A noted [monetary extremist] resident at GMU’s Mercatus Center fretted on March 20th that Japan’s efforts during 2001-06 to have the central bank finance deficits ‘didn’t work’ – i.e., they failed to ignite meaningful levels of wealth-sapping inflation.

The reason? As our sage tells us, was that there was ‘no commitment… to a permanent expansion of the monetary base’ as expounded in the ratiocinations of that dark genius of modern central bank theorising, Michael Woodford. We replied:-

‘Theory tells us why Japan didn’t inflate’ Really? That would be news to all those who still wrestle with this! But two things – non-Tinkerbell expectations-type things – may in fact explain it.

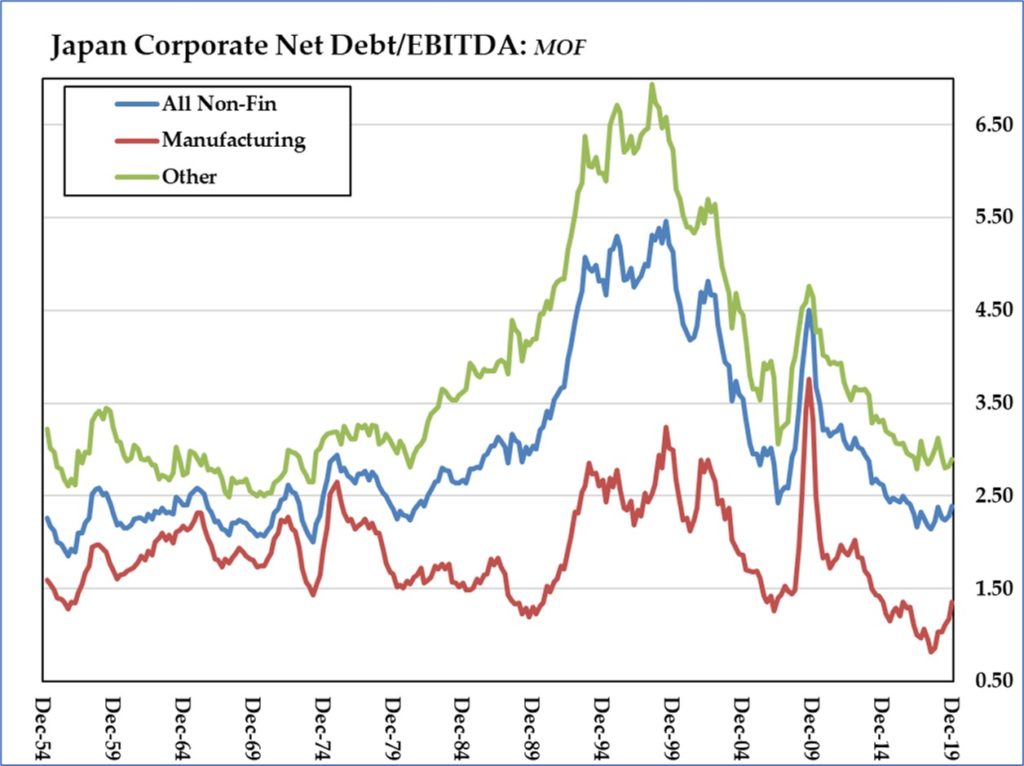

In the first instance, business made a big shift from being heavily – if not disastrously – indebted in the go-go, zaitech “Rising Sun”/”Black Rain” era of the bubble to today’s to near record low levels of net debt/EBITDA, mirrored by the state’s plunge into the red and all intermediated by the BOJ

In effect, corporate debt was slowly washed to the government whose IOUs were bought by the central bank. Reserves issued against these offset bank deposit liabilities to the now flush businesses who were happy to hold them because NIRP and the ‘yield curve control’ implemented by the BOJ destroyed the usual transaction/savings balance distinction between money and other forms of holdings.

So what we had here was substitution, not outright inflation.

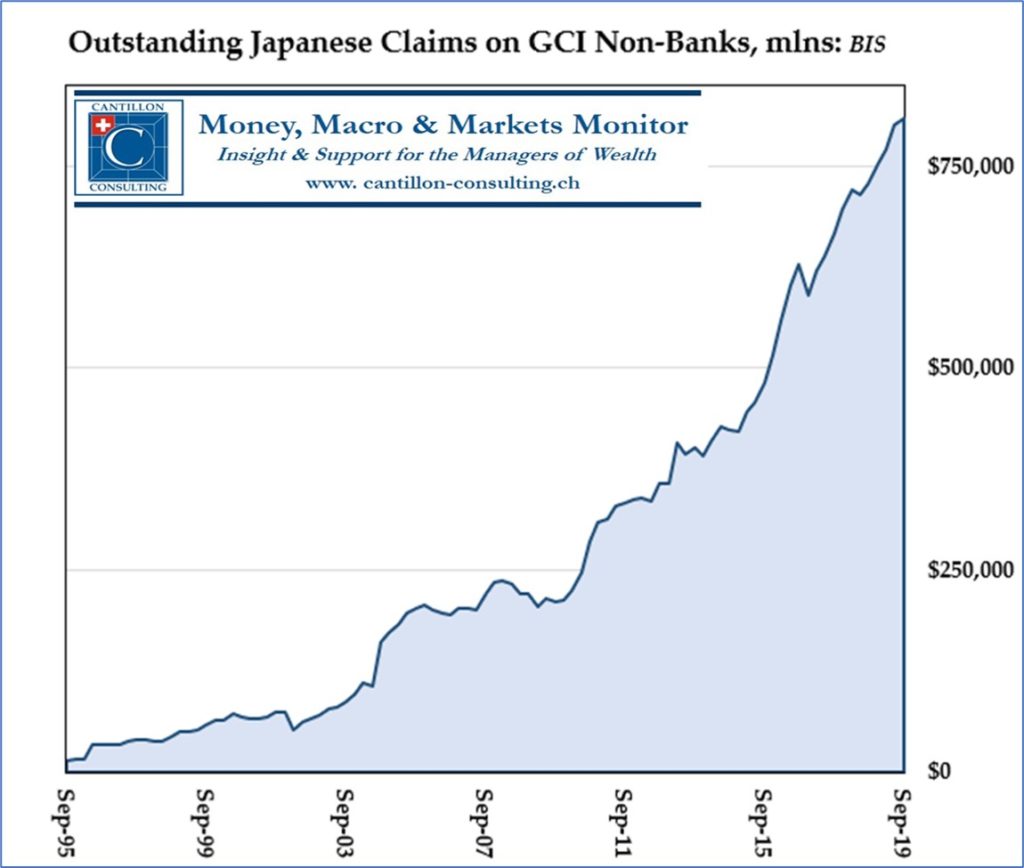

Meanwhile, much of Japan’s newly created money was swapped up and used to finance speculative purchases elsewhere in the world, rather than sitting at home boosting prices there. By way of example of its contribution to the cycle’s speculative excesses, see here for the claims accumulated on ‘’non-bank financial institutions’ – loosely, hedge funds – in Grand Cayman.

Another matter which should not be overlooked is that a country which used to be wondered at for its eye-wateringly high prices – but which is highly internationally competitive and capital intensive – should probably have seen steady, beneficial, productivity-led price declines not increases, however modest. From this we can argue that there has indeed been ‘inflation’ on the home front; it is just that its effects have been partly hidden.

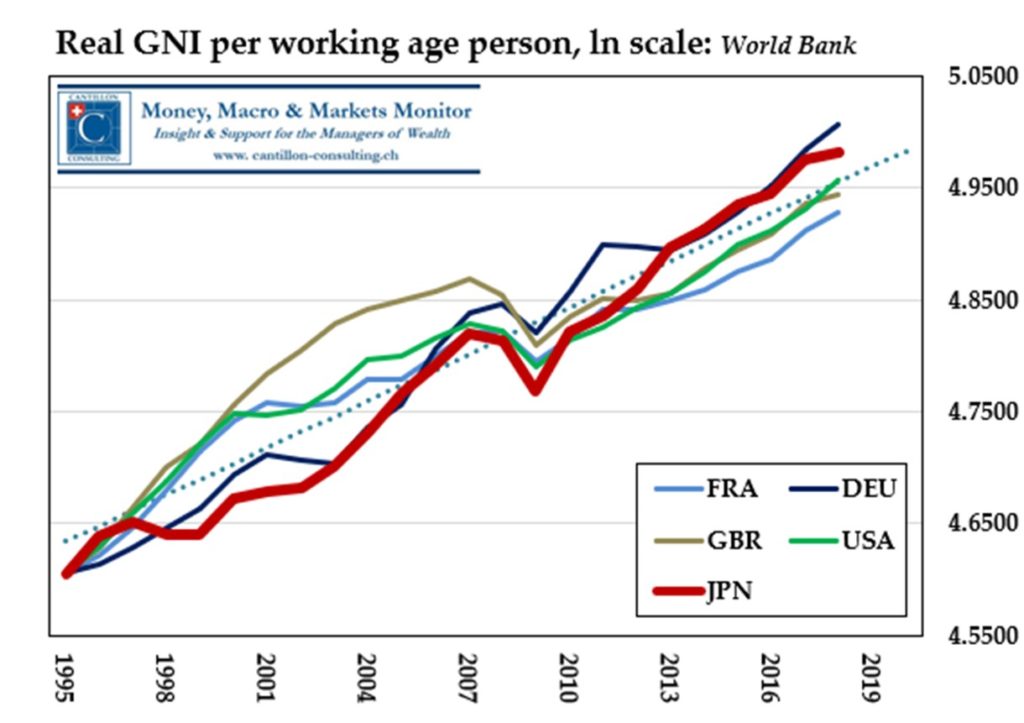

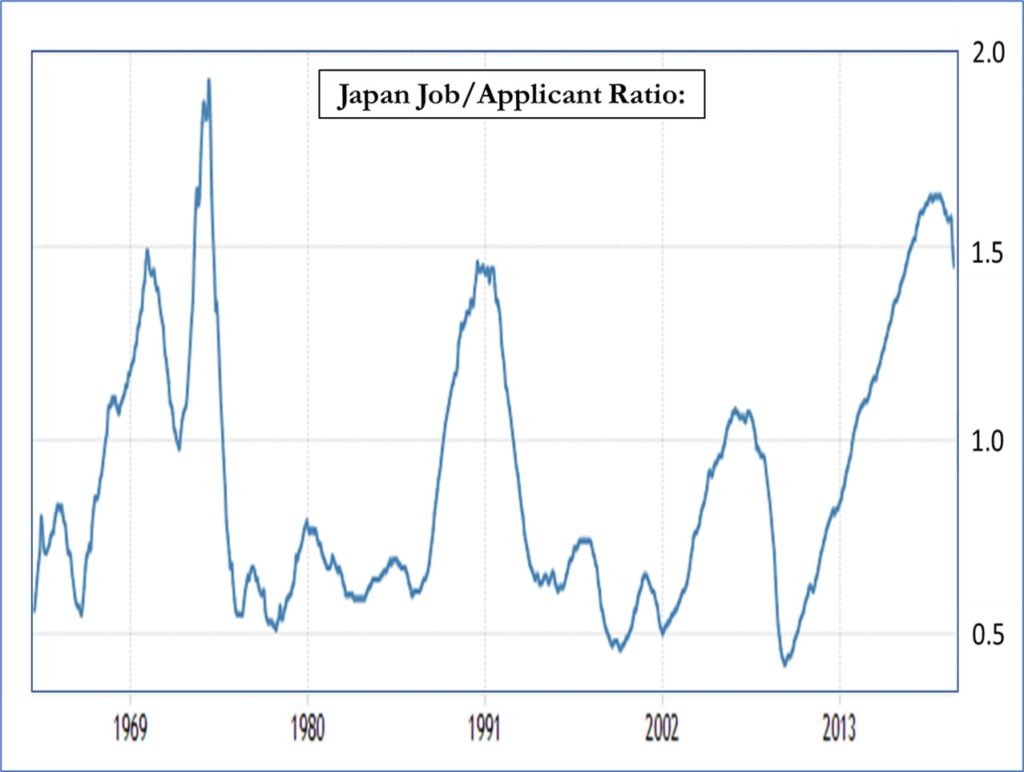

Note also that, adjusted for the working age population, real national income in Japan has compared favourably to the other large developed nations over most of the past quarter-century, while that other sign of economic good health – the jobs/applicants ratio – had been at multi-decade highs until the recent global slowdown began.

Just what IS supposed to be the country’s problem?

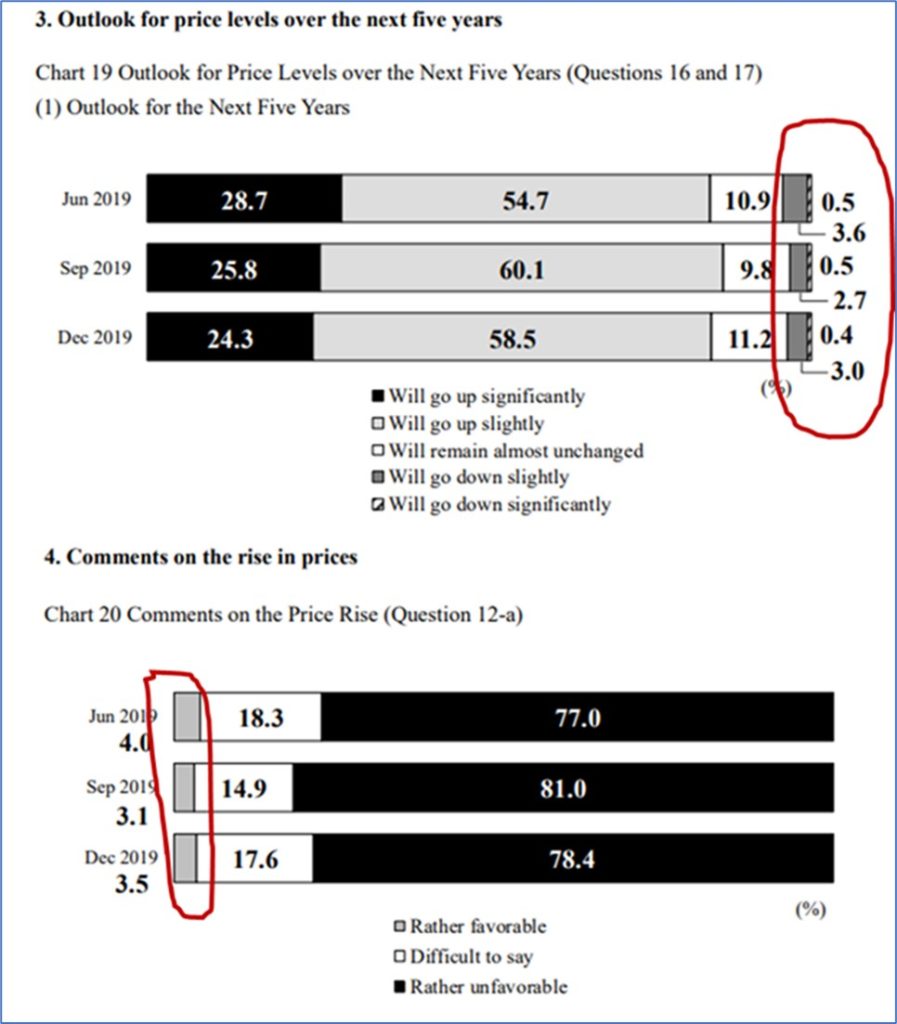

Note, too, that the regular BOJ survey of people’s attitudes and expectations shows NO signs of a ‘deflationary mindset’, NOR does it show people begging for their purchasing power to be more rapidly eroded at the behest of idiot savant monetary cranks!