Those of us who have not been stuck on Mars for the past five years, tending our potato patch, will be dimly aware that the Grand Mages of the economic world – the central bankers – have been manfully searching their spell-books and bubbling their alembics in order to exorcise the dreaded demon of Deflation from the land, terrified that the world will collapse around them if too many shoppers are too routinely confronted with anything that might smack of being a bargain.

It might therefore intrigue you to learn that during the stretch from the middle of 2010 to midsummer 2015, in what has supposedly been enough of a near-deflationary period to put the fear of Catchings and Foster into any self-respecting, MIT-schooled central banker, the Kansas City Fed tells us that US ranchland still managed a rise in value of no less than 75% – equivalent to a CAR of almost 12% (nigh on 1% a month, in fact!).

The same source relates that, in the four years to its own peak in June 2014 (since when it has admittedly fallen back a touch), the sort of land that went under the plough rather than under the hoof actually doubled, inflating at a rapid trend rate of 19% p.a.

Back in the Emerald City, Toto, since the start of 2010, the pension funds who are the main investors in the sorts of commercial properties tracked by the NCREIF have also seen the returns on those investments (i.e., a tally which includes both rental income and capital appreciation) double; a handsome reward amounting to a compound rate of 12.4% a year.

A good deal less spectacular, but nonetheless decidedly creditable, the period from 2012 to the present has meanwhile seen timberland return those same institutions a cumulative 35%, or 8.2% a year on average.

Similarly, the median price data coming from the NAR and the Bureau of the Census show that, compared to where they were four years ago, both new and existing homes now fetch 35% more upon sale—a 7.8% annual gain. On top of that, BLS data for ‘rent of primary residence’ reveals landlords are charging 13% more today than in 2011, a compound rate increase of 3.1% which hides the fact that rises have been accelerating of late and are currently running at over 4% annualized – the fastest pace since the real estate bust of 2007. For reference, the alternative Census figures agree on the quadrennial number but put national median rents so far in 2015 at 5.5% over those in the like period last year. Either way, property returns here, too, have been brisk.

Nor should anyone think this is a trivial matter. After all, this concerns a market with assets in non-financial private hands alone amounting to close to $50 trillion, alongside which there is the property owned by financial businesses, government, and foreigners to consider. Compare this with the Fed’s estimates of a stock of around $24 trillion in bonds outside its own coffers and in domestic hands or the native equity holdings of just over $30 trillion and we see that here we are talking about something which represents around half the patrimony of the nation.

Now, do you suppose that the quality or quantity of the service provided by bricks and mortar, corn, cattle and carrots rose just as smartly over these 4-5 years as did capital prices and returns or must we reluctantly conceded that this was more a case of a surplus of money chasing a (relative) dearth of purchasables – i.e., of inflation, pure and simple?

As an aside, do the handsome levels or return being produced here convince you that we now find ourselves marooned in such a limbo of ‘low aggregate demand’ and that we are surrounded by such a ineradicable glut of whatever it is we might conceivably produce for profitable sale that the ‘natural’ interest rate – loosely, that unobservable setting that prevents economic balances from seeding and multiplying like rats on a rubbish heap – has fallen into mind-bendingly negative territory as that Man with Two Brains, Larry Summers argues has in fact happened?

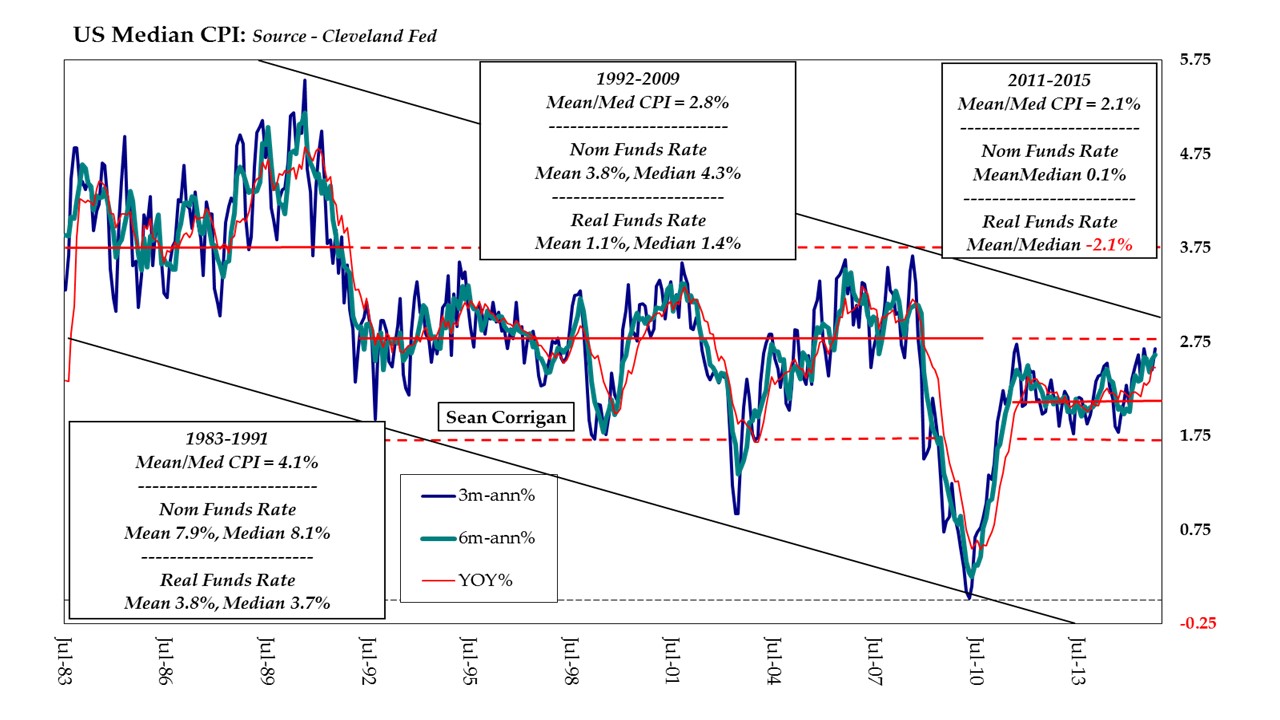

More generally, the Cleveland Fed’s median CPI measure, after the briefest of swoons during the post-Crash liquidation, has ever since averaged pretty much that same magic 2% which is become the Holy Grail of our present pack of Expectations Anchormen and women—a matter which they, being wedded to all sorts of other, equally idiosyncratic statistical approximations of the rate of decline of money’s value, have chosen entirely to ignore.

On the latest count, that same MedCPI has accelerated to its fastest six-monthly pace of increase in seven years to stand just a whisker below the mean/median rate of 2.8% which obtained over the period 1992-2009. You may recognise this as an interval which largely overlaps with the one somewhat amusingly known by our central banker friends – with more than a hint of wistful self-congratulation – as the ‘Great Moderation’; that is, the one in which we in the West managed two cataclysmic booms-and-busts and to which our Asian neighbours added a third, just to be going along with.

Never mind. We can all sleep safe in our beds at night knowing that those responsible for such a momentous misreading of affairs have successfully indoctrinated their successors in the same ways of thinking; that the same ‘models’ are in use to confirm their prejudices as to the workings of the economy; and that therefore we can be assured that nothing will take them, the Diadochi, painfully by surprise in the months and years to come, no matter how extreme and unprecedented their actions may be.

Back in those halcyon days, you might wish to be informed, the Fed Funds rate was typically around 4% nominal and it therefore normally stood somewhere between 1% and 1.5% over the prevailing rate of CPI change. Even that lofty setting proved far too low a ‘natural’ rate, remember, for the soundness of the economic calculation of millions of businesses and billions of individual borrowers and savers, as evidenced by the outbreaks of the Asian Contagion, the Tech Boom, and the GFC itself.

With that in mind and from today’s lowly vantage of 0.0-0.25%, it seems the good people of the FOMC might soon find themselves with a good deal of work to do, if ever they actually steel themselves to set about doing it, that is.

THE ABOVE IS AN EXTRACT FROM WORK WHICH APPEARS AS THE SEMI-MONTHLY ‘MIDWEEK MACRO MUSINGS‘, OFFERED ALONGSIDE THE FULL IN-DEPTH MONTHLY, ‘MONEY, MACRO & MARKETS‘ AND PUBLISHED BY HINDESIGHT LETTERS.

PLEASE CLICK HERE FOR MORE DETAILS

NB The foregoing is for educative and entertainment purposes only. Nothing herein should be construed as constituting investment advice. All rights reserved. ©True Sinews