[An edited version of the following appeared in Moneyweek under the title, ‘What’s unsettling the US Dollar?‘]

‘Dollar makes worst start to the year since 1985,’ screamed the headlines a few weeks ago in a classic click-bait attempt to get people to read about what they already should know by using a somewhat artificial statistic – after all, since when did the world revolve around what happened specifically between Dec 31st and July 31st?

The veracity of the statement also rather depends on what index one uses to measure the decline. Using the BIS and Fed basket of major currencies makes it a rather less dramatic ‘worst first seven months’ since 2003. Conversely, using the Fed’s Broad index, one cannot find a similarly weak period in a record stretching back to the start of the floating rate era in 1973 (before which such numbers become meaningless, of course).

Ironically, a glance at the charts shows us that if President Trump has presumed to ascribe all the rise in the stock market since his election to his avowed intent to ‘Make America Great Again’, he has kept notably quiet about his incumbency’s overlap with a no less obvious depreciation of the nation’s currency after 5 ½ years of notable strength.

That said, it is far too simplistic to attribute the Greenback’s slide solely to the chaos already threatening to engulf his administration (if, indeed, that is an appropriate term for the reality TV series in which our man still seems to think he is starring). Similarly, there has been a concerted effort to spin Emmanuel Macron’s faute de mieux victory as a defeat for something called ‘populism’ in Europe and hence as such a ringing endorsement of the Union itself – a reprieve which, naturally, the single currency should reflect.

What we must be wary of here, however, is Man’s natural tendency to tell Just So stories in order to ‘explain’ events well after they have occurred. We must also avoid being fooled when those with either ideologies or vested interests to advance make an after-the-fact attempt to hammer square peg facts into the round holes of their belief systems.

So, looking beyond the pat political interpretation, it is also the case that the prior 45% rise in the dollar has helped propel the US stock market to an historically elevated level in relation to its peers, whether one compares their prices or their total returns. Interestingly, only the last – and therefore the most expensive – twelve months or so of this move has been much helped by foreign portfolio purchases, if we trust the US Treasury’s reporting of them, though the steady influx of direct investment (i.e., M&A and the reinvestment of earnings) has served to keep up the overall support from abroad.

Perhaps of greater significance has been the global appetite for US corporate debt – a desire which has amounted to over $350 billion in 2 ½ years and which has therefore made a meaningful contribution to the whopping $860 billion total issued by US non-financial corporates as a means of funding roughly two-thirds of their $1.3 trillion-plus of stock buybacks. Though some good part of the ROW uptake will have been currency-hedged or simply (and equivalently) leveraged up using short-term dollar funding, some appreciable amount has also been bought naked, thus driving up the dollar alongside the S&P500 and hence boosting that measure’s relative standing vis-à-vis its peers

As a brief aside, one should know that the single biggest buyers of US equities over this horizon, dwarfing even the all-conquering ETFs with their $560 billion of acquisitions, have been the corporates themselves. When you start to apply central bank-depressed discount factors (yields) to an earnings stream being spread over a progressively central bank-depressed share count, is it any wonder that stock prices soar far beyond what seems to be the underlying economic. reality?

In turn, much of the appetite for US bonds has arisen from the urgent need to escape the negative yields at home, engineered by the likes of the ECB, the BOJ, and the SNB. As a result of Snr Draghi continuing to do ‘whatever it takes’ long after the obvious need for it has passed – coupled with a gingerly tightening Fed and further boosted by initial predictions that Team Trump would further reflate the economy – the yield differential or ‘spread’ between US Treasuries and their bellwether German counterparts had recently hit its highest level since the fall of the Berlin Wall.

Now, however, some of those factors are beginning to unwind. As doubts start to creep in about the ongoing momentum of the US economy and as few concrete measures are expected imminently to be enacted to alter its course, US yields have dropped back from near two-year highs of 2.6% to today’s midrange 2.2%. Simultaneously, several rounds of more positive monthly data from across the Channel have prompted talk that, perhaps as soon as this autumn, the Ultramontane inflationists on the ECB council might finally have to give some ground to their northern European critics – a construction to which Pope Draghi himself inadvertently gave credence in a speech given in Sinatra at the end of June.

Similarly, the same hint of the long-awaited Renaissance saw European stocks finally do better than American over the first half of the year. Since nothing, in the game of double-bluff which financial markets comprise, succeeds like visible success, this rise has contributed to a positive reassessment of the euro’s prospects. Ironically, the DAX and its fellows have since beginning to suffer from that self-same accelerating rise in the value of the single currency, perhaps overlooking the possibility that his will only reinforce the doves on the ECB Council in their desire to be ‘persistent’ and ‘patient’ in pursuing their policies.

On all fronts then, the fundamentals have allowed for a change in interpretation, feeding back to corroborate and to be corroborate by the breaking of a succession of important technical levels. This feedback loop has only heightened the greenback’s woes, rocketing the euro soaring 13 big figures upwards to touch its best levels since the start of 2015.

Beyond the currency markets themselves, there are widespread signs that both global trade and industrial output have begun shaken off their lassitude of the previous couple of years. For example, global air freight tonne-kilometres were up more than 10% in the first six months of the year – their best showing since the rebound from the depths of the GFC. Across the departure hall, passenger miles, too, are up nearly 8%: the steepest climb in 12 years.

More generally, the CPB figures for world trade volumes are up more than 5% year-on-year; an increase not seen in six years. Add in the rebound in the price of many of the bulk commodities involved in that trade and it might be no surprise to learn that their dollar values are up double-digit amounts, again a 6-year high. As for production – typically a far less volatile indicator – that is said to be putting on its best face in three years – since just before the ‘hidden recession’ of late 2014 kicked in, in fact.

All these factors are positive for industrial commodities and, in particular, for base metals. Research we have carried out shows that when the dollar trades poorly relative to its trend of the preceding three years (and, please note, that could mean a slower rate of climb, as well as an outright decline), commodities tend to do well – and to do so superproportionally to the obvious inverse effect of the lower numeraire on their world price.

Similarly, when trade and industrial activity each pick up relative to their recent respective trends, commodities again tend to rally. A further series of correlations can be had with both absolute and relative performance of emerging market (especially Asian) stocks, as well as with those in the traditional resource-countries, Canada and Australia, much of which has its own obvious internal logic in the interplay between those most actively digging the holes and those most voraciously demanding the stuff pulled out of them.

Add to this helpful constellation the fact that commodities returns are languishing at multi-year lows in comparison to both equites and bonds; that they are generally an unloved asset class with long years of disappointment having provoked an exodus by investors, closures by some big-name hedge funds, and the withdrawal from the market of several large banking houses; and it might just be time to set aside trying to guess whether the UD dollar can resist the pull of gravity and to check the pulse of Dr. Copper, in particular.

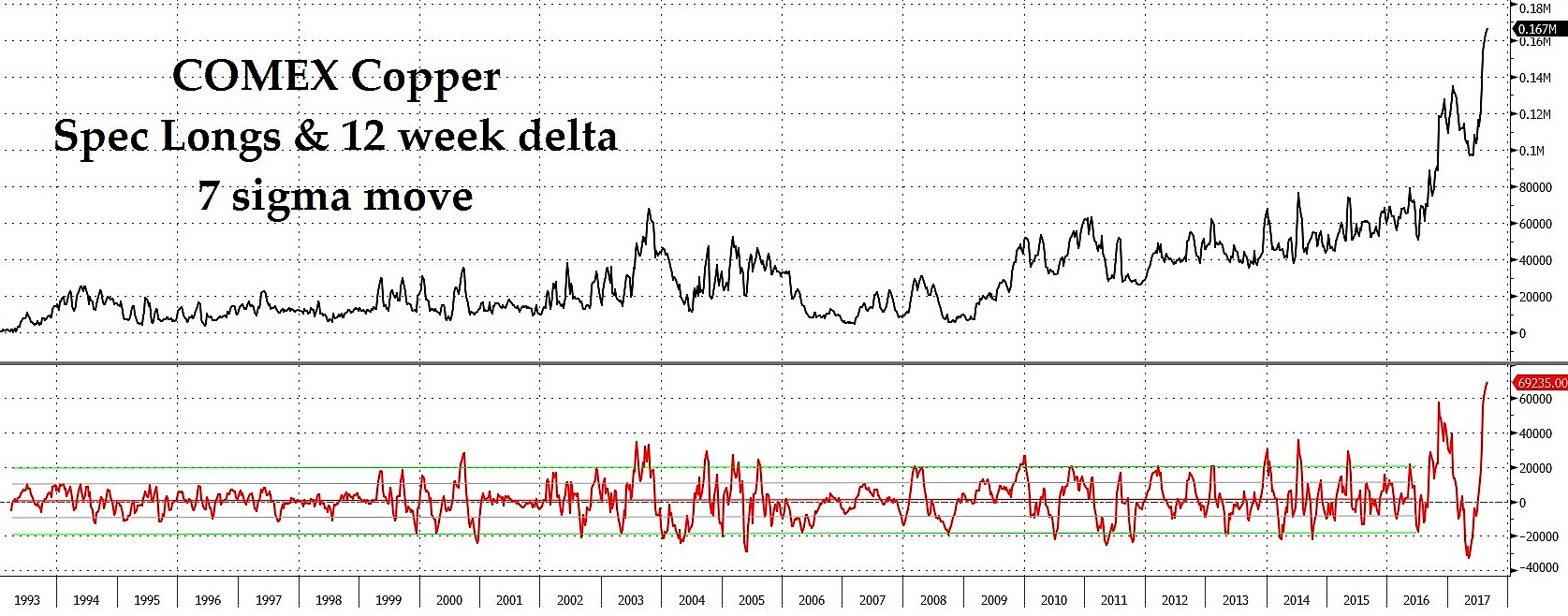

Postscript: Over the two-week delay between this article’s submission and publication, copper rallied a good 7%, since when it has moved on another 3%+ to what is fast approaching a 3-year high, some 60% off its lows, making close to a 50% retracement of its 2011-16 slump, and completing a nice swing formation during the ‘Trump reflation’ trade.

While the general thesis expounded here still holds good, all of this market action – accompanied, as it has been, by a 7-sigma (!) build in gross spec longs – urges caution. The longer-term trend may yet have further to go, but the risks of an intervening correction have climbed appreciably and so warrant tightening stops if not outright profit-taking