Regular readers of these pages (whether here or in the author’s previous professional incarnations) will recognise that the analysis is informed by a core belief that while money should never be confused with wealth – and that therefore the latter cannot be conjured up by the central bank like a rabbit from a magician’s hat, however much people might wish it were so – the former is anything but neutral in its effect upon the creation, the distribution, and even the destruction of said wealth.

A secondary, but still highly important distinction to which we insist it is necessary to hold fast is that money – the supreme present good, the demand liability instantly and universally redeemable today at par, the generally dominant (if not absolutely exclusive) medium responsible for the smooth and efficient exchange of goods and services, the great enabling mechanism which obviates the need not just for barter, but for interpersonal trust among a transaction’s counterparties – is different from credit – which latter is actually a claim on money (and hence on the potential to acquire all other goods) only realisable in the future.

As Walter Boyd put it in his celebrated letter to PM William Pitt of 1801 in which he excoriated both the Bank of England’s wartime suspension of the convertibility of its issue and the ill-understood inflation to which it gave rise:-

‘By the words “Means of Circulation,” “Circulating Medium” and “Currency,” which are used almost as synonymous terms in this letter, I understand always ready money, whether consisting of Bank Notes or Specie, in contradistinction to Bills of Exchange, Navy Bills, Exchequer Bills, or any other negotiable paper, which form no part of the circulating medium, as I have always understood the term. The latter is the Circulator; the former are merely objects of circulation.’

As the redoubtable Scotsman went on to spell out: ‘…the common-place declamation upon the encrease of the public debt, as forming an addition to the circulating medium of the country…’ was only ‘…to confound causes with effects…’ since ‘…the public debt and the currency of the country are “Distinct, as is the swimmer from the flood.”’

The case that this clear functional distinction may occasionally become blurred by the ease with which many debt claims can also find acceptance as intermediaries in exchange – most readily in the somewhat incestuous exchange of one claim for another in financial markets – is neither here nor there. When the end of the chain is eventually reached, when the game of pass the parcel at last comes to a halt, it will be money that effects the final, definitive, unrepudiable settlement of all the associated obligations taken under contract. The first of the only two possible exceptions to this dictum arises in the exceedingly unusual circumstance that the baker really does now want his shoes re-heeled and that the cobbler is equally and simultaneously anxious for a fresh loaf of bread for his lunch and that the two concur that no better use for their output presents itself at the precise moment they agree to deal by way of a swap. The second comes about when it just so happens that, last week, the baker let the cobbler have a loaf on account and now wants his shoes done in order to wipe the slate clean.

As we say, not entirely unimaginable coincidences, but very, very unlikely in a world where we have so prodigiously divided our labour among the inconceivably complex, intimately interwoven strands of that Gordian knot of production from which we all routinely derive such enormous, if mundanely unrecognised, benefit.

It may also be true that the most pervasive, the most disarmingly lucrative (if chronically disaster-fraught) attribute of our banks is that they possess a precious, collective monopoly of being able to transmute credit into money simply by substituting their demand liabilities for those of a third party who is himself unable to – indeed, is not contracted to – discharge his schedule of dues for the moment. From the banks’ exploitation of this enormous legal privilege it is certainly the case that the money:credit divide may often become quite blurred.

Since it also means that even claims relating to the most immobile and long-lasting instances of physical capital may ordinarily be instantly monetized (and the saver thereby relieved of his freely-assumed and economically desirable duty of abstinence) this is a deed which disconnects the title from the reality of a temporally separated act of inception and consummation. It is all very well the bank putting its own capital at risk by engaging in a so-called ‘maturity transformation’ in one direction – by putting the short-term deposits it attracts to work in offsetting long-term liabilities – since one could argue that, if sufficiently well capitalized, the bank’s combination of demand deposit and undated equity might make a time-weighted whole equivalent to the tenor of the loan. The converse, however, when it deliberately creates demand deposits for those bringing it long-dated paper us far more objectionable on fundamental grounds for this renders the all-important natural rate of time preference of only nugatory importance in setting market rates of discount and so opens up a Pandora’s Box of entrepreneurial error.

In exercising this privilege, what the bank is actually doing is to set an actuarial expectation of gain – if one regrettably buttressed by the morally hazardous assurance which it typically extracts from a biddable public authority of support when the gamble misfires – against the mathematical certainty that it can never hope to discharge all such obligations at once. Given that this is what it implicitly promises to do when it issues them, this practice constitutes perhaps the most long-lasting, socially-accepted, legally-condoned fraud ever perpetrated.

During the heady atmosphere of the upswing, almost any legally recognised evidence of a claim (like the vast majority of its kind, probably no more than an ephemeral pattern of electric charge peppering the semi-conduction layer of some anonymous microchip) can be rendered up as quid pro quo in the acquisition of a second, similarly disembodied title. Hence, credit can give rise to more credit and each can power the whirligig interchange of the other, irrespective of whether these pass across a bank’s books or whether they circulate among the other, more exotic species of financial intermediary which populate the wilder reaches of the so-called ‘shadow’ system.

Whatever the split between the two, it will still not be possible to do away with money entirely. For, as the great Cantillon made clear all of three centuries ago, when the notional gains from such mutually reinforcing dealings swell the individual’s reckoning of his net worth beyond a certain point, he will be tempted to draw down upon them so as to enjoy a portion of these illusory winnings in a more deliciously material form.

At that moment, our hero will find that money’s service is no longer to be scorned for unless he can persuade the Audi dealer to accept his AAPL stock certificates in payment for his new wheels (an arrangement which is merely a refined case of what took place between the baker and the cobbler of our recent acquaintance), he must first sell them for money and then transmit this to the car dealer’s account. That money, in turn, will either come from the existing holdings of the third party who buys him out (meaning that no overall change has taken place, only a swapping of names on the corporate register and the bank account roll) or else the bank will create it ab novo for him.

Yes, that creation may be easier to arrange if the bank thinks that because that our would-be R8 owner is also an Apple shareholder this makes him a less risky proposition (whether or not it takes a formal charge over his shares in return), but, nonetheless, it has to involve a new emission of money – one which can only be extinguished again if the car dealer uses it to pay down some of his own, pre-existing debt or if he puts it beyond immediate use by making it over to his savings from his demand account.

Incidentally, if it transpires that the dealer grants our man a car loan, this does not vitiate the argument since the loan (usually made against evidence of income – i.e., against a prospective stream of money – by the way) does not constitute a final settlement of the trade, only an agreement to spread this out over a series of instalments this in return for the reward of interest. To reach that finality still requires a money payment, exactly as before, even if this now comes in a series, or is deferred to a future balloon, rather than being immediately handed over.

The further the boom progresses, of course, the more feasible it will seem to add extra floors to the skyscraper of credit being erected upon the narrow foundations of boring old money. The more easily one debt will suffice to pay for another in the market, the less the transactional demand for money in finance and so the further the existing stock can be stretched. The more easily debts can be passed on from one hand to another, the more often they will be countenanced in the purchase of goods and services outside the Great Casino, too, further limiting the appearance of money’s necessity – at least while the good times continue to roll.

At the same time, the more credit that is summoned into being, the more likely it is that at least some of the countervailing entries on the liability side of the T-account of the loan-granting bank will take the form of money, if not usually in full measure. Thus, from an analytical point of view, the evolution of the money supply will still be suggestive even if the broader credit trends must be examined for a full understanding of what is afoot.

Any disproportion between money and credit becomes all the more evident in two particular cases. One comes towards the end of the cycle when the relative shortage of cash – and the corresponding difficulty of achieving financial finality – is making itself felt, piling up accounts receivable and other such testimony to the growing constipation of the system. It is, for example, easy to show that when the ratio of money (for which we use M1-type estimates) to all other forms of bank liability (M3 less M1, for example) rises or falls, both intangible indicators such as business confidence surveys, as well as more concrete measures such as shipments and revenues, wax and wane in sympathy.

The second key instance – one which definitionally does not show up in the badly named ‘monetary’ aggregates – arises when the banks become addicted to the ostensibly self-cancelling business of shuttling entries back and forth between themselves in the form of interbank lending and deposit taking. As the salutary events of 2008 should have made us all aware, the salient difference between the zero net exposure which they trumpet to their regulators and the rising gross exposure which they are actually incurring can be a catastrophically wide one once the integrity of the system within which these are undertaken comes into question and the money shortage, so long ignored, makes itself forcibly apparent.

It is a useful truism that in credit/business cycles, too, the bigger they are, the harder they fall. Once the architectural aspiration to build ever heavenward starts to stretch the limits of engineering possibility, it is often the case that Humpty Dumpty becomes panicked at the resulting sway in the structure and so attempts a foredoomed base jump off the financial Burj from whose observation deck he has been hitherto admiring the view. Suddenly, that scanty underpinning of money becomes much more highly prized. We all start to show a more insistent preference for pelf in place of promises. Where we have had no choice but to take more IOUs from our cash-strapped customers, we urgently ty to convert them into money-proper and – Hey Presto! – before you know it, we are all rushing out of the shadows and back towards the harsh, fluorescent glare of the banking hall.

What a pity then that when we do crowd, jostling and shouting, in there, we find that the bank, too, has been suckered into stretching its balance sheet too far and into compromising its liquidity too greatly to disentangle itself, never mind us. This is also the point when we are rudely reminded that liquidity itself, of course, is never an absolute, but rather an emergent, non-linear property of a web of interchanges whose gossamer threads are now tearing apart and whose once-flexible nodes and ganglia have suddenly frozen up. In other words, we can only all be liquid when none of us much cares to be.

As Cantillon, drawing on his own successful experiences in both the Mississippi and South Sea Bubbles of the early 18th century put it:-

‘In 1720, the capital of public stock and of Bubbles which were snares and enterprises of private companies at London, rose to the value of 800 millions sterling, yet the purchases and sales of such pestilential stocks were carried on without difficulty through the quantity of notes of all kinds which were issued, while the same paper was accepted in payment of interest. But as soon as the idea of great fortunes induced many individuals to increase their expenses, to buy carriages, foreign linen and silk, cash was needed for all that, I mean for the expenditure of the interest. And this broke up all the systems.’

Parenthetically, though there is no way of doing such a thing accurately and consistently across such a great historical divide, a quick now-and-then comparison of the wages of various military ranks and of professionals such as lawyers roughly scales that £800 million up to around £200 billion today. An imposing total indeed for a nation of only some 5 million, much less affluent souls.

As the canny Irishman went on to sum up:-

‘This example shews that the paper and credit of public and private Banks may cause surprising results in everything which does not concern ordinary expenditure… but that in the regular course of the circulation, the help of Banks and credit of this kind is much smaller and less solid than is generally supposed. Silver [money] alone is the true sinews of circulation.’

Now, dear reader, you can see the derivation of the name under which our work is currently being published, as well as the reason we have a satirical print of the Rue Quincampoix as our banner – and a twitter icon of John Law’s head crossed out with a bend sinister, gules, apocryphally the heraldic symbol of bastardy.

With that rather lengthy preamble out of the way, let us now turn to more immediate considerations. For the alarming truth is that, despite the worst Faustian efforts of the world’s central banks to work their malign magic and thereby spare both commercial banks and governments the ignominy of facing up to the full consequences of their boom-time folly, they have lately been faltering badly in their prime inflationary purpose.

To interrupt the flow for a moment, we should also bear in mind that the culminating mania whose consequences we are still trying to camouflage was only able to degenerate as far as it did because of the complicity of those very same central banks we now look to for salvation. This they did over a succession of previous manias through their profound corruption of the vital economic signals comprised by interest rates – by slashing them precipitately to then-unheard of lows before baby-stepping them predictably back up to lower highs as each replacement wave of malinvestment and overconsumption expanded amid the rubble of its predecessor.

We should add to the charge sheet the indictment that they openly encouraged fiscal irresponsibility as a crass Keynesian offset to the aftershocks of the imploding Tech boom and so offered a fatal inducement to the political class to buy votes regardless of the ultimate cost. They resolutely ignored the mounting total of sectoral and external imbalances, each increasingly being financed in the most volatile, most self-aggravating fashion. To cap it all, they turned a blind eye to the worst excesses of the pandemic of ‘regulatory arbitrage’ which was then raging unchecked through the world’s financial centres like a rat from the hold of a Genoese merchantmen let loose in the sewers of 14th century Messina.

But we digress. The issue at hand is that if our principal indicator of this is not misleading us, central bank inflationism is visibly on the wane, at least on the grandest of scales. Granted, it is always important to maintain a healthy distrust of economic aggregates – which can have as little relevance to the individual well-being of the people whose actions incrementally contribute to it as does the thoroughly dubious concept of a global temperature to the detailed understanding of climatic, much less meteorological, conditions. That being said, one convenient and broadly useful gauge to which we make frequent appeal is one which, to continue the metaphor, is perhaps more weather-vane and wind-sock than a precise, scientific anemometer but which, nonetheless, can serve to warn us of an approaching squall.

In essence what we consult is our own estimate of developments in a quasi-global, single-currency measure of the supply of money. We construct this indicator in practice by adding together M1+ type data both for the seven largest developed nations (25 of them if you note that one of the constituents consists of the entire Eurozone) and for the eight largest emerging nations, each of them being translated in turn into US dollars before summation.

Changes in the stock of money can strictly only affect nominal variables in a direct way – and then with often unpredictable lags and with differing degrees of vigour (see our discussion above of how this differs according to the phase of boom and bust). While the impact on real quantities is even more uncertain, it can nevertheless be seen that periods of strong money growth rarely go unreflected in a plot of broader economic activity. Perhaps unsurprisingly, such episodes tend to accompany some combination of rising prices, increased trade, and higher output. Naturally, the converse applies, for just as a rising market incites the creation of more money and credit with which to push prices yet higher and so seemingly to furnish a post hoc justification for each earlier round of lending, so too can the convective spiral flip over into a maelstrom of falling values, insistent margin calls, and significant banking impairment when things go awry.

Usually, the causality appears to run from the money to the material economy since it is far easier to create and direct the use of new means of payment than it is to launch a new industry or to expand the stock of physical capital within and attract new workers to an existing one but, just occasionally, major innovations in technique, politics, or law can launch us upon one of those orgies of excitement we term a New Era and our impressively elastic banking system will soon respond in kind by engaging in a rapid and often equally innovative expansion of its own. Of such things as canal booms, railway manias, and tech bubbles born.

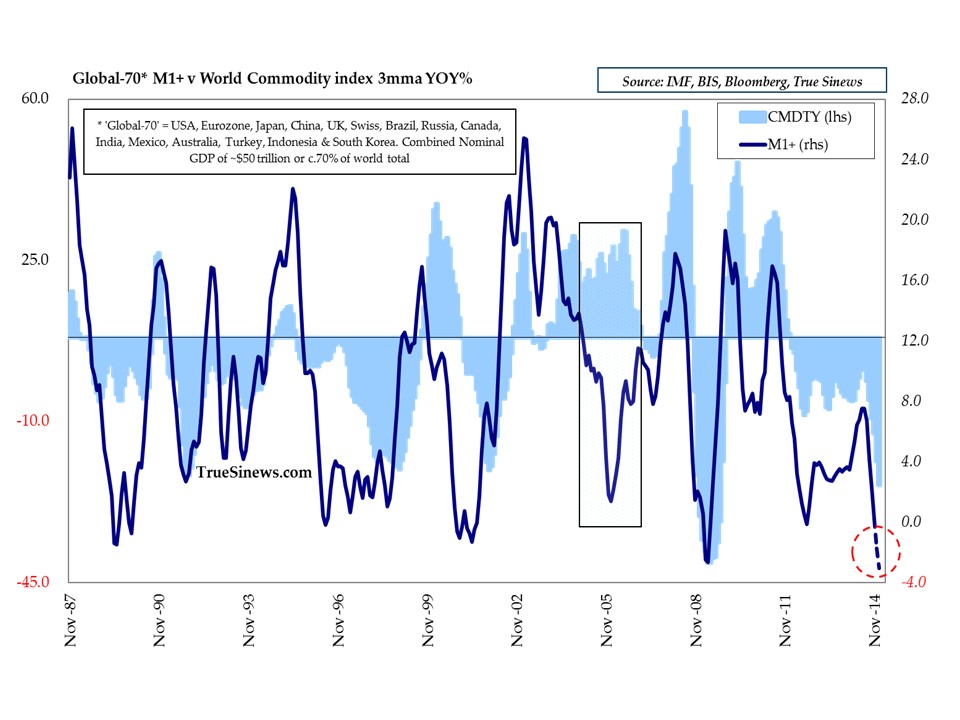

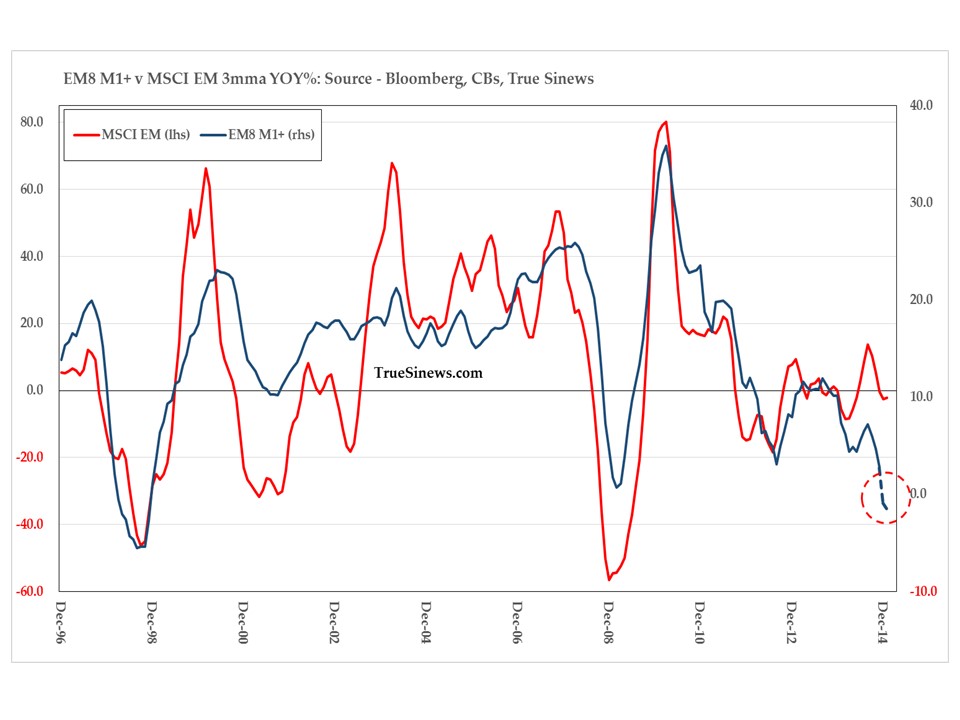

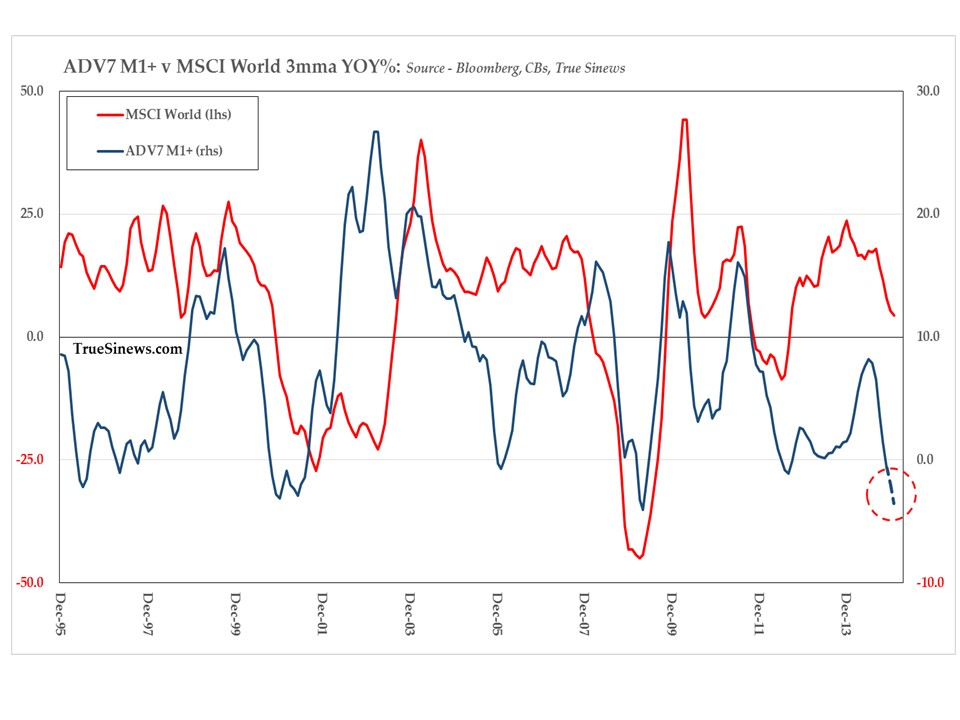

To us then, it is no accident that the dramatic 180-degree swing which the last six months have seen, taking us from record levels of complacency (as characterised by the lowest equity and currency vols on record, together with the lowest junk and EM bond spreads since LEH) to today’s whipsaw expressions of angst, has taken place amid a sharp slowdown in money growth, with the headline number dropping from a 2 ½ year high of 7.5% YOY to near zero. Within this, the EM component has fallen from 8.2% to 2.8% (the worst since the GFC) and the Advanced Country version now dipping its toe into the minus column.

In fact, taking our life into our hands by extrapolating the last several months of money supply trends and applying to them the exchange rates of the moment, things might be very much more parlous than even this suggests, with the Advanced Country projection receding at a pace which was only worse during the icy depths of the post-LEH freeze and with EMs on target to hit their lowest since the devastating Asian Contagion of 1997-8. Taken as a whole, this somewhat precarious ‘nowcast’ suggests we might currently be witnessing our least expansive global monetary conditions – QE, ZIRP, and all – since our proprietary data series began back in 1987.

Much of this shrinkage is, of course, due to the rise and rise of the US dollar. Not simply a banal matter of expectation of divergent central bank policies, the relative return boost this gives US assets over their increasingly stressed ROW alternatives – not to mention the rivet-popping pressure it applies to unhedged offshore borrowing and semi-legal commodity collateral trades – is feeding back to keep the dollar ascending. This further reduces the effective weight of that part of the world money stock denominated in now depreciating currencies and retards our indicator to the point where it warns not just of falling prices of things like energy and metals (in themselves no bad thing), but possibly of a shrinkage of trade and of a coming decline in output. The present pain might therefore be the start of a prolonged trial, but it also has the potential to intensify in a dramatic fashion if somebody, somewhere finds that their MTM threshold of tolerance has been crossed in their now burdensome carry trades.

Finally, bear in mind that, under such circumstances, even if Draghi (or his successor) manages to outflank his German opposition and indulges in an orgy of securities buying, not only will its possible effects include a paradoxical weakening of Euro banks as earning assets are replaced by penalty-interest excess reserves, but the resulting fall in the euro might be enough to negate any increase generated in the local money supply when this is considered from a global perspective, just as much of Japan’s beggar-thyself expansion has proven to be largely self-cancelling thus far.

A stronger dollar, other things being equal, also heightens the risks emanating from China where the need to ensure export competitiveness could contradict the imperative not to force mass liquidations among all those who have been shipping in vast quantities of petrochemicals, metals, and grains in order to use cheap (and once, reliably cheapening) dollars to fund speculative positions formerly concentrated in real estate, now in domestic equities. If we do see greater redemptions of foreign liabilities in China, this means that the stock of base money – absent any offsetting OMOs – will be correspondingly diminished. Barring the policy confusion of a lowering of reserve requirements by the PBoC, this would also imply yet more deceleration – perhaps even outright contraction – in overall money supply, even when measured in renminbi terms.

All in all, if such trends persist, monetary tightening may well proceed apace regardless of whether or not the Fed, the BoE, or any other late-cycle central banks actually move to push up interest rates.

We’re not sure even he gets why it is the case, but such a scenario would certainly make the recently bearish Bill Gross look remarkably prescient about what 2015 has in store. Though we would strongly contend that its demerits are vastly overstated, it cannot be denied that low nominal money growth is hardly conducive to the widespread price appreciation upon which so many hopes are misguidedly pinned. Low money growth will also cast doubt on the viability of a credit structure which has only been extended, not cut back as it should have been, during these last six years of policy-directed dearth and denial. Low money growth will be widely disruptive as it calls into question the entire premise that a few chosen members of the Nomenklatura can make good the ills of the world through the parlour magic trick of money illusion.

It will be even more disruptive if some among them decide that the only reason for the failure of their collective delusion of grandeur is that they have not been deluded enough and that even more wild-eyed palliatives are therefore needed. Disruption on such a scale is not what the budding entrepreneur wants to contend with as he contemplates whether to risk both his capital and his reputation in launching or expanding a business, in ordering new equipment, or hiring new staff and so fostering a meaningful recovery. Disruption on such a scale is not something we should wish to inflict upon a system we have been both unable and unwilling to fully repair.

Either way – damned if they do, damned if they don’t – disruption seems to be what we will get in the months ahead.

NB The foregoing is for educative and entertainment purposes only. Nothing herein should be construed as constituting investment advice. All rights reserved. ©True Sinews