There are signs that not only is money beginning to circulate more rapidly through cash registers everywhere, but that Corporate America is beginning to make good some of its recent, much-cited lack of physical investment and, conversely, is starting to eschew some of its contemporary over-indulgence in financial engineering.

It may be early days to be jumping to overly grand conclusions, but the last few quarters’ trend nonetheless bears watching.CHA-CHING!

As a glance at the financial press will readily confirm, PMI surveys around the globe – of which there now seem to be an embarrassing profusion, not to say, confusion – increasingly agree in generating gratifyingly expansionary readings.

Given the demonstrably close relationship that changes in at least the better-established of these measures (such as the IfO in Germany and the ISM in the US) have with a quickening of business revenue growth, the first big question to ask is whether some of that vast, superfluous overhang of money which has been so frustratingly inactive (from a policy-maker’s perspective) in much of the post-Crisis era now, at last, beginning to become ‘activated’, once more.

If such flows are indeed everywhere beginning to quicken – if such special factors such as the sudden, panicky perception of the need for a prudential reserve in the vast Eurodollar market; or the near-universal, ZIRP-driven eradication of differences between transactional and savings accounts; or the enforced suffocation of bank balance sheets with trillions of costly central bank credit balances, have now become far less inhibitory – it is not hard to envisage a rapid, non-linear feedback emerging as cheap money once surges more vigorously through relatively inelastic markets for goods and services.

Though the doomsday vision of catastrophic, man-made warming leading to a run-away melting of the ice-caps and hence to even more warming may be nothing more than an example of classic millennialist pessimism (an age-old affliction mixed together, in the modern age, with a dose of chattering class cant, a generous twist of corporatist rent-seeking, and a large dollop of closet Marxism), but an analogous process in the world of finance is perhaps not so very hard to imagine.

Which is not to say that such a visualization will not, alas, be far beyond the scope of our Groupthink-prone, central banking elite who will still not ‘understand’ inflation any better if it next begins to ‘surprise’ to the upside, rather than to the down as the buoyancy of commodity prices may be starting to herald.

THE BOTTOM LINE

But let’s not be unduly pessimistic. Beyond the survey data and the question of sales volumes, there are also tantalizing signs that corporate decision-makers are slowly beginning to opt for a higher quantum of capital expenditures and that, simultaneously, at least some of the fervour has gone out of buying back equity as a way to flatter both earnings per share and return on equity (as opposed to the much less-frequently cited return on invested capital).

While domestic orders and sales of capital goods in Germany are growing at their fastest rate in over five years and while spending on software, plant and equipment in Japan has reached a post-Crisis zenith, let us concentrate here on what is happening in the USA.

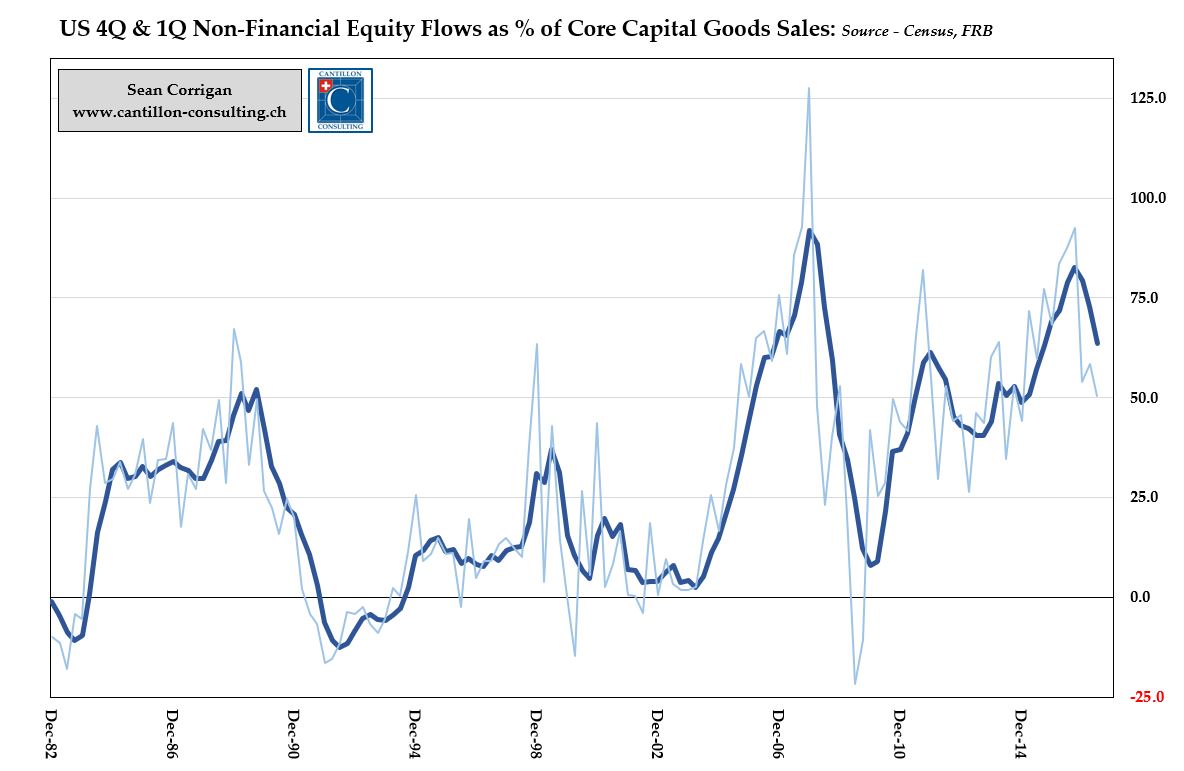

There, so-called ‘core’ capital goods shipments (i.e., those which exclude both defence spending and the lumpy fluctuations of civilian aircraft orders) have shaken off their recent funk to rise at a healthy 5.7% 3mmaYOY which is the briskest clip in five years. Coincident to this, the pace of equity retirement registered in the Flow of Funds accounts in June (a useful proxy for actual buybacks), declined to the lowest level in ten quarters after a nine-monthly decline only exceeded in the wake of the last two crashes in 1999-2000 and 2008-9

This represented an outlay roughly half of the sum of capital goods shipped – another 10 quarter low and mercifully far below September 2016’s post-Crisis high (indeed, third highest ever) tally of over 92%.

Is this the first evidence of a welcome return to moderation: that workshop engineering might rise a little higher on the to-do list than the financial kind? If this is indeed the case, it might not even have such an unequivocally negative impact on stock prices as might be imagined since the obvious fall off in the leveraged buying of shares by companies themselves might be mitigated by the fact that, as a matter of aggregate arithmetic, more below-the-line capital expenditures mean a greater proportion of recorded revenues do not generate a fully-expensed offset in the same accounting period.

If, therefore, both revenues and overall profits are on the rise, a good deal of the rationale behind attempts to boost EPS the Wall St. way might evaporate and so set in train a more virtuous circle, long before the physical benefits of such investments filter down into realised gains in productivity and – one might subsequently hope – in real wages.

We can only hope.