That’ll teach’em!

Enticed by the seemingly risk-free profits being offered by the Chinese stock market stabilization drive, burned fingers spent the week from the lows creeping back to the flames, adding another $1 billion-a-day to the official margin total as they did.

Then, WHAM! The biggest single day fall since the last market crash in 2007; a two day move which scored no less than 4.2 sigmas in a 17-year sample (in fact the three-day peak-trough slump was an astonishing 16%!). This is the source of an increasing level of embarrassment for a regime which must at all times exude an air of Olympian control in order to compensate for its lack of representative legitimacy.

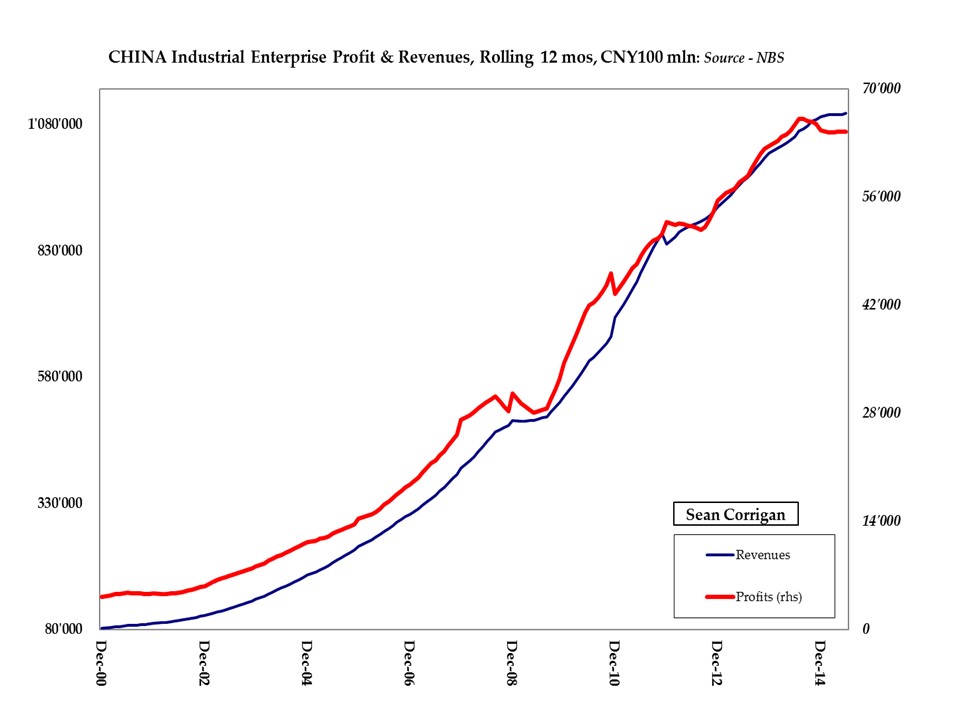

Though unlikely to have provided the catalyst, it was perhaps fitting that the slump came on the morning when the monthly estimate of industrial corporate performance was released. While this did show an improvement from QI’s lowly 4.9% yoy profit growth to a more respectable looking 7.1%, this was not without the caveat that the advance was the result of a combination of lower financing costs (and, one supposes, stock market related gains) as well as from the boost to utilities conveyed by lower input prices.

Revenues told another story: they were a sickly 2.2%YOY—not the stuff of which 7%+ nominal GDP numbers are long to be made.

FOR A REGULAR INSTALMENT OF MY ANALYSIS, PLEASE VISIT ‘MONEY, MACRO & MARKETS’ AT HINDESIGHT LETTERS WHERE THE JUNE EDITION IS NOW AVAILABLE, AS IS THE LATEST WEEKLY ‘MIDWEEK MACRO MUSINGS’

NB The foregoing is for educative and entertainment purposes only. Nothing herein should be construed as constituting investment advice. All rights reserved. ©True Sinews