Seemingly oblivious to the idea of ‘purdah’ – a period of dignified silence to be observed in the run up to the taking of policy decisions—the ECB’s Chief Economist, Peter Praet, felt able to give AFP a wide-ranging interview this week and truly remarkable it was, too.

Asked to comment on the efficacy of the Bank’s measures, our man responded with dogmatic certitude that ‘…with regard to credit, yes’ they were effective. ‘With regard to financing conditions, yes. With regard to the economy, yes.’ The sting in the tail was that ‘…however, the transmission to the price dynamics takes more time, notably in a context of lower oil prices.’

So what the Chief Mage is saying is that our incantations and imprecations have ensured that all is good in the kingdom, thank you, and that the delivery of an earthly Paradise would be complete were it not for the potentially ‘poisonous’ fact that Europe’s shoppers are still having to pay the Gulf sheikhs too little for their fuel!

In saying this, Praet explicitly played up that old canard that the instant a would-be buyer believes that prices are going to fall, he will desist from any and all consumption. Like all persistent fallacies this is not without a misleading kernel of truth but it also overlooks the imperatives of the undeniable ache of that empty-belly, I-want-it-now, sweetshop-window craving which comprises human time preference.

Goods today are generally prized more highly than goods tomorrow. Hence why, in normal times, we find the net present value of a cash flow is lower than its future nominal value. Hence why far too many of us are routinely tempted to borrow – often at eye-wateringly high real rates of interest – in order to exhaustively consume all manner of fripperies, much less necessities, NOW!, rather than waiting patiently to accumulate the means to buy our desiderata with the cash we have gradually set aside for the purpose.

Thus, if I know that tomorrow I can buy two pints of beer for the same money it will cost me for one today, I may still wish to quench my thirst or be sociable with my friends tonight. Two sets of earrings for my wife the day after her birthday will still not give her the pleasure that one will entail when she unwraps it on the day itself. Thus, the expectation that prices may be lower tomorrow will not bring the economic system to meltdown – else why would anyone ever queue to buy the newest tablet or smartphone?

Moreover, the idea that Moses would have had sharp words to say with Jehovah for the ‘poisonous’ gift of a CPI-suppressing manna from heaven – i.e., that a reduction in outlays on a vital resource (in our case, largely a technologically, rather than a supernaturally, driven one) could have ill effects in the round – is too bizarre to be given credence anywhere except at a full moon gathering of dancing DSGE macromancers.

Herr Praet might also notice that whereas the collective ‘we’ were once borrowing heavily from its vendors to finance our energy purchases, they are now having to settle their own excess consumption and so allowing us to redeem some of our debts. That is what intertemporal exchange is all about, is it not, so why the gnashing of teeth and tearing of hair?

Our current account deficits have shrunk; their surpluses have dwindled and, indeed, turned to deficits as a result, freeing up both our balance sheets and our income streams for other purposes. How can Praet imagine that this is such a latent evil that he will further seek to distort capital accounting, disrupt the monetary mechanism, confound the economic plans and aspirations of countless millions, and sow yet more havoc across the world’s exchanges and asset markets in order to ward it off?

Would it not be easier to organize a whip round and send an extra 50¢ a litre to aid the newly struggling sons of the desert and the shoeless frackers of shale? Surely all our troubles would be behind us, if only it didn’t take so little of our disposable income to fill up the family car or to power the local factory?

Yet, for precisely just such twisted reasons, Praet declared that Draghi has ordered his minions to ‘re-examine the toolbox and to have an in-depth, 360-degrees reflection’ on whatever they can next enact in the pursuit of ‘Whatever it Takes’, regardless of whether ‘it’ should even be undertaken. The real ‘360 degrees’ at work clearly involves our masters’ heads swivelling around that far and taking their powers of ratiocination with them!

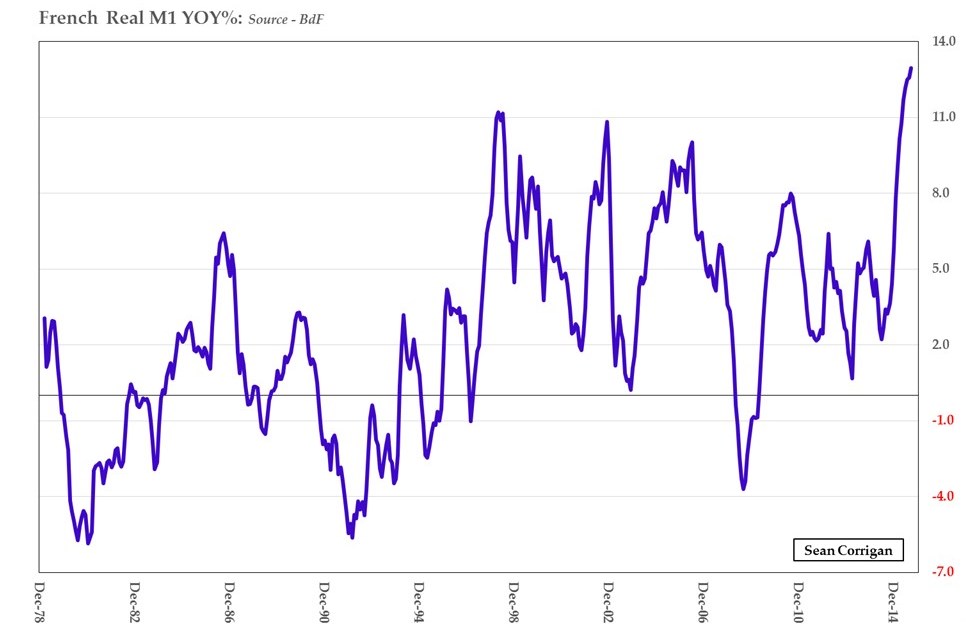

A sober glance at the data strongly suggests that QEuro is already a treatment too far with, e.g., France seeing record levels of real money growth; with double digit increases in the measure obtaining across almost the entirety of the Eurozone (and beyond, if we look to the collateral damage being inflicted upon its near neighbours in Switzerland and Scandinavia); and with even poor, benighted Greece finally emerging from one of the few instances of genuine deflation anywhere to be had.

Ironically, Praet himself underlined the futility of the very programme of which he is such a forceful advocate when he bemoaned the fact that the level of weakness in a France which, as he himself pointed out, has been thankfully absent a debt or a banking crisis was ‘surprising’. But, with next to no financial opportunity cost for delay and obfuscation on the part of the authorities both there and elsewhere, where do you suppose you should seek the reason that the ‘implementation of reform’ is proving so ‘difficult’, Herr Praet?

If it helps you find the answer, I do have a mirror you could borrow.

THE ABOVE IS AN EXTRACT FROM THE BIWEEKLY ‘MIDWEEK MACRO MUSINGS‘, OFFERED ALONGSIDE THE FULL IN-DEPTH MONTHLY, ‘MONEY, MACRO & MARKETS‘, BY HINDESIGHT LETTERS.

PLEASE CLICK HERE FOR MORE DETAILS

NB The foregoing is for educative and entertainment purposes only. Nothing herein should be construed as constituting investment advice. All rights reserved. ©True Sinews