[This article appeared in slightly abridged form in the Epoch Times under the title, ‘The Fed’s Quantitative Tightening‘]

The older a bull market gets, those who are paid to comment on it become more and more desperate for new things to say about it – a professionally pressing need which tends to split the pundits into two distinct camps, each equally one-eyed about whether prospects are good or bad.

Among them is a batch of doomsayers which had been peddling the line that loosening monetary policy has become ineffective but which is now croaking that the blinded Samsons at the Fed are about to pull the whole temple crashing down about our ears by tightening it again.

Alas, they can’t really point to interest rates yet, not when the Fed has so far only managed a paltry 1% climb in ‘real’ rates to minus 1%. Their next attempt at alarmism is to insist that our fate is sealed by the ‘flattening yield curve’ – even though the fall in long yields and credit spreads means that financing terms are, if anything, easier than they were before the Fed first began to move

Beyond that, they hold a new terror over us. For – GASP! – the Fed is about to reduce the size of its balance sheet at some indeterminate date in the future, or so it says.

Given that the post-crisis quintupling of this balance sheet to the present $4.5 trillion was the very essence of ‘quantitative easing’ – the process by which banks and zombie firms were rescued, borrowers favoured at the expense of creditors, spendthrifts helped and savers hindered, capital allocation tainted and stock-markets turbo-charged – how can this fail to be the case, the Jeremiahs ask.

Balance Sheet Dynamics

Here, it may surprise the reader to learn that the Fed stopped expanding its balance sheet a little over three years ago and that, notwithstanding this, money supply has grown by around $700 billion and its bigger brother, M2, by circa $2.4 trillion; personal income has risen by an eighth and economy-wide spending by around 10%, even after weathering the intervening shale bust.

Moreover, while all this was going on, that part of the Fed’s overall contribution which the textbooks tell us is the most important in ensuring banks can accommodate an increase in activity – namely, the quantity of those reserves off whose base they are supposed to multiply their own, ‘inside’ money creation – has already fallen – yes, FALLEN – by roughly $600 billion, or by just over a fifth.

So, what gives? How has such a mighty change been effected and yet been almost entirely disregarded by market observers? For three main reasons.

Firstly, we must point out that modern, advanced-economy banking does not in fact operate via the classic reserve-multiplier mechanism on which this forecast relies, but rather on the basis of its constituents’ regulatory (risk-weighted) capital, as first standardised in the so-called Basel Capital Accord of 1988.

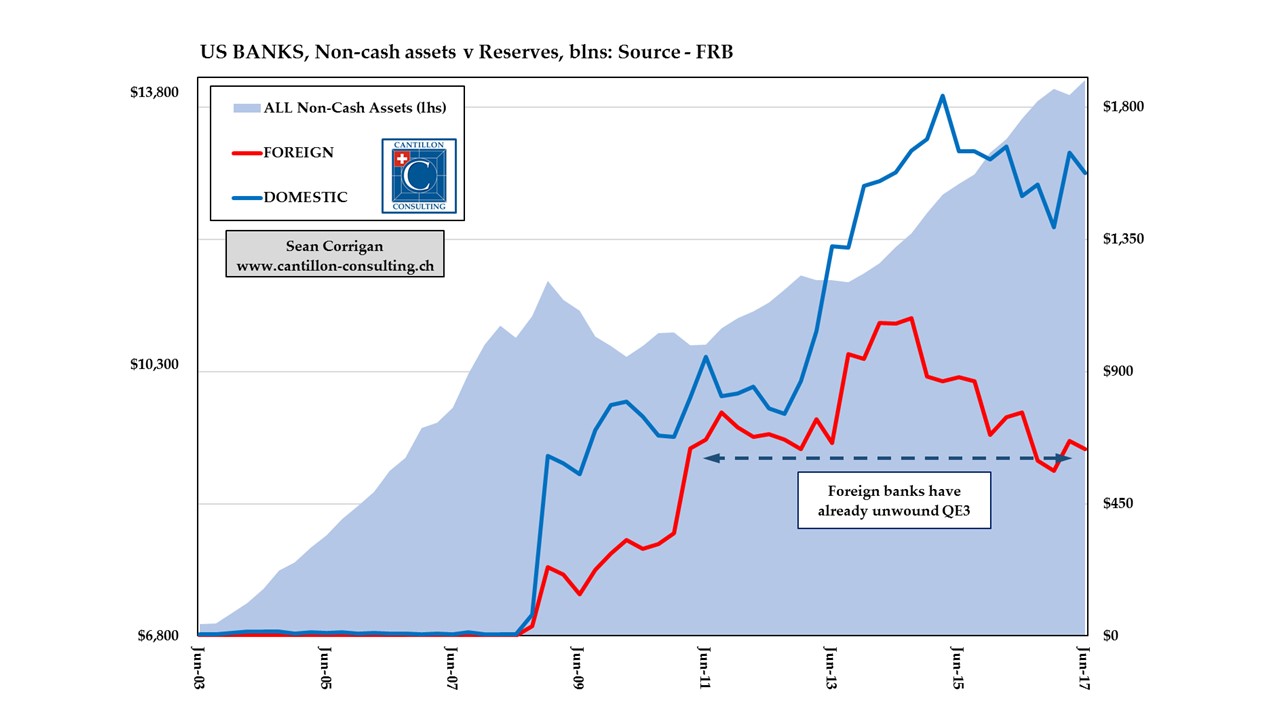

The second factor arises from the behaviour of those foreign banks horribly caught out in 2008 by the huge cross-border arbitrage they had been running to finance both America’s and their own, home-grown bubbles.

One estimate of the resulting ‘Eurodollar’ market puts its size at around $10 trillion on the eve of the GFC – a ‘shadow’ market roughly equal in magnitude to the entire US domestic system itself.

Set against this vast exposure, foreign banks in the US held than $1 billion (sic) in reserves. Not so much an inverted fiat-money pyramid as a fiat-money wormhole, you might say.

In the wake of the collapse, the Fed was soon scrambling to ease some of the ensuing pressure by undertaking $1/2 trillion in dollar ‘swaps’ with its various counterparts around the world. This allowed its peers to supplement their frantic attempts at domestic money creation with an emergency shot of now-scarce greenbacks, besides.

Suitably chastened, over the next few years, foreign banks entirely reversed themselves to where, in the summer of 2014, they had borrowed a net $660 billion from their head offices in a tremendous, $1.3 trillion turnaround from the $600 billion they had lent to HQ on the eve of the debacle.

In good part, these monies were used to build an unprecedented $1.1 trillion warchest of reserves at the Fed – a sum which represented a massive 40% both of their combined total assets and of the overall total of such reserve balances conjured into existence via QE. Finally, they could sleep at night.

But here’s a dirty little secret. As the perceived need for such a backstop has faded, nine years on from the catastrophe, foreign banks have already reduced their holdings of reserves by over $500 billion – or by a little under a half.

Did you notice the accompanying crisis? No, me neither.

The Modern Monetary Soup

This brings us to our final factor, one which is rooted in a subtlety of money itself.

In normal circumstances, people can be relied upon to hold as little of their wealth as possible in the form of ready cash since it generally yields little or nothing and, more broadly, because its retention represents an abstention from the enjoyment of other goods and services with little reward for associated self-denial.

Thus, when everything is running smoothly, the bulk of the money in existence is only there to provide a transactional medium; a means through which to buy and sell all the countless billion of things we exchange with one another each and every day.

Currently, however, we are in a situation where the difference between the (classically zero) yield on money and that on the safer alternatives – such as savings accounts, money market funds, and T-Bills, for example – has become negligible and even – ever since the Fed decided to pay interest on reserves – entirely reversed. Thus, money’s usually trivial, decidedly secondary role as a ‘store of value’ has instead become greatly enlarged.

Not only does this partial ‘immobilization’ of the Fed’s money flood explain the relatively sluggish response of inflation to the new abundance, it also strongly suggests that, as ‘renormalization’ progresses, it can be unwound to a large degree without any adverse consequences ensuing, either.

In fact, through an ongoing process of substitution, that missing $500-odd billion has been quietly locked away out of harm’s way, elsewhere in the system.

$200 billion has gone into issuing extra non-multipliable notes and coins – some sizeable, if ultimately unknowable, fraction of which circulates outside the territory of the fifty states, to boot.

On top of that the US Treasury, the GSEs, and various foreign central banks have increased their account with the Fed to the tune of some $350 billion rather than depositing it with the commercial banks. Finally, the Fed’s new-fangled reverse repos have absorbed another $80 billion or so.

Elementary, My Dear Watson

All of this means that while the Fed has not strictly reduced its balance sheet yet, it has already neutralized around a sixth of it – and it has achieved this to the accompaniment of precisely zero dogs barking in the night.