Many people are trying to draw analogies with the Great Depression, with wartime, or the 70s stagflation era but we feel most of these analogies are missing the mark. Here we explain why:-

The Great Depression was a ‘sudden-stop’ shock which ended the credit-boom lending to Weimar(effectively an Emerging Market economy, in the aftermath of WWI and the ensuing hyperinflation) caused when the Young Plan – which tied the Boom and the Versailles reparations together – looked to be in jeopardy. It was made worse by politics (war debts, French fears of German revanchism, etc), protectionism (Smoot-Hawley), Hoover’s call to maintain wage-rates, and FX chaos (especially when the 1931 Credit Anstalt collapse froze British credits and drove this pillar of the international financial architecture off the gold standard).

The initial slump and its ‘secondary (financial vicious cycle) depression’ were addressed by the New Deal measures, but the attempt to emulate what was then seen as Mussolini’s economic successes were soon plagued with boondoggle vote-buying (“Tax! Tax! Tax! Spend! Spend! Spend! Elect! Elect! Elect!” was a slogan of the era), FDR’s cynical capriciousness, and the actions of the Brain Trust cranks in general. This was offered a closer parallel to the post-GFC years than to today’s ‘Contamino Bay’ lockdown.

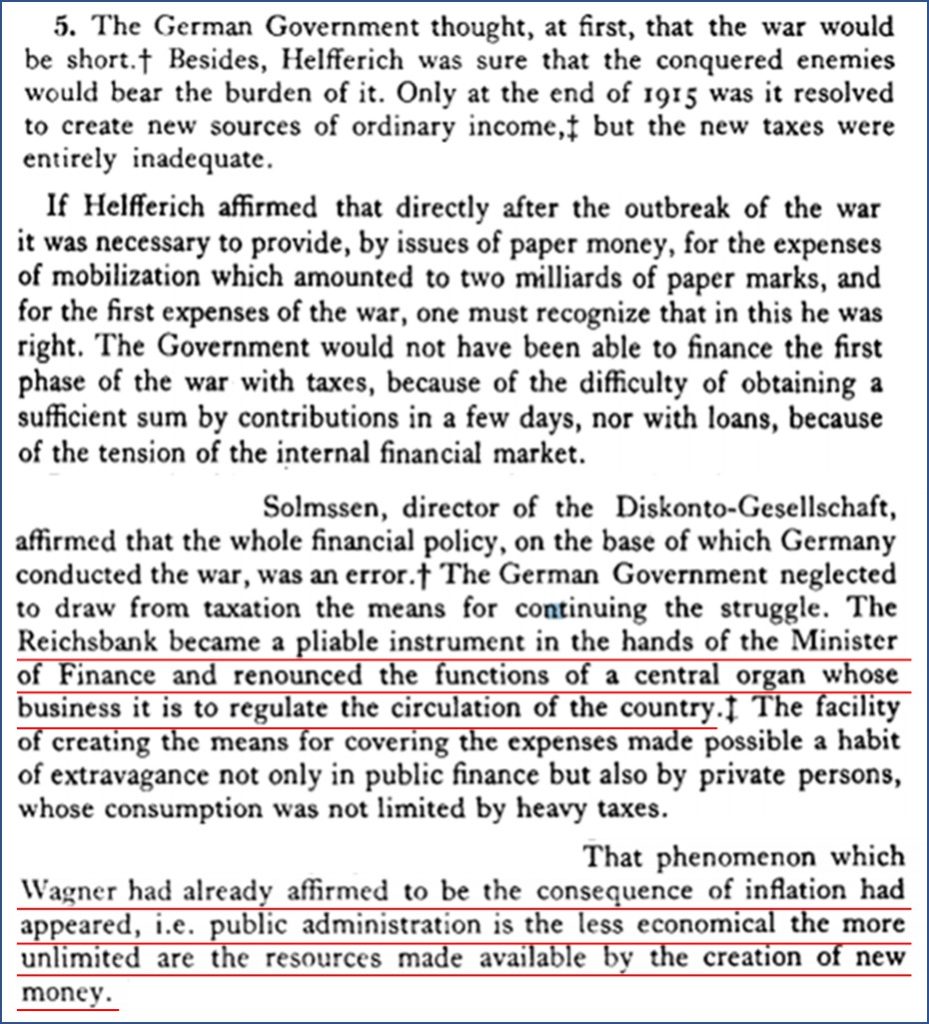

Wartime, too, falls short even if we can see close monetary parallels in Pitt’s Bank Restriction Act of 1797, suspending sterling convertibility, Lincoln’s issue of ‘greenbacks’ during the American Civil War (MMT when it actually WAS almost modern), and, course, the ‘temporary’ steps taken by the Reichsbank in the throes of the Great War.

But war beats ploughshares into swords: it doesn’t shut half the nation’s factories. Excess money creation is partly mopped up in war bonds and partly frozen by rationing. Unused liquidity builds up and tends to explode in an inflation after hostilities cease, until either the money itself loses the greater part of its value or the supply of goods adjusts to the new priorities of peace

A closer analogy to what we are undergoing today would be a siege, or the sort of blockade the Germans endured in 1914-18. We must tighten belts and make do with shrunken productive possibilities, living off government hand-outs – this time partly in the form of loans, not commissary chits and ration cards.

For now, we have to allow for the partial (if substantial) loss of income but, at some point, state dole & spending will inevitably impinge on lower provision of goods and this Must surely mean higher prices if, as ever, selectively higher ones.

The Underconsumptionists stand foursquare against this idea, hitching their old hobby-horse of demographics to the new bandwagon of a societal chastening to argue that people will spend less and that this will hinder ‘recovery’ – i.e., of a return to our bad, old ways.

The idea that a population brought to terms with its debt-laden lack of resilience might actually be better-off by forgoing a return to easy-money improvidence, or that the surest remedy for a lack of wealth is saving, not self-indulgence, naturally never occurs to such types but, even on their own terms, we can rapidly deal with their concerns.

The first, demographics, is not only a stale fish of no particular relevance to our discharge from the isolation ward, but a red herring in that some of us think ageing populations are inflationary, given that they imply the presence of fewer workers together with the consumption of the capital with which one would rather they be equipped in order to make up for their lack of sheer numbers.

The second idea, that the experience will teach people to live more within their means is a highly dubious proposition. If such a widespread disavowal of exhaustive consumption cannot be dismissed out of hand, an outbreak of fatalistic, Weimarian, fin de siècle hedonism is every bit as likely to take place, especially among the young.

Of greater moment when we consider what will happen when there is a general release from confinement, is the question of whether the Fed (as well as its counterparts abroad) will sell its extraordinary purchases of securities back to now-reassured savers, investors and, inevitably, speculators. Another is: will businesses have to – or even simply wish to – devote some part of earnings to paying back their loans?

This latter may seem unfair in that the shutdown and its concomitant loss of trade were not their fault, but somebody, somewhere is going to have to bear the loss of wealth which has taken place and the more transparently that is done, the fewer the damaging side-effects of the financial legerdemain which would otherwise be required to disguise that loss.

This boils down to the issue of how much of the vast extra monies created (which SOMEBODY, somewhere holds) will be spent as soon as the opportunity again arises and how much will be safely retired in paying down debt and unwinding ‘assistance’?

Though few will consider this to be the case, to the extent that latter scenario occurs in a productive machinery restored to a semblance of working order, Say’s Law will function – new output will pay for renewed consumption – thus warding off the worst side-effects while a paying-back takes place which will involve the steady realisation of the capital lost to the restriction measures.

Given the need to replace that lost capital as rapidly as possible, a radical programme of ‘Auflockerung’ consisting of deregulation, of a bonfire of red tape, of streamlined (and, hopefully shrunken) government, of boldly pro-entrepreneurial policies would greatly speed the healing process.

Sadly, we’re more likely to get almost the reverse: a determination on the part of the State that it should not, in fact retreat but instead undertake policies more analogous to the Autostrada construction of the 20s and New Deal boondoggles of the 30s – this time with a debilitating Green tinge to them.

It is theoretically possible that we emerge from this poorer though not permanently impaired. But sadly, there are few Erhards and Cowperthwaites in our modern-day Treasuries and finance ministries and there is no single central bank head with the vision and courage to force his institution to climb back into its box, ending its years of wild economic rampage.

We must therefore fear the worst.