Markets have paradoxically both been on edge – and in the throes of euphoria – since the repo shock in mid-September, being at the same time alarmed and yet strangely reassured by the Fed’s frantic backpedalling and the $400+ billion boost to its balance sheet which this entailed.

However, at a time when an already faltering flow of business revenues across the major nations has now to weather the unquantifiable, but potentially far-reaching, disturbance spread by the China coronavirus outbreak, the margin for error seems slim, indeed. Extreme levels of overstretch are everywhere apparent.

To download as a PDF, please click here: 20-02-21 Overstretch

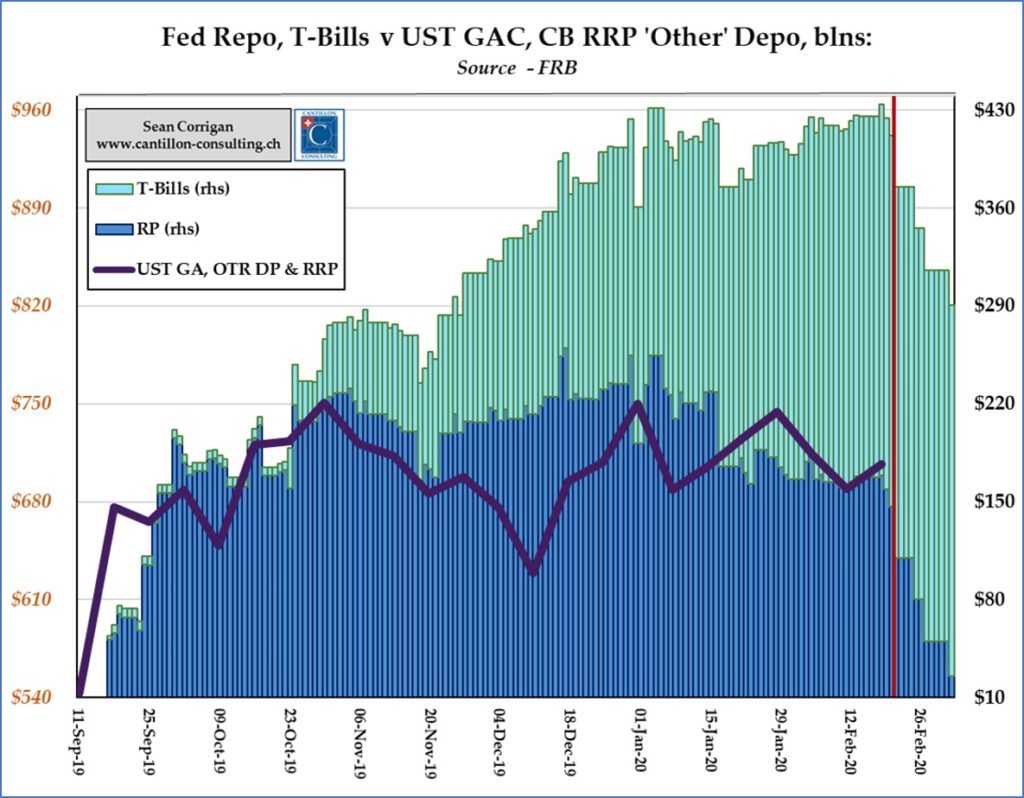

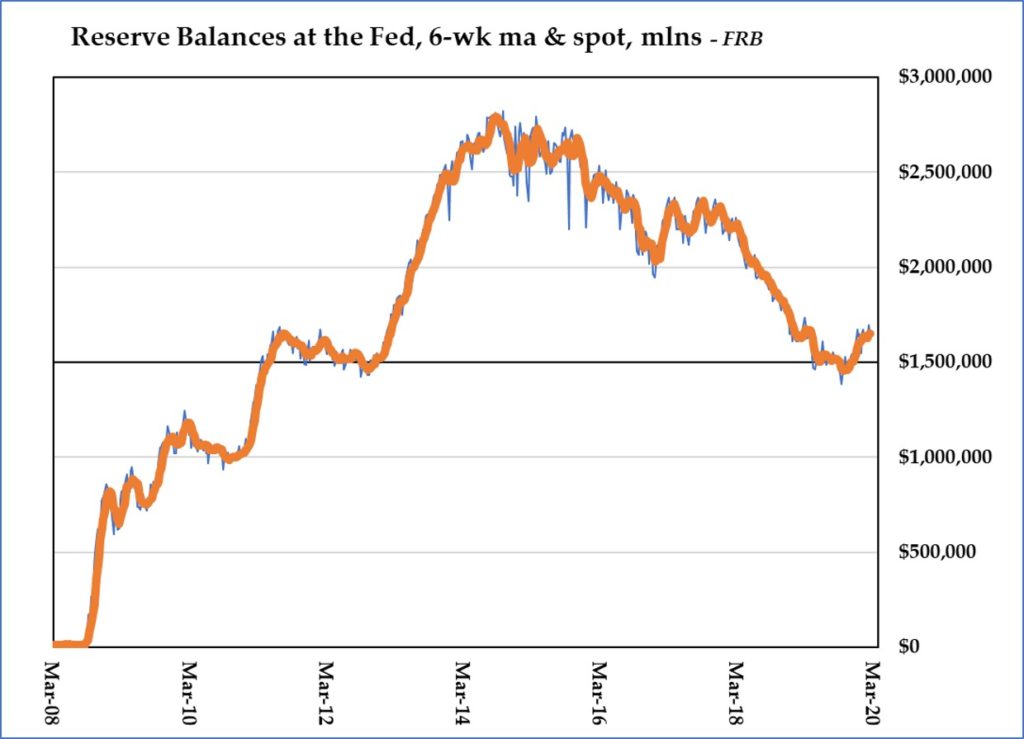

Yes, the Fed has added a significant quantity of reserves after running, unexpectedly, into a regulatory log-jam built of a tangle of intertwined, post-GFC, stable door-bolting rules issued by a multitude of didn’t-see-it-coming overseers of banks.

No. this hardly constitutes another round of QE (for one, the bump in QI’17 was just as large) and, besides, it has already run its course, there being essentially no new net additions of T-Bills + repo since Christmas.

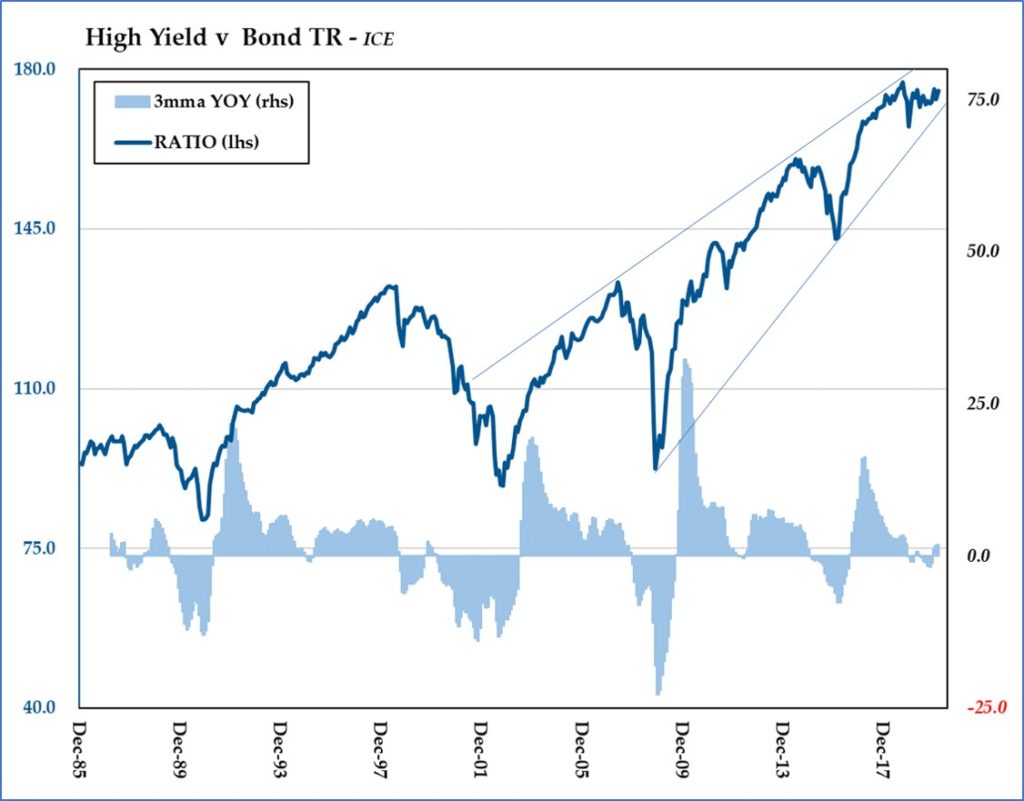

That said, the inferences as to Fed behaviour, rightly or wrongly drawn from its recent words and deeds, have clearly re-energised risk-taking, helping the Nasdaq to a 30%, run in the past 4 months, the S&P500 itself to a 20% gain, and pushing junk bonds to achieve record low yields.

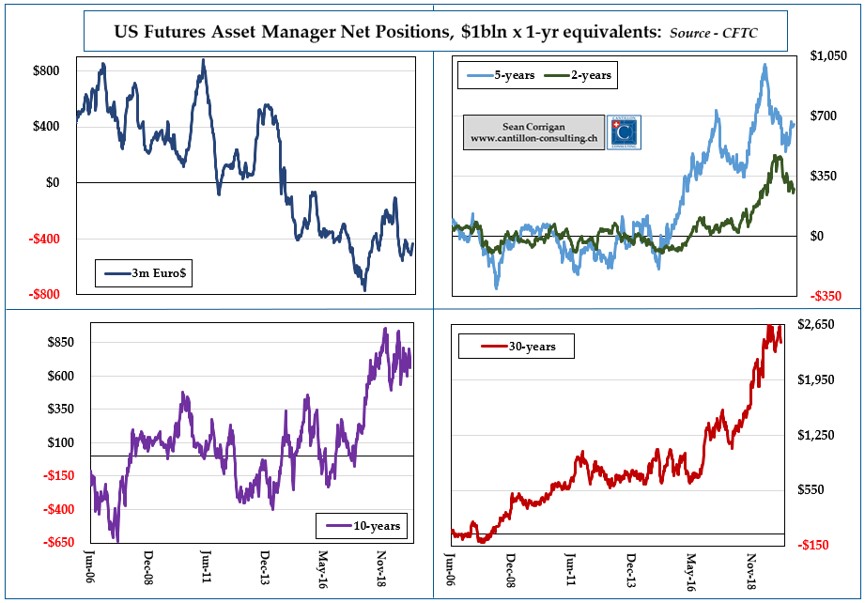

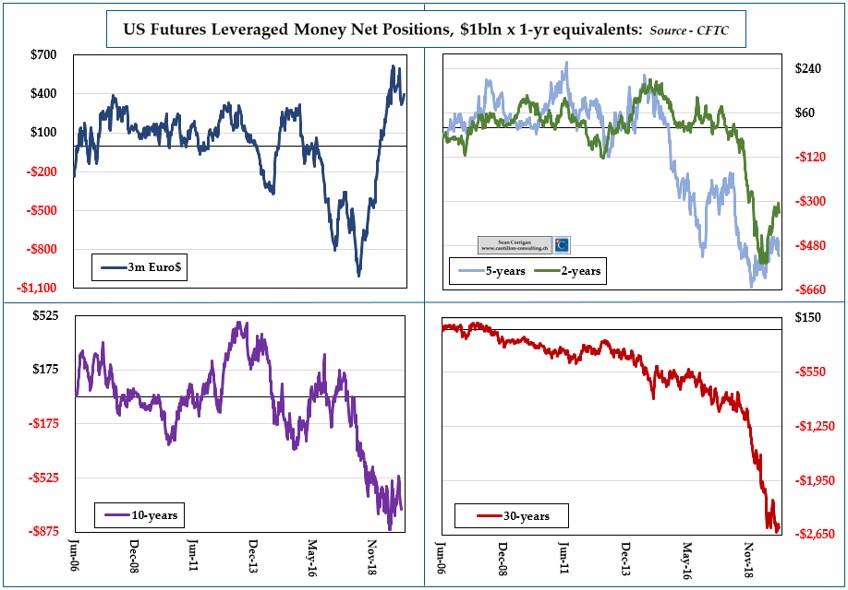

Whatever the technicalities of the autumn squeeze, it is clear that financial leverage and positioning in general has become extremely elevated – as have the maturity mismatches linking funding to exposures.

The buy-side is also confined within a dully mechanistic regulatory straitjacket which – against a backdrop of central bank extremism – imposes clearly sub-optimal behaviour on the custodians of savers’ monies.

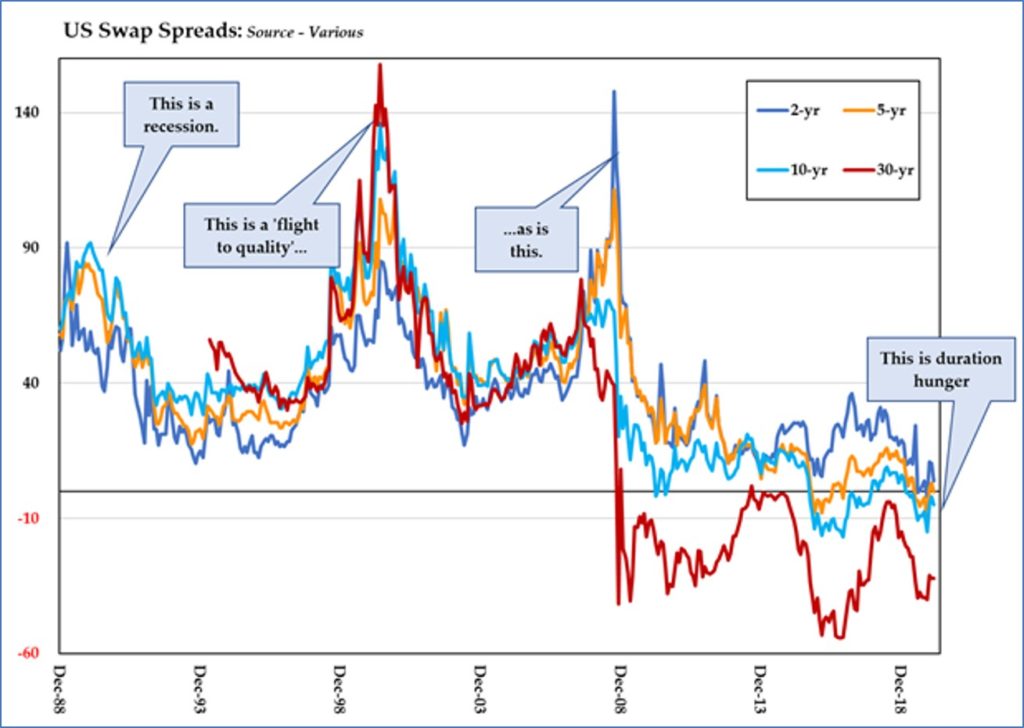

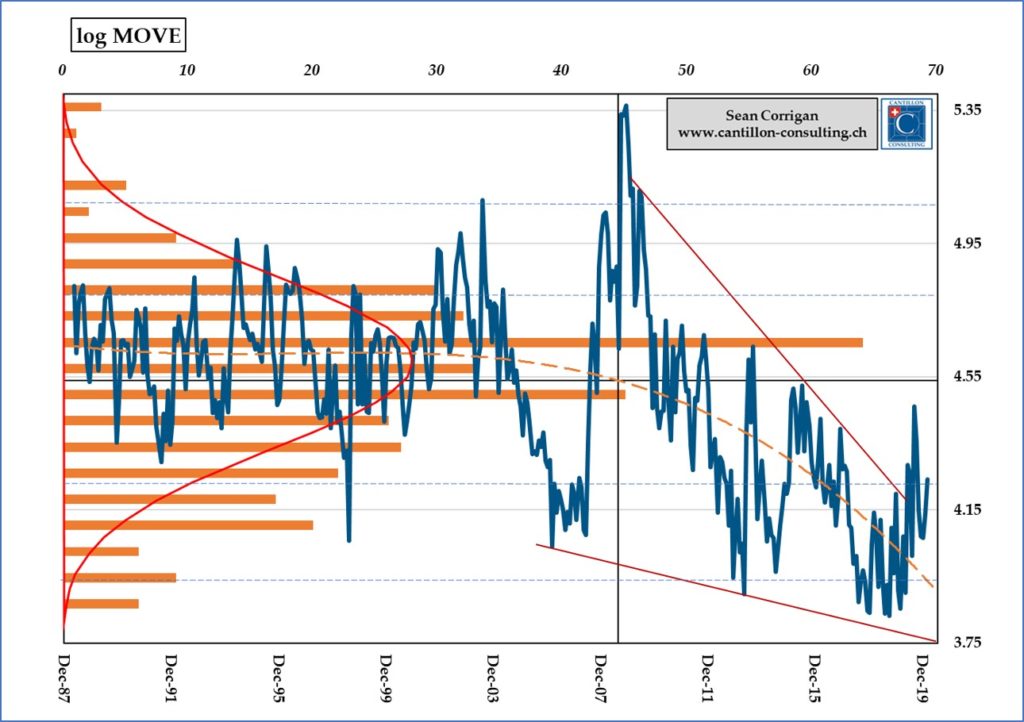

Bonds have become Giffen goods – the more expensive they get, the more they must be bought – meaning feedbacks are positive, not negative, and hence that speculation is inherently destabilising, not self-correcting.

Add in the blind, empirical belief that flat/inverted yield curves are infallible harbingers of recession (and, hence, their role as generators of expectations of further central bank laxity) – and the dog begins to chase its own tail at a dizzying speed.

Of course, if one segment has record long exposures, others are likely to be similarly, if inversely, extended. In futures, ‘leveraged money’ – hedge funds and CTAs – are heavily short, though one presumes they must have some offsetting positions elsewhere, off the exchange.

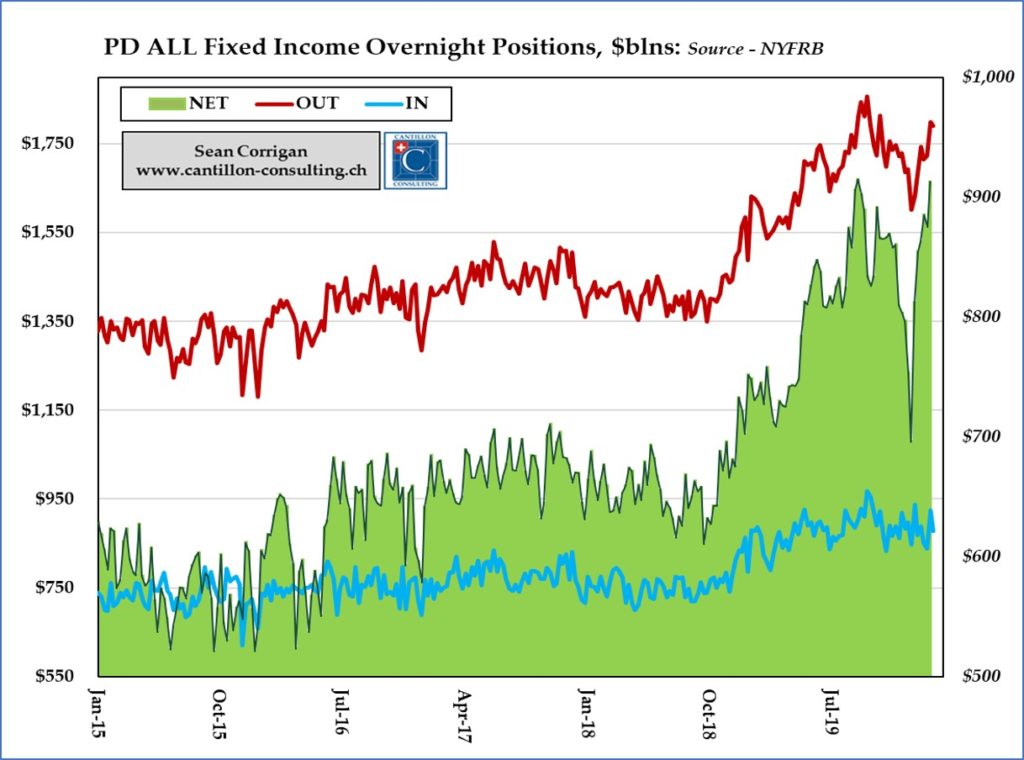

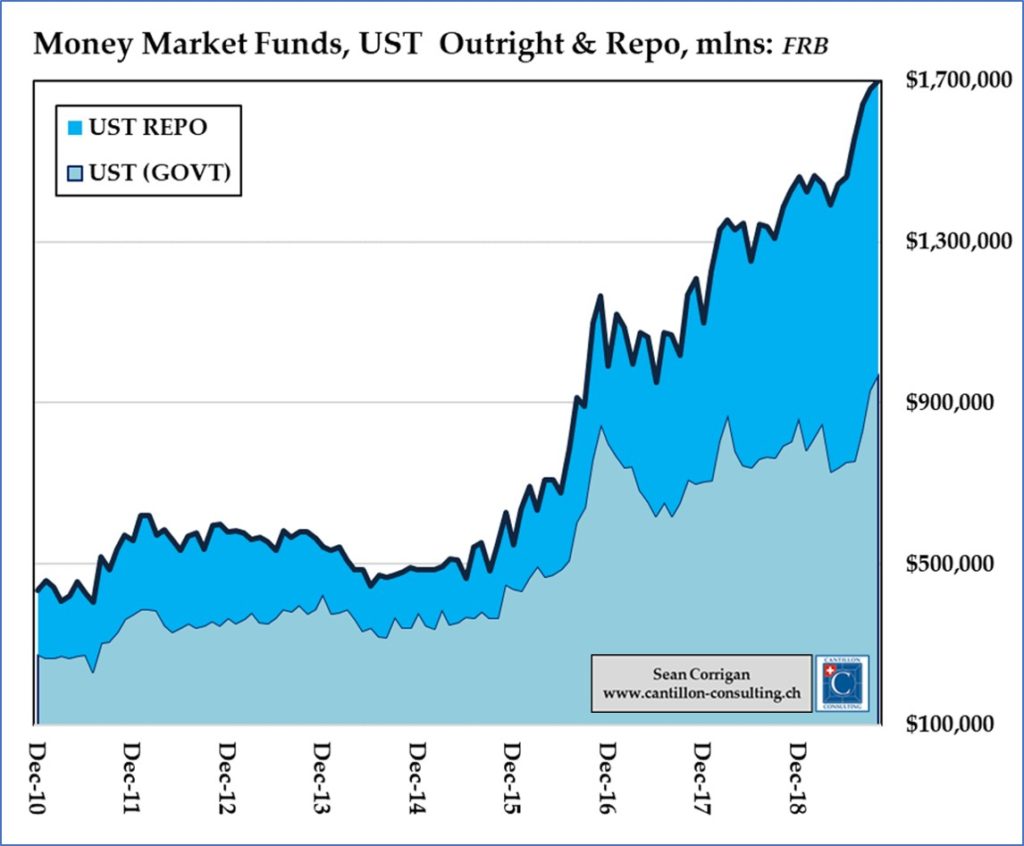

Primary dealers, for their part, have over $900 billion dollars net to fund each and every day against their fixed income holdings (twice that on a gross basis) – an unprecedented amount which is almost half as large again as that recorded during 2016-18.

This provides another reason why the widening Federal budget deficit seems so easy to cover.

30-year obligations being carried in overnight wholesale markets – what could possibly go wrong?

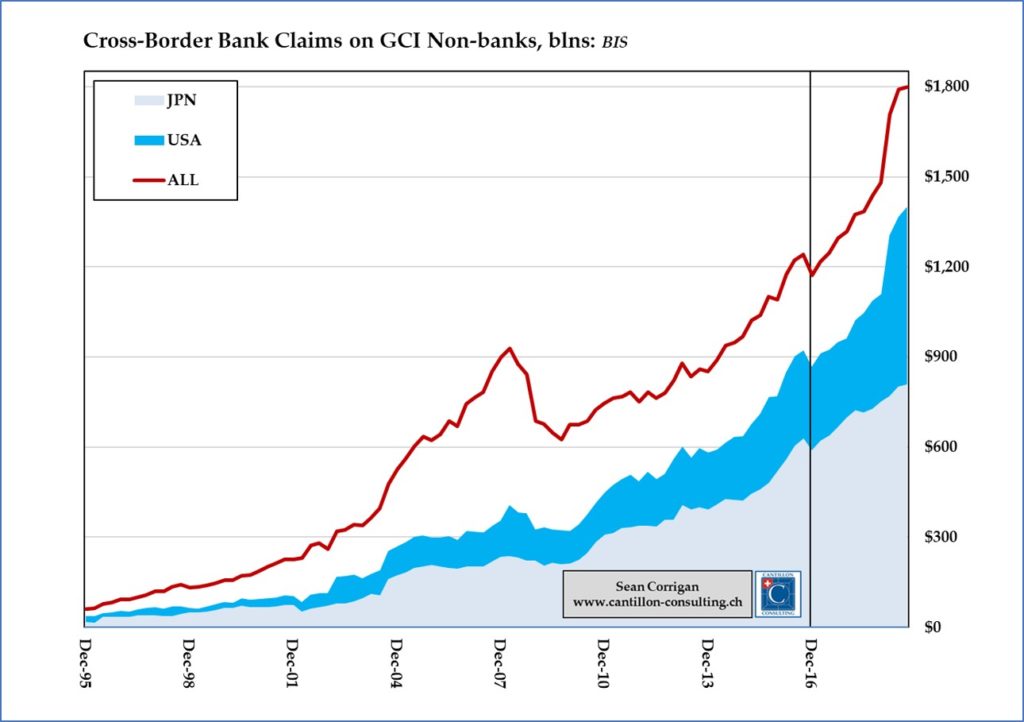

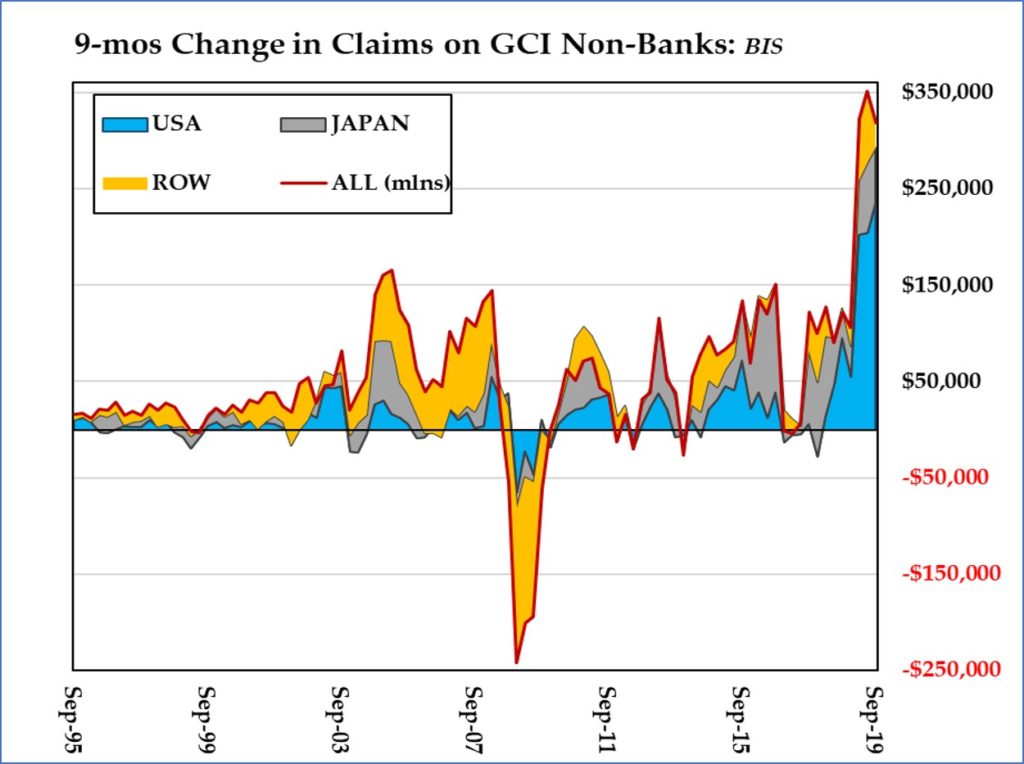

All the while, hedge fund activity has been heading into the stratosphere. Taking cross-border claims on Grand Cayman non-banks as our proxy, we can see that lending jumped 25% in the year to last September (coinciding with that month’s panic-inducing repo squeeze) to stand almost twice as high as on the eve of the GFC.

Notably, this latest burst of speculative excess has been funded largely from the US itself, with $235 billion – or three-quarters – of the $320 billion jump in loans originating there. Hot money flows are again dominating the asset markets while the Fed watches helplessly on.

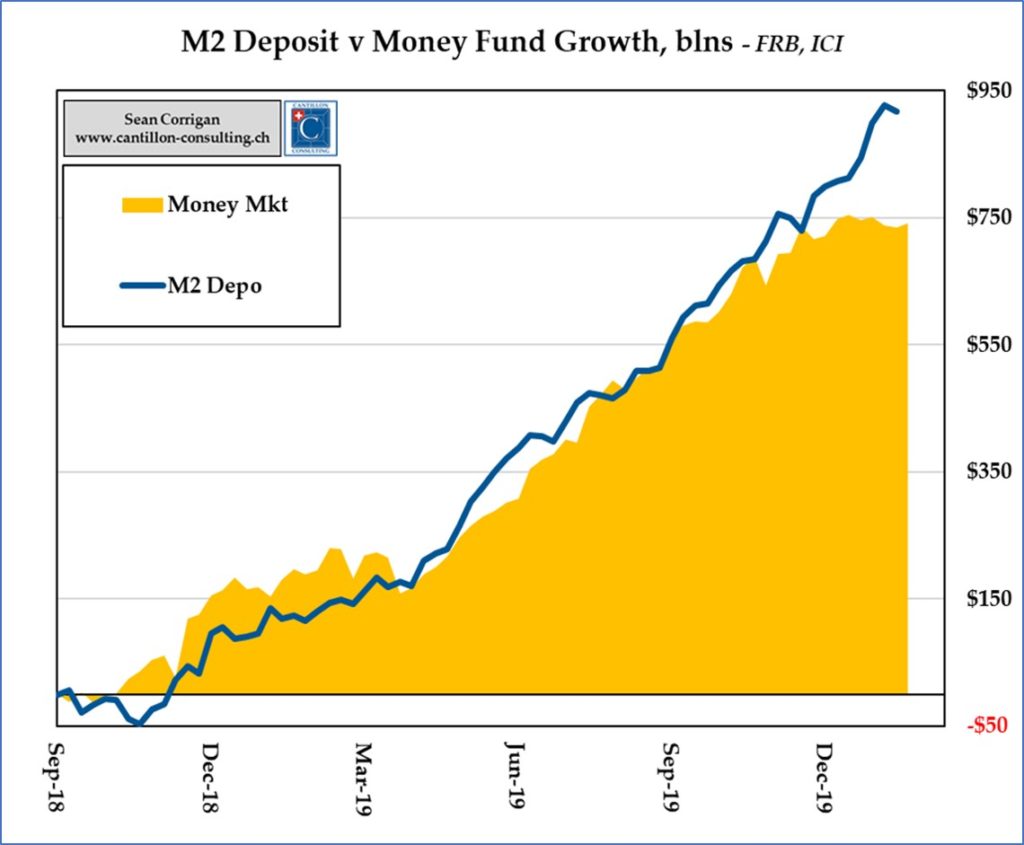

Enabling much of this has been the extraordinary appetite for money market funds (alongside their fixed income counterparts) since the QIV’18 attack of the vapours.

Here we see that, for much of this period, inflows have matched – almost dollar for dollar – the increase in traditional bank deposits. During the acceleration of the monetary aggregates which accompanied the equity (and wider ‘risk) market rebound after Christmas that year, money funds have swollen ~20% – nearly three times the pace of concurrent deposit growth.

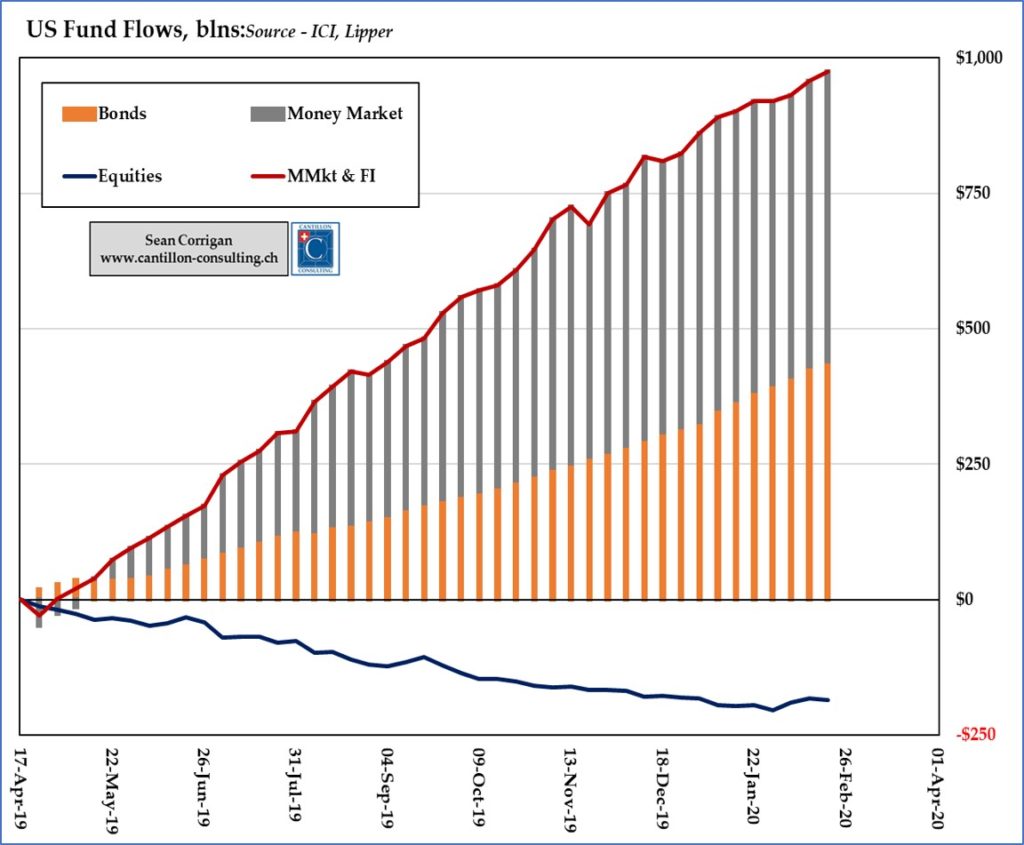

Taking instead the period since last spring’s intensification of the “Trade Wars”, bond and money funds, combined, have taken in nearly $1 trillion – a sum which almost entirely matches the increase in Treasury debt outstanding due to the yawning fiscal deficit. Outright holdings and repo have both played their part here.

Though some of this represents a voluntary saving of the Federal overspend (and hence mitigates inflationary pressures, if at the expense of more productive uses of people’s money), it, too, carries mismatch risk, especially where funds are treated as surrogate transaction monies (or ‘swept’ therefrom).

The institutional component may be less benign, comprising in part a self-aggravating cycle of re-loading buyers while instilling a mounting sense of sellers’ regret – a ‘monetary disequilibrium’ process helping stretch valuations & exposures ever further.

With the Automotive/Trade War/Boeing 737-MAX headwinds turning into a super-virus typhoon, the chance of a sudden reversal appears least likely in ‘risk-free’ dollar bonds, no matter how rich.

But beware a ‘pulling-up-the flowers-watering-the-weeds’, cross-margin storm erupting just about anywhere else. Vols are low, credit spreads meagre, equity markets unnaturally elevated – and the dollar, too is rising, threatening Emerging Market borrowers with instant ruin.

Be careful in case the elastic holding it all so precariously together suddenly goes, *PING!*

Copyright ©2020 Cantillon Consulting Sàrl. Any disclosure, copy, reproduction by any means, distribution, or other action which relies on the contents of such materials, made without the prior written consent of Cantillon Consulting, is strictly prohibited and could lead to legal action.