Back in the halcyon days of summer, it seemed nothing could go wrong.

Commodities were still things it was not utterly disreputable to own. Base metals had shaken off a springtime swoon to hit 18 month highs. Though still suffering from that enervating, post-bubble flatness, precious metals had just enjoyed a neat little 10% rally. Energy was threatening to print new 2 ½ year highs as WTI sold for more than $107 at the front and $86 at the back of the curve. Nor were people much interested in paying for downside protection: across the complex, options premia were as low as ever they had been in recent years.

Volatility – and risk measures in general – were drifting ever southwards, everywhere you looked. The US equity market’s VXO index was being quoted in single figures, the lowest in its 29-year history. As a percentage of the underlying equity level, it was barely still on the chart – 16 standard deviations below the mean and under one fifth of the median. Germany’s VDAX was doing its best to keep up (down, in fact) touching its lowest in 18 years at just over half the 23-year median reading. Emerging markets? Got it. Price high, vols low, the ratio between the two at an extreme, and the VIX-VXEEM spread less than 2% – around a fifth of that typical over its short 4-year track record.

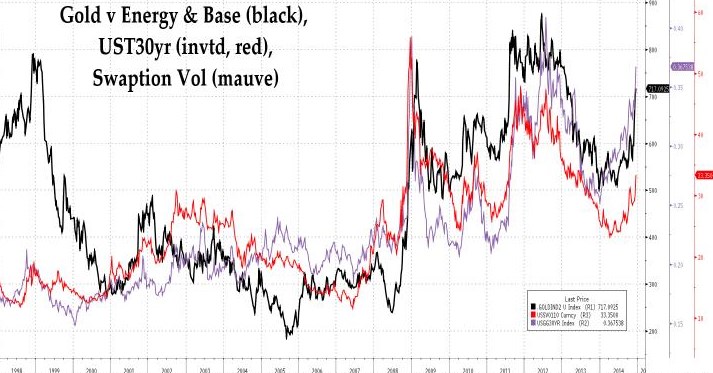

In the fixed income market, swaption vol was back in the low 20s – a level not undercut since the Lehman crisis exploded and, adjusted for yield, the level was actually in the very first percentile of the past 18 years’ range. Baa bond spreads were down at 135bps over Treasuries, the smallest premium since early 2005, while junk bond equivalents were the lowest on record, their 220bps reading less than half the 27-year median of 460bps. Even Greece was trading a relatively rich 415bps over Bunds, their best since the T2 blow-up in 2010.

Nor was forex immune. JPM’s G7 volatility gauge stood at 5.2%, just more than half the 22-year median and – you guessed it – a record low. The EM equivalent? Yes. A record 14-year series low some 40% below the median.

Leverage is a little harder to measure since much of who borrows what and to buy what is not available for public scrutiny. Suffice it to say that not only was US margin debt printing new outright highs at $466 bln, it also set a new high water mark as a percentage of market cap. The real leverage, though, is that internal to the corporate sector itself. Taking just the US as an example, the period since 2010 (inclusive) has seen non-financial corporates retire almost $1.8 trillion in equity despite the fact that they have only had $480 billion in own funds to disperse after paying taxes and dividends and making capital outlays. This means that they have simultaneously borrowed $1.3 trillion simply in order to juice the EPS ratio – a move they have accomplished by issuing a like amount of bonds for a sum which equates to around 10% of aggregate book value.

No-one watching these markets will need to be told that, just six months on, we live in a very different world, indeed. Suffice it to say that bond vol is 10% higher, FX vol has more than doubled to Taper Tantrum levels, junk is trading not 220bps over, but 500 – half way back to the climax of the Euro storm of 2011 before Draghi uttered the magic words ‘whatever it takes’. Outright panic is a very real possibility, especially in today’s lightly buffered, Volcker rule markets.

Coming in the final quarter of the year, the tumult has also upset that cosy if cynical compression of positioning into window-dressed winners and universally-shunned losers. Everyone who was anyone was long the Nikkei, short the yen, didn’t you know, Dahlings? Rates in the US were obviously headed higher, so both percentage and absolute eurodollar shorts were respectively close to and at record levels and net note and bond positions were similarly bearish. The dollar index – having finally steamrollered the last reluctant sceptic of its rise – had garnered spec longs to the tune of three-quarters of all-time high O/I. The euro net spec short was half of record O/I, the yen equivalent accounted for 70%.

Everyone with the same viewpoint, far too many interlinked positions, far too much lazy consensus. And now – BANG! No wonder the reaction has been savage.

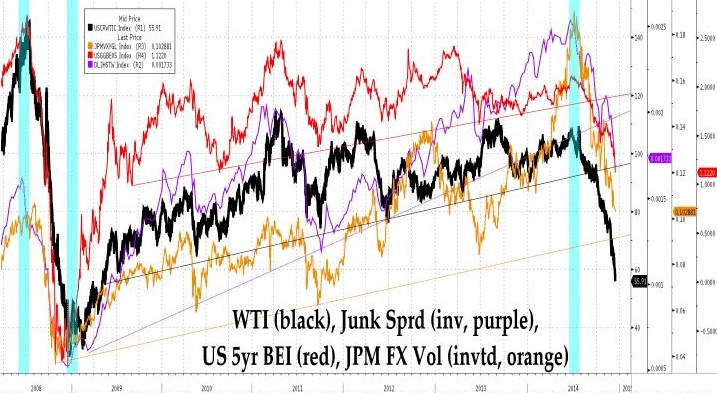

Look at the graphs. Since 2008, US break-even inflation has wiggled up and down in a broad consonance with the price of crude. Given such behaviour from a flawed, market-generated reading conferred with far too much significance by a Fed desperate to pretend it is at least partly deterministic in its actions, it should not be hard to imagine how much the deflationistas are bleating now that the black stuff is spiralling earthward out of its SuperCycle pretensions like an overeager Icarus cursed with Virgin Group sponsorship.

Junk was likewise in loose synch with the same gyrations, long before every newly-born shale doubter became an expert on the drillers’ credit ratings. Likewise, FX vol followed much the same beat, partly because anxiety tends to rise when the greenback, too, is on the up. Weaker commodity prices also go in the market’s mind with demand side weakness, especially in China, and with knock-on export earnings effects in producers like Brazil and South Africa and so link back to EM valuations that way, too.

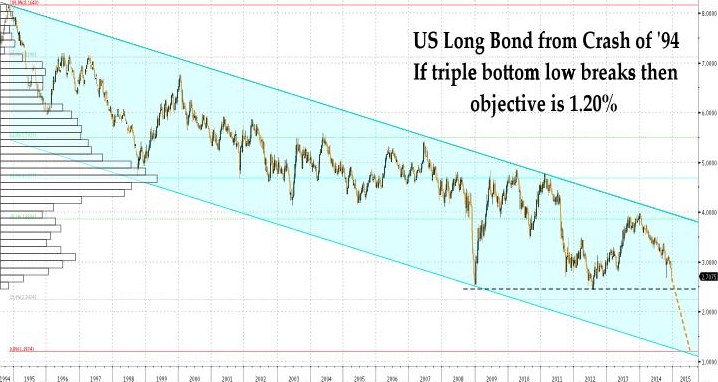

Similarly, after a long time in the doldrums, gold has been relatively – if not yet absolutely – perky of late as that classic ‘bird of ill omen’ ratio – the price of the metal in terms of a basket of industrial commodities – is starting to rise along with that of a long bond not a million miles away from testing its 2.45/50 double bottom. And this, in the case of bullion, despite an almost overnight shift in tin-hat theorising from thinking that the very tight cash market of a week or so ago was all due to Moscow’s anti-dollar acquisition to fretting that its latest reversal is all down to that same Moscow frantically unloading the stuff once more.

So now it is all starting to unravel. Since OPEC’s demarche last month, as we know oil has plunged $50/bbl at the front, $20 at the back and could well be heading for $40 a pop, both on current technicals and on historical precedent (see chart). Gulf stock markets – especially that serial bubble-blower, Dubai – have strongly felt the chill. Across the Atlantic and even reckoned with its frankly unreal official peso rate, the Merval is off 45% when translated back into dollars, the Bovespa and the Colcap have shed 40%, while the Bolsa is down 25%, all on the same basis.

Russia is another case entirely. After several uneasy months, confidence has finally crumbled with CDS spreads soaring from 100 to fast approaching 600, while both the RTS index and the ruble have lost around three-fifths of their value, a calamitous move for the latter not a world away from the three-quarter loss it suffered during the nation’s bankruptcy in 1998. Though the causation may be working in reverse today – and though Russia was not alone in toppling into the financial abyss back then – no-one will wish to dwell on what happened to the price of oil ($10/bbl), gold ($250/oz), or copper ($1,400/tonne) in the aftermath of that particular implosion!

Eastern Europe as a whole is beginning to wobble. Budapest in USD has touched a 5 ½ year low, leading the MSCI regional index to another slide of 40% from those late June highs. Raiffeisen Bank – notable for its lending into and beyond the hinterland of the old Austro-Hungarian empire – has come under the cosh as a result, the shares suffering a black run descent of 60% since June to a suffer the ignominy of hitting a post-flotation low. More and more, the dreaded word ‘contagion’ is beginning to be whispered.

Courtesy of the discussion of it in the BIS’ latest quarterly, the focus has also been on the high volume of cross-border leverage prevailing – much of it hidden away from regulatory fiat and popular consciousness in offshore borrowing via foreign non-bank subsidiaries. The price action so far shows that to the extent this has been a feature, it has been mostly about unwinding yen carry trades, the unit having retraced as much as six big figures versus the US, much to the chagrin of those arch competitive devaluers, Kuroda and Abe, no doubt.

What has not yet begun to be priced in, however, is the possible cost of Russia succumbing to either an involuntary default or a deliberate moratorium. Even to suggest that latter might seem a step too far, but there must surely be limits to the sphinx-like patience of even a Putin or a Lavrov.

Between them, these two have so far striven hard to present, especially to the emerging nations, a front of international respectability and reasonableness and to portray their land as the victim of a concerted attempt at destabilization launched by the hardliners in the America foreign affairs hierarchy. Thus, the only pre-emptive action they have taken to date in the wholly unnecessary conflict with the Ukraine has been to secure their strategic – and, they would add, historic – foothold in the Crimea. Even here, they then arguably secured the mandate of the overwhelming majority of the people for their intervention.

But now the stakes have been raised by the acute financial disruption they are suffering, perhaps to the point where it may no longer be wise to play their long, patient game of waiting for the regime in Kiev to collapse of its own accord and for Europe to baulk at the costs of underwriting American Full Spectrum Dominance. Moreover, the US congress has just passed – in the most morally questionable, if procedurally correct, fashion – a bill which several major figures at home and abroad have stated is tantamount to a declaration of war on Russia, a bill to which it appears the Nobel Prize winner manqué in the White House will append his signature this week.

If so, how might the Kremlin respond? Well, certainly not with military force. But it could impose a grain embargo, a disruption which would serve additionally in reserving the harvest for its own people at lower cost than the crop would now bring on world markets. It could perhaps demand payment for gas deliveries in rubles, not dollars, thus forcing the Europeans to take up the defence of the currency on its behalf. But beyond all this, it might impose capital controls in such a manner as to lock Western funds in place and to suspend all payments of principal and interest thereon until a wider settlement of the dispute was achieved.

In this context, it helps to be aware that, at end June, the BIS says that member state banks with money out to the country stacked up as follows:-

France, $51 bln; Italy, $29 bln; USA, $23 bln; Germany, $22 bln; Japan, $19 bln; NL, $17 bln; UK, $15 bln; Sweden, $10.5 bln; Swiss, $6 bln – in a total of $235 bln. Then there was the matter of the $253 bln in international bond issuance by Russia, $180 bln in the name of banks and other financial institutes, $39 bln raised by non-financial corporates and $35 bln by the government.

[In passing, consider that each of these figures individually were comparable in scale to the domestic security market which stood at $286 bln while banks’ domestic claims amount to around $500 bln].

Clearly such sums are subject to downward revision in light of the withdrawals that presumably lay behind the currency moves but, nevertheless, they must remain sizeable. Were they to be frozen, then in place of some of the Western chickenhawks puffing up their chest feathers about excluding the Russians from SWIFT, the latter would have thrown a rather large spanner of their own into the international plumbing in anticipation. After all, financial warfare can be a two-edged sword, can it not?

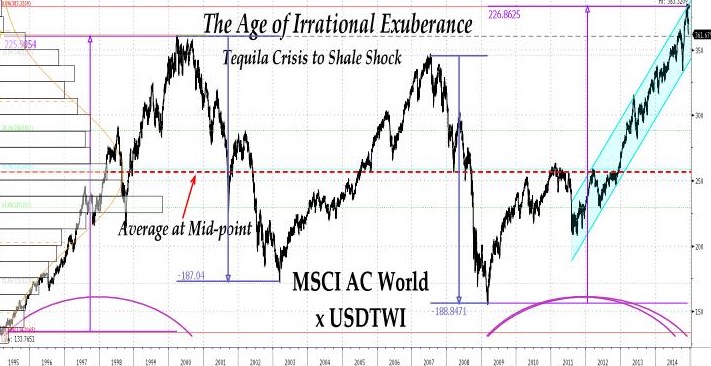

Suffice it to say in conclusion that the uncertainties presently being generated have the potential to undermine two crucial kinds of trust – that one must have in the merits of one’s own exposure and that equally critical faith in the reliability of one’s counterparties. If it does, the third great bull run of the 20-year age of Irrational Exuberance could well reach its culmination, after a rally of almost exactly the same magnitude as and of similar duration to the one which ushered it in, all those years ago.

NB The foregoing is for educative and entertainment purposes only. Nothing herein should be construed as constituting investment advice. All rights reserved. ©True Sinews