To the delight of everyone with a vested interest in the continuance of the global central bank bubble, the latest data round from China revealed that, in the past four months, the cumulative total of new RMB loans in China has set a major new high, amounting to no less than CNY4.6 trillion—a number 50% or so greater than the average of the preceding two years and one equal to around $730 billion, or $6 billion a day, even at today’s newly depreciated rate of exchange. Yet, in that same time, the figure for ‘total social finance’ rose by no more than (sic) the 2012-14 seasonal average of CNY5 trillion.

The bare excess that latter sum represents over the increment in bank loans means that, for much of the summer, the formerly vibrant ’shadow’ component has only represented 7% of the total credit offered to the ’real economy’ (to use the PBoC’s optimistic description of the measure). A scant proportion last seen way back in 2002, this shows the extent to which the authorities are now having to mobilize the commanding heights of the financial system—their own giant, state-owned banks—in the attempt to prevent a collapse of the excesses which were either unleashed in the course of their earlier ill-advised interventions or tacitly encouraged in the days when they were pretending to keep a tight rein on the more orthodox forms of credit and so forcing borrowers out into the Twilight Zone.

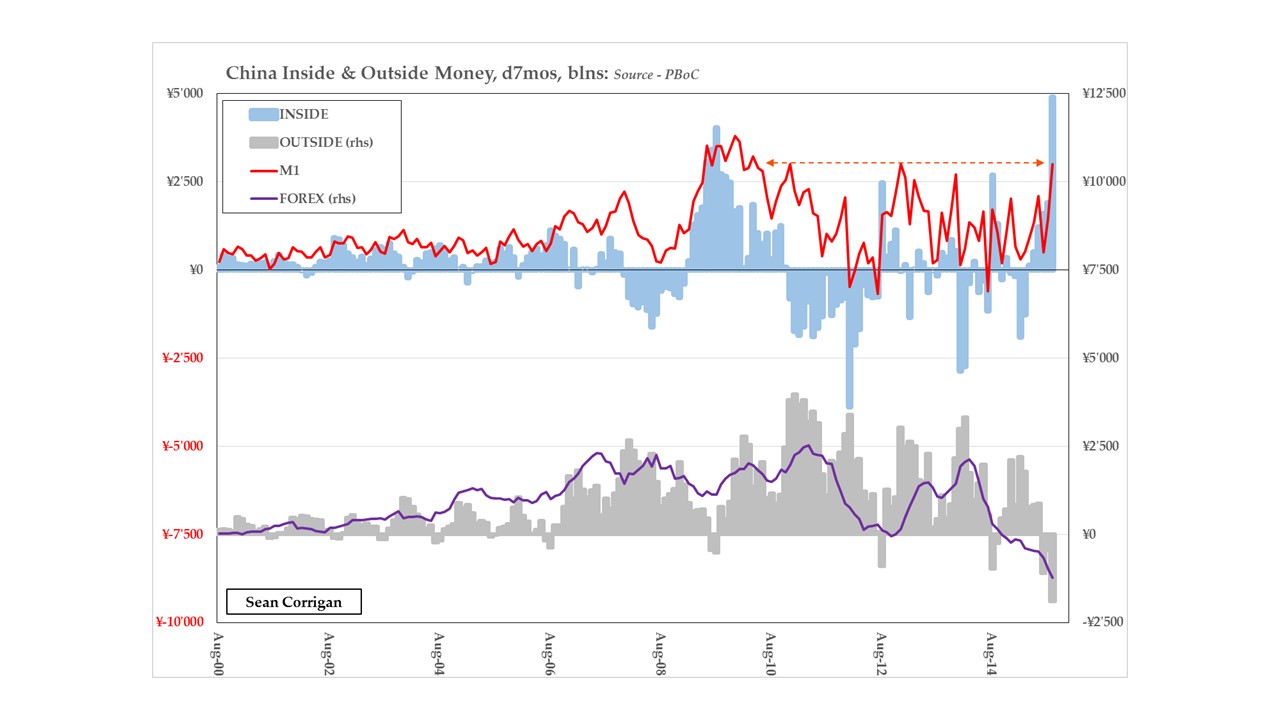

With the real economy nevertheless showing few unequivocal signs of improvement, the corresponding jump in autonomous, ‘inside’ money creation by the commercial banks—as opposed to that originating ’outside’ at the central one—is a double-edged sword. On the one hand, such a rebalancing toward more liquid means could revitalize corporate spirits—not least by eroding the mountain of receivables: on the other, if no renaissance occurs, the most volatile of banking liabilities will have risen even as upward pressure on earnings and NPLs intensifies—a potentially combustible mix.

What should also be a matter of some concern is that even by the official, highly disputed reckoning, Nominal GDP this past year has only grown by 6.2% – a relative snail’s pace of the kind seen at the height of the last two great upheavals, viz. the 1997-8 Asian Contagion and the 2008-9 GFC itself. Strip out a supercharged, bubble market ‘contribution’ from the financial sector and it gets worse, dropping to just 5% yoy.

Now compare this with the PBoC’s count of ‘total social finance’ – already standing at more than twice GDP and growing – at 12.9% p.a. – at twice the pace. That means that even after financing every incremental extra yuan of recorded national income in the past twelve months, a grand total of CNY11 trillion in excess credit was contracted.

Truly unsustainable!

THE ABOVE IS AN EXTRACT FROM THE BIWEEKLY ‘MIDWEEK MACRO MUSINGS‘, OFFERED ALONGSIDE THE FULL IN-DEPTH MONTHLY, ‘MONEY, MACRO & MARKETS‘, BY HINDESIGHT LETTERS.

PLEASE CLICK HERE FOR MORE DETAILS

NB The foregoing is for educative and entertainment purposes only. Nothing herein should be construed as constituting investment advice. All rights reserved. ©True Sinews