Since the spring of 2014, the euro has lost around a quarter of its value, Mario Draghi has finally joined the Big Boy’s League by launching his own, decidedly belated version of QE, and—everywhere but in poor, benighted Greece—the growth of the money supply has been bordering on the explosive.

Over those same fifteen months, banks in the Eurozone’s German powerhouse have increased the tale of assets on the other side of their balance sheets (’money’ being a liability of the banks who create and intermediate it, of course) by €19 billion a month or by €285 billion in total, an increment just ahead of the €245 billion gain undergone by the same banks’ added contribution to M1.

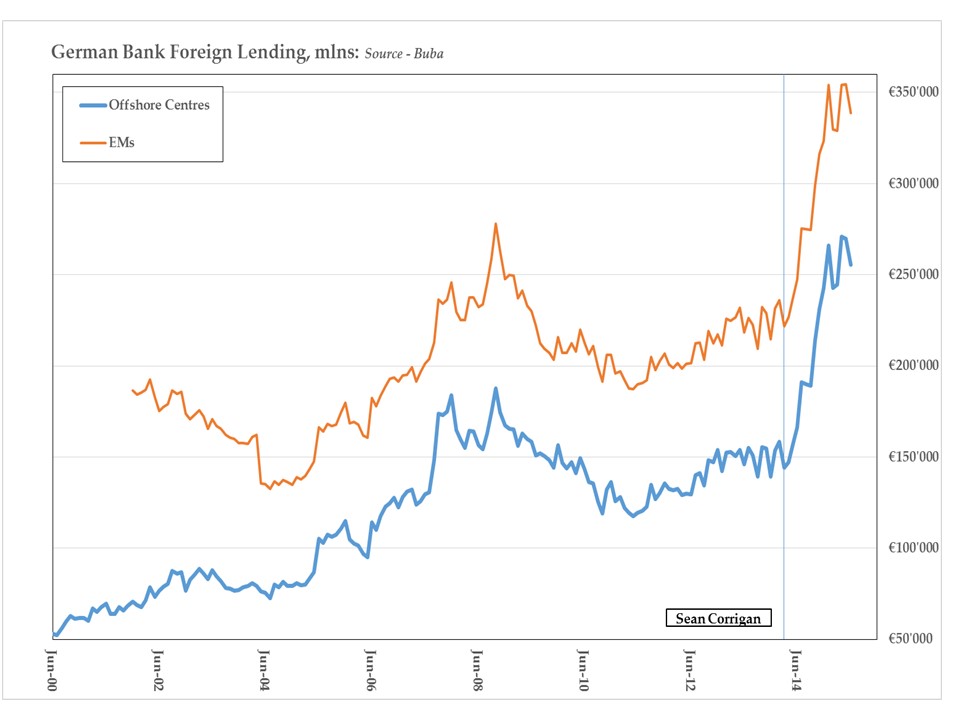

So far, so unexceptionable. But what we find on closer inspection is that while about a fifth of these new loans have gone to domestic households and non-financial businesses (as per the ECB’s wish), roughly twice as much—a cool €110 billion—has been lent to entities domiciled in Grand Cayman, playground of the world’s speculative elite. This is a sum which comprises a full two-fifths of all new German bank assets and two-thirds of all their cross-border lending.

Looking at things from a slightly different perspective, in the twelve months to March, the BIS reckons that member banks financed the hedge fund haven to the tune of $126 billion (pushing the total above a trillion dollars for the first time ever) of which the Buba numbers show an (exchange-rate adjusted) $92 billion—or almost three-quarters—emanated from the Heimat.

While acknowledging Germany’s need to recycle its swelling current account and while being sympathetic to the yield hunger being suffered by its legions of the thrifty, this does tend to suggest that no lesson has been forcefully enough imparted to them by the sub-prime debacle to help them stop their ears to Mario’s Lorelei-like enticements to come and drown in the Rhine of Reckless Riskiness all over again.

FOR A REGULAR INSTALMENT OF MY ANALYSIS, PLEASE VISIT ‘MONEY, MACRO & MARKETS’ AT HINDESIGHT LETTERS WHERE THE AUGUST EDITION IS NOW AVAILABLE, AS IS THE LATEST WEEKLY ‘MIDWEEK MACRO MUSINGS’

NB The foregoing is for educative and entertainment purposes only. Nothing herein should be construed as constituting investment advice. All rights reserved. ©True Sinews