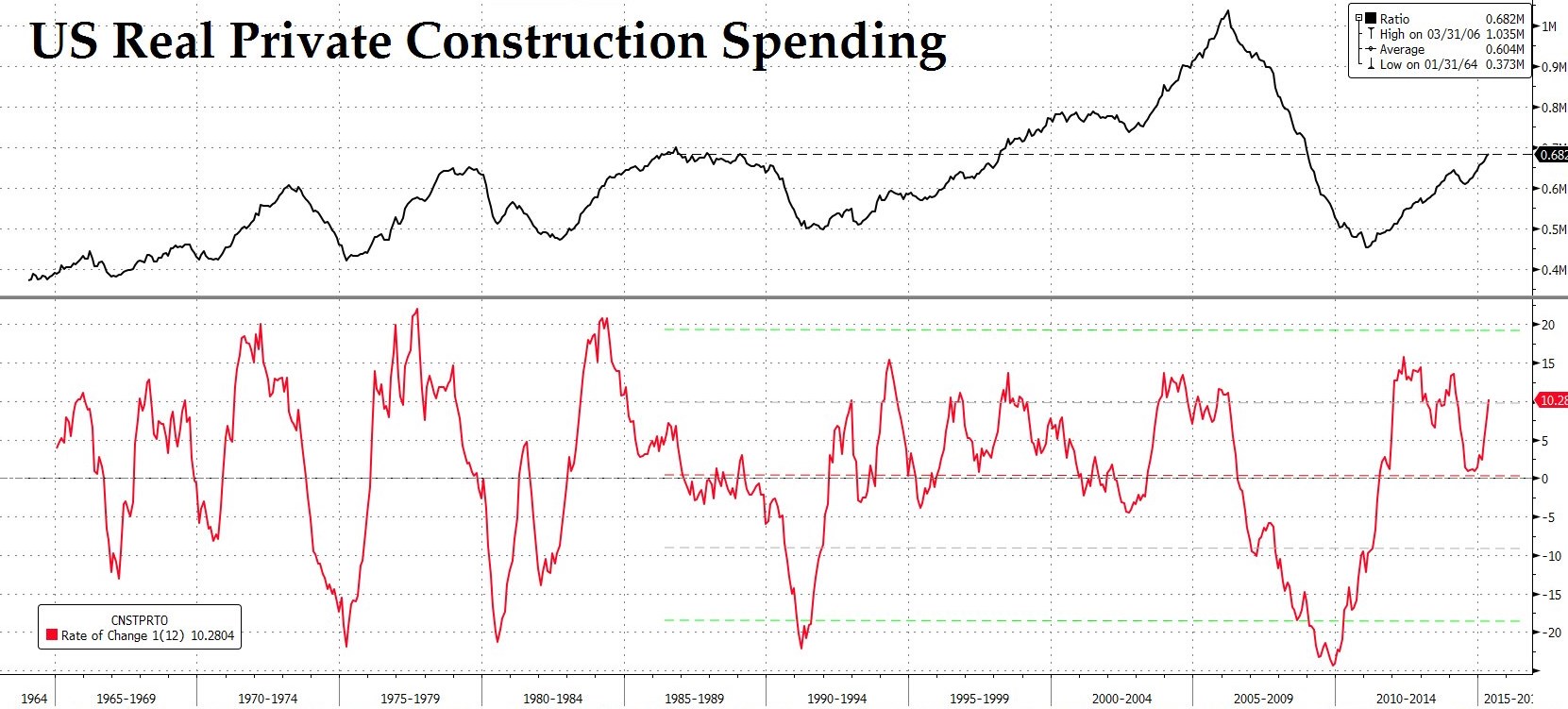

No surprise, perhaps, that real construction spending is up more than 10% in a year to its best level since the GFC. In fact, this measure was only ever higher during the period 1998-2008 which started with the loose policies of the ‘Committee to Save the World’ and ended with the even looser ones of the ‘Committee to Save the World from the Committee to Save the World’!

Construction accounts for around $1 in every $30 that circulates in the economy and for one job in every eighteen in the private sector so this does help the cyclical upswing. Employment in the sector has expanded at a CAR of 3.7% these past 4 1/2 years versus a CAR of 2.3% for all private jobs. The sum of earned wages are a third higher (at a 6.6% CAR), appreciably better than the one-fifth and 4.4% CAR achieved in general.

Given the irrefutable historical testimony of the disasters which ensue once a construction boom takes full root – and also given both the empirical and Austrian-theoretic conclusion that this is one of the most interest rate sensitive sectors in the economy – can we please act now, before it is too late, Janet?

FOR A REGULAR INSTALMENT OF MY ANALYSIS, PLEASE VISIT ‘MONEY, MACRO & MARKETS’ AT HINDESIGHT LETTERS WHERE THE JUNE EDITION IS NOW AVAILABLE, AS IS THE LATEST WEEKLY ‘MIDWEEK MACRO MUSINGS’

NB The foregoing is for educative and entertainment purposes only. Nothing herein should be construed as constituting investment advice. All rights reserved. ©True Sinews