So, finally, the world’s most open conspiracy came to full fruition and Magic Mario actually got to do a little of ‘whatever it takes’ after 2 1/2 long years of bluster. Sweeping aside the objections of what appears to have been most of Northern Europe, the triumph of the Latins was near complete. For all his stubborn resistance, Jens Weidmann proved no Arminius and the airy council rooms of the ECB building in Frankfurt no Teutoburger Wald whose mazy forest tracks and swampy margins proved so deadly to the legions of that earlier Roman legate, Publius Quinctilius Varus.

Indeed, there was some suggestion in the Dutch press that Mario got his way without even putting the issue of his vast ‘stimulus’ programme to a formal vote and so prevented Jens, his fellow German, Sabine Lautenschläger, the Netherlander Klaas Knot, and their Estonian and Austrian colleagues from registering their opposition to the decision and also therefore from making concrete the divisions which it has sharpened within an already fractious governing body.

In pressing ahead with the implementation of its own version of QE, the ECB has taken a further, significant step away from the template of the old Bundesbank and one more towards that of such latter-day, Gosplans of all-intrusive macro-management as the Fed and the PBoC. While any model of central banking is a very poor alternative to a system of genuinely free banking, one cannot quite suppress a pang of nostalgia for the traditions of the ECB’s predecessor, with its rigid insistence on being as far removed from politics as possible; for eschewing any taint of pliant fiscalism; and of sticking reasonably consistently to its primary task of preventing easy money from encouraging reckless behaviour – whether on the part of home-buyers, stock market plungers, Alexander-complex industrialists, or office-hungry politicians.

The hallowed institution of our youth may well have dished out a very tough form of love, but its true virtue was that its heads did not presume to sit at some metaphorical control centre of the economy, constantly flipping switches and pushing buttons to ordain whose traffic lights should be red and whose green; whose heating should be turned up and whose down; whose satellite dish should receive which channels and at what hour. Instead, the old Buba simply tried to ensure that the generators were running smoothly, that there would be neither blackouts nor power surges, and by and large left the choice of what its fellow did with their electricity down to them.

Sadly, as the crisis has dragged on and as the cost in forgone human opportunity has mounted, the established political architecture – a structure populated largely by careerist pygmies who clutch eagerly at anything which might boost them a few points in the next focus group assessment and who are therefore only too happy to absolve themselves of any duty of true statesmanship – has visibly crumbled. That degradation has elevated, almost by default, the central bank itself to the cloud-topped heights of an interventionist Olympus – and rare the presiding member of that august body who does not relish a taste of ambrosia and a sip of nectar before going out to hurl thunderbolts among the weaklings thronging helplessly among the mountain’s gloomy foothills.

No longer is the job seen as one of trying to ensure the wheels do not come off the creaking old Trabant of fractional reserve banking, or of trying to ensure that the nation does write too many cheques – whether issued abroad or at home – against its actual ability to generate income. No, now we must make constant appeal to the gods of central banking to assist us with all the minutiae of our lives in a show of the same touching naivety our ancestors displayed in regard to their tutelary deities. ‘O Holy Draghi, Thrice Blessed One, let it please Thee to ripen the corn in my field, to keep my children’s teeth from rotting too soon, and to allow me to win a few denarii when I play at dice in the tavern this evening!’

Such is the Zeitgeist that we deem it to be sacrilege even to look objectively back at the sorry record of the past seven years lest we start to wonder if we are in fact suffering from is the toxic side-effects of the attempted cure rather than from the disease we are aiming to treat with it. We see it as blasphemy, therefore, to ask whether those awfully sanctimonious Austrian ‘liquidationists’, on the one hand, or those careful Japanese students of their own country’s long malaise – such as Keiichiro Kobayashi and Tadashi Nakamae – on the other, might be right in saying that we Westerners currently have everything back to front in our reasoning.

Might it be so hard to imagine that to try to tempt into renewed borrowing the very people who are still suffering the effects of their previous over-borrowing might not only be economically futile but ethically indefensible, too? Could it be that what is shackling enterprise and hobbling endeavour; that what prevents the crewing of a hopeful new fleet of merchantmen with the slaves loosed from the oars of a now obsolete galley, is the attempt to weld in place the rusted links of their chains of past obligation? Can we not simply strike off the irons even if some do collapse after their manumission? Or must we continue to prevaricate by slyly skewing all contractual terms in favour of the debtors – whether by forcibly suppressing the interest rates applicable to their claims (and so penalising the prudent everywhere); by depreciating the currency in which they are serviced and redeemed (with all the inequities that visits on buyers and sellers); or by transferring the IOUs to the government so that the non-exempt Estates might share the cost through a hike in their already burdensome taxes?

Apparently it is so hard to reconsider our methods that all we are left with is to double and redouble the dose of the poison we have been so unavailingly prescribed. Given the prevalence of this dogma, it was only to be expected that, once it had insidiously secured the political backing for the move, the ECB would not be in any way half-hearted about its first real foray into the world of Bernanke’s ‘making sure it‘ – i.e., that phylloxera of finance, the wasting disease of deflation – ‘doesn’t happen here.’ With a programme of €60 billion a month in bond purchases the Bank will henceforth be gorging on duration to the tune of €720 billion a year, a total heavily in excess of the past five years’ €315 billion average net new sovereign issuance.

Whether it will end up doing more harm than good, or indeed, doing anything at all, is another matter entirely. To see why we say this, we should first recall that Blackhawk Ben himself once tried to allay the fears being provoked by his bond buying drives by saying they were nothing more than an asset swap. Our response at the time was to say, ‘Yes, but you are swapping non-money for money on an unprecedented scale’ – an act that can have the most far-reaching consequences, indeed.

Moreover, the ‘swap’ is not just a monetary, but also an overtly fiscal act if you reckon with the reduction in the interest charged when rolling over some of the outstanding debt, as well as the naked seigniorage to be had from substituting reserves (especially those to which are appended negative interest rates) for higher-yielding securities in all their tens of hundreds of billions. The cynic might say that this is in fact nothing less than the most perfect form of debt repudiation ever carried out in the long, weary infamy of sovereign default.

The fact that the most feared of the likely effects of such a programme – a widespread, self-aggravating spiral of price rises to rage like a pestilence though the markets for goods, services, and labour – has not yet materialised is seen by the smug – and among them, we must count Friend Draghi, with his supercilious call for a ‘statute of limitations’ on the promulgation of such concerns – as a complete justification of their actions.

Ironically, since the QEasers are wedded to the same sort of cart-before-the-horse shamanism that Roosevelt and Morgenthau practised when setting the price of gold over the former’s breakfast egg – namely, the superstition which holds a rise in prices to be in and of itself the most effective trigger for a return to prosperity – the refusal to date of said prices to budge very far at all should have occasioned the Serial Stimulators to question the efficacy of their nostrums and not to stoop to throwing brickbats at those who expect the same thing to ensue which the policy-makers themselves so greatly desire, if admittedly in a somewhat less vigorous fashion than the one the wheelbarrow worrywarts have been publicly dreading.

Faced with the patient’s continued lack of response, the physician should really be posing the question not only of whether the medicine is appropriate for the case but whether he completely misdiagnosed the ailment in the first place. There are many plausible explanations for why recorded ‘inflation’ has been so subdued, among which narratives are several common themes to be found. One such is that the debt overhang and the consequent evergreening of loans keeps other lenders chary of becoming exposed to firms being run for cash at their bankers’ behest lest the first hint of a better liquidation value, or the arrival of a new, get-all-the-bad-news-out-now, broom as CEO, signals a ruinous end to the lender’s forbearance.

Another postulates that the straitened condition of the public treasury leaves people anxious about the next wave of confiscatory taxation. A third contends that mere basis point levels of interest rates are counterproductive in serving to eradicate the necessary distinction between money – whose main purpose is to circulate uninterruptedly from one transaction to the next – and savings – which are supposed to pass the baton of spending on to a third party, giving them the power to transact in one’s place. One can see elements of all these at work today, frustrating the designs of those in command of the printing press.

But yet another feasible diagnosis is that ‘inflation’ is not so much as dead as it is hidden: that its true measure is the admittedly unobservable one of how much policy has propped up prices which should have fallen much, much further when the overabundance caused by the credit-driven malinvestment of the past met with the much lessened appetite and much reduced means of purchase of consumers who also had succumbed to the lure of too much cheap credit in the boom.

Central bankers would view that last scenario as something of a triumph, for they are utterly wedded to the myth that falling prices are especially pernicious in the face of unresponsive or ‘sticky’ wages – a credo to which the Swiss may be about to give the lie as they consider whether to offset the franc’s dramatic rise with the introduction of extra, unpaid hours for workers, or even the dismissal and re-engagement on inferior terms of their entire staff. The central bankers also subscribe to the risible theory that the very expectation that prices may be about to fall is enough to send the Body Economic into an instant catatonia of abstention: a state of utter pecuniary paralysis where we all sit around, bellies rumbling, fires unstoked, children unshod – and latest tech upgrades unqueued for – until those prices finally bottom out.

The greater truth, however, may be that what is being done to assist them is the very thing that is preventing markets from clearing; that it magnifies entrepreneurial uncertainty (and so effectively raises hurdle rates much faster than low market rates can reduce them); and that, by avoiding the bankruptcy of the few, it ensures the enervation of the many, as sub-marginal businesses cling on to labour and capital which could be better used elsewhere and where the life-support afforded them absorbs too much space on bank balance sheets – much to the detriment of the would-be creatively destructive who must wait in vain to snap up the bargains with which they stand ready to reorder the commercial world.

Beyond this, it is also doubtful whether this sort of QE is even well-grounded in the basic theory of how it is supposed to take effect, rather than at the more rarefied levels we have visited above regarding why we should wish it to do so. While no one can condemn the lack of effort expended by the BOJ, the Fed, the BOE, or even the PBoC, the track record is in truth a spotty one.

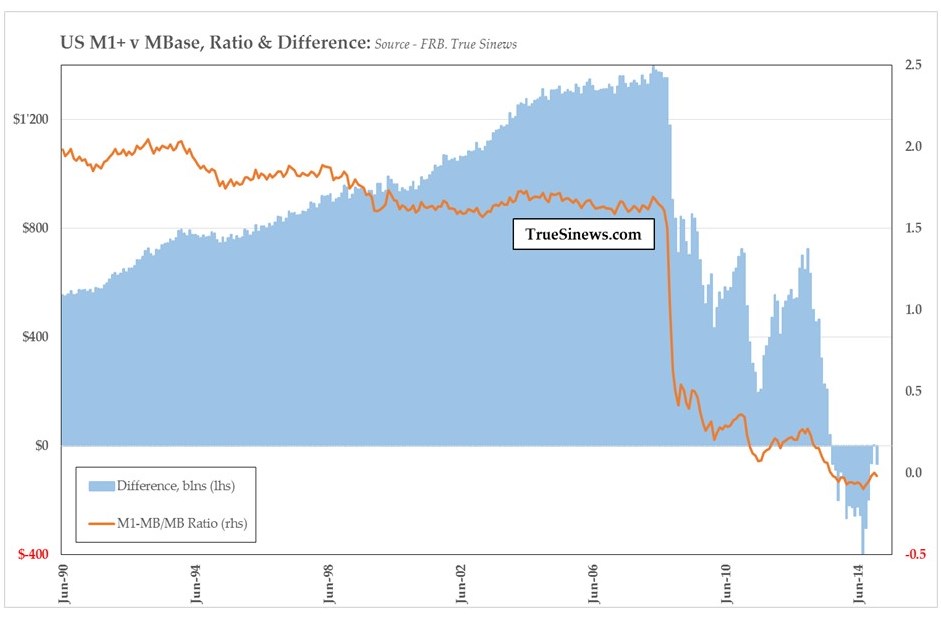

This is not least because it is not at all evident that central bank gavage can always do much to get the golden goose laying again. Instead, the record suggests that its creation of vast increments of ‘outside’ money – currency and reserve balances – is not quite so ‘high-powered’ as the textbooks would have us believe, not in a world where it has for long not been banks’ reserve quotients which matter for the application of Liebig’s Law of the Minimum to credit policy. Indeed, if we look at what has happened to the other big central banks when they have opened the sluice-gates, we must conclude that their ‘outside’ money has largely come to substitute for, not provide the catalyst for ‘inside’ money creation by the commercial banks.

Take the UK. There, since the Crash of 2008, the BOE has quintupled the monetary base, no less: yet money supply is up only a third (and M4 lending has actually declined £158 billion or ~7%), meaning that while at least positive in this case, the ‘multiplier’ has amounted to a paltry 16p of extra ‘inside’ money for every £1 sterling of the ‘outside’ kind. [Draghi, Deflationistas more generally and retro-Radcliffian ‘total liquidity’ fans should all take note that falling bank lending has been clearly trumped by the impact of rising money supply in exciting Britain’s typically unbalanced recovery]

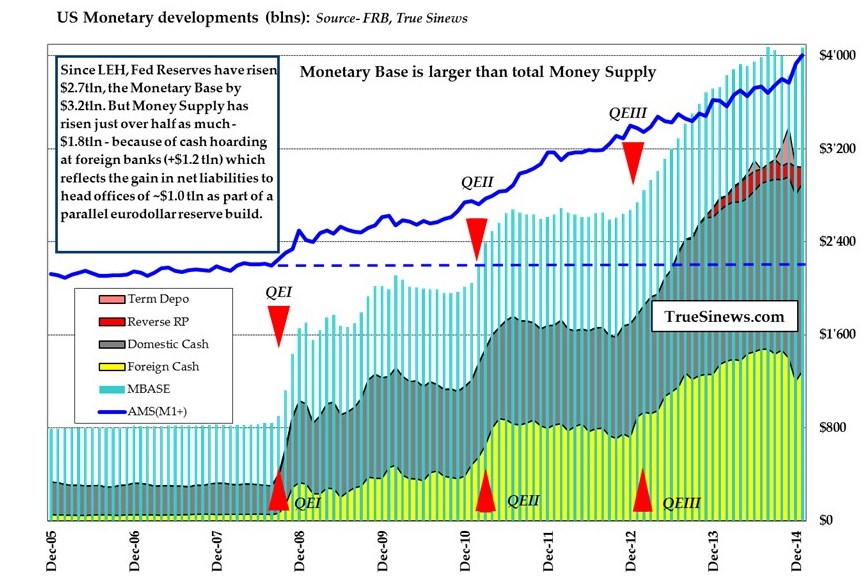

For its part, QEI-III in the US has seen roughly $2.7 trillion added to reserves and so – with currency included – the monetary base has been pumped up by $3.2 trillion since the LEH-AIG crisis. However, money supply proper (essentially M1+) has ‘only’ risen by $1.8 trillion (actually an ‘only’ which constitutes an historically high deviation from trend). This is a combination which bears the construction, therefore, that far from boosting its stock, the Fed has destroyed 45¢ of bank ‘inside’ money for every $1 of the ‘outside’ variety it has injected.

Capping it all, since the assault on good sense that is Abenomics was first perpetrated two years ago, the BOJ has doubled the monetary base there, an increase of Y138 trillion. Yet M1 has grown by no more than 11%, or Y60 trillion, in that same period, implying that the BOJ has managed to vaporise 57 ‘inside’ sen for every ‘outside’ yen it writes onto its own books.

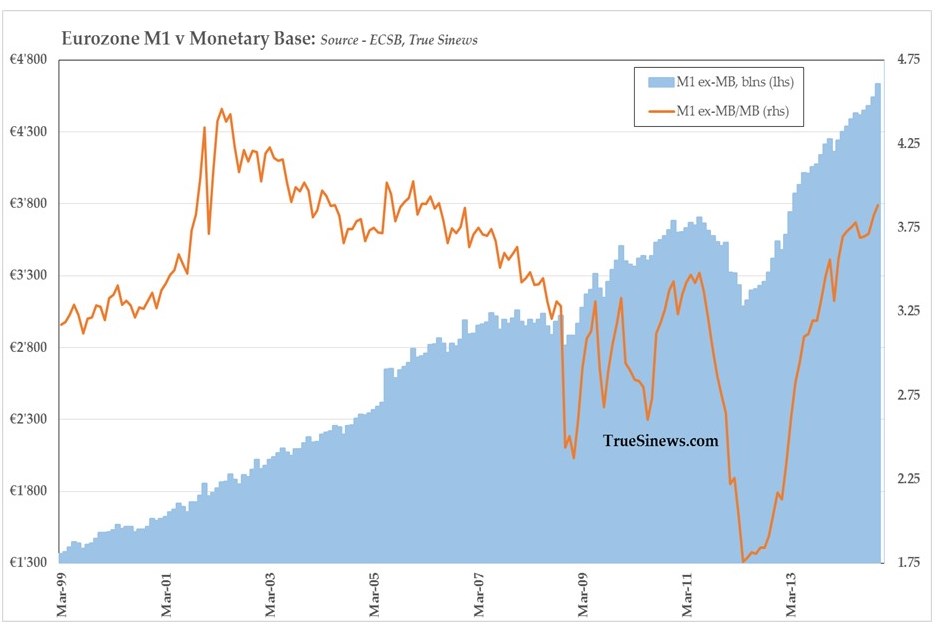

As for the ECB itself, it has actually managed to keep the nominal money supply growing at the eminently reasonable clip of 6.6% CAR since the Crash. Moreover, 2014 closed with the growth of real money accelerating to almost 7% – a whisker off the best in nearly a decade if we ignore the anomalous rebound from 2008’s tailspin. In the background, the reader should be aware, the monetary base has been wildly erratic as policy has coughed and spluttered, fortunately with very little correlation to what has being going on beyond the corridors of power.

Why is it, then, that the members of the Southern Front of the ECB have pushed through such a controversial policy now? Are they really that anxious to prevent the hard-pressed Spanish housewife from reaping the benefits of lower fuel costs in her household budget? Do they really suppose they will advance the cause of ‘structural’ reform when even the most reckless government can now turn to the Bank to ensure that its debt will always find a willing buyer? Do they think they are unwinding the ‘Doom Loop’ between banks and their governmental masters or that, if they do, this will again spur the banks to lend to every businessmen crossing their threshold or – a proposition harder yet to defend – that it will make businessmen more eager to borrow from the banks? Do they ever stop to work out whether this would be a good thing if it were to occur, rather than a three-lane highway to hell?

One thing the policy will certainly do is bleed income from those very same, sorely afflicted banks their Guardian Angel purports to protect. Why do we say this? Simple arithmetic shows us that once banks have satisfied their circa €100 billion minimum reserve requirement (and earned the associated €50 million interest on it) they start to become subject to the negative deposit rate – as they are already to the tune of around €140 billion in excess holdings. In a year’s time, Messrs. Draghi et Cie will have bought their €720 billion allotment, so banks will be paying 20bps on €860 billion per annum, or €1.72 billion, to their overlords in Frankfurt. Six months later, they will be the grateful recipients of another €360 billion and will be paying a further €720 million to keep them safe, too. Potentially, they will simultaneously lose earnings on their €1.87 trillion in holdings of government securities (the average interest rate at issuance for all of which is 3.0% but whose replacement rate and/or running yield will be not only be appreciably lower now but destined to decline further as a result of the ECB’s actions).

Now given that the Bloomberg European Banks index has a market cap of €900 billion and trades on a multiple of approaching 45, we can see that earnings for its members amount to roughly €20 billion (including the winnings of British, Swiss, and Scandinavian, as well as Euro banks). That €2 billion deposit tax therefore represents a sizeable chunk of profit, even without reckoning on income losses elsewhere in the portfolio and before allowing for the cost of any extra capital which has to be raised as balance sheets swell and leverage ratios rise.

But what of the wider effects? Well, householders earn around €70 billion in net interest a year (before taxes), so that is about to take a hit. They also keep around 60% of their financial assets – a sum of €12.2 trillion as of QI’14 – in the form of deposits, debt securities, and loans, around a third of which resides in their pension and insurance plans rather than being directly owned. Against this, they are collectively on the hook for €6.1 trillion in loans, so putting their chances of loss at twice those of the possibilities for gain even before they start to cough up higher pension contributions and insurance premia as institutional income dwindles.

For all those involved in this grouping, the main hope – apart from some miraculous burst of hiring and productive expansion suddenly occurring in response to Draghi the Magnificent’s latest conjuring trick – is that the notional gains on their €8.2 trillion of equity exposure (€3 trillion of that at the pension and insurance companies) continue to accrue and that these can actually be used to pay the bills, as and when they arrive.

The caveat here is that contained in our previous piece and embedded in our header: that ‘silver is the true sinews of the circulation’. Let us try to explain.

One of the most evident effects of all the reflationary attempts to date is that while it is no more than arguable that they may have had some marginal impact on actual wealth creation above and beyond what would have happened anyway as people readjusted to the post-Crash, they have without doubt unleashed one speculative wave after another in the markets.

Rather than the greater weight of nominal money at people’s disposal being recalibrated as the kind of precautionary real balance one holds against one’s foreseeable regular outlay on goods and services (a phenomenon which comprises the old-school inflationary reapportionment for which the authorities so yearn), it has taken place in terms of the portfolio balance of assets to be held in a minimal interest rate environment. If the excess money burns a hole in one’s pocket, the ‘inside’ type cannot be collectively diminished, except by paying down debt (and the ‘outside’ type not all unless the central bank is complicit in the deed). Thus, it will be used mainly to pass other assets around in an ascending spiral of price appreciation until a new level of comfort is reached between notional net worth and cash at hand.

The problem is that such a spiral can all so easily go into reverse if the money is now withdrawn from its job of passing parcels between the players so it can be used to buy things outside the circle. Prices will assuredly dip and if the check delivered to the rise in valuations as the first few cash out their chips dislodges one or two too many margined grains of sand, the resulting avalanche can swiftly come to make boring old money seem winningly secure once more and so give rise to further waves of selling. What goes up, and all that.

So has it largely been these past several years. A perceived surfeit of money has not circulated with much renewed vigour against tangible goods and real side transactions, as was hoped would be the case, but it has swirled with often cyclonic fury among all the buyers and sellers, firstly of commodities, then of EM securities, then of junk debt, tech stocks, equities in general, and lately of US equities in particular.

Hence the overstretched valuations in both bond and stock markets and hence the politically-sensitive perception that ‘inequality’ is rising – that only the 1% is benefiting. To the extent that latter charge holds water, the great irony is that – pace Piketty and the rest of the petulant Progressives – it is not because the evil Plutocrats have somehow rigged the game in their favour, but because the Global Left, being avowedly Keynesian-Inflationist for the most part, has got its redistributional arithmetic horribly wrong.

The ‘euthanasia of the rentier’ is not, dear Maynard, taking place to the advantage of the horny-handed sons of toil, nor even to the gain of the scowling industrialists who ‘exploit’ them so mercilessly, but the spoils are rather going to the remuneration committee royalists in the corporat(ist)e boardroom – furnished as it is in C-Suite plush with trimmings of ESOP perverse incentive. And what is true of Davos Man holds true in spades of the grandest of punters of Other People’s Money who can now font leurs jeux in a global financial casino made even bigger and brasher than before by the misplaced arguments and ill-judged actions of the Krugmans, Kurodas, Carneys, and Coeurés of this world.

Too low interest rates and falsified capital calculation is at the root of much of what afflicts us, gentlemen of the central bank, and the sooner you accept this truth and retreat humbly to your appointed place, adopting as you do the self-effacing demeanour and taciturn approach of the Bundesbanker of yore, the better it will be for all us in the sorely put-upon 99% for a change.

Addendum: Some members of the Euroclerisy have been stamping their feet in pique in recent days, moaning that the tattered fig leaf offered by Draghi to the dwindling band of constitutionalists – viz., that four-fifths of QE will be a home-grown affair whereby the National Central Banks will be charged with buying whatever bonds and incurring whatever risks they see fit – has been a gross breach of the principle (!) of solidarity and that it enshrines a dreadful obeisance to those outdated tenets of democratic sovereignty which is anathema to all good servants of the Apparat.

That this is nothing more than a straw man, served up to hide their, the QEasers’, end run around the spirit of the law should be obvious from a scan of the Eurobanks’ own accounts (much less from a glance at the still lofty T2 totals extant out there).

As of the third quarter of last year, Euro MFIs had, as a group, non-bank deposit liabilities of €12.2 trillion, 87% of which were taken from individuals and businesses in their own country and just 5% from other members of the Zone. Of the €12.7 trillion in loans to non-banks, again seven-eighths were domestic and a piffling 5% were extended to residents among their Euro ‘partners’. Seen in that light, an inspection of the geographical origin of securities held showed they were, by comparison, the souls of impartiality with a mere 65% issued within the home borders and 23% coming from across the frontier.

That’s integration for you!

READERS WISHING FOR A FURTHER PERSPECTIVE ON ECONOMICS AND POLITICS AND ON THEIR IMPLICATIONS FOR FINANCIAL MARKETS ARE INVITED TO SUBSCRIBE TO THE SEMI-MONTHLY ‘MIDWEEK MACRO MUSINGS‘ FOR A SYNOPTIC VIEW, AS WELL AS TO THE FULL, IN-DEPTH MONTHLY, ‘MONEY, MACRO & MARKETS‘, BOTH OF WHICH ARE NOW AVAILABLE, COURTESY OF HINDESIGHT LETTERS.

PLEASE CLICK THE LINKS FOR MORE DETAILS

NB The foregoing is for educative and entertainment purposes only. Nothing herein should be construed as constituting investment advice. All rights reserved. ©True Sinews

s